CarInsurance.com Insights

- Yes, your car insurance rate can change when you move — even if you stay with the same insurer.

- ZIP code is a major pricing factor, with rates influenced by local accident frequency, theft rates, weather risk and population density.

- Moving to a high-traffic urban area often raises premiums, while relocating to a rural or low-crime area may lower them.

- State laws and minimum coverage requirements can impact your rate, especially if you move across state lines.

- You must update your insurer immediately after moving, as failing to report an address change can lead to claim denial or policy cancellation.

Moving soon? Don’t let your car insurance catch you off guard.

More than 28 million Americans move each year, and a new address can mean a big change in your car insurance rate. Whether you’re crossing state lines or simply heading to a new ZIP code, where you live significantly impacts how much you pay.

Use our moving calculator to estimate how your premium might change based on your new location, age, and coverage — so there are no surprises when you unpack.

Will my insurance go up if I move?

Compare my rates by

27% for a decrease of

- State minimum32% lower

- Liability only33% lower

- Full coverage27% lower

Compare annual rates by company

| Austin, TX | Foster City, CA | ||

|---|---|---|---|

| Allstate | $4,133 | - $1,106 | $3,027 |

| Auto Club Enterprises (AAA) | $3,499 | - $1,505 | $1,994 |

| Farmers | $6,561 | - $4,521 | $2,040 |

| Progressive | $5,192 | - $3,350 | $1,842 |

| State Farm | $2,326 | - $1,110 | $1,216 |

| USAA | $1,900 | - $525 | $1,375 |

| City average | $3,074 | - $985 | $2,090 |

| State average | $2,696 | - $428 | $2,268 |

| Allstate | $11,598 | - $3,077 | $8,521 |

| Auto Club Enterprises (AAA) | $9,356 | - $1,732 | $7,624 |

| Farmers | $21,348 | - $14,258 | $7,090 |

| Progressive | $19,891 | - $12,484 | $7,407 |

| USAA | $6,619 | - $2,006 | $4,613 |

| City average | $10,065 | - $2,737 | $7,328 |

| State average | $10,004 | - $1,964 | $8,040 |

| Allstate | $4,815 | - $1,248 | $3,567 |

| Auto Club Enterprises (AAA) | $4,267 | - $1,814 | $2,453 |

| Farmers | $9,377 | - $6,667 | $2,710 |

| Progressive | $6,273 | - $3,874 | $2,399 |

| State Farm | $2,755 | - $1,075 | $1,680 |

| USAA | $2,268 | - $487 | $1,781 |

| City average | $3,858 | - $1,267 | $2,591 |

| State average | $3,514 | - $681 | $2,833 |

How CarInsurance.com’s ConfidentMove Calculator helps you

Moving can impact your car insurance more than you think, but with our ConfidentMove Calculator, you won’t be caught off guard. This tool shows how your premium might change based on ZIP code, coverage level, age and insurer, so you can plan smarter, save time and avoid overpaying for car insurance.

Here’s how it helps real drivers like you:

- Relocating to a new state? See how your rates could shift based on different laws and risk factors.

- Comparing ZIP codes in the same city? Find out which neighborhoods cost less for the same coverage.

- Adding a teen driver after the move? Estimate the impact of both location and age on your policy.

- Wondering if you should switch insurers? Instantly compare which companies offer better rates in your new area.

- Trying to decide where to live? Use insurance cost as a tie-breaker when comparing potential locations.

- Unsure which coverage level fits post-move? Toggle coverage types to see cost differences before adjusting your policy.

How much will my car insurance change if I move?

Depending on where you live and where you’re moving, your car insurance policy cost could go up if you move. Location is a primary factor in setting car insurance rates.

For example

Moving from Reno, Nevada, to San Antonio, Texas, could result in a rate change of $146 per year, 5% higher for full coverage car insurance. Farmers has the greatest increase of 67% from $2,995 in Reno to $5,010 in San Antonio.

Location-specific factors that can impact the cost of car insurance when moving states include weather patterns in that area, the cost of medical bills and car repairs and the frequency and cost of lawsuits due to each state’s tort vs. no-fault laws.

Finally, auto insurance fraud can also affect car insurance costs when you move out of state.

We made moving with insurance one step simpler

Discover how your new ZIP code will impact your rate, and learn what to do before, during and after your move.

Insurance impacts: Moving within your state vs. moving to another state

Generally, moving will impact your car insurance, but factors such as your premium and coverage requirements will depend on whether you move within the same state or to another state. Here’s what you need to know about car insurance for in-state vs. out-of-state moves.

How does your address affect car insurance rates?

Insurers consider the frequency, severity or cost of claims based on a ZIP code and assign a risk level based on one’s address in most states. Currently, California and Michigan are the only states that don’t allow ZIP codes to factor in car insurance rates.

Here are some other location-specific factors that can affect car insurance rates:

- Number of vehicles stolen

- Claims for property theft out of a car

- Reports of vandalism

- Fraudulent injury claims

Moving can cause your car insurance rates to increase or decrease. And while no set number is true for every situation and across all regions, car insurance rates in large, bustling metropolitan areas tend to be higher than those in rural areas.

Why? The basic principle applies that the denser an area, the greater the number of cars and busier highways mean an increased likelihood of getting into an accident. Furthermore, urban areas tend to have higher car theft rates and vandalism.

Do I need a new car insurance policy if I move within the same state?

You don’t need to get a new policy if you move in-state, but moving is an excellent opportunity to compare quotes to ensure you’re paying the lowest rate for insurance. Car insurance prices can vary between cities and ZIP codes in the same state.

For example, we got sample quotes for a driver between the ages of 25 and 44 living in San Francisco, CA, with a state minimum coverage policy. For ZIP code 94102, the sample rate was $313 per month, and for ZIP code 94123, it was $266.

Once you move, you must notify your insurer of your address changes so they can update their records. This will ensure your policy remains active and updated with the new information.

Lauren McKenzie, senior insurance agent at A Plus Insurance, says drivers who moved within the same state must update their new address to avoid an incorrect rating or possible cancellation.

Do I need to change my car insurance if I move out of state?

If your car insurance company doesn’t offer coverage in the state you’re moving to, you’ll need to change carriers. Most states have minimum limits for property damage liability and bodily injury liability. Beyond that, some states require uninsured motorist and personal injury protection insurance.

“When you move a policy may extend temporarily, but you will have to switch to a state-specific policy in your new state as they aren’t interchangeable.”

Ezra Peterson

Senior director of insurance sales for Way.com

New Hampshire is the only state that doesn’t require car insurance. However, you’ll still need proof that you have sufficient assets to cover property damages and medical bills, as required by the financial responsibility laws.

“Customers who move to different states will need to update their insurance company in order to rewrite the policy in the new state … or find another local insurance company to obtain new insurance within the new state,” McKenzie says. “Since Insurance premiums are largely based on location and ZIP code, updating this pertinent information on the policy is necessary.”

Can I have car insurance in two different states?

Not unless you have cars garaged in two different states. For example, if you have a house in Maine with a Ford Explorer garaged in that state, the Ford would be insured in Maine. But if you also have a Tesla Model 3 garaged at your summer home in Florida, the Tesla would be insured in Florida.

Can I keep my current auto insurance policy if I move to a neighboring state?

The short answer is no, says Ezra Peterson, senior director of insurance sales for Way.com in Dallas, Texas.

“When you move, a policy may extend temporarily, but you will have to switch to a state-specific policy in your new state, as they aren’t interchangeable,” he says.

When do I inform my car insurance company about my move?

Once you have your new address and move date, contact your car insurance company as soon as possible. Even if you’re on a tight deadline, this is your first step — they can give you a quote and will let you know about rate adjustments. Moving is an excellent time to get quotes for car insurance, but you can switch your car insurance at any time.

Adding a teen driver at a new address

If you have a teen driver who’s insured on your current policy, you’ll need to add them when you move. Adding a teen to your car insurance policy at a new address will impact your rate. Depending on your location, insuring a teen driver could be more expensive or less expensive than what you’re currently paying.

Because insuring a teen can be pricey, it’s a good idea to talk to your insurance company about ways to save money. For example, many insurers offer discounts to students who achieve good grades in school. Some carriers provide a discount to teens who complete a driver safety course, or attend school at least 100 miles from home and don’t have access to a vehicle.

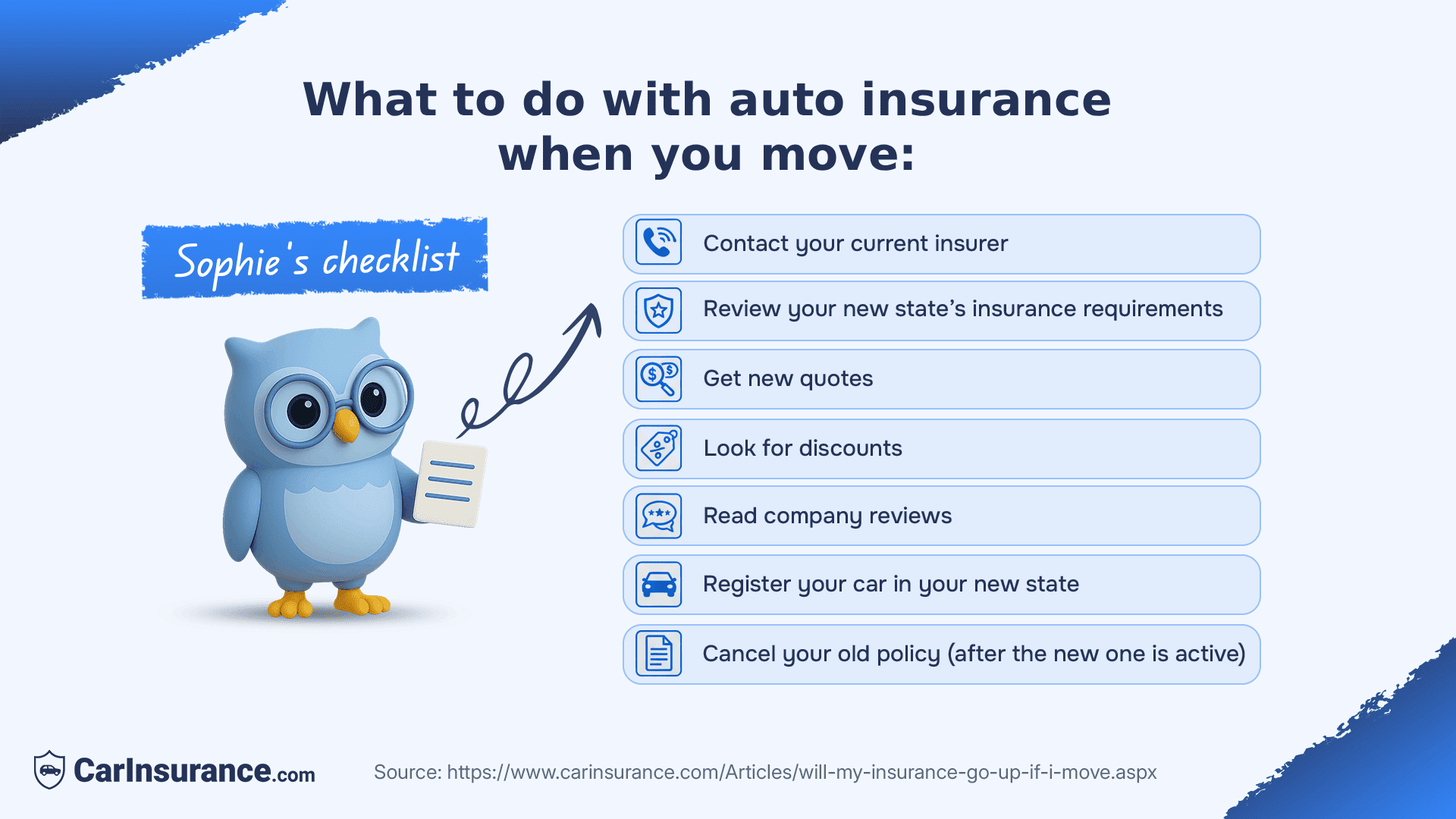

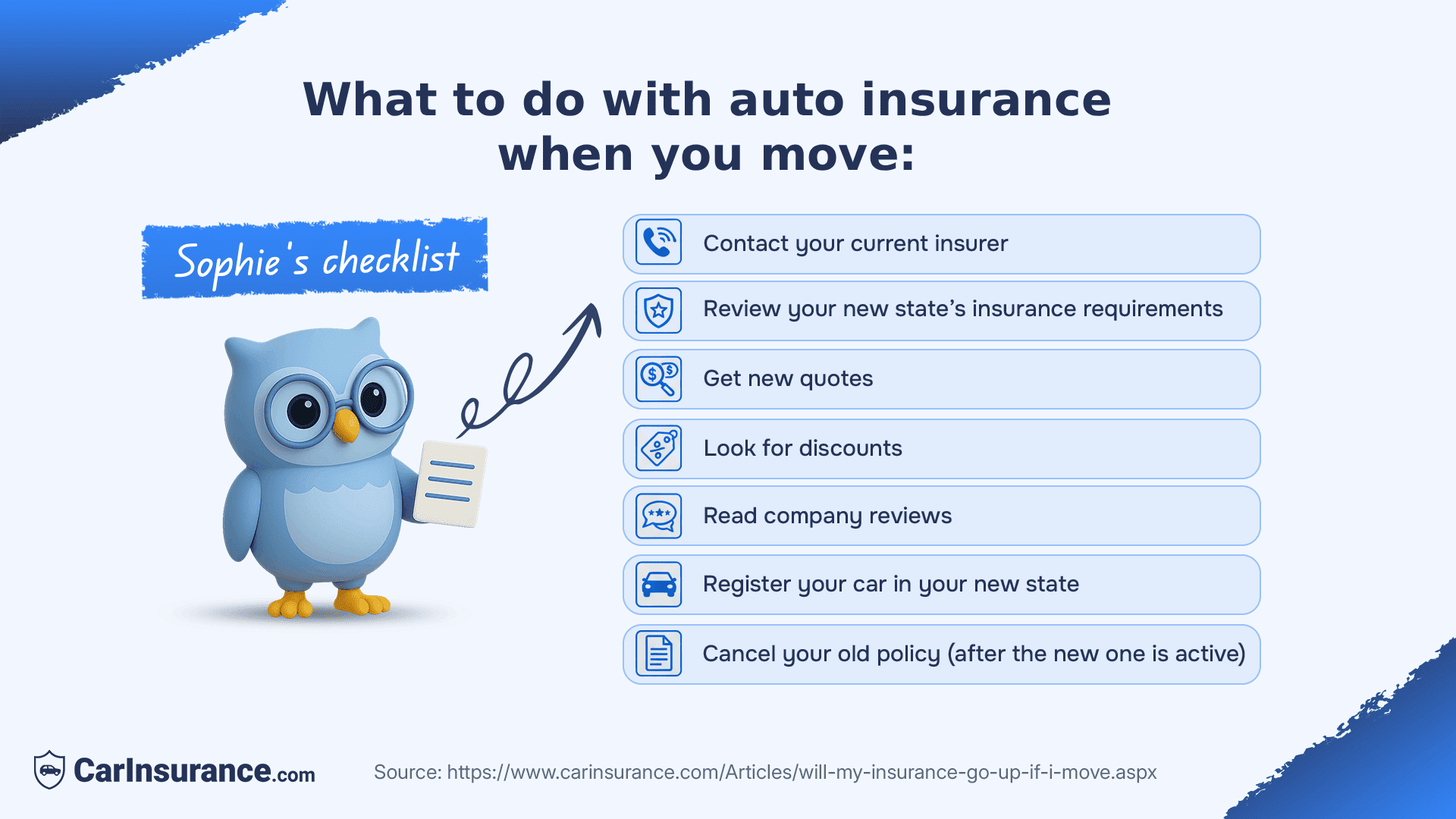

Sophie’s checklist: What to do with auto insurance when you move

If you’re gearing up for a big move, here’s what you should have on your to-do list for car insurance when uprooting to a new abode:

Reach out to your current insurer to see if moving will affect your car insurance rates

Let them know that you’ll soon be changing your address. If you’re moving to a different state and your current car insurance company offers policies in that state, ask for a quote.

“Customers do not need to give notice to an insurance company before moving,” McKenzie says. “Generally, customers have 30 days to contact their insurance provider after the move and update the new address.”

Make sure you understand your new state’s car insurance requirements

Research the minimum insurance requirements if you’re moving to a new state. This information can be found on the state’s DMV website. Each state has different minimum requirements for car insurance, so your rate might be affected accordingly.

However, state minimums aren’t enough protection for most people. Purchase an auto policy with higher liability limits and full coverage to protect you financially in a crash.

Get quotes to see if your car insurance will go up if you move

Getting quotes from several insurance companies to see if your car insurance will increase if you move is a good idea. That way, you can compare them side-by-side. Just make sure the quotes are for the same coverage limits.

To get the most accurate quote, be sure to provide the VIN and year, make and model of your cars, the number of cars you want to insure and an estimate of how many miles you put on your vehicle each year.

Look for discounts when moving

To keep the costs down — especially if you’re moving to a place where your car insurance will go up — ask about discounts for which you’ll qualify. You might be able to lower your car insurance cost by bundling your policy with other policies like homeowners or renters, getting a policy for multiple cars under one roof, having a clean driving record and enrolling in autopay.

Read company reviews

If you’re considering going with a new insurance company, see which companies are ranked the best by CarInsurance.com editors. Check the NAIC website for consumer complaints and AM Best for its financial stability rating. You can also get the scoop on a company’s track record by reading the insurance company’s J.D. Power reviews.

Register your car in the new state if you move

After getting new car insurance or updating your policy, you must register your car in your new state at the DMV. Make an appointment at the DMV if you can, and make sure you have all the required documents before arriving at your appointment.

Cancel your old policy after the new policy is in effect

After you’ve purchased a new insurance policy, be sure to cancel your old one. Otherwise, you might be paying unnecessarily for double coverage. Make sure there isn’t a coverage gap — triple-check policy start and end times and dates.

How soon should you update or switch your car insurance after moving?

This varies by insurance carrier and by state. Sooner is even better, so you have plenty of time to do your homework, find different rates, and get quotes from several car insurance companies.

“Generally speaking, you should notify your existing carrier of a material change to the policy as soon as it’s official and you have moved into your new home,” Peterson says.

At this point, the insurer may just write you a new policy for that state, provided they operate there, or advise you of the cancellation/non-renewal period, he says. However, your current insurer might not be the cheapest in your new state.

Once you notify your insurance company of the address change, they will advise you of the termination date of your existing coverage (usually 30 days or at policy renewal), meaning you need to procure a new policy in that state.

How can I prevent an unexpected premium increase when moving out of state?

Obtaining online quotes based on your new address can help you avoid a considerable premium increase. Then, you’ll have a reasonable estimate of what you should expect to pay when moving to a new state.

“Many states offer premium comparison tools on their Department of Insurance websites, which can provide a good gauge of what an average premium difference will look like,” Peterson says. “Remember, for every state you see a premium increase in, you may find a decrease in other states.”

Other things to consider after moving

Things to update after moving to a new state:

- Driver’s license: Visit your new state’s DMV to update your driver’s license, typically within 30 days of moving.

- Vehicle registration: Register your car in your new state and obtain new license plates.

- Car insurance: Update your car insurance policy to meet your new state’s minimum coverage requirements.

- Voter registration: Update your voter registration to ensure you can vote in local and national elections.

- Mailing address: Update your address with USPS, banks, credit card companies, subscriptions and important contacts.

- Utilities and services: Set up or transfer electricity, water, internet and other services.

- Tax information: Update your state tax withholding information with your employer or accountant.

- Healthcare providers: Find new doctors, dentists and pharmacies, and transfer your medical records.

- School enrollment: Enroll children in local schools and update records.

- Pet licenses: Update your pet’s registration and vaccinations to comply with local regulations.

Updating these key items will ensure a smooth transition and help you stay compliant with state laws.

Frequently asked questions

When should you switch your car insurance while moving?

If you’re moving, ideally, you should switch your car insurance before the change of address – the sooner, the better – so you’ll have plenty of time to do your homework for different rates and get quotes from a handful of car insurance companies. You can use CarInsurance.com’s free online calculator to compare rate quotes from multiple companies using a single application.

How do you switch your car insurance after you’ve moved?

If you’ve already moved and have yet to switch your car insurance, do so as soon as possible. Depending on your state, you may be unable to register your car and obtain your license plates. To switch your car insurance after moving, contact your car insurance company and request an address change to reflect your new address. After you’ve purchased a new policy, you’ll need to cancel the old one.

Do you need insurance to register your car in a new state?

Yes. Most states require proof of insurance before you can register your vehicle. Each state DMV has different rules and regulations, so you’ll want to check the laws in your state.

How do you update your address if you’re moving?

Updating your address is easy. Inform your car insurance company of your upcoming move and your new address. While some insurance companies require you to change your address over the phone, others allow you to update it online or through an app.

What should you do if your move is temporary?

If you’re moving for a few weeks, you don’t need to change your car insurance. If you’re moving for several months or longer, contact your insurance company to discuss the situation and ensure you follow the company’s rules. Insurance policies typically run for six months (or longer) but can be canceled if you no longer need insurance. Importantly, ensure you don’t have a gap in coverage, which can mean penalties down the line.

“If the move is temporary, like moving across states, the customer needs to notify the insurance provider within 30 days of the move,” McKenzie says. “The insurance company will determine if they are able to write business in the new State and what the cost would be, or if a customer will need to look for insurance elsewhere.”

What should you do if your current insurance company doesn’t offer coverage in the state you’re moving to?

This could be your opportunity to find more affordable car insurance. Log onto the DMV in the state you’re moving to and determine its auto insurance and registration requirements. Different states usually have different regulations and laws.

Get three quotes from different insurers to see which will offer you the best policy. Once you’ve chosen a new insurer, call or go online to finalize your premium and purchase. Get the beginning date of your new policy in writing and don’t allow a coverage gap. Once you’ve purchased a new policy, you can cancel the old one.

Preparing for a move: Will relocating increase your insurance costs?

If you maintain a good driving record, shop around for the best rates, and notify your insurance company about your new address and any changes in circumstances that may affect your premiums.

Ultimately, your location affects your insurance rates, so shop for the cheapest policy.

~Shivani Gite contributed to this story

Resources & Methodology

Sources

- AM Best. “AM Best Rating Service.” Accessed February 2026.

- NAIC. “NAIC Consumer Complaints.” Accessed February 2026.

- J.D. Power. “J.D. Power Reviews.” Accessed February 2026.

Methodology

CarInsurance.com commissioned Quadrant Information Services to get car insurance rates. The rates are based on sample profiles of 40-year-old male and female drivers carrying full coverage policies with limits of $ 100,000/$300,000/$100,000 and $500 collision and comprehensive deductibles. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs