An insurance card is proof of coverage, whether it’s a small plastic card in your wallet or a digital version on your phone. While the design, color and layout vary from one company to another, they all serve the same purpose. It shows who’s insured, which vehicle is covered and whether the policy is active.

In this guide, we break down what an insurance card looks like and the information it includes.

What information appears on an insurance card?

Insurance cards vary in appearance from one company to another because each insurer designs and prints its own format. However, most insurance cards include information needed to prove that you carry the minimum required coverage, not the list of all the coverages you have.

While the exact format varies by insurer and state, most cards include:

- Policyholder’s name: The individual or individuals insured under the policy.

- Insurance company name and logo: It helps identify the insurer providing coverage.

- Policy number: The unique identifier for your insurance policy.

- Policy effective and expiration dates: These dates indicate when your coverage begins and when it expires.

- Vehicle information: Usually the vehicle’s year, make, model and sometimes the VIN (Vehicle Identification Number).

- Coverage details: Some insurance companies also include the coverage details on your insurance card.

- NAIC number: Each insurance company has a unique NAIC number, which is displayed on a card.

- Agent’s name and claims contact details: Some carriers also add customer service or claims phone number, and in some cases, the agent’s name and office contact details.

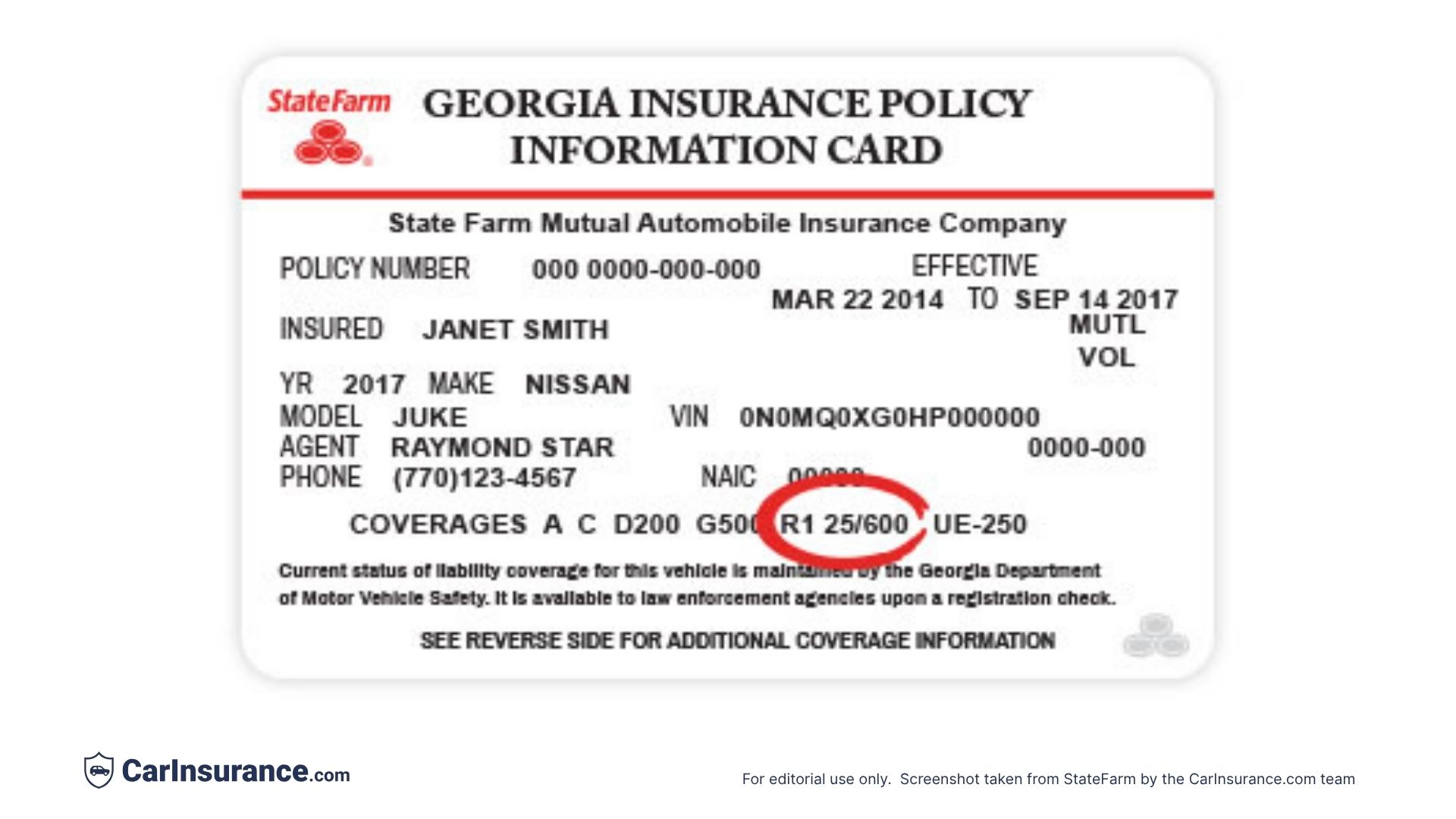

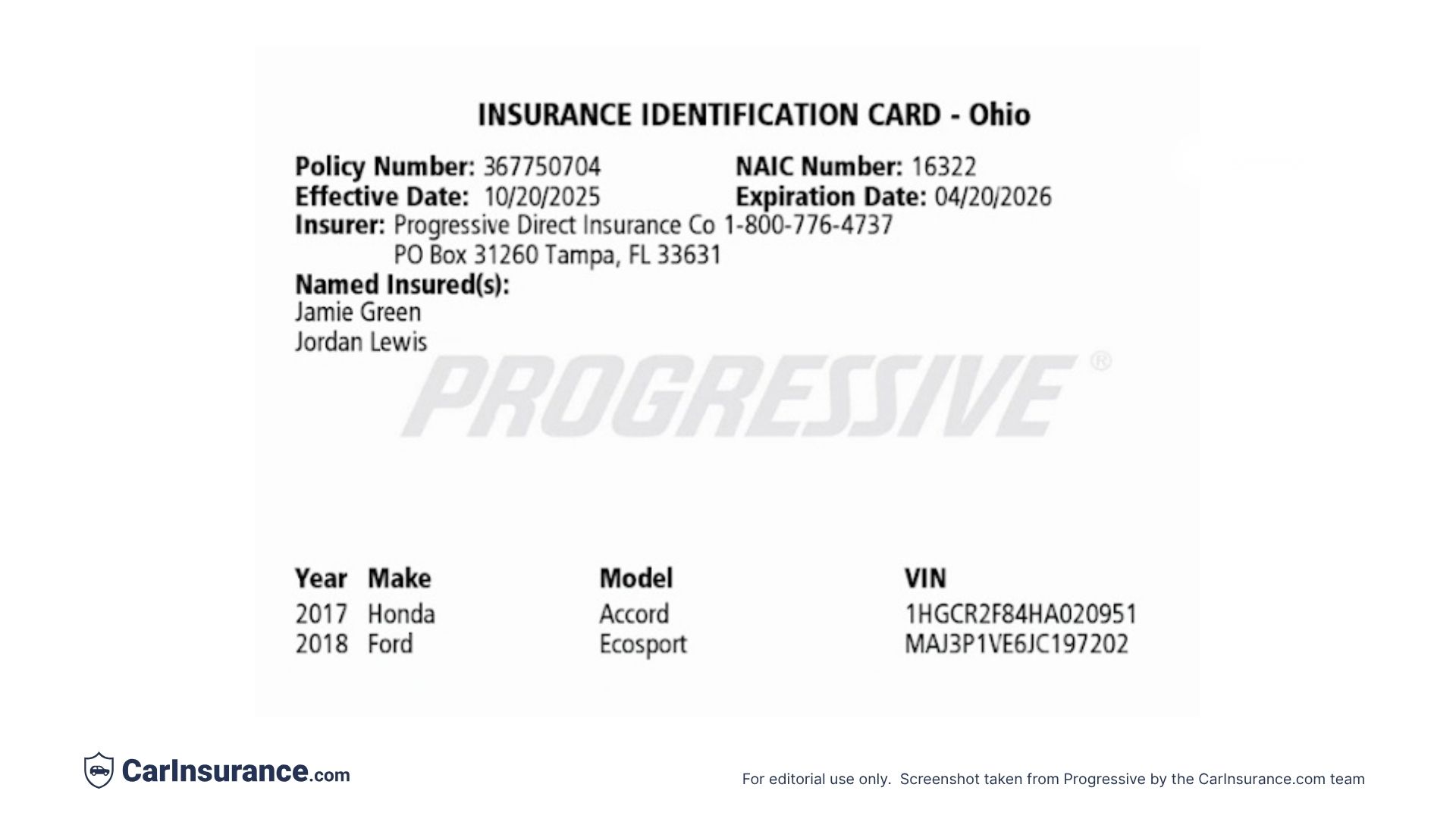

Below are a few snapshots from different insurance companies showing what an insurance card looks like.

Screenshot taken from State Farm

Screenshot taken from Progressive

Physical vs. digital insurance cards

Both physical and digital insurance cards serve the same purpose. They prove you have the required auto insurance if you’re pulled over. The difference is how you access and store them.

- Physical insurance card: A physical insurance card is the traditional paper or plastic card your insurer mails. Many drivers keep it in the glove box or wallet. It doesn’t rely on battery life or cell service, but it can be lost, damaged or forgotten in another vehicle.

- Digital insurance card: A digital insurance card is an electronic version of the same information, usually available in your insurer’s mobile app or as a downloadable file that you can store in your phone. It’s convenient because you’re likely to have your phone with you, and updates, such as policy renewals or vehicle changes, appear automatically. However, you may have trouble accessing it if your phone battery dies, you have no signal and the card isn’t saved offline.

In many states, digital proof of insurance is legally accepted; however, it’s still a good idea to keep a physical card as a backup, ensuring you’re covered in any situation.

What if the vehicle information on my insurance card is incorrect?

If the vehicle information on your insurance card is incorrect, contact your insurance company right away and request an updated card. Details like the insured individual’s name, vehicle’s year, make, model and insurer’s details help prove that the specific car you’re driving is covered, and errors can lead to delays or confusion if you’re in an accident or pulled over.

Don’t try to correct the card yourself by writing on it or editing an image; instead, ask your insurer to update the card details if needed and issue a new physical or digital ID card. You can then replace the old ones in your car and on your phone.

Do I need to carry my insurance card if I have the app?

Many states accept digital proof of insurance, so if your insurer’s app includes an electronic ID card, that will usually work when you’re pulled over or need to show proof of coverage.

However, there’s always a chance your phone battery dies, the app won’t load, or the officer prefers a physical card. Because of that, it’s smart to keep both. Use the app for convenience, but carry an insurance card as a backup so you’re covered in any situation.

Why does my digital card look different than my printed card?

Your digital card may look different because it’s designed for a phone screen. The format, colors or icons may change between the app and print, but the key details, such as your name, vehicle, policy number and coverage dates, should match on both. If any important information is missing or doesn’t match, contact your insurer to update the details.

Does an insurance card include coverage details?

Many insurance companies include only basic information on their insurance cards, such as the policyholder’s name, vehicle details, policy number and coverage dates. Some insurers may also list limited coverage information, but for full details, including what’s covered, your limits and your deductibles, you’ll need to review your policy documents or declarations page.

Sources

- Progressive. “What is proof of insurance?”Accessed November 2025.

- Allstate. “Auto insurance cards.” Accessed November 2025.

- State Farm. “How electronic proof of insurance can assist you.” Accessed November 2025.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs