CarInsurance.com Insights

- The Subaru Crosstrek is the cheapest car to insure, with an average premium of $192 per month, followed by the Jeep Wrangler ($193) and the Honda CR-V ($193).

- The cheapest type of vehicle to insure is an SUV, followed by a truck and a sedan.

- Sixteen of the 20 cheapest vehicles are SUVs with standard advanced driver assistance systems.

- Trucks like the Jeep Gladiator, Ford Maverick and Nissan Frontier are also more affordable to insure than other vehicles.

- The Mazda MX-5 Miata is the only sports car on the list, and the Chevrolet Express is the only van on the list.

The type of vehicle you own is one of the main factors insurance companies consider when determining your insurance rates. Solid, safe and reliable vehicles with low repair costs tend to be cheaper to insure than sports cars, foreign vehicles or cars with a history of costly repairs.

We found the least expensive vehicle to insure is the Subaru Crosstrek, a compact SUV that costs an average of $1,150 for six months or $192 per month.

It’s smart to consider how your vehicle choice affects your car insurance rates. If you’re shopping for a new car, keep reading to find the cheapest cars to insure in 2026.

The 20 cheapest cars to insure in 2026

According to CarInsurance.com’s 2026 analysis, the following vehicles have the lowest average car insurance rates of the models in our study.

- SUVs/Crossovers: Subaru Crosstrek, Honda CR-V, Jeep Wrangler, Volkswagen Tiguan and Mazda CX-5

- Sedans/Hatchbacks: Subaru Legacy, Volkswagen Jetta, Toyota Corolla, Honda Accord and Honda Civic Sedan.

- Trucks: Jeep Gladiator, Ford Maverick, Nissan Frontier, Toyota Tacoma and Chevrolet Colorado

See the table below for the 20 cheapest vehicles to insure in 2026. It includes models from Subaru, Jeep, Volkswagen, Mazda, Honda, Chevrolet, Buick and Toyota.

| Cheapest model | Vehicle type | Six-month rates | Monthly rates |

|---|---|---|---|

| Subaru Crosstrek | SUV | $1,150 | $192 |

| Jeep Wrangler | SUV | $1,154 | $193 |

| Honda CR-V | SUV | $1,158 | $193 |

| Subaru Outback | Station wagon | $1,161 | $194 |

| Volkswagen Tiguan | SUV | $1,165 | $194 |

| Mazda CX-5 | SUV | $1,172 | $195 |

| Volkswagen Taos | SUV | $1,181 | $197 |

| Honda HR-V | SUV | $1,188 | $198 |

| Subaru Forester | SUV | $1,189 | $198 |

| Chevrolet TrailBlazer | SUV | $1,191 | $198 |

| Mazda CX-30 | SUV | $1,191 | $198 |

| Buick Envista | SUV | $1,194 | $199 |

| Toyota RAV4 | SUV | $1,207 | $204 |

| Jeep Compass | SUV | $1,207 | $201 |

| Toyota Corolla Cross | SUV | $1,209 | $202 |

| Chevrolet Trax | SUV | $1,212 | $202 |

| Chevrolet Express | Van | $1,213 | $202 |

| Subaru Impreza | Hatchback | $1,217 | $203 |

| Mazda MX-5 Miata | Sports Car | $1,219 | $203 |

| Hyundai Venue | SUV | $1,221 | $204 |

“Four Subaru models made the top 20 of the cheapest cars to insure, thanks to their built-in safety features (like EyeSight Driver Assist), which lower claim frequency.”

What makes these car models so affordable?

The cars that topped the list have a few things in common: they’re safe, practical, widely driven and relatively affordable to repair.

Subaru Crosstrek

As Subaru’s best-selling subcompact SUV, the Crosstrek offers a slew of advantages for the budget-minded: an MSRP under $27,000, excellent crash test ratings and multiple driver safety tech features.

Jeep Wrangler

Though the Jeep Wrangler scores a little lower on some safety tests (primarily due to its tendency to tip), it’s still a widely popular model. Rugged construction and new safety features keep premiums affordable, too.

Honda CR-V

In addition to its top safety ratings and widely available replacement parts, the Honda CR-V has some of the lowest claim frequencies in its class.

Subaru Outback

The second Subaru to make CarInsurance.com’s shortlist, the Outback stands out for its top-tier safety scores (the 2024 model was an IIHS Top Safety Pick). Standard AWD keeps it stable in poor conditions and Subaru’s status as the most reliable brand draws drivers who prioritize safety.

Volkswagen Tiguan

The 2025 Tiguan received a five-star safety rating from the National Highway Safety Administration, the highest score available. The Tiguan’s standard safety features and relatively low risk profile also help keep this model in the top five.

Why does your car model affect insurance rates?

Cars with lower insurance costs are often family-friendly vehicles. They typically have smaller engines, come equipped with strong safety features and are frequently driven by parents, who tend to be more cautious on the road. This combination leads to fewer accidents, which helps keep insurance rates down.

Safety features such as airbags, lane departure, backup cameras and automatic restraint systems are all factored into an insurance premium and typically push your insurance rate down. Minivans and SUVs are good examples and often come with some of the lowest insurance premiums on our list.

“Repair and replacement costs are a huge factor for insurance rates,” says Zach Lazzari, founder at Cross Border Coverage. “For example, some vehicles have very high repair costs for common fender bender damage. Entire panels may require replacements on one vehicle, while others can be fixed with a simple dent remover and some fresh paint.”

Which types of cars have the most affordable insurance?

SUVs are the most affordable vehicle type to insure, with 16 of the top 20 cheapest vehicles in 2026 being SUVs of various sizes.

Three other vehicle types made our list, and two are Subarus: the Outback, a station wagon, and the Impreza, a hatchback sedan with the same body platform as the Crosstrek.

Just one sports car made our list: the Mazda MX-5 Miata.

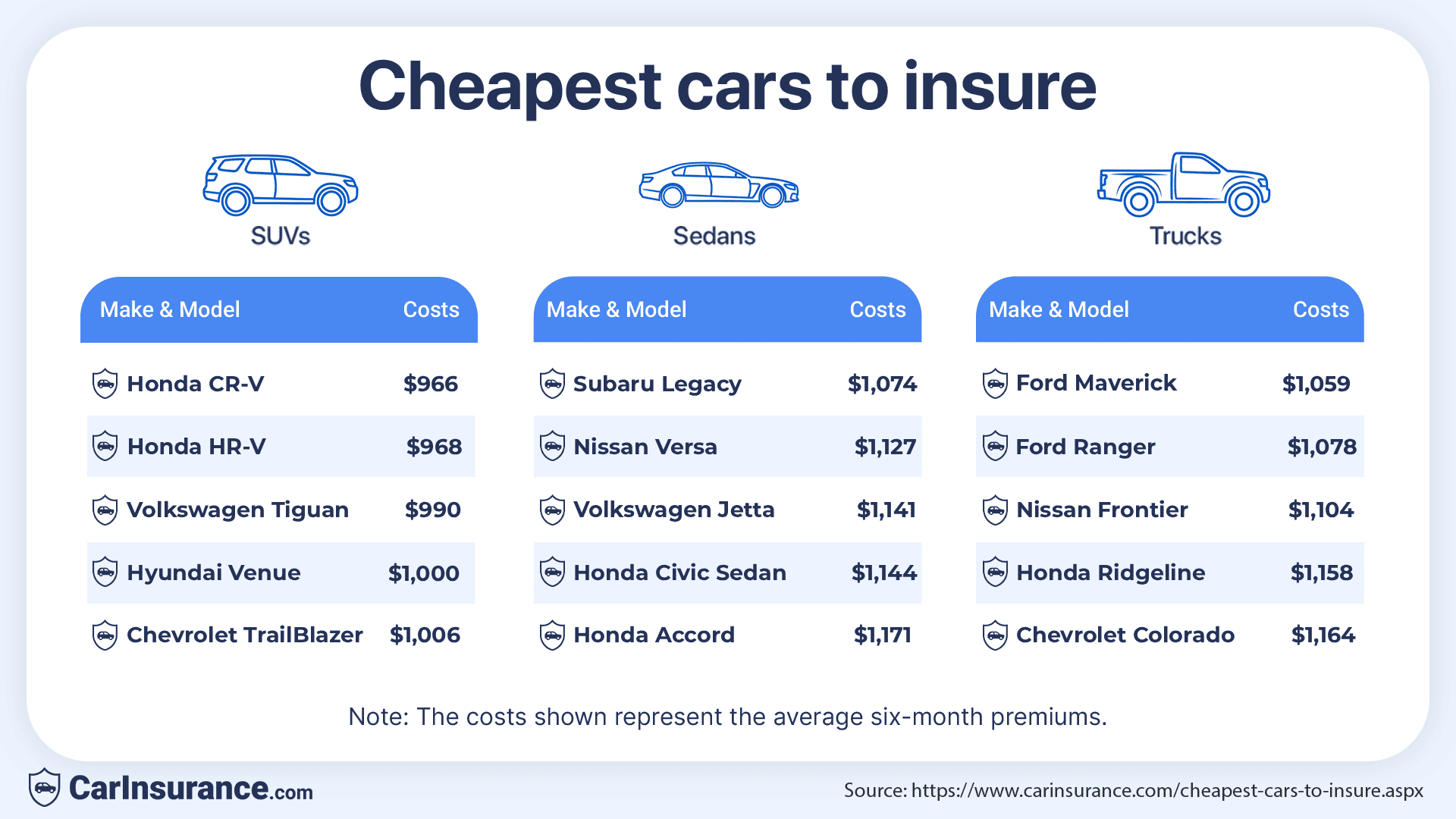

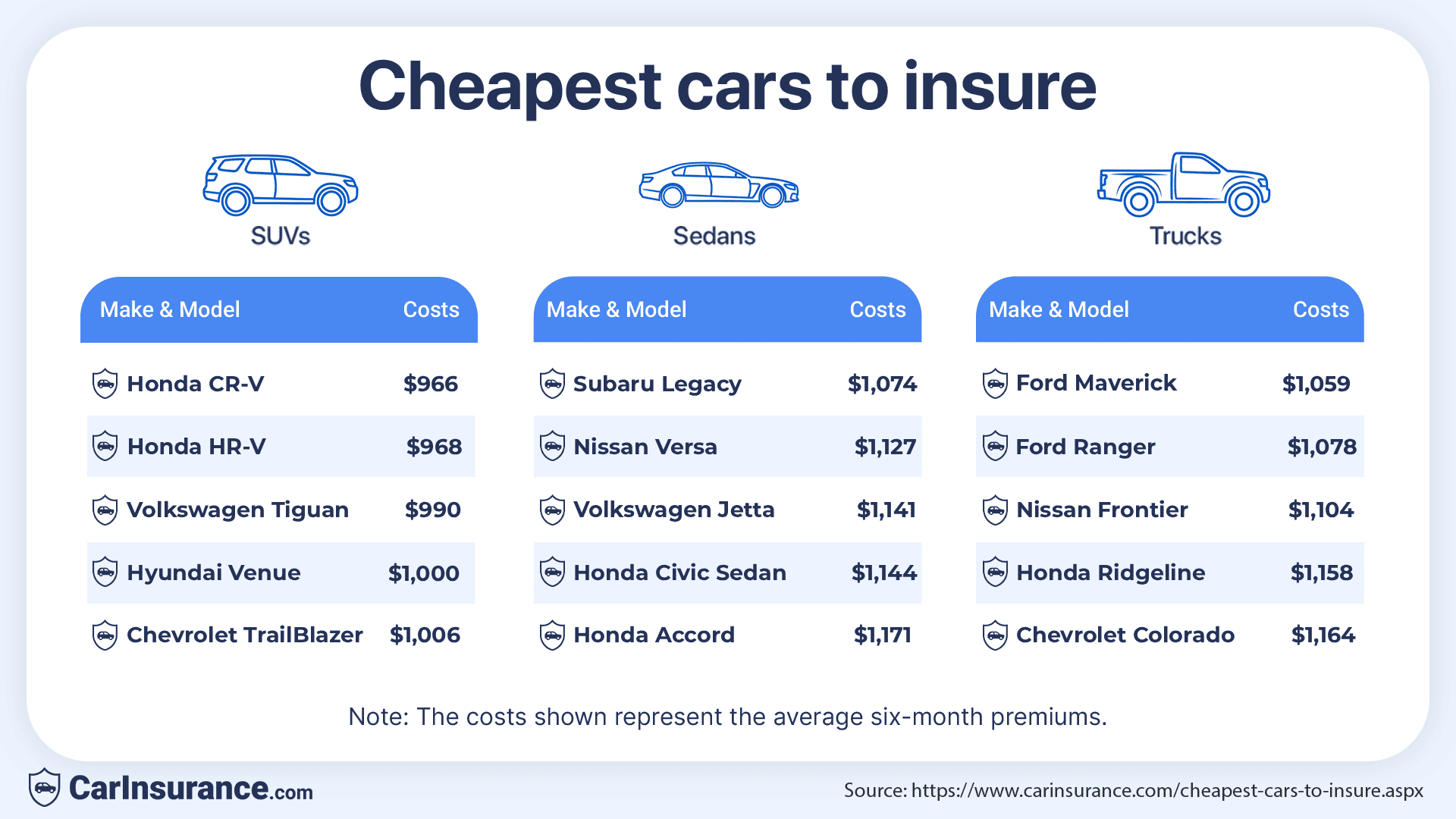

What are the cheapest SUVs to insure?

The cheapest SUVs to insure are as follows:

- Subaru Crosstrek: $1,150 average six-month premium

- Jeep Wrangler: $1,154 average six-month premium

- Honda CR-V: $1,158 average six-month premium

- Volkswagen Tiguan: $1,165 average six-month premium

- Mazda CX-5: $1,172 average six-month premium

What are the cheapest sedans to insure?

The cheapest sedans to insure are:

- Subaru Legacy: $1,265 average six-month premium

- Volkswagen Jetta: $1,339 average six-month premium

- Toyota Corolla: $1,386 average six-month premium

- Honda Accord: $1,402 average six-month premium

- Honda Civic: $1,404 average six-month premium

Sophie’s Smart Stat

Sedans cost 10-15% more to insure than comparable SUVs due to lower bumper heights and less structural protection in multi-vehicle crashes.

What are the cheapest trucks to insure?

The cheapest trucks to insure include:

- Jeep Gladiator: $1,230 average six-month premium

- Ford Maverick: $1,244 average six-month premium

- Nissan Frontier: $1,269 average six-month premium

- Toyota Tacoma: $1,271 average six-month premium

- Chevrolet Colorado: $1,273 average six-month premium

How much will your specific car cost to insure?

Insurance costs vary by exact trim level, ZIP code and driver profile. Use CarInsurance.com’s Rates by Car Model tool below to see personalized estimates for your vehicle. The tool analyzes data from seven major insurers across all 50 states, providing ZIP-level accuracy without requiring personal information.

How can I find the cheapest car to insure in my state?

Select your location and vehicle type to see which makes and models are the cheapest to insure, with average six-month rates.

State regulations, such as no-fault insurance systems and minimum coverage requirements, significantly affect vehicle insurance costs. The same Honda CR-V may cost $800 per six months in Ohio but $1,400 in Michigan due to personal injury protection (PIP) requirements.

Which insurance companies offer the cheapest rates for these vehicles?

Every car insurance company determines rates differently, leading to different premiums across the industry. The table below shows the average premiums for the cheapest rates by vehicle and company.

Select your state and vehicle type to see which insurance companies offer the cheapest car insurance, with the lowest average six-month rates.

What are the cheapest cars to insure for young drivers?

The table below highlights the cheapest cars to insure for 18-year-olds in each state.

Select your state and vehicle type to see the cheapest cars to insure for 18-year-olds, with average six-month rates.

Note: Rates are based on insurance costs for 18-year-old drivers.

Most insurance companies carefully consider a driver’s age before determining premiums. In most cases, young drivers pay significantly more than experienced drivers. However, for new drivers, some cars are cheaper to insure than others.

Why do young drivers pay more for car insurance?

Young drivers aged 16-24 are much more likely to be in an accident than older drivers, according to the National Highway Traffic Safety Administration, with more than 12% of crashes caused by drivers under age 20.

That leads insurers to charge massive premium surcharges. Rates decrease by age 25, when claim frequency drops significantly.

Sophie’s Tip

Pair an affordable vehicle with good student discounts (3.0+ GPA) and defensive driving courses to save money on teen premiums.

Best and cheapest ways to add a teenager to your car insurance policy

How do I choose the cheapest car to insure?

To choose the cheapest car to insure, prioritize vehicles with advanced safety features as standard equipment, avoid high-performance engines and select models with low theft rates.

Mid-size SUVs with proven reliability and robust parts markets, like the Honda CR-V or Subaru Forester, consistently offer the best insurance value.

- Prioritize safety technology: Choose vehicles with forward collision warning, automatic emergency braking and lane departure warning as standard features. These systems reduce accident rates by up to 50% and help you qualify for insurance discounts.

- Avoid electric vehicles for now: EVs cost more to insure due to expensive battery replacements and limited repair networks.

- Skip luxury and sports cars: Sports cars are designed for speed, often leading to accidents and claims. A large engine under the hood will always lead to a massive insurance premium. Vehicles with engines over 300 horsepower or luxury badges (BMW, Mercedes, Audi) can double your insurance costs compared to mainstream brands.

- Check theft statistics: Consult the National Insurance Crime Bureau’s “Hot Wheels” list and avoid frequently stolen models. The Hyundai Elantra and Kia Optima saw theft rates skyrocket over the past few years because they were especially vulnerable to theft.

- Consider used vehicles: Cars that are 3 years old cost up to 35% less to insure than brand-new models because they have lower replacement values. A 2023 Honda CR-V costs $150-200 less every six months than a 2026 model.

- Compare trim levels: Base trims with fewer features save $50-150 per six-month premium compared to loaded models. Premium audio systems, leather seats and sunroofs increase replacement costs without improving safety.

Which trim levels and features make cars cheaper to insure?

Base trim levels with standard safety features but fewer luxury amenities offer the lowest insurance costs. For example, the 2026 Honda Civic LX costs less to insure than the Touring model because its lower sticker price means lower replacement costs. However, the same safety technology keeps both trims equally safe.

Choose the base-level vehicle if a low insurance premium is your most significant consideration. This will be the lowest-priced trim with the least expensive features.

Key vehicle features that lower auto insurance premiums:

- Standard advanced driver assistance systems (ADAS): Look for a trim level with advanced safety features as standard equipment. Many car makers have made their advanced safety systems standard across all trim levels, including the base model. Honda Sensing, Subaru EyeSight and Toyota Safety Sense 2.0 are high-tech safety features that can lower premiums.

- Security systems: If a car is stolen, your insurer must pay for a replacement vehicle. They will discount your premium if your vehicle has an anti-theft device installed. The discount may be even more significant for GPS tracking devices.

- Widely available parts and simple repairs: Popular models like the Honda CR-V have abundant aftermarket and OEM parts, reducing repair wait times and costs compared to those of luxury vehicles that require dealer-only parts.

“Repair and replacement costs are a huge factor for insurance rates,” says Lazzari.

Wise Words

Don’t pay extra for premium audio or leather seats if you’re prioritizing low insurance costs — these features increase replacement value without improving safety.

Frequently Asked Questions

What is the absolutely cheapest car to insure in 2026?

According to our rate analysis, the cheapest car to insure in 2026 is the Subaru Crosstrek, with an average monthly premium of $192.

Do used cars cost less to insure?

Not always. Although used cars typically have lower market value due to depreciation, they may not cost less to insure if they lack advanced safety features or if you’re insuring a high-value luxury vehicle or sports car.

Do electric vehicles have cheaper insurance?

Electric vehicles can actually be more expensive to insure thanks to their costly batteries, higher repair costs and higher average MSRPs.

What is the cheapest car to insure for a 16-year-old driver?

The cheapest car for a 16-year-old driver to insure depends on the state and some other factors. For example, it can cost just $1,021 to insure a Honda Civic hatchback for young teen drivers in Hawaii.

What’s the cheapest new car to buy AND insure?

The Subaru Crosstrek is a vehicle that is both cheap to insure and to purchase. The Crosstrek has a starting MSRP of $26,995 and costs an average of $192 monthly ($1,150 for six months) to insure.

Resources & Methodology

Sources

- IIHS. “2026 Honda CR-V.” Accessed February 2026.

- IIHS. “2025 Jeep Wrangler.” Accessed February 2026.

- IIHS. “2025 Subaru Outback.” Accessed February 2026.

- IIHS. “Autobrake slashes rear-end crash rates for pickups, but few are equipped.” Accessed February 2026.

- Kelley Blue Book. “Car Thieves Love Hellcats, Hyundais, Kias — and Ignore Teslas.” Accessed February 2026.

- NHTSA. “Young Drivers: Overview.” Accessed February 2026.

- Subaru. “Subaru of America reports October 2025 sales.” Accessed February 2026.

- Volkswagen. “2025 Volkswagen Tiguan earns Top Safety Rating from National Highway Traffic Safety Administration.” Accessed February 2026.

Methodology

CarInsurance.com commissioned Quadrant Information Services to get car insurance rates. The rates are based on the sample profiles of 40-year-old male and female drivers carrying full coverage policies with limits of 100/300/100 and $500 collision and comprehensive deductibles. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs