CarInsurance.com Insights

- Grace periods aren’t guaranteed by law in most states, and insurers set their own rules for how long coverage extends after you buy a new car.

- Many insurance companies offer a temporary grace period (typically 7–30 days) to add your new vehicle to your existing policy, but terms vary widely.

- Coverage during the grace period usually mirrors your existing policy, so full coverage extends only if your current policy has it.

- If you don’t already have insurance, no grace period applies — you must secure a policy before you can legally drive your new car.

- Contact your insurer promptly and confirm grace-period rules to prevent coverage gaps, legal penalties, and risks of being uninsured.

What is a new-car insurance grace period?

A new-car insurance grace period is a short window — typically set by your insurer — during which your newly purchased vehicle is temporarily covered under your existing policy before it’s officially added. This gives you time to update your insurance without accidentally driving uninsured.

However, most states don’t mandate grace periods by law, and insurers are free to decide whether and how long they extend coverage. Always check your specific policy or ask your agent directly to understand how grace periods work for you.

Typical grace period lengths and how coverage works

Insurers commonly offer grace periods ranging from about 7 to 30 days after you purchase a new car, especially if you already have an active auto insurance policy.

During this time, the new vehicle may automatically receive the same coverage type and limits as your current policy — for example, full coverage if your existing policy includes comprehensive and collision.

But terms vary:

- Some carriers may provide only a few days of grace period coverage.

- Others may extend up to 30 days.

- Some policies don’t include any grace period at all.

When don’t grace periods apply?

If you do not already have active auto insurance, you won’t receive a grace period — you must put a policy in place before driving your new car. This is crucial because nearly every state requires at least basic liability coverage to operate a vehicle.

Similarly, some finance or lease agreements require proof of full coverage (beyond liability) before you take possession, regardless of grace period rules.

What are the risks of relying on a grace period?

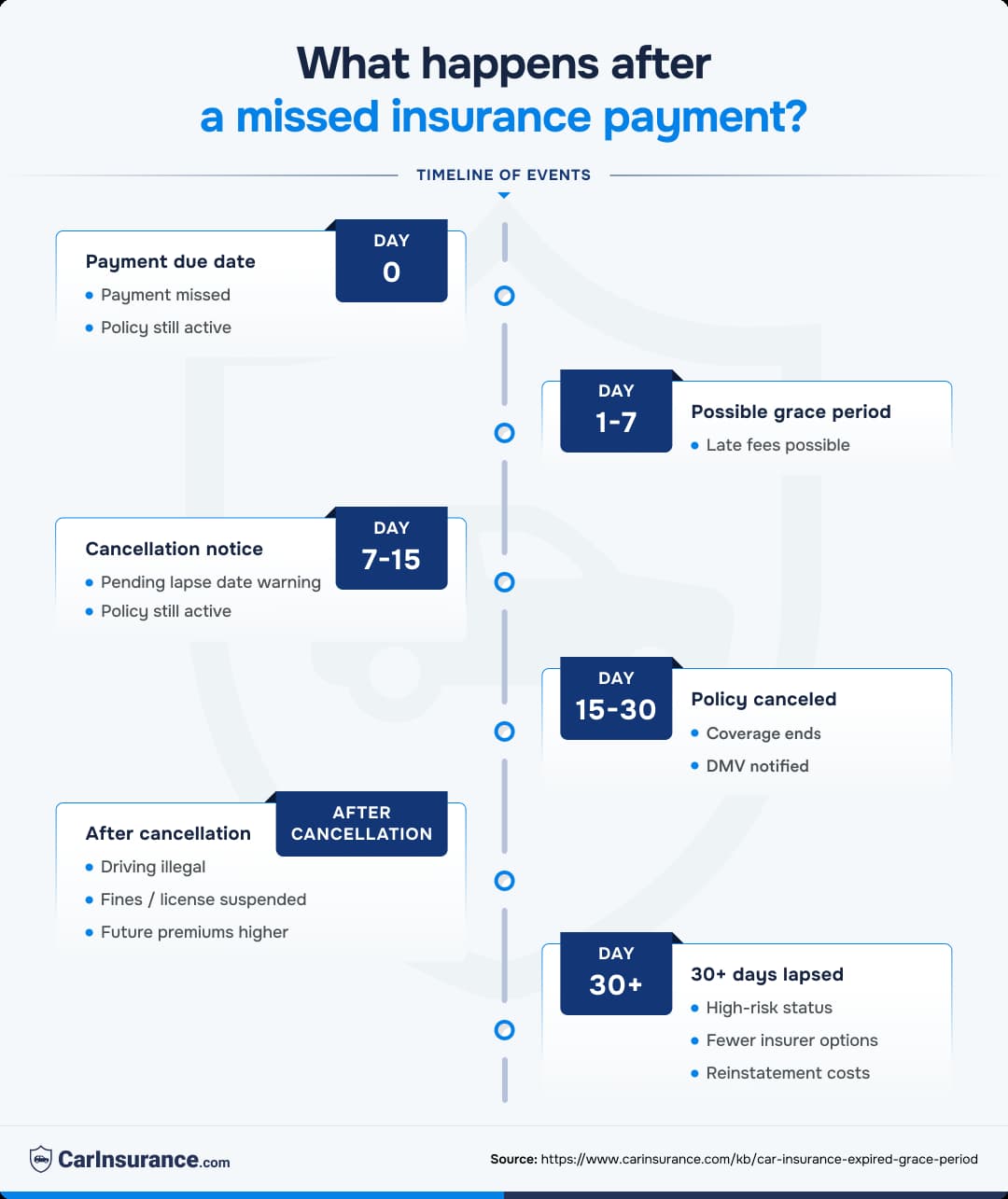

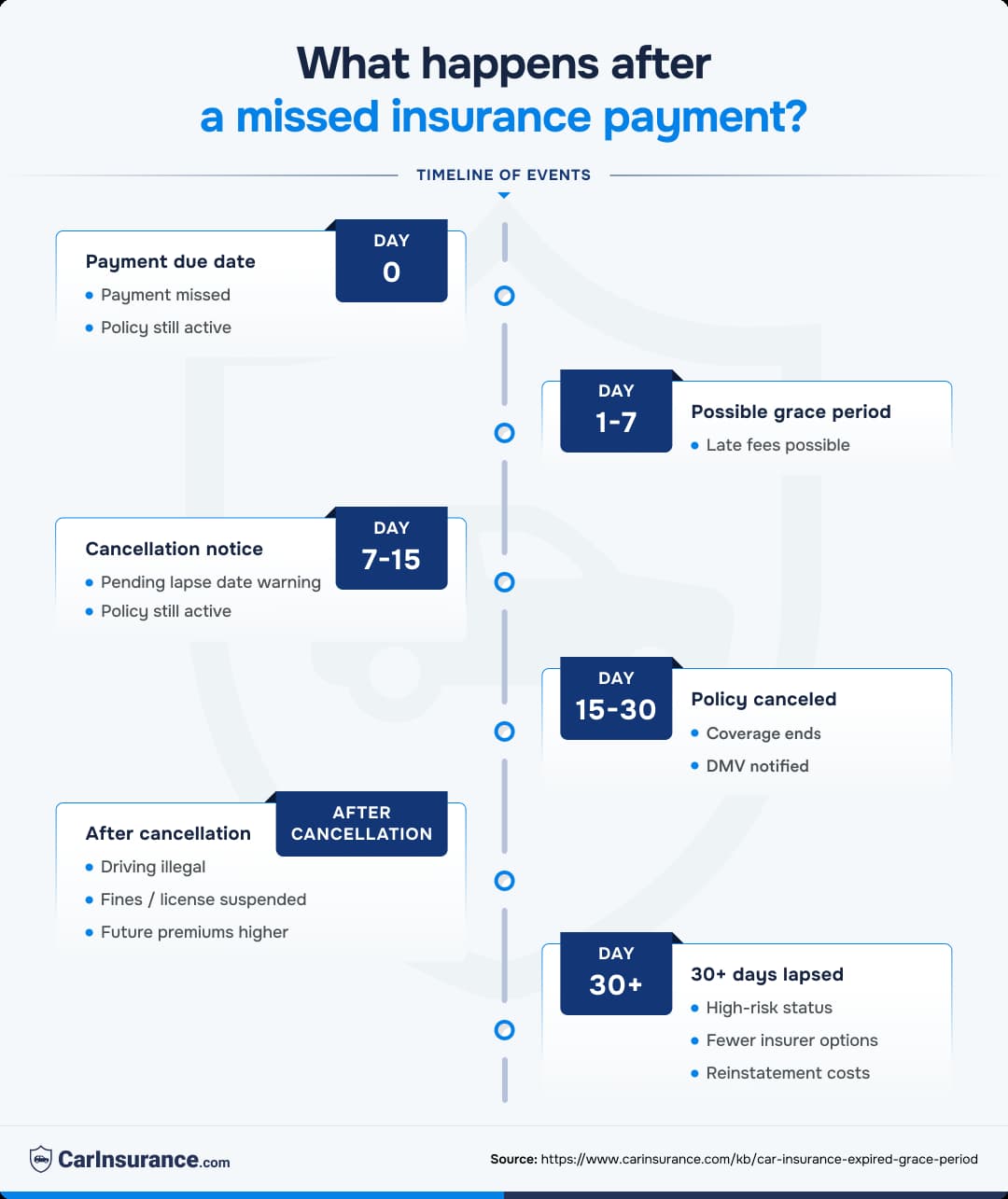

A grace period can be a helpful buffer, but if you assume it applies and delay adding your car to your policy, you could face serious consequences:

- A gap in coverage if your insurer doesn’t offer a grace period.

- Limited coverage if your existing policy only has basic liability.

- Legal penalties or fines for driving uninsured in many states.

- Higher future premiums if a lapse in coverage is recorded.

What should you do after buying a new car?

To avoid coverage gaps, take these steps immediately after purchase:

- Contact your insurer with the new car’s VIN, make, and model.

- Confirm whether your current policy offers a new car grace period and how long it lasts.

- Add the new vehicle to your policy promptly, especially if you have specific coverage requirements from a lender or lease.

- Ask for proof of insurance to take with you to registration or DMV.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs