Your insurance rates are based, in part, on how old you are. Find out why age is considered and which ages you can expect to pay the most for car insurance.

Car insurance rates are based on various factors, with age being among the most critical. Teen drivers between the ages of 16 and 19 are nearly three times as likely as drivers who are 20 or older to be in a fatal crash, according to the Centers for Disease Control and Prevention (CDC).

Car insurance for drivers younger than 25 is expensive. Teens and young drivers are largely inexperienced behind the wheel and are more prone to accidents, which makes them a high risk to auto insurance providers.

Average car insurance cost per month by age and state

We broke down the car insurance cost from age 16 to age 75 in every state. Read on to learn average car insurance rates by age and gender, which age group pays the most for car insurance and much more.

Calculate car insurance rates by ZIP code

Rates vary by location. Our tool helps you understand how your ZIP code impacts your premium.

For 30 year old Male ( Liability - Minimum)

Carinsurance.com Insights

- Car insurance is most expensive during the teen years with rates decreasing substantially by age 25 and continuing to decrease until age 65.

- Full coverage car insurance costs $7,149 annually for a 16-year-old.

- For a 20-year-old, full coverage car insurance costs $3,739 per year – significantly cheaper than teen rates.ost expensive driver to insure is a 16-year-old.

Average car insurance rates by age

Age significantly impacts car insurance rates, with younger and older drivers often paying more compared to those in the middle age range. Rates are cheapest for drivers in their 40s, 50s and 60s. The average car insurance cost for teens is high but decreases when they turn 20.

In the charts below, you’ll see the average car insurance rates by age for the different coverage sets:

| Age | Non-owner state minimum | State minimum | Liability-only 50/100/50 | Full coverage 100/300/100 |

|---|---|---|---|---|

| 16 | $832 | $2,111 | $2,527 | $7,149 |

| 17 | $743 | $1,729 | $2,083 | $5,954 |

| 18 | $666 | $1,480 | $1,799 | $5,249 |

| 19 | $552 | $1,135 | $1,387 | $4,126 |

| 20 | $503 | $1,005 | $1,233 | $3,739 |

| 21 | $435 | $817 | $1,009 | $3,094 |

| 22 | $413 | $752 | $934 | $2,858 |

| 23 | $392 | $695 | $867 | $2,670 |

| 24 | $381 | $654 | $817 | $2,524 |

| 25 | $357 | $585 | $740 | $2,259 |

| 30 | $334 | $525 | $669 | $2,012 |

| 35 | $329 | $512 | $656 | $1,947 |

| 40 | $325 | $503 | $649 | $1,897 |

| 45 | $322 | $498 | $644 | $1,869 |

| 50 | $315 | $481 | $625 | $1,790 |

| 55 | $310 | $471 | $612 | $1,737 |

| 60 | $311 | $471 | $611 | $1,717 |

| 65 | $321 | $488 | $632 | $1,742 |

| 70 | $341 | $526 | $676 | $1,841 |

| 75 | $366 | $589 | $748 | $2,010 |

- State minimum: The state-mandated minimum insurance requirement to drive a car legally.

- Liability car insurance: $50,000 per person limit to cover bodily injury you cause to others in an accident, up to $100,000 per accident, with $50,000 to pay for damage you cause to another car or property.

- Full coverage: Liability with a $100,000 limit per person to cover bodily injury you cause to others in an accident, up to $300,000 per accident, with $100,000 to pay for damage you cause to another car or property, plus comprehensive and collision insurance, with $500 deductibles.

Chart: Average car insurance rates by age and state

Refer to the chart below to see average car insurance costs by age and by state for full coverage. Enter your state in the search box to see what you can expect to pay.

Select your state below to see the average auto insurance rates by age for a full coverage policy

| Age | Average Premium |

|---|---|

| 16 | $6,472 |

| 17 | $5,538 |

| 18 | $4,762 |

| 19 | $3,831 |

| 20 | $3,497 |

| 21 | $2,813 |

| 22 | $2,557 |

| 23 | $2,353 |

| 24 | $2,220 |

| 25 | $1,933 |

| 30 | $1,773 |

| 35 | $1,714 |

| 40 | $1,676 |

| 45 | $1,643 |

| 50 | $1,558 |

| 55 | $1,513 |

| 60 | $1,477 |

| 65 | $1,601 |

| 70 | $1,694 |

| 75 | $1,890 |

How age and gender affect car insurance rates

Gender can play a role in determining car insurance rates, as insurers often use statistical data to assess risk. Statistically, women tend to get into fewer accidents – especially serious accidents – and have fewer DUI convictions, according to the Insurance Information Institute. Consequently, young men tend to pay higher premiums.

As drivers age, the difference in rates between genders typically diminishes, with insurance costs becoming similar for men and women. Some states — California, Hawaii, Massachusetts, Michigan, North Carolina and Pennsylvania – don’t allow gender to be used as a factor for calculating rates.

While gender can influence car insurance premiums, its impact varies based on age and regulatory environment.

The influence of age on insurance premiums

The experts agree that age can absolutely play a factor in car insurance rates.

“Insurance companies analyze accident statistics and claims data, which show that younger and older drivers are more likely to be involved in accidents,” says Ofir Sahar, owner/CEO of Barter Insurance. “Teen drivers face the highest premiums due to their lack of driving experience and a higher likelihood of risky behaviors, such as speeding or distracted driving. As drivers gain experience, particularly after age 25, their premiums generally decrease because they are statistically less likely to cause accidents.”

Interestingly, this trend can reverse as drivers become seniors, “an age range when factors like slower reaction times may increase perceived risk,” notes Dennis Shirshikov, a professor of economics and finance at City University of New York/Queens College.

In 1939, Allstate was the first to tailor auto rates by age, mileage and car use.

Why do teens and seniors pay more for car insurance?

Teen drivers have crash rates almost four times those of drivers 20 and older per mile driven, according to the Insurance Institute for Highway Safety.

Conversely, drivers in their mid-30s to mid-50s usually enjoy lower rates as they are considered more experienced and responsible. However, rates rise again for senior drivers as insurers associate advanced age with slower reaction times and a higher probability of accidents.

“Teens and seniors pay more for car insurance because insurance companies see them as driving wildcards — teens are busy learning the ropes, while seniors might be struggling to remember where they left them,” says Dr. James Brau, Joel C. Peterson Professor of Finance at Brigham Young University, “It’s all about the risk – teens and seniors are more risky drivers on average, so companies charge higher premiums to cover the risk.”

Insurance companies view teens and seniors as more likely to engage in risky driving behaviors, leading to a greater likelihood of claims.

States where age doesn’t affect rates

Truth is, age is a factor used by insurers in most states to help determine premium costs. But Massachusetts, California and Hawaii are states where age is not a factor in calculating car insurance rates.

The impact of gender on car insurance rates

Your sex can also impact what you pay for coverage.

“Gender can affect car insurance rates because statistical data show differences in driving patterns between males and females. Young male drivers often face higher premiums due to a higher incidence of accidents and risk-taking behaviors compared to female counterparts,” Shirshikov says. “However, it’s important to note that some states have regulations that prohibit insurers from using gender as a factor in determining rates.”

As you advance in age and gain more driving experience, rating factors between males and females become less significant, particularly after the age of 40, according to Jonathan Shaw, a Farmers Insurance agency owner in Lubbock, Texas.

“Older females will still likely see a slightly better rate than older males because, throughout their lives, they will statistically be safer drivers than males,” Shaw says.

State-specific regulations

Insurance rules can vary from state to state. Knowing your state’s laws can help provide information on rating factors that carriers use.

“For instance, in California, it is illegal for carriers to let gender be a rating factor – while many other states have gender as an important factor in the rate,” Shaw says.

Similarly, Hawaii doesn’t allow age or length of driving experience to determine premiums.

“These different regulations aim to create a more equitable system, but they also mean insurers place more emphasis on other factors like driving record or credit history,” Shirshikov says.

Expert insights and ways to save by age group

Let’s look at savings strategies based on car insurance age brackets.

Teen drivers (16 to 19 years old)

Young drivers can pay less by maintaining good grades, as many carriers offer discounts for students with a high GPA. Completing a driver’s education or defensive driving course can also decrease premiums.

“Joining a parent’s policy is often cheaper than getting individual coverage, too,” personal finance expert David Kindness says.

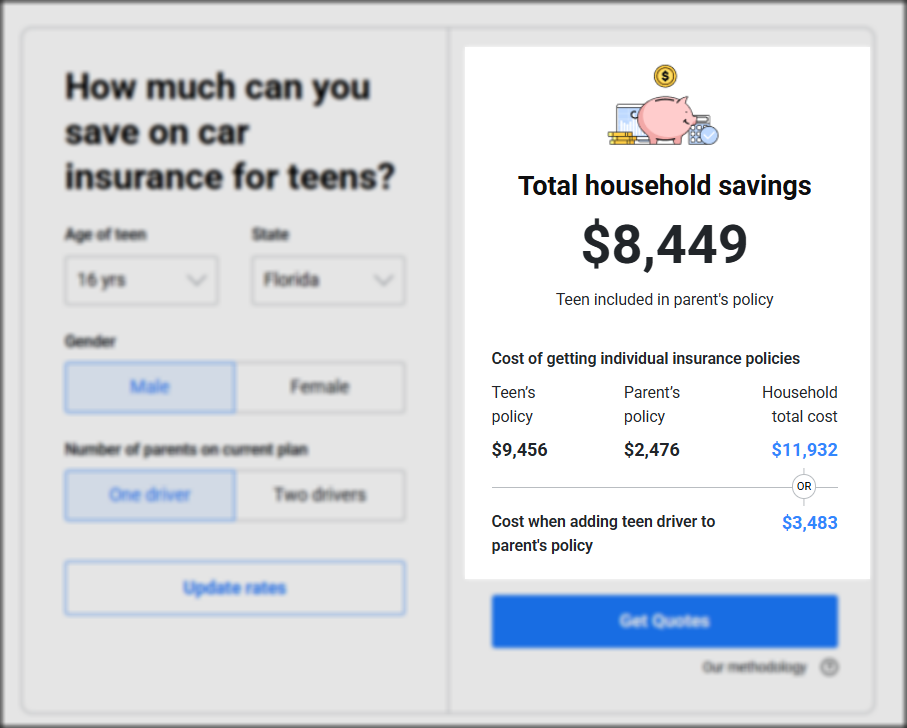

Using CarInsurance.com’s InsureMyTeen calculator, we found that adding a 16-year-old to your policy costs $5,452 compared to $13,901 for separate policies, resulting in a savings of $8,449.

You can see the cost difference below.

Calculate now:How much can you save on car insurance for teens?

Also, participating in telematics programs that monitor your driving habits could lead to discounts for safe driving.

“I know everyone loves to drive the cool older sports car for a first vehicle, but that’s a great way to shoot up your rate quickly. The best thing at this age is to start with an older car – think Toyota Camry or Buick Century,” Shaw says.

Young adults (ages 20-25)

When you hit your 20s, your rates start to drop from your teens, but you’ll still pay more than most drivers until you reach age 25.

“College students may still be able to take advantage of the good student discount that many carriers will continue to offer in this age range,” Shaw says.

As is true of any age group, Kindness advises maintaining a clean driving record and exploring usage-based (telematics) insurance that rewards safe driving.

“Shopping around for rate quotes regularly can also help,” he adds.

Pay-per-mile insurance could save you money if you don’t drive frequently.

Additionally, once you embark on a first or second job within your chosen career, check with your carrier to learn if they offer an occupational discount.

See the average car insurance cost by age for standard coverage sets in the following tables.

Cost for 20-year-olds

For a 20-year-old male, the annual cost of a full coverage policy is $3,943 per year; for a female driver, the same policy costs $3,537 annually. For a 50/100/10 liability-only policy, premiums for a 20-year-old male are $1,275 per year and rates for a female are $1,192.

See the table below for a breakdown of insurance rates for various coverage levels at age 20.

| Age | Coverage level | Females | Males |

|---|---|---|---|

| 20 | Non-owner state minimum liability | $491 | $516 |

| 20 | State minimum liability only | $967 | $1,043 |

| 20 | 50/100/50 liability only | $1,192 | $1,275 |

| 20 | 100/300/100 full coverage | $3,537 | $3,943 |

Cost for 21-year-olds

For a 21-year-old male, the average annual cost for a full coverage policy is $3,231 per year, while 21-year-old females pay $2,958 per year for the same policy. Liability-only policies with limits of 50/100/50 cost $985 annually for females and $1,034 for males.

See the chart below for a breakdown of insurance rates for 21-year-olds at various coverage levels.

| Age | Coverage level | Females | Males |

|---|---|---|---|

| 21 | Non-owner state minimum liability | $427 | $442 |

| 21 | State minimum liability only | $794 | $840 |

| 21 | 50/100/50 liability only | $985 | $1,034 |

| 21 | 100/300/100 full coverage | $2,958 | $3,231 |

Cost for 22-year-olds

For a 22-year-old male, the average annual rate for full coverage is $2,965 per year and for a female driver, the same policy costs $2,750 per year. For a liability-only policy with limits of 50/100/50, annual rates for a female are $918 and $950 for a male.

See the chart below for a breakdown of insurance rates for 22-year-olds at various coverage levels.

| Age | Coverage level | Females | Males |

|---|---|---|---|

| 22 | Non-owner state minimum liability | $407 | $419 |

| 22 | State minimum liability only | $735 | $769 |

| 22 | 50/100/50 liability only | $918 | $950 |

| 22 | 100/300/100 full coverage | $2,750 | $2,965 |

Cost for 23-year-olds

For a 23-year-old male, the average full coverage rate is $2,756 per year, and $2,584 per year for a female driver. For a liability-only policy with 50/100/50 limits, an annual policy costs $856 for a female; for a male, the same policy costs $877 for a male.

See the chart below for a breakdown of insurance rates for 23-year-olds at various coverage levels.

| Age | Coverage level | Females | Males |

|---|---|---|---|

| 23 | Non-owner state minimum liability | $389 | $396 |

| 23 | State minimum liability only | $683 | $706 |

| 23 | 50/100/50 liability only | $856 | $877 |

| 23 | 100/300/100 full coverage | $2,584 | $2,756 |

Cost for 24-year-olds

For a 24-year-old male, the average annual rate for full coverage is $2,594; for a male driver, the rate is $2,594 per year. For a liability-only policy with limits of 50/100/50, a male driver pays $823 annually while a female driver pays $812.

See a breakdown of insurance rates for various coverage levels in the table below.

| Age | Coverage level | Females | Males |

|---|---|---|---|

| 24 | Non-owner state minimum liability | $380 | $382 |

| 24 | State minimum liability only | $647 | $662 |

| 24 | 50/100/50 liability only | $812 | $823 |

| 24 | 100/300/100 full coverage | $2,454 | $2,594 |

Cost for 25-year-olds

The cost between a female and male nearly equalizes at age 25 at $737 per year for males and $743 per year for females for a liability-only policy with limits of 50/100/50. For a full-coverage policy, 25-year-old males pay $2,295 per year and 25-year-old females pay $2,224.

See a breakdown of insurance rates for various coverage levels in the table below.

| Age | Coverage level | Females | Males |

|---|---|---|---|

| 25 | Non-owner state minimum liability | $359 | $356 |

| 25 | State minimum liability only | $586 | $585 |

| 25 | 50/100/50 liability only | $743 | $737 |

| 25 | 100/300/100 full coverage | $2,224 | $2,295 |

Average adult drivers (26-59 years old)

You can expect average rates to decrease once you hit the sweet spot demographic of 26 to 59.

“Mid-age drivers use bundling policies, such as combining auto and home insurance with the same provider for discounts. Also, regularly review your coverage to adjust deductibles or remove unnecessary extras. And life changes – including marriage or moving – can affect rates, so updating your insurer accordingly can be beneficial,” Shirshikov says.

This is also the age group where occupational discounts are most likely to occur, so inquire with your carrier.

Senior drivers (drivers 60 and older)

As you head toward retirement, there’s mixed news. On the positive side, you’ll have garnered much more experience behind the wheel and will likely be a relatively safe driver averse to taking risks. Unfortunately, rates can go up for many older drivers, even if you maintain a clean driving record.

“Fortunately, in many instances, you can still qualify for an occupational discount if you are a retiree from a field that is eligible,” Shaw says. “Additionally, this age range will start to see policyholders who drive fewer miles per year, so it could be a great time to look at pay-per-mile types of policies.”

Seniors may also benefit from mature driver discounts by completing refresher courses for older adults.

“And memberships in organizations like AARP also often come with insurance benefits,” Shirshikov says.

Car Insurance for teens:

- How much is car insurance for a 16-year-old?

- How much is car insurance for a 17-year-old?

- How much is car insurance for an 18-year-old?

- How much is car insurance for a 19-year-old?

Car Insurance for adults:

- How much is car insurance for a 30-year-old?

- How much is car insurance for a 40-year-old?

- How much is car insurance for a 50-year-old?

Car Insurance for seniors:

Additional factors influencing rates

Age is just one factor that car insurance companies assess when deciding how much you pay. Each rating factor – along with the type of coverage you choose, deductibles and discounts – influences the rate you’ll pay for your car insurance policy.

Other factors that affect car insurance rates include:

- Address and ZIP code

- Vehicle make/model

- Marital status

- Driving record

- Credit score

- Annual mileage

Maximize your savings: Tips to lower your car insurance for every age

Shopping around for car insurance before your policy renews biannually or annually is the best way to save money on car insurance. Shopping for a new policy after a life event, such as adding a teen driver to your policy, getting into an at-fault accident or getting a DUI, is wise.

Get quotes from at least three different insurers, comparing the same coverages to ensure you clearly understand what you’re getting for your money. Drop coverage you don’t need and increase your deductible if you have money in savings to cover it in case of a claim.

Car insurance discounts by age

Regardless of age, you can trim costs by qualifying for car insurance discounts matching your driver profile. Here are a few different types of discounts for teens and senior drivers:

- Auto/home bundle discount: 13%

- Student-away discount: 16%

- Good student discount: 14%

- Married discount: 8%

- Driver training discount: 7%

- Senior defensive driver (age 65+): 4%

- Daily commute 5-10 miles each way: 6%

- Annual mileage of 7,500-9,999: 8%

Common questions about car insurance rates by age and state

At what age does car insurance typically decrease?

Premiums generally begin to decrease after drivers turn 25. This is when insurers view drivers as having gained sufficient experience, reducing the perceived risk. However, this decrease assumes a clean driving record. Serious violations can negate these benefits, regardless of age.

Should I keep my adult child on my policy or have them get their own?

Keeping an adult child on your car insurance policy can be more cost-effective, particularly if they live at home and drive family vehicles. But if they have moved out or purchased their own vehicle, it might be better for them to get their own policy. Carefully consider the potential impact on your premiums if they have an accident. Note that if your child’s vehicle is titled under their name only and they no longer reside in your household, they cannot remain on your policy and would need their own.

Why do men pay more for car insurance?

Males, particularly young men, tend to pay more for coverage because statistical data show they are more likely to be involved in accidents or engage in risky driving behaviors. Carriers use this data to assess risk and set premiums accordingly. Although it might seem unfair or gender-biased, insurance rates are based on aggregated data trends.

Which age group pays the most and least for car insurance?

Drivers younger than 26 and older than 65 typically pay the highest premiums due to the higher risk factors associated with these age groups. Drivers between 30 and 60—especially 45 to 53—usually enjoy the lowest rates, as they are considered experienced and statistically safer drivers.

Your age, your rates: Get a tailored car insurance quote today

Knowing the facts about insurance rates by age and gender can help you make a more informed decision about coverage when shopping around for a policy or before renewing your existing policy. Ask your carrier how to lower your costs and qualify for discounts that can help offset any surcharges due to gender or age.

Resources & Methodology

Sources

- Centers for Disease Control & Prevention. “Teen Drivers.” Accessed July 2025.

- Insurance Institute for Highway Safety. “Teenagers.” Accessed July 2025.

Methodology

CarInsurance.com commissioned Quadrant Information Services to provide the auto insurance rates for males and females driving a Honda Accord LX with a clean driving record. The hypothetical driver has a full coverage policy with limits of 100/300/100 and $500 comprehensive/collision deductibles. The data comes from 53,409,632 quotes, 170 companies and 29,152 cities.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.