CarInsurance.com Insights

- Your state’s DMV determines if you need an SR-22, not your insurance company. Common triggers include license suspensions, DUI convictions, or driving without insurance.

- Expect to pay an average of $382 a year for non-owner SR-22 insurance. It could be higher or lower depending on the state you live in.

- Georgia, Missouri, and Texas offer SR-22A certificates for some minor violations instead of a standard SR-22 certificate, which typically results in a lower increase in cost. Ask your DMV if you qualify; it could save you hundreds per year.

- You can purchase a non-owner SR-22 online in most states. The insurer electronically files your SR-22 with the DMV immediately after payment is received.

- Make sure you keep your insurance card in your wallet or phone at all times. You could face license suspension, a fine or potential jail time if you fail to show proof of insurance when pulled over.

If you’ve been cited for multiple violations, involved in serious accidents, or convicted of a DUI/DWI, you may need SR-22 insurance to keep your license.

An SR-22 isn’t a policy, it’s a state-required certificate proving you carry the minimum coverage. For drivers without a vehicle, a non-owner SR-22 insurance policy fulfills this requirement, helping you stay compliant while keeping costs low.

In this guide, we break down the cheapest non-owner SR-22 insurance companies, average rates by state, and how to find affordable coverage — even after a serious driving offense.

What is non-owner SR-22 insurance?

Non-owner SR-22 insurance is car insurance coverage for high-risk drivers who don’t own a car. If you’ve been involved in a DUI/DWI, reckless driving or multiple car accidents, a car insurance company will deem you a high-risk driver.

When you do get behind the wheel, you will still need an insurance policy that covers bodily injury liability and property damage liability. Car insurance companies offer non-owner liability policies when auto insurance is required, but the driver doesn’t own a vehicle.

Typically, the need for a non-owner policy arises because:

- The state mandates that someone have auto insurance, but they don’t own a car.

- Someone who doesn’t own a car wants insurance coverage when they occasionally drive non-owned vehicles like rental cars or a family member’s vehicle.

Mark Friedlander, director of corporate communications for the Insurance Information Institute (Triple-I), an industry research and advocacy organization, says not being able to provide proof that you have non-owner auto insurance and an SR-22 filed with the state’s DMV could be considered a misdemeanor in most jurisdictions.

If you’re pulled over by law enforcement and can’t provide proof, Friedlander says you could be looking at the following punishments:

- Suspension or revocation of your driver’s license

- Court costs, attorney’s fees and fines initiated by your state, county or city

- Potential jail time if you have been caught multiple times without proof of insurance

Who needs non-owner SR-22 insurance?

High-risk drivers, or those with severe moving violations on their driving record, must often file an SR-22, and if they rent or borrow cars frequently, they would want a non-owner SR-22.

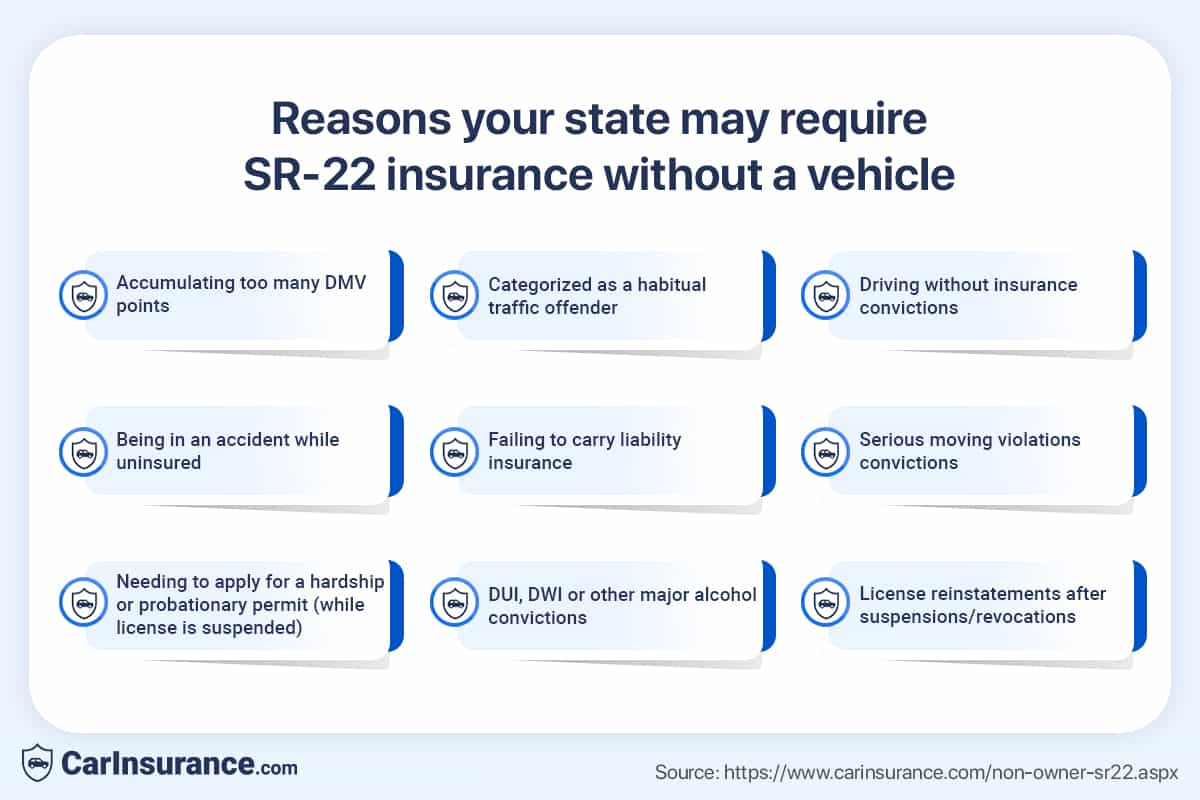

According to Andrew Head, certified financial planner and associate professor of finance at Western Kentucky University, some of the reasons your state may require SR-22 insurance without a vehicle include:

- Accumulating too many DMV points

- Categorized as a habitual traffic offender

- Conviction for driving without insurance

- Driving uninsured and being involved in a motor vehicle accident

- Failing to carry liability insurance on your vehicle

- Involvement in a serious moving violation (such as reckless driving) convictions

- Needing to apply for a hardship or probationary permit (while license is suspended)

- Receiving a DUI, DWI or other major alcohol offense convictions

- Reinstating your license after a suspension or revocation

Three states – Georgia, Missouri and Texas – separately issue an SR-22A certificate, which differs from an SR-22.

“An SR-22A certificate is primarily for low-level driving offenders, such as those who fail to carry their state’s minimum liability coverage,” Friedlander says. “Your insurer issues an SR-22A certificate and files it with your state’s Department of Motor Vehicles, just like an SR-22.”

Being required to file an SR-22A could adversely impact your auto insurance rates depending on why you need the certificate, although your premium likely won’t jump as high as it would if you need an SR-22.

How does non-owner SR-22 insurance work?

When you’ve received a DUI/DWI, reckless driving or multiple moving violations, you will be required to file an SR-22 form, which verifies your financial responsibility. A non-owner policy is the type of insurance you may need if you don’t own a car. Hence, you have insurance and state-mandated forms to comply with the laws for such a situation.

States can mandate non-owners to obtain car insurance and carry an SR-22 to verify financial responsibility. That’s because state agencies know these individuals can be negligent and harm others and their property while driving, even if they don’t own the car they’re operating.

“Be aware that not owning a vehicle may make it more difficult to obtain an SR-22 certificate,” Friedlander says. “You will need to furnish proof of insurance to earn the certificate. If you don’t own a vehicle, you should apply for a non-owner auto insurance policy before filing for an SR-22 certificate.”

What does non-owner SR-22 insurance cover?

Typically, this policy covers liability up to the limits purchased and is secondary to the auto insurance policy of the vehicle’s owner. For example, if you borrow and drive a friend’s car, their policy will be primary.

A non-owner SR-22 insurance policy will typically include the following:

Depending which state you live in and the car insurance company you’re using, you may also be able to buy other types of car insurance coverage, including:

A non-owner SR-22 insurance policy is not a primary car insurance policy. It does not offer the physical damage coverages of collision or comprehensive policies. So, if you’re involved in an accident when driving a friend’s vehicle, any damages incurred won’t be covered by your non-owner policy.

How much does non-owner SR-22 insurance cost?

A non-owner SR-22 car insurance policy ranges from $175 to $660 on average annually, based on the state you live in. The average cost for a non-owner SR-22 insurance policy is $382.

However, if you are filing an SR-22 for a traffic conviction other than a DUI — for instance, a license suspension or driving uninsured — it may be less. An SR-22 filing will also change your status from a preferred customer to a non-standard risk customer.

How to get non-owner SR-22 insurance

Purchasing a non-owner SR-22 insurance policy is similar to buying a standard car insurance policy. It’s best to understand what you need and to find the best option for your budget. A good way to find cheap SR-22 non-owner insurance quotes is to compare car insurance quotes from multiple companies.

“Prices vary from company to company, so it pays to shop around,” Friedlander says. “Get at least three price quotes from national and regional carriers. You can obtain multiple quotes via online comparison tools, on the phone directly from insurers, or through a local insurance agent representing a single company or multiple insurers.”

If you are buying a new auto insurance policy, ask if the company files SR-22 forms before you spend time getting a quote. Even though you’ll pay more for coverage attached to an SR-22, you can still save by comparison shopping.

“When shopping for coverage, non-owner car insurance policyholders with an SR-22 filing should look for discounts in addition to comparing the base price of the policy. Some common discounts you may be eligible for are bundling (such as bundling auto and home or renters insurance coverage with the same insurer), paying your bill in full and electronic communications,” Friedlander says. “You also may be eligible to sign up for a usage-based telematics program where insurers provide discounts based on tracking your driving habits via a mobile app.”

Average annual car insurance cost of non-owner insurance with an SR-22 by state

The state with the most affordable non-owner SR-22 insurance is Iowa at an average annual rate of $175. The most expensive state in the U.S. for a non-owner SR-22 policy is Florida at $660 per year, followed by Rhode Island at $600 per year and Utah at $543 per year.

Find out how your state ranks for a non-owner SR-22 policy in the table below.

| State | Average annual non-owner state minimum rate | Average annual non-owner SR-22 rate | % Difference | $ Difference |

|---|---|---|---|---|

| Alaska | $260 | $316 | 22% | $56 |

| Alabama | $380 | $481 | 26% | $101 |

| Arkansas | $266 | $389 | 46% | $123 |

| Arizona | $396 | $487 | 23% | $91 |

| California | $299 | $335 | 12% | $36 |

| Colorado | $282 | $374 | 33% | $92 |

| Connecticut | $395 | $497 | 26% | $102 |

| Washington, D.C. | $310 | $354 | 14% | $44 |

| Delaware | $344 | $374 | 9% | $30 |

| Florida | $545 | $660 | 21% | $115 |

| Georgia | $312 | $359 | 15% | $47 |

| Hawaii | $395 | $465 | 18% | $70 |

| Iowa | $153 | $175 | 15% | $22 |

| Idaho | $187 | $224 | 20% | $37 |

| Illinois | $279 | $285 | 2% | $6 |

| Indiana | $259 | $305 | 18% | $46 |

| Kansas | $274 | $325 | 19% | $51 |

| Kentucky | $375 | $404 | 8% | $29 |

| Louisiana | $330 | $379 | 15% | $49 |

| Massachusetts | $445 | $492 | 10% | $47 |

| Maryland | $438 | $457 | 4% | $19 |

| Maine | $238 | $261 | 10% | $23 |

| Michigan | $513 | $522 | 2% | $9 |

| Minnesota | $302 | $308 | 2% | $6 |

| Missouri | $358 | $369 | 3% | $11 |

| Mississippi | $321 | $342 | 7% | $21 |

| Montana | $299 | $331 | 11% | $32 |

| North Carolina | $470 | $503 | 7% | $33 |

| North Dakota | $209 | $242 | 16% | $33 |

| Nebraska | $186 | $235 | 26% | $49 |

| New Hampshire | $318 | $393 | 24% | $75 |

| New Jersey | $459 | $515 | 12% | $56 |

| New Mexico | $293 | $329 | 12% | $36 |

| Nevada | $346 | $407 | 18% | $61 |

| New York | $421 | $441 | 5% | $20 |

| Ohio | $214 | $261 | 22% | $47 |

| Oklahoma | $242 | $289 | 19% | $47 |

| Oregon | $441 | $521 | 18% | $80 |

| Pennsylvania | $263 | $324 | 23% | $61 |

| Rhode Island | $518 | $600 | 16% | $82 |

| South Carolina | $368 | $414 | 12% | $46 |

| South Dakota | $170 | $206 | 21% | $36 |

| Tennessee | $363 | $457 | 26% | $94 |

| Texas | $447 | $482 | 8% | $35 |

| Utah | $444 | $543 | 22% | $99 |

| Virginia | $290 | $379 | 31% | $89 |

| Vermont | $296 | $361 | 22% | $65 |

| Washington | $349 | $400 | 15% | $51 |

| Wisconsin | $230 | $260 | 13% | $30 |

| West Virginia | $367 | $408 | 11% | $41 |

| Wyoming | $215 | $245 | 14% | $30 |

How much does non-owner SR-22 insurance cost with a DUI by state?

If you have an SR-22 with a DUI, you’ll pay significantly higher rates. Non-owner SR-22 car insurance with a DUI averages $646 annually. Drivers in North Carolina, Hawaii, Michigan and Florida are penalized with the highest rates, while drivers in Iowa, South Dakota and North Dakota don’t see a huge increase in their rates.

See the difference between annual rates with an SR-22 and one DUI vs. a standard non-owner policy in the table below.

| State | Average non-owner annual rate | Average annual non-owner SR-22 with 1 DUI | % Difference | $ Difference |

|---|---|---|---|---|

| Alaska | $260 | $407 | 57% | $147 |

| Alabama | $380 | $638 | 68% | $258 |

| Arkansas | $266 | $466 | 75% | $200 |

| Arizona | $396 | $856 | 116% | $460 |

| California | $299 | $791 | 165% | $492 |

| Colorado | $282 | $659 | 134% | $377 |

| Connecticut | $395 | $908 | 130% | $513 |

| Washington, D.C. | $310 | $459 | 48% | $149 |

| Delaware | $344 | $598 | 74% | $254 |

| Florida | $545 | $1,100 | 102% | $555 |

| Georgia | $312 | $502 | 61% | $190 |

| Hawaii | $395 | $1,397 | 254% | $1,002 |

| Iowa | $153 | $226 | 48% | $73 |

| Idaho | $187 | $325 | 74% | $138 |

| Illinois | $279 | $460 | 65% | $181 |

| Indiana | $259 | $443 | 71% | $184 |

| Kansas | $274 | $481 | 76% | $207 |

| Kentucky | $375 | $779 | 108% | $404 |

| Louisiana | $330 | $616 | 87% | $286 |

| Massachusetts | $445 | $897 | 102% | $452 |

| Maryland | $438 | $751 | 71% | $313 |

| Maine | $238 | $406 | 70% | $168 |

| Michigan | $513 | $1,205 | 135% | $692 |

| Minnesota | $302 | $460 | 52% | $158 |

| Missouri | $358 | $500 | 40% | $142 |

| Mississippi | $321 | $620 | 93% | $299 |

| Montana | $299 | $538 | 80% | $239 |

| North Carolina | $470 | $2,063 | 339% | $1,593 |

| North Dakota | $209 | $315 | 51% | $106 |

| Nebraska | $186 | $456 | 145% | $270 |

| New Hampshire | $318 | $567 | 78% | $249 |

| New Jersey | $459 | $622 | 36% | $163 |

| New Mexico | $293 | $561 | 91% | $268 |

| Nevada | $346 | $643 | 86% | $297 |

| New York | $421 | $535 | 27% | $114 |

| Ohio | $214 | $459 | 115% | $245 |

| Oklahoma | $242 | $523 | 116% | $281 |

| Oregon | $441 | $850 | 93% | $409 |

| Pennsylvania | $263 | $705 | 168% | $442 |

| Rhode Island | $518 | $948 | 83% | $430 |

| South Carolina | $368 | $534 | 45% | $166 |

| South Dakota | $170 | $296 | 74% | $126 |

| Tennessee | $363 | $831 | 129% | $468 |

| Texas | $447 | $568 | 27% | $121 |

| Utah | $444 | $713 | 61% | $269 |

| Virginia | $290 | $717 | 147% | $427 |

| Vermont | $296 | $579 | 96% | $283 |

| Washington | $349 | $633 | 81% | $284 |

| Wisconsin | $230 | $386 | 68% | $156 |

| West Virginia | $367 | $514 | 40% | $147 |

| Wyoming | $215 | $460 | 114% | $245 |

Non-owner SR-22 insurance costs by company

While rates can vary based on the state you live in, the annual average rates for a non-owner policy range from $111 to $1,100. Please note that these rates are for an SR-22 filing only – rates for an SR-22 with a DUI are significantly higher.

Learn more about other insurers’ rates in the table below.

| Company | Average annual cost | Average monthly cost |

|---|---|---|

| Allstate | $706 | $59 |

| American Family | $254 | $21 |

| American National | $203 | $17 |

| Arbella Insurance | $481 | $40 |

| Auto Club Enterprises (AAA) | $199 | $17 |

| Auto-Owners | $111 | $9 |

| CSAA Insurance (AAA) | $909 | $76 |

| Erie Insurance | $265 | $22 |

| Farmers | $628 | $52 |

| Frankenmuth Insurance | $660 | $55 |

| GEICO | $346 | $29 |

| Iowa Farm Bureau | $250 | $21 |

| Kemper | $219 | $18 |

| Mercury Insurance | $506 | $42 |

| National General | $1,100 | $92 |

| Nationwide | $503 | $42 |

| North Carolina Farm Bureau | $345 | $29 |

| Progressive | $593 | $49 |

| Safety Insurance | $192 | $16 |

| Sentry Insurance | $451 | $38 |

| Shelter Insurance | $310 | $26 |

| Southern Farm Bureau | $249 | $21 |

| State Farm | $351 | $29 |

| Travelers | $345 | $29 |

| Vermont Mutual | $159 | $13 |

| Western National Insurance | $167 | $14 |

| Westfield Insurance | $201 | $17 |

| USAA* | $193 | $16 |

Note: USAA is only available to military community members and their families.

What can I do to avoid needing SR-22 non-owner insurance?

The simplest way to avoid the need of an SR-22 is this: Maintain adequate auto insurance coverage and drive responsibly. But if you are required to get SR-22 insurance, use it as an opportunity for a second chance at responsible driving.

“Recognize first that the requirement of an SR-22 is no trivial thing; the state requires this ‘super verification’ of coverage because you have been deemed very high risk. This most often involved driving in a way that puts other people’s lives in jeopardy,” Head says.

“Simply choosing to drive at all always poses a risk to others – doing so without insurance can mean adding possibly ruinous financial hardship to an innocent person already reeling from an injury. Think of an SR-22 as a second chance instead of a punishment. The state is allowing you to drive, despite a past mistake.”

In other words, to avoid being in a situation requiring SR-22 insurance, take your responsibility as a driver very seriously.

People also ask

I don’t own a car, but I need an SR-22 to comply with DMV regulations. Can I get an SR-22?

If you need an SR-22 but don’t own a car, you can still meet the requirement by filing a non-owner SR-22 form. Look for an insurance company that offers non-owner SR-22 insurance, which is for individuals who don’t own a vehicle but need proof of financial responsibility to maintain their driving privileges.

How do you cancel a non-owner SR-22 insurance policy?

“We recommend you contact your state’s department of motor vehicles to confirm the process in your state,” Friedlander says. “In many states, you can get an SR-22 removed from your driving record after three years by notifying your auto insurer, which will cancel the SR-22 filing with your state. However, if you cancel early, penalties can include getting your driver’s license suspended.”

If you purchase a car, you must immediately alert your car insurance carrier to cancel your non-owner policy and get a standard auto policy. The process for canceling the SR-22 certificate itself varies by state.

“You simply replace your non-owners auto insurance policy with a regular auto insurance policy that has your SR-22 certificate attached,” says Rick Estrella, director of operations for Estrella Insurance.

Key takeaways: Non-owner SR-22 insurance

- SR‑22 is not insurance — it’s a state‑required certificate that your insurer files to prove you carry the minimum auto liability coverage required by law.

- Non‑owner SR‑22 policies are for drivers without vehicles, offering liability protection (bodily injury and property damage) while deferring primary coverage responsibility to the vehicle owner.

- They are generally more affordable than full policies, with the average annual cost around $382, versus $331 for a state‑minimum coverage owner policy — only about $50 more a year.

- These policies help maintain or reinstate driving privileges for drivers flagged by serious violations like DUIs, uninsured driving, major accidents or license suspensions.

- SR‑22 filing fees are modest, typically ranging from $15 to $50, paid alongside your insurance.

- Coverage period and obligations remain, even if you don’t own a car; you must maintain continuous SR‑22 filing to prevent license suspension — usually for three to five years, depending on state and offense.

- Lower costs compared to standard SR‑22 policies (for vehicle owners) — non-owner SR‑22 coverage tends to be more cost-effective because it excludes comprehensive or collision components.

Frequently Asked Questions: Non-owner SR-22 insurance

Does non-owner SR-22 insurance cover any car I drive?

Your non-owner auto insurance policy will cover any vehicle you drive, including a rental car. But the vehicle must not be titled in your name and you should not have regular access to it. Your non-owner policy should stipulate that you only drive an unspecified vehicle occasionally.

Can I move to a different state with a non-owner SR-22?

If you plan to move to a different state while carrying a non-owner SR-22, here’s what you should do:

- Notify your insurance company: Inform your current insurer about your move. They will help you maintain SR-22 compliance in your new state and ensure your policy reflects your new location.

- Check state requirements: Different states have varying SR-22 requirements. Verify whether your new state requires SR-22 filings or has equivalent financial responsibility laws. You may need to file a new SR-22 form there, even if your current state no longer requires it.

- Maintain continuous coverage: Keep your non-owner SR-22 insurance active throughout the move. Any lapse in coverage could result in license suspension or other penalties, even after relocating.

How long do I need to carry non-owner SR-22 insurance?

Most states require SR-22 insurance for three years, though it can vary depending on the violation and your driving history. It’s important not to let the policy lapse, as your insurer must notify the state if the SR-22 is canceled.

Can I get non-owner SR-22 insurance with a suspended license?

Yes. In most states, you can buy a non-owner policy and file an SR-22 to begin the process of license reinstatement. Once the SR-22 is active and accepted by the state, you may be allowed to drive again under reinstated status.

Can I switch from non-owner SR-22 insurance to a regular policy later?

Yes. When you buy or lease a car, you can switch to a standard auto policy with SR-22 filing. Your insurer can usually transfer the SR-22 to your new policy without interruption, helping you maintain continuous coverage.

What’s the difference between an SR-22 and non-owner insurance?

An SR-22 is not a type of insurance — it’s a state-required form proving you have coverage. A non-owner policy is an actual insurance product that includes liability protection for drivers who don’t own a car. When you combine them, it satisfies both legal and insurance requirements.

Can I buy non-owner SR-22 insurance online?

Yes. Many major insurers — including Progressive, State Farm and GEICO — allow you to purchase non-owner SR-22 insurance online or through an agent. The insurer will electronically file the SR-22 with your state immediately after purchase.

What happens if I don’t keep my non-owner SR-22 insurance?

If you don’t keep your non-owner SR-22 insurance active, it can lead to serious consequences, including:

- License suspension: The SR-22 form is required to prove financial responsibility, and if your insurance lapses or is canceled, your insurer will notify the state. This typically results in an automatic suspension of your driver’s license.

- Fines and penalties: You may be required to pay fines or additional fees to reinstate your driving privileges after the suspension.

- Extended SR-22 requirement: The state may extend the period you’re required to carry SR-22 insurance, increasing the time you need to maintain continuous coverage.

- Pricier insurance: Failing to keep your SR-22 insurance active may signal to insurers that you are a high-risk driver, leading to even higher insurance premiums in the future.

Resources & Methodology

Methodology

CarInsurance.com editors collected rates from Quadrant Information Services for a 40-year-old male and female driver carrying a full coverage insurance policy with limits 100/300/100 and $500 comprehensive and collision deductibles. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs