Featured studies: Insurance rate analyses and trend reports

Explore in-depth reports on state-by-state car insurance rates, ZIP code cost comparisons, patterns in risky driving behaviors and surveys about the best U.S. DOTs and DMVs. Our analyses provide up-to-date insights into the evolving dynamics of car insurance premiums.

Which state has the best department of transportation? A new survey of American drivers finds the DOTs in Wyoming, New York and Mississippi come out on top when looking at customer satisfaction, road conditions and more.

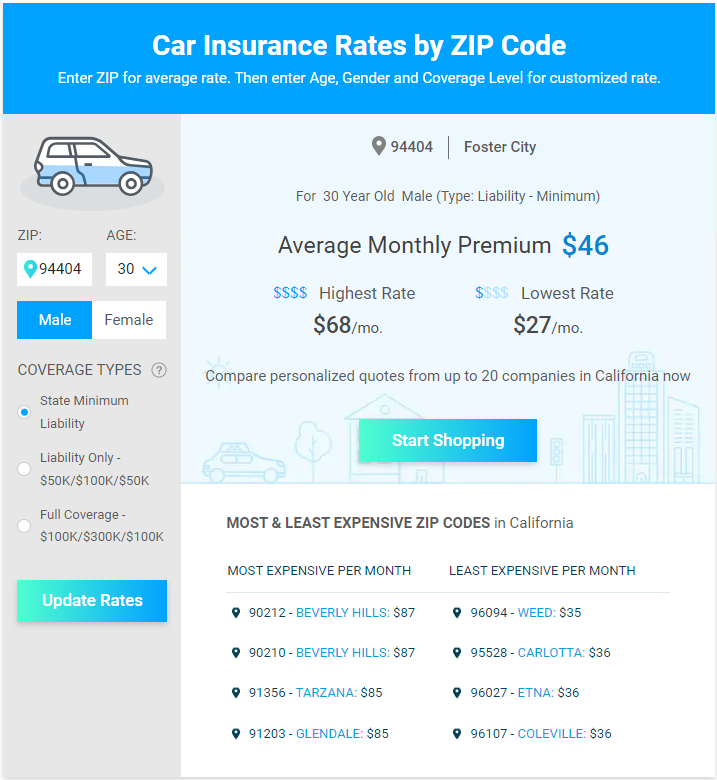

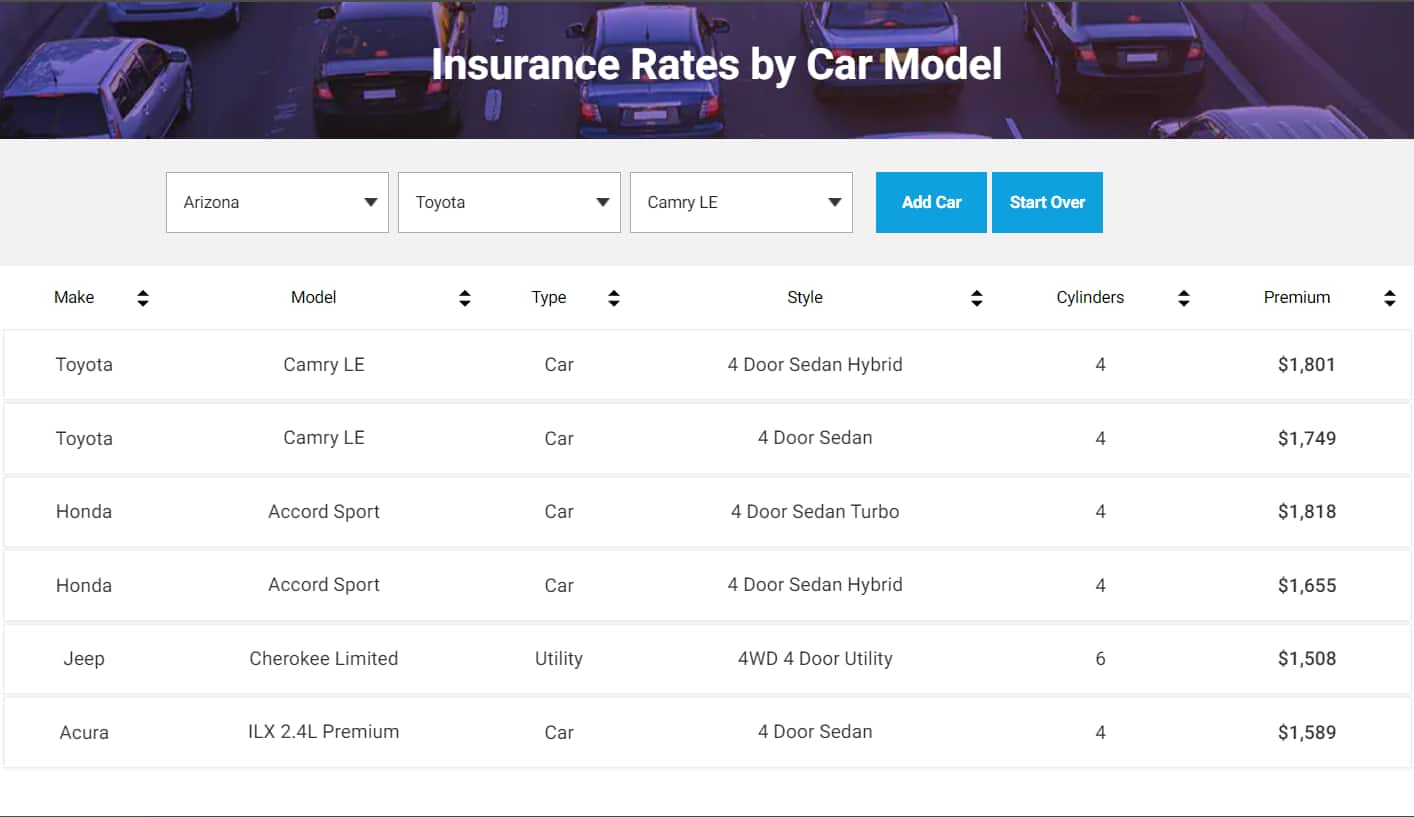

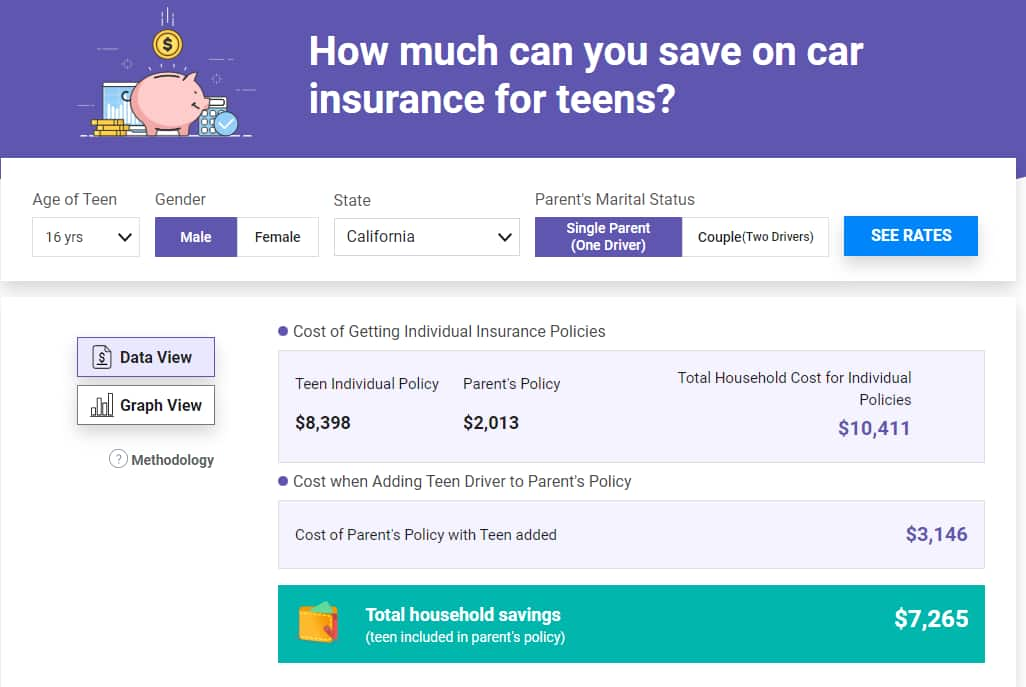

Location is one of the main factors in determining car insurance rates by ZIP code. These cities have the highest and lowest car insurance rates in 2024.

Auto insurance rates by state change drastically based on your ZIP code and other factors. See how your state ranks for average insurance rates and which states have the cheapest and most expensive auto insurance.

From drunk driving to texting behind the wheel, risky driving behaviors increase the chance of an accident and skyrocket insurance rates.