One of the best ways to make sure you’re getting the lowest rates on your auto insurance is to comparison shop, at least once every year right before your policy renewal, says Penny Gusner, senior consumer analyst at CarInsurance.com. Now, there’s an app to help you do that.

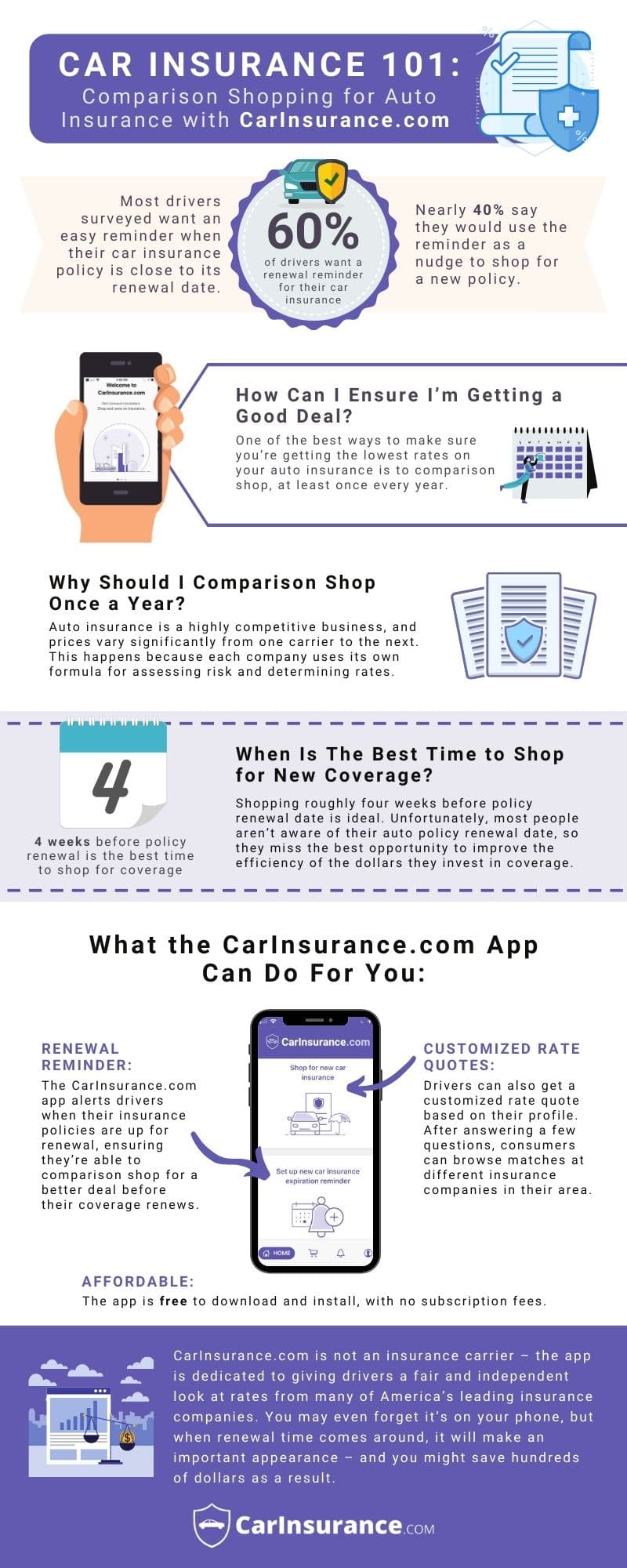

Auto insurance is a highly competitive business, and prices vary significantly from one carrier to the next. This happens because each company uses its own formula for assessing risk and determining rates.

The best time to shop for coverage is roughly four weeks before policy renewal. Unfortunately, most people aren’t aware of the expiration date on their auto policy, so they miss the best opportunity to improve the efficiency of the dollars they invest in coverage.

There’s no shortage of smartphone reminder apps these days. There are calendar apps, grocery list apps, apps that keep track of appointments, medications, even when to flip your mattress! But apps that focus on car insurance renewals—and that give drivers a convenient way to shop for coverage from dozens of leading providers—have been hard to find.

Until now, with the launch of the CarInsurance.com mobile app.

Presenting the CarInsurance.com mobile app

Busy people need reminders—and that’s exactly what the new CarInsurance.com app does. After an easy setup, the app provides a pop-up alert one month, two weeks or a day before your car insurance policy is up for renewal. It also gives you a convenient starting point to review your coverage and check the best rates.

Drivers like you have expressed their interest and excitement for an auto insurance reminder app. A survey of nationwide car owners, conducted by CarInsurance.com, finds that over 60% of drivers want an easy way to be reminded of when their car insurance policy is close to expiration. Nearly 40% say they would use the reminder as a nudge to shop for a new policy. Clearly, car owners want a better way to help them stay on top of their insurance investment.

CarInsurance.com’s new app is unique, in large part because we’re not an insurance carrier. We’re dedicated to giving you a fair and independent look at rates from many of America’s leading insurance companies. You can be confident in the information you receive through this new tool.

Once installed, you may forget the CarInsurance.com app is on your phone. It’s designed for one purpose—to help you improve your coverage. When renewal time comes around, it will make an important appearance—and you might save hundreds of dollars as a result.

How the new CarInsurance.com app works

The CarInsurance.com app is free to download and install, and has no subscription fees. It’s easily found on the iPhone App Store (an Android version will be releasing soon). Setting up a renewal alert takes less than 30 seconds; just launch the app, click on “Set up your new car insurance expiration reminder,” and you’ll arrive at the registration screen.

All you have to enter is the name of your insurance company, the policy renewal/expiration date, and how many weeks before that date you’d like to be reminded. You can easily register information for multiple vehicles, each with its own reminder.

You can set the alert to show a month prior to your expiration date, one week prior or a day before. (The next version of the app will include more time-frames, including two weeks.) The notification will appear at the chosen time on your home screen and alert you to the upcoming expiration. When you have the app open, a countdown clock will appear to show you how much time you have until expiration. You can also receive an email notification if you so choose.

Of course, the CarInsurance.com app also makes it easy to shop for coverage. Click on “Shop for new car insurance”—then, after answering a short series of questions (typically five to seven), you’ll be matched to companies in your area offering coverage that is customized for you.

CarInsurance.com looks at dozens of leading insurance companies to make sure you’re getting competitive rates for your area. If you choose one of the companies listed to initiate a new policy, you’ll be linked to that company’s website to begin the purchase process.

Why shopping for auto insurance 30 days before expiration is ideal

By the time you receive your notification from the CarInsurance.com app, you will probably have received a renewal notice from your present carrier. This gives you a good deal of important information.

- You’ll have an up-to-date quote from your carrier on next year’s policy.

- Because the notice will likely include a declaration page, you’ll be able to easily review your coverages, limits and deductibles. This makes it easy to compare apples-to-apples as you shop, so you can determine if switching car insurance companies will save you money.

“One month gives you time to compare at least three other companies,” says Gusner. “You’ll be able to vet them to make sure your favorite—the one with the lowest rates—also has a good customer service track record, good financial strength, and good claims service.”

Auto insurance app designed with you in mind

You can also use the shopping tool anytime during the year, even outside of renewal time, making it a great tool when buying a car. It’s wise to include the cost of insuring a new car or buying used car insurance when budgeting for your vehicle purchase. “If you can’t easily afford the insurance cost,” says Gusner, “then you can’t really afford the car.”

As Gusner points out, however, the 30-day renewal milestone is one you shouldn’t pass up. “You may qualify for a discount from your present insurer for renewing. Or you may get one from a new carrier for switching at least 14 days before your current policy expires,” she notes. “If you wait until just one or two weeks before the policy renews, you may miss out on these discounts. So, don’t delay.”

An app that will grow with you

Over time, CarInsurance.com’s new app will continue to expand, providing you with a one-stop smartphone destination for all your auto insurance shopping needs. Calculators, coverage tips and buying guides are just some of the features planned.

Remember, if you don’t compare rates annually you can wind up overpaying for the same coverage, without even being aware of it. At the least, you’ll be confident that you’re getting a good deal from your current carrier. To download for the iPhone, click here