CarInsurance.com Insights

- Comparing multiple online quotes reveals real price differences, since each insurer weighs your driving history, coverage levels and ZIP code uniquely.

- Having your driver and vehicle details ready speeds the process, letting you get accurate online rates without phone calls or paperwork delays.

- Online quote tools help you fine-tune coverage in real time, making it easy to see how deductibles, limits and add-ons change your price.

- Buying online gives you immediate proof of insurance, allowing you to finalize coverage the same day if you need to register or pick up a car.

- Reviewing policy terms before you click “buy” protects your budget, ensuring your chosen limits, deductibles and discounts match your expectations.

Buying car insurance online is one of the fastest ways to find affordable coverage tailored to your needs. Instead of calling multiple agents, you can compare quotes from top insurers on your schedule, often receiving same-day coverage.

All it takes is entering details about yourself, your vehicle and your driving history. With digital tools, bundling options and instant quote forms, the online process saves time and helps you make smarter decisions about your coverage.

Step-by-step guide to buying car insurance online

Getting car insurance online is as easy as filling out a quote form and providing personal details about yourself and your vehicle.

First, figure out how much you currently pay (per month and annually) and understand your coverage limits. You might have to permit insurers to check your credit report and driving record. In most states, both play a crucial role in determining your rates.

Step 1: Compare car insurance quotes from different companies

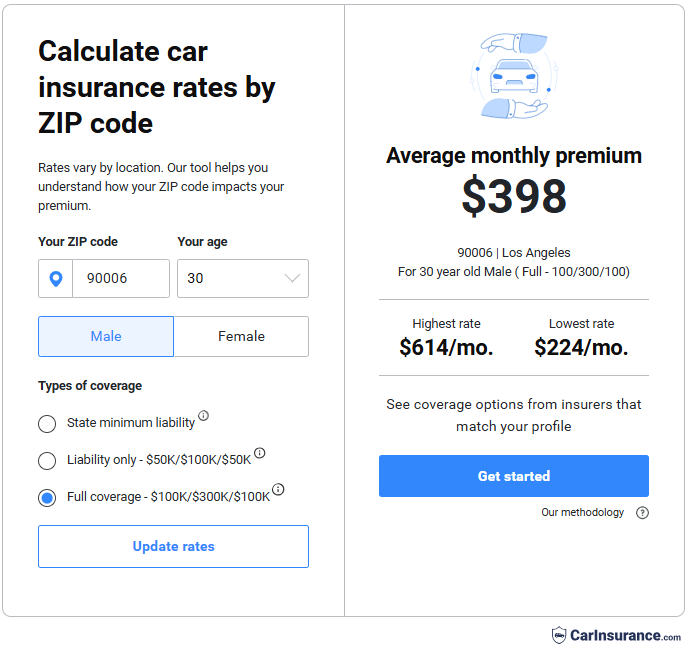

Figure out how much car insurance you should buy, as well as what average car insurance rates are for your ZIP code, your age group and your preferred level of coverage. Then, you’re ready to begin researching quotes from carriers. Experts recommend getting quotes from at least three insurers when comparing car insurance.

Step 2: Select your policy’s coverage limits

You’ll need to purchase liability insurance since it’s required in nearly all states to drive a car legally. Bodily injury liability coverage covers other people’s injuries if you’re at fault in an accident. Property damage liability insurance pays for the damage to another vehicle or other property caused by your car.

While you can legally drive after buying your state minimum liability coverage, it’s not recommended because the cost of a car accident can be much higher than what your insurance will pay out if you have only minimum coverage.

Unless your income and assets are minimal – you do not own a home or have savings or investments – we recommend liability limits of $100,000 per person and $300,000 per accident for bodily injury and $100,000 for property damage.

Buying extra liability insurance to protect you and your assets is typically affordable. It exemplifies how the best car insurance may not be the cheapest.

Once you’ve set your liability limits, decide if you want to purchase optional coverages, such as:

- Collision coverage: Pays for damage to your vehicle caused by a collision, regardless of fault.

- Comprehensive coverage: Covers non-collision damage, such as theft, vandalism, or natural disasters.

- Gap insurance: Covers the difference between your car’s value and the amount you owe on your loan or lease if it’s totaled.

- Uninsured motorist/under-insured motorist coverage (UM/UIM): Protects you if you’re hit by a driver with no insurance or insufficient coverage.

- Personal injury protection (PIP): Pays for medical expenses and lost wages for you and your passengers after an accident, regardless of fault.

| State | Annual rate for state minimum | Annual rate for 50/100/50 liability only | Annual rate for full coverage 100/300/100 | Increase liability & state minimum | Increase liability & state minimum | Increase state minimum & full coverage | Increase state minimum & full coverage | Collision | Comprehensive |

|---|---|---|---|---|---|---|---|---|---|

| National Average | $563 | $709 | $1,693 | $146 | 26% | $1,130 | 201% | $650 | $267 |

| Alaska | $338 | $428 | $1,236 | $90 | 27% | $898 | 266% | $592 | $146 |

| Alabama | $449 | $654 | $1,522 | $205 | 46% | $1,073 | 239% | $600 | $196 |

| Arkansas | $445 | $602 | $1,587 | $157 | 35% | $1,142 | 257% | $658 | $297 |

| Arizona | $534 | $783 | $1,649 | $249 | 47% | $1,115 | 209% | $573 | $187 |

| California | $568 | $838 | $2,043 | $270 | 48% | $1,475 | 260% | $968 | $136 |

| Colorado | $531 | $967 | $2,166 | $436 | 82% | $1,635 | 308% | $600 | $439 |

| Connecticut | $682 | $748 | $1,436 | $66 | 10% | $754 | 111% | $560 | $117 |

| Washington, D.C. | $583 | $732 | $1,877 | $149 | 26% | $1,294 | 222% | $852 | $218 |

| Delaware | $695 | $845 | $1,707 | $150 | 22% | $1,012 | 146% | $627 | $157 |

| Florida | $1,120 | $1,957 | $3,015 | $837 | 75% | $1,895 | 169% | $582 | $204 |

| Georgia | $655 | $834 | $1,638 | $179 | 27% | $983 | 150% | $561 | $174 |

| Hawaii | $388 | $527 | $1,282 | $139 | 36% | $894 | 230% | $550 | $137 |

| Iowa | $273 | $336 | $1,156 | $63 | 23% | $883 | 323% | $423 | $367 |

| Idaho | $318 | $396 | $1,012 | $78 | 25% | $694 | 218% | $464 | $137 |

| Illinois | $519 | $575 | $1,474 | $56 | 11% | $955 | 184% | $684 | $185 |

| Indiana | $405 | $487 | $1,283 | $82 | 20% | $878 | 217% | $573 | $192 |

| Kansas | $424 | $448 | $1,477 | $24 | 6% | $1,053 | 248% | $514 | $483 |

| Kentucky | $732 | $951 | $1,944 | $219 | 30% | $1,212 | 166% | $657 | $266 |

| Louisiana | $693 | $1,310 | $2,969 | $617 | 89% | $2,276 | 328% | $918 | $466 |

| Massachusetts | $626 | $784 | $1,741 | $158 | 25% | $1,115 | 178% | $736 | $234 |

| Maryland | $890 | $960 | $2,076 | $70 | 8% | $1,186 | 133% | $886 | $173 |

| Maine | $342 | $346 | $988 | $4 | 1% | $646 | 189% | $488 | $108 |

| Michigan | $1,742 | $1,352 | $3,945 | -$ 390 | -22% | $2,203 | 126% | $1,740 | $750 |

| Minnesota | $682 | $725 | $1,667 | $43 | 6% | $985 | 144% | $636 | $295 |

| Missouri | $670 | $776 | $2,374 | $106 | 16% | $1,704 | 254% | $1,009 | $505 |

| Mississippi | $393 | $552 | $1,448 | $159 | 40% | $1,055 | 268% | $561 | $272 |

| Montana | $431 | $586 | $1,670 | $155 | 36% | $1,239 | 287% | $605 | $443 |

| North Carolina | $482 | $528 | $1,417 | $46 | 10% | $935 | 194% | $641 | $167 |

| North Dakota | $331 | $343 | $1,258 | $12 | 4% | $927 | 280% | $502 | $401 |

| Nebraska | $481 | $526 | $1,845 | $45 | 9% | $1,364 | 284% | $627 | $663 |

| New Hampshire | $361 | $383 | $982 | $22 | 6% | $621 | 172% | $468 | $113 |

| New Jersey | $1,145 | $1,322 | $2,199 | $177 | 15% | $1,054 | 92% | $665 | $131 |

| New Mexico | $448 | $690 | $1,649 | $242 | 54% | $1,201 | 268% | $631 | $224 |

| Nevada | $820 | $1,293 | $2,327 | $473 | 58% | $1,507 | 184% | $662 | $163 |

| NewYork | $826 | $900 | $1,832 | $74 | 9% | $1,006 | 122% | $658 | $191 |

| Ohio | $349 | $423 | $1,082 | $74 | 21% | $733 | 210% | $508 | $121 |

| Oklahoma | $443 | $722 | $1,954 | $279 | 63% | $1,511 | 341% | $674 | $425 |

| Oregon | $733 | $793 | $1,440 | $60 | 8% | $707 | 96% | $493 | $102 |

| Pennsylvania | $444 | $568 | $1,418 | $124 | 28% | $974 | 219% | $634 | $204 |

| Rhode Island | $641 | $814 | $1,786 | $173 | 27% | $1,145 | 179% | $765 | $142 |

| South Carolina | $573 | $761 | $1,671 | $188 | 33% | $1,098 | 192% | $452 | $319 |

| South Dakota | $280 | $304 | $1,523 | $24 | 9% | $1,243 | 444% | $458 | $735 |

| Tennessee | $384 | $469 | $1,250 | $85 | 22% | $866 | 226% | $567 | $184 |

| Texas | $551 | $794 | $1,880 | $243 | 44% | $1,329 | 241% | $694 | $310 |

| Utah | $677 | $848 | $1,824 | $171 | 25% | $1,147 | 169% | $729 | $147 |

| Virginia | $494 | $512 | $1,210 | $18 | 4% | $716 | 145% | $532 | $142 |

| Vermont | $317 | $340 | $1,074 | $23 | 7% | $757 | 239% | $541 | $180 |

| Washington | $508 | $829 | $1,462 | $321 | 63% | $954 | 188% | $459 | $134 |

| Wisconsin | $544 | $612 | $1,712 | $68 | 13% | $1,168 | 215% | $803 | $268 |

| West Virginia | $470 | $529 | $1,417 | $59 | 13% | $947 | 201% | $567 | $269 |

| Wyoming | $300 | $337 | $1,730 | $37 | 12% | $1,430 | 477% | $793 | $583 |

Step 3: Save money when you buy car insurance online

Consider increasing your deductible and maximizing discounts to reduce your car insurance expenses.

Increase your deductible

Shoppers can save 9% to 23% by increasing their deductibles from $250 to $1,000 on a full coverage policy, according to CarInsurance.com data. See the table below for how much you can save on your car insurance policy by increasing your deductible.

| State | Annual full coverage rate, $250 deductible | Annual full coverage rate, $1,000 deductible | Decrease | Decrease |

|---|---|---|---|---|

| Alaska | $1,362 | $1,092 | $270 | 20% |

| Alabama | $1,642 | $1,384 | $258 | 16% |

| Arkansas | $1,776 | $1,405 | $371 | 21% |

| Arizona | $1,792 | $1,478 | $314 | 18% |

| California | $2,191 | $1,820 | $371 | 17% |

| Colorado | $2,395 | $1,951 | $444 | 19% |

| Connecticut | $1,560 | $1,309 | $251 | 16% |

| Washington, D.C. | $2,031 | $1,617 | $414 | 20% |

| Delaware | $1,862 | $1,535 | $327 | 18% |

| Florida | $3,167 | $2,873 | $294 | 9% |

| Georgia | $1,797 | $1,503 | $294 | 16% |

| Hawaii | $1,401 | $1,142 | $259 | 18% |

| Iowa | $1,302 | $997 | $305 | 23% |

| Idaho | $1,128 | $893 | $235 | 21% |

| Illinois | $1,650 | $1,277 | $373 | 23% |

| Indiana | $1,417 | $1,131 | $286 | 20% |

| Kansas | $1,659 | $1,272 | $387 | 23% |

| Kentucky | $2,096 | $1,762 | $334 | 16% |

| Louisiana | $3,257 | $2,666 | $591 | 18% |

| Massachusetts | $1,862 | $1,486 | $376 | 20% |

| Maryland | $2,254 | $1,864 | $390 | 17% |

| Maine | $1,107 | $866 | $241 | 22% |

| Michigan | $4,410 | $3,486 | $924 | 21% |

| Minnesota | $1,849 | $1,479 | $370 | 20% |

| Missouri | $2,681 | $2,059 | $622 | 23% |

| Mississippi | $1,591 | $1,290 | $301 | 19% |

| Montana | $1,887 | $1,440 | $447 | 24% |

| North Carolina | $1,497 | $1,318 | $179 | 12% |

| North Dakota | $1,441 | $1,069 | $372 | 26% |

| Nebraska | $2,131 | $1,576 | $555 | 26% |

| New Hampshire | $1,111 | $869 | $242 | 22% |

| New Jersey | $2,314 | $2,060 | $254 | 11% |

| New Mexico | $1,818 | $1,475 | $343 | 19% |

| Nevada | $2,473 | $2,180 | $293 | 12% |

| NewYork | $1,974 | $1,668 | $306 | 16% |

| Ohio | $1,193 | $943 | $250 | 21% |

| Oklahoma | $2,215 | $1,720 | $495 | 22% |

| Oregon | $1,560 | $1,328 | $232 | 15% |

| Pennsylvania | $1,584 | $1,227 | $357 | 23% |

| Rhode Island | $1,953 | $1,603 | $350 | 18% |

| South Carolina | $1,784 | $1,533 | $251 | 14% |

| South Dakota | $1,749 | $1,240 | $509 | 29% |

| Tennessee | $1,371 | $1,106 | $265 | 19% |

| Texas | $2,079 | $1,685 | $394 | 19% |

| Utah | $2,017 | $1,639 | $378 | 19% |

| Virginia | $1,363 | $1,077 | $286 | 21% |

| Vermont | $1,203 | $942 | $261 | 22% |

| Washington | $1,582 | $1,344 | $238 | 15% |

| Wisconsin | $1,924 | $1,483 | $441 | 23% |

| West Virginia | $1,597 | $1,239 | $358 | 22% |

| Wyoming | $1,984 | $1,405 | $579 | 29% |

Maximize discounts on car insurance

During your online buying process, you will be asked questions that will let insurers know if you qualify for car insurance discounts, which will help you get the cheapest car insurance, such as discounts for:

- Occupation/professional membership

- Safety/anti-theft devices

- Good driving

- Telematics programs

- Bundling with home/renters policies

Step 4: Pay for your new car insurance policy and get your insurance card

Once you’ve purchased your auto insurance policy, you can download an insurance card or print your proof of coverage. Ensure your new policy begins before your old policy ends so you don’t have a coverage gap. Then, you can cancel your old policy.

Read our guide to switching car insurance companies

Where can I buy same-day car insurance online?

Most insurers offer coverage that becomes effective the same day you purchase it. While not all may explicitly label it as “same-day” car insurance, if the policy’s start date is the same as the purchase date, it qualifies as such.

Some of the companies that will insure you instantly include:

- Allstate

- American Family

- Amica

- Farmers

- GEICO

- Liberty Mutual

- Nationwide

- Progressive

- State Farm

- Travelers

- USAA

Best car insurance company for digital/online experience

According to our 2026 Best Auto Insurance Company survey, the top national carriers for best website/online experience include the following carriers (in no particular order):

- Auto Club Enterprises (AAA)

- CSAA Insurance Group (AAA)

- GEICO

- Mercury

- Progressive

- Travelers

- USAA

Ryan, from Perryville, Missouri, left the following review of Progressive on BestCompany.com:

“I love Progressive auto insurance. It was easy to insure my car online and print the insurance card for proof of insurance. Progressive was the lowest-priced policy in my area, and I am glad to have such ease of application and confirmation.”

Online insurance quotes vs. online insurance purchases: What’s the difference?

Online auto insurance quotes provide an estimate of what your premium might be based on the information you enter, but they aren’t a binding offer.

In contrast, an online auto insurance purchase involves finalizing coverage details, confirming rates, and completing the transaction to obtain an active policy. Quotes are for comparison, while purchases secure coverage.

What to do if your preferred insurer doesn’t offer online purchasing

Not all car insurance companies offer full online policy purchasing — some only allow you to start the process online before connecting you with an agent to complete the sale. If your preferred insurer doesn’t support instant online checkout, you still have several good options:

1. Start a quote online, then call

Many insurers offer a hybrid model: you can enter your details online to receive a quote, but must speak to a representative to finalize the purchase. This gives you a head start on pricing and coverage selection while keeping the human touch for questions or final tweaks.

2. Use an insurance marketplace or comparison tool to check rates

Tools like CarInsurance.com’s ZIP code calculator allow you to compare rates from multiple insurers. If your preferred company isn’t online-friendly, you may still find an equivalent policy from another insurer that offers immediate purchase.

3. Ask if they’ll email you the application

If your chosen insurer doesn’t offer online purchasing, ask if they can send a digital application via email or provide an e‑signature option. Many companies offer semi-digital workflows even if their public site doesn’t.

4. Switch temporarily, then revisit later

If speed matters — such as meeting a registration deadline — consider buying a short-term policy online from another provider. You can always switch to your preferred company later, especially once their digital tools improve.

5. Don’t compromise on coverage or price just for convenience

While buying online is fast, make sure you’re not paying more or accepting less coverage just for digital convenience. It’s worth the extra 15–20 minutes to call your preferred provider and ask about discounts, coverage add-ons, or bundling options.

Write down your quote reference number before calling — it speeds up the process.

Look for filters like “Buy online” or “Instant coverage” in quote tools.

Common mistakes to avoid when buying car insurance online

Some common mistakes people make when shopping for car insurance include not understanding what the various parts of their policies mean and how much coverage they need.

Here are some other common mistakes to avoid:

- Concealing information or lying on the application

- Providing incorrect information

- Missing payments

- Not asking about discounts

- Forgetting to renew your policy before it expires

- Not understanding your deductibles

- Not shopping around

- Only purchasing the state minimum coverage

- Focusing only on the price

Frequently Asked Questions: Can you buy car insurance online?

Can you purchase car insurance online?

In most cases, yes, you can buy car insurance online instantly. When you purchase a policy, you’ll pick a coverage date, which can be the current date. Once you pay, you’ll be covered.

What are the pros and cons of buying car insurance online?

Pros: It’s convenient – you can compare quotes from multiple insurance companies simultaneously. It’s fast: With an online quote, you fill out a short form, get quotes, and see the insurance companies that best match you. It’s flexible: Shop online for car insurance anytime. It’s low-pressure: Even if you need insurance immediately, you’ll avoid sales pressure by shopping online.

Cons of buying car insurance online: You’re on your own. Some people prefer expert advice on auto insurance options from an experienced agent. If so, shopping online might be a starting point before contacting an agent.

What are some common myths or misconceptions about purchasing insurance online?

- Buying car insurance online will hurt your credit. “The type of information the company looks at creates a ‘soft inquiry,’ which does not affect your score,” says Rocky Lalvani, a financial coach and enrolled agent with the IRS and Profit Comes First consultant in Harrisburg, Pennsylvania.

- Buying car insurance online is always cheaper: It’s not always cheaper –compare rates among various carriers to find the best company for you.

- You can’t get personalized or accurate quotes: Quotes can be personalized just as easily online as with an agent.

- You’re limited to online-only companies: While some companies won’t allow you to purchase a policy online, you can still compare quotes and do company research online.

Is it cheaper to buy car insurance online?

It depends on the company. Buying online might not be cheaper if the car insurance company sells coverage online and through agents at its offices. Regardless of whether the carrier has agents working out of offices, there are discounts associated with buying online that may lower your rate.

When and why might you prefer to buy from an agent?

You may prefer to buy from an agent if the insurance company you want to purchase a policy from operates that way or if you have questions about insurance and want expert guidance from an agent.

“You might prefer to buy auto insurance from an agent when you need personalized advice tailored to your specific coverage needs and want help navigating complex policy options,” says James Brau, Joel C. Peterson Professor of Finance at Brigham Young University. “An agent can also assist with claims and offer ongoing support, ensuring you have the best protection as your circumstances change. For example, my brother-in-law is an agent, and his clients love having a personalized touch with him.”

Is it safe to buy car insurance online?

Yes, it’s safe to buy car insurance online. Just as you would take precautions when buying any other service or product online, you want to be sure the vendor is legitimate by researching the company’s history, reading the site’s “About Us” section and its terms of privacy and security.

You can also check with your state’s insurance commissioner to see if the company is listed and how many complaints it has received, as well as the Better Business Bureau and the National Association of Insurance Commissioners.

Resources & Methodology

Methodology

CarInsurance.com commissioned Quadrant Information Services to get car insurance rates. The rates are based on the sample profiles of 40-year-old male and female drivers carrying full coverage policies with limits of 100/300/100 and $500 collision and comprehensive deductibles. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs