CarInsurance.com Insights

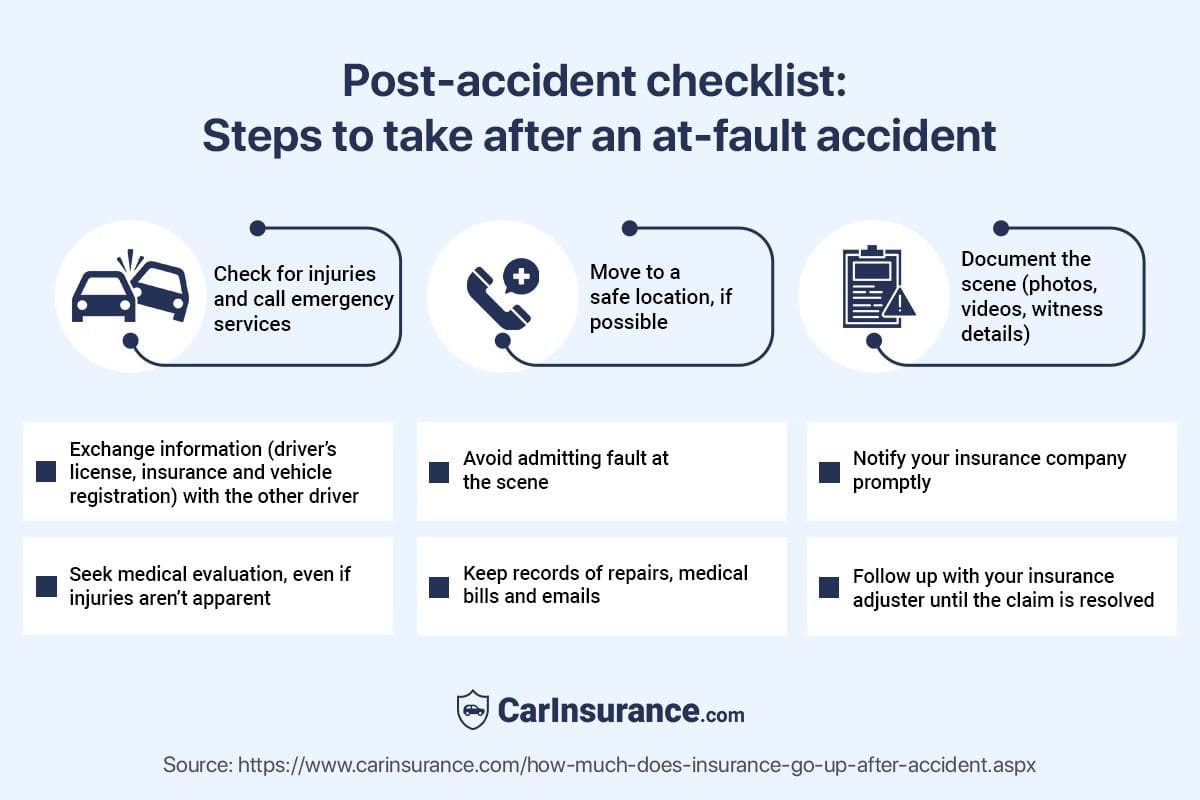

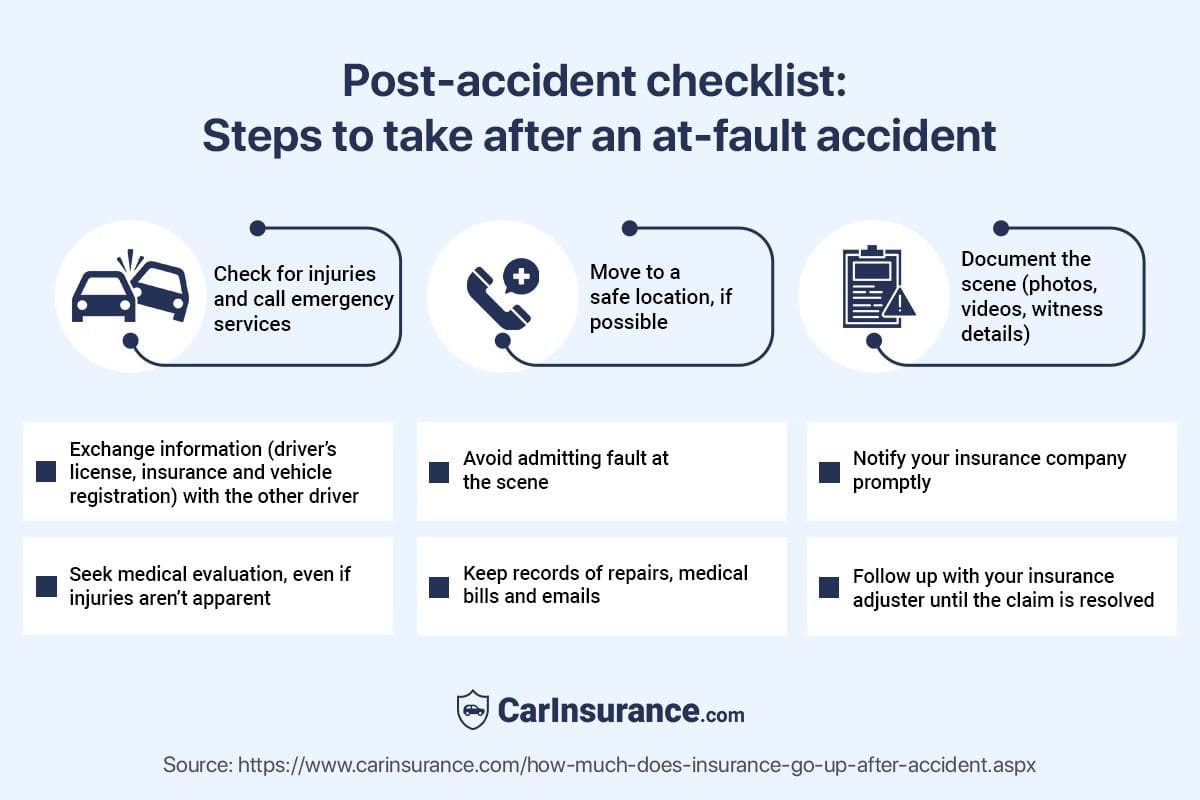

- After a car accident, make sure you document the damage and any injuries with photos.

- Exchange information with the other driver but don’t admit fault.

- One at-fault property damage accident over $2,000 can increase your annual car insurance rates by more than $1,000.

A car accident is a sudden, stressful event. In the moments immediately following a collision, it can be challenging to think clearly about what to do. However, your actions at the scene are critical — they protect your safety, your legal rights and your insurance claim.

This comprehensive guide provides a clear, step-by-step checklist of what to do after an accident, from ensuring everyone is safe to filing your claim.

Here are the steps you need to take after a car crash.

What should I do after an accident?

Here’s what you need to do after a car crash.

1. Move your vehicle out of traffic

If you’re in an accident, move your car to the side of the road so you don’t block or endanger others. If you drive off from the scene, it will be considered a hit-and-run, a severe infraction in most states.

2. Check for injuries

Some states require that you provide help if anyone is injured, but don’t do anything that could cause further injuries. If anyone’s injured, call 911. The shock of a car crash can mask injuries, so if you see or feel any injuries, seek immediate treatment.

“If you are hurt, you should follow up with a medical professional or get emergency care right away,” says Jason Turchin, Esq., a personal injury attorney at the Law Offices of Jason Turchin in Weston, Florida. “Delays in medical care could hurt your case. Insurance companies may argue that your delay in treatment caused you further harm that may have been mitigated by prompt treatment.”

3. Call the police for a report

Insurers like to have a police report if possible, and it’s required in many states. If you have a minor parking lot accident, the police may not have time to come to the scene, but you can tell your insurer that you did make the call.

Furthermore, if there were any witnesses, get their names and phone numbers. Ask them to stay until law enforcement comes so that their statements can be recorded. Independent witnesses tend to give an unbiased description of how the accident happened.

4. Exchange information with the other driver

The basic rule of thumb is to exchange the following information with the other driver:

- Name

- Name of the owner if it’s not the same as the driver

- Contact information, if possible: Phone number and email address

- Names of any passengers

- Vehicle’s make, model and license plate number

- Insurance information: Company name, policy number and phone number

- The responding police officer’s name and badge number

5. Document the accident scene, vehicle damage and injuries

Take photos of the damage to each car, any injuries and the scene of the car crash. Additionally, document the time and date of the accident and include any information about the speed you were driving and the road conditions.

“If there is any visible damage to either vehicle, photograph the property damage. This can help in assessing the causation of your injuries when it comes to settling your claim,” Turchin says.

“Photographs of the accident scene can also help the insurance company and your attorneys determine who is at fault for the crash and get a better sense of how the accident happened. Injury photographs can also help document your injuries as they looked at the time of the accident.”

6. Contact your insurance company to file a claim

The drivers and others who are filing claims contact the insurance companies that are involved.

If the other driver was at fault, contact his or her insurer to make your claim. Also, contact your own car insurance company if your policy requires it or if you are making a claim.

7. Follow up with medical treatment

If you experience any pain or injuries following the accident, seek prompt treatment.

“Consistent medical treatment can provide evidence that your injuries are related to the accident. Insurance companies may look for reasons to deny your claim or offer you a lower settlement if there are gaps in medical treatment,” Turchin says.

8. Keep track of any expenses related to the car crash

Track any expenses you have to pay due to the car crash.

“Part of claim settlement is to try and make you whole, so you should keep proof of any out-of-pocket expenses such as medical bills, prescription co-payments, vehicle repairs or rental cars,” Turchin says. “Keep track of any expenses you incur because of the accident so you can seek reimbursement from either the at-fault driver’s insurance company or your own insurer.”

Insurance claims process for car accidents – here’s what you need to know

Who determines fault in the accident?

Both law enforcement and insurance companies determine who is at fault, or if both drivers are partially at fault.

The police determine fault for traffic violations and issue tickets and penalties to the drivers accordingly. A claims adjuster will be appointed for the insurance companies involved and decide who’s at fault in the crash.

It may be that one driver is found to be entirely at fault and will thus be liable for all damages, or both drivers may be found partially at fault for the incident. If both drivers are found to be at fault, state negligence laws (a tort-based system vs. a no-fault system) will determine the insurance payouts.

No-fault insurance applies only to bodily injuries. Your personal injury protection (PIP) pays for your own medical bills, but if the other driver were at fault, their liability coverage would pay for damage to your car.

Will an accident affect my car insurance rates?

An accident’s effect on your rates depends upon the circumstances of the accident and how many claims you’ve had in recent years.

If you’re at fault, it’s your first accident with minor damages, which may eliminate your good driver discount. If you weren’t at fault and the claims were made through the other party’s insurance, it likely won’t affect you. However, if, you’ve already made a few claims in a short period of time, any claim may affect your rates.

Some states allow insurers to surcharge drivers only for certain accidents or if damages were over a specific amount.

An accident typically will affect your rates anywhere from three to five years – it depends upon state laws and the guidelines of your car insurance company.

How much will a car accident increase my car insurance rates?

Though many factors determine how much car insurance goes up after an accident. On average, rates will increase by the following amounts, based on a CarInsurance.com analysis:

| Accident/comprehensive claim | Average annual rate | $ Increase after accident | % Increase after accident |

|---|---|---|---|

| 1 at-fault property damage accident over $2K | $2,969 | $1,074 | 57% |

| 1 at-fault property damage accident under $2K | $2,948 | $1,053 | 56% |

| 1 comprehensive claim for over $2K | $2,241 | $346 | 18% |

| 1 comprehensive claim for under $2K | $2,227 | $332 | 18% |

| 2 at-fault property damage accident over $2K | $4,232 | $2,337 | 123% |

| 2 comprehensive claims for over $2K | $2,502 | $607 | 32% |

| At-fault bodily injury accident | $3,093 | $1,198 | 63% |

| Single vehicle accident (driver’s car only) | $2,960 | $1,065 | 56% |

Learn more about How can you get cheap car insurance after an accident?

Frequently Asked Questions: What to do after an accident

How long does an accident stay on my record?

It varies by state. In some states, accidents don’t even go on your driving record, or only appear if you were deemed at fault and ticketed for a traffic infraction. You’ll have to contact your state’s Department of Motor Vehicles to determine if the accident will go on your record and how long it will stay there.

If I don’t report an accident, does my insurance company know?

If there is no police report, nothing noted on your driving record and you paid out of pocket for any damages you caused, it would be unlikely that your insurer would know about a minor accident you were in.

If claims are involved, your car insurance company will know about the accident even if you don’t get a police report or personally notify your insurer. When claims are paid out, auto insurance providers record the claims information in a central database.

Learn more: How to make a diminished value claim

Final thoughts on what to do after a car accident

Whatever you do after a car accident, don’t admit fault. Having a car crash is stressful, but proper documentation and following the claims process with your insurer will make it go more smoothly.

Resources & Methodology

Methodology

CarInsurance.com editors collected rates from Quadrant Information Services for a 40-year-old male and female driver carrying a full coverage insurance policy with limits 100/300/100 and $500 comprehensive and collision deductibles. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs