CarInsurance.com Insights

- The average cost of car insurance in California is $2,416 a year or $201 per month, based on our data analysis.

- Minimum liability coverage in California costs around $551 annually for limits of 30/60/15, while liability-only coverage costs $864 per year for limits of 50/100/50.

- GEICO provides the most affordable annual rates for full coverage car insurance in California, costing $1,919 per year.

- In California, driving incidents can significantly increase premiums, with a speeding ticket raising rates by up to 43%, a DUI raising rates by 177%, and an at-fault accident by up to 78%.

Car insurance costs in California vary greatly depending on various factors, including the type of coverage you choose, coverage limits, your address and personal factors.

GEICO offers the cheapest annual rates for full coverage car insurance in California at $1,919 annually, or $169 per month.

Whether you’re a new driver, switching insurance companies or just trying to save money, it’s important to understand your options.

This guide explains everything you need to know about buying car insurance in California, including the factors that affect your premiums and experts’ recommendations for avoiding overpaying.

We’ve analyzed quotes from various national and regional car insurance companies in California to help you confidently choose the right policy.

How much is car insurance in California?

We found that drivers in California pay $201 monthly for full coverage car insurance.

Understanding the average insurance cost can help you plan your budget. Remember, car insurance rates vary widely, depending on the type of car you drive, your driving history and other personal factors.

See how rates change in California based on driver profile:

- Teen drivers in California pay the most — about $519 a month or $6,233 a year.

- Young drivers in their 20s pay an average of $302 monthly or $3,622 annually, for car insurance.

- Senior drivers pay around $202 monthly or $$2,424 a year.

- A speeding ticket can increase your rates to $298 monthly or $3,576 annually.

- An at-fault accident increases car insurance rates to $354 a month or $4,246 a year.

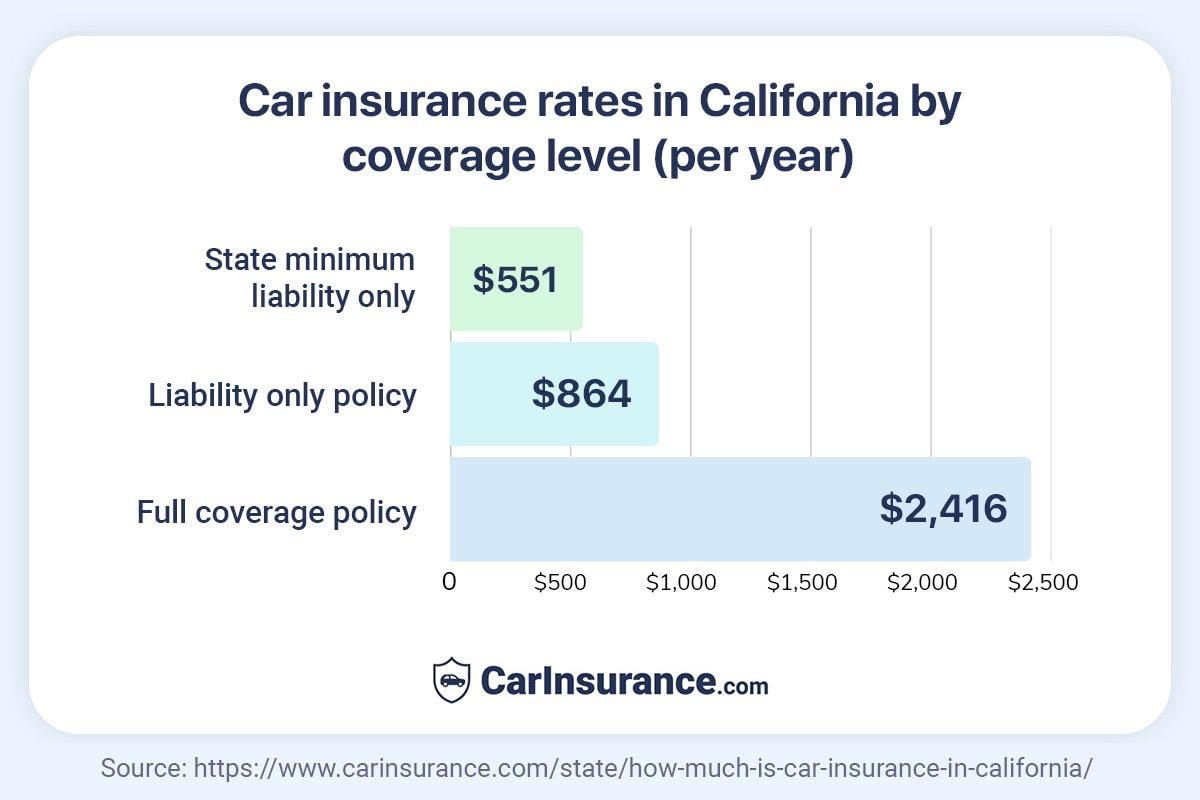

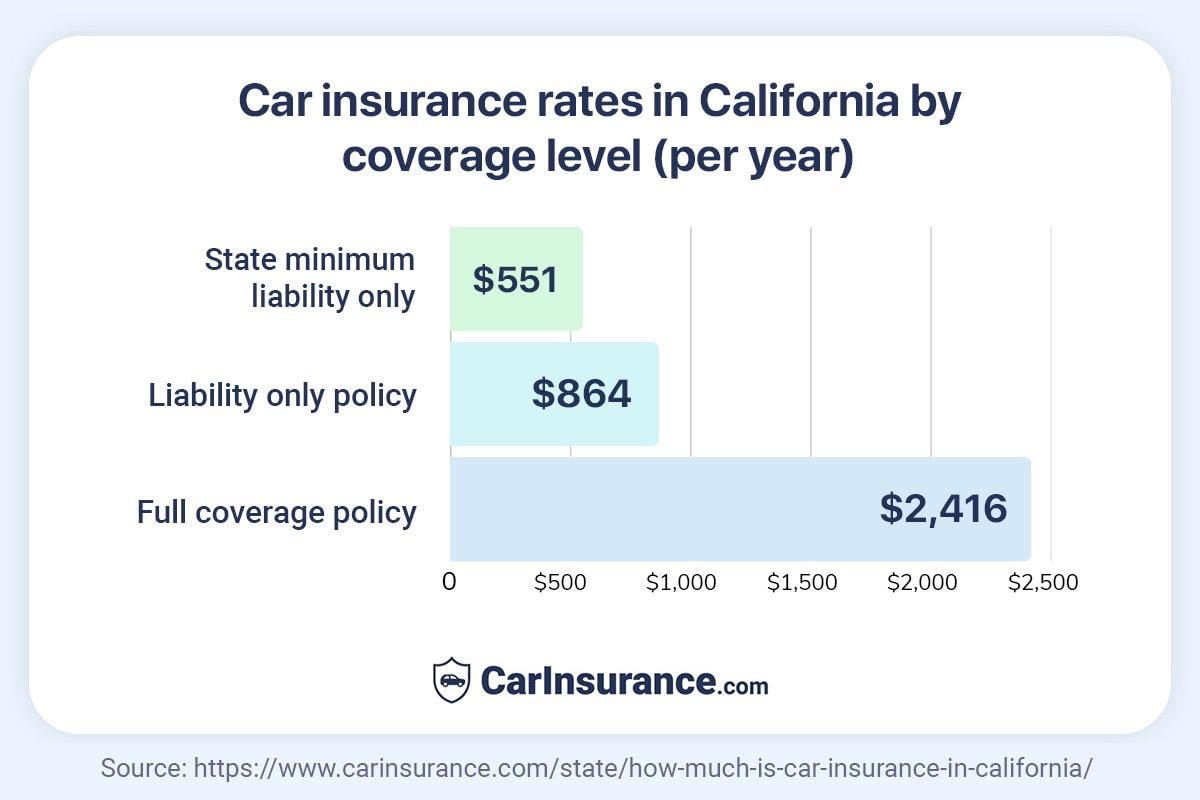

Average cost of auto insurance in California by coverage level

Car insurance costs in California can differ based on the coverage limit. To legally drive, California residents must adhere to the minimum liability limits of 30/60/15.

Liability-only insurance policies are the most affordable option and provide the minimum coverage required in California. However, they don’t offer much protection.

While liability insurance protects you from financial loss by covering legal defense and damages if you’re found responsible for causing injury or property damage to others, it doesn’t protect your vehicle or passengers.

On the other hand, full coverage car insurance is more expensive, but it offers extensive protection. It helps cover your vehicle in case of accidents, theft, natural disasters, and animal collisions. Full coverage can make you feel more secure, knowing you’re well-protected if something happens.

Full coverage car insurance comprises liability, comprehensive, collision and any other coverage required by your state.

Below, you will find the rates for car insurance in California for different coverage levels.

| Coverage Level | Avg. Monthly Cost in CA | Avg. Annual Cost in CA |

|---|---|---|

| State Minimum – Liability Only BI/PD | $46 | $551 |

| Liability Only – 50/100/50 BI/PD | $72 | $864 |

| Full Coverage – 100/300/100 Liability BI/PD with $500 Comp/Coll Deductible | $201 | $2,416 |

State minimum car insurance in California

California laws mandate that all drivers carry insurance with minimum liability limits of $30,000 for bodily injury liability per person, $60,000 for bodily injury liability per accident and $15,000 for property damage liability.

California’s state minimum coverage costs $551 a year but doesn’t provide much protection for drivers. California drivers may purchase additional coverage, such as comprehensive and collision insurance, increase their liability limits, and add personal injury coverage or other endorsements for extra protection.

Drivers in California must be aware of the minimum insurance coverage requirements to stay compliant.

Liability-only car insurance in California

According to CarInsurance.com data, liability-only car insurance costs $864 in California for liability limits of 50/100/50 – $50,000 in bodily injury coverage, $100,000 in bodily injury coverage per accident and $50,000 in property damage coverage.

Liability-only insurance helps cover the costs if you damage someone else’s car or injure someone in an accident. It’s more affordable than full coverage insurance, but remember, it doesn’t pay for repairs to your vehicle or cover injuries to your passengers.

Full coverage car insurance in California

The average annual premium in California is $2,416 for a full coverage policy with limits of 100/300/100 – $100,000 in bodily injury coverage, $300,000 in bodily injury coverage per accident and $100,000 in property damage coverage.

Experts recommend that drivers purchase full coverage insurance with the highest liability limits they can afford to be financially protected. Full coverage car insurance policies include liability, comprehensive and collision coverage.

How does California’s liability insurance differ from no-fault systems?

California follows a tort system, which differs significantly from no-fault systems in how claims are handled after a car accident.

In California, the driver found to be at fault for an accident is responsible for paying the other party’s damages (medical expenses, property damage, pain and suffering, etc.). Fault is determined by insurance companies or, if contested, by the courts.

California requires drivers to carry liability insurance, which covers damages to others if they are at fault in an accident. It includes bodily injury and property damage. The responsibility for paying for damages depends on who is found to be at fault. The party at fault, or their insurer, pays for the damages and injuries. You can file a lawsuit against the at-fault driver for damages if you’re the injured party.

Calculate the cost of car insurance in California

A policy that is perfect for someone living in one ZIP code might be expensive for a driver living in another.

When determining insurance premiums, companies study crime rates, traffic conditions, car thefts and population density in different areas. This research helps them assess the associated risk and set competitive policy prices.

This means that residents in California’s higher-risk neighborhoods bear greater financial burdens than those in areas with lower risks.

Our tool lets you quickly obtain insurance quotes for different coverage limits specific to your ZIP code within minutes. Input your ZIP code to see how much you can save on premiums.

Calculate car insurance rates by ZIP code in California

Rates vary by location. Our tool helps you understand how your ZIP code impacts your premium.

For 30 year old Male ( Full - 100/300/100)

Estimate car insurance in California by car model

Car insurers in California use the make and model of your car to determine your insurance rates. Cars deemed more expensive to repair, such as luxury cars and EVs, may raise your rates more than those with cheaper repair costs.

For example, luxury brands like Maserati, BMW, Porsche, and Audi tend to have higher insurance costs. On the other hand, more affordable brands like Subaru, Hyundai, Honda, and Mazda typically have the cheapest insurance costs.

Find out how much you’ll pay for car insurance for your vehicle make and model in California.

Guide: How to estimate car insurance using our car insurance estimator tool

Car insurance rates by age group in California

As you age, the cost of your car insurance might change. As a young driver, you’ll pay more than an experienced, older driver. This is because younger drivers are more prone to accidents. The Insurance Institute for Highway Safety reports that the crash rate for teen drivers is four times higher than for drivers 20 years old or older.

Car insurance companies know teen drivers are less experienced and riskier to insure. California drivers aged 30 to 60 have the lowest average auto insurance rates at $2,392 annually.

Drivers aged 16-19 pay $3,841 more for car insurance than California drivers aged 30-60 per year.

See the average rates by age group below:

- For teen drivers: Teens aged 16-19 can expect to pay $6,233 per year for a full coverage car insurance policy.

- For young adults: Drivers aged 20-25 can expect to pay $3,509 yearly for a full coverage policy.

- For average-aged adult drivers: Drivers aged 30 to 60 can expect to pay $2,392 annually in California.

- For senior drivers: Drivers aged 65 and older can expect to pay $2,424 per year.

Check out our detailed guide on average car insurance rates by age

Rates based on driver profile, history and habits in California

If your driving record includes a DUI, speeding ticket or an at-fault accident, your rates will increase significantly. A DUI conviction in California can increase your premiums by up to 177% because insurers see you as a risky driver.

If you receive a speeding ticket in California, be prepared for your car insurance rates to rise by up to 43% when you renew your policy. This increase might last for about three years. However, the exact amount of the increase depends on the specific laws in your state, your insurance provider and your driving record.

Find below how much your car insurance rate increases depending on driving incidents:

- Speeding ticket: Up to 43% increase

- DUI conviction: 177% increase

- At-fault accident (bodily injury and property damage): 78% increase

Even if you’ve received a traffic ticket, you can still save money by comparing insurance quotes.

Car insurance cost in California for high-risk drivers

In California, drivers deemed high-risk face higher car insurance premiums due to the increased risk. Factors like past accidents and traffic infractions significantly affect premium costs.

Luckily, there are ways for high-risk drivers to reduce their premium payments. Shopping around and comparing quotes is a great place to start, as each company will have its own rate structure tailored to individual needs.

Use the tool below to see which company offers cheaper rates for drivers with speeding tickets, DUI convictions and at-fault accidents.

Select your state and risk factor below to see the insurance company and its average annual full coverage rates.

Learn more: The 10 most important factors that affect car insurance rates

Explore car insurance costs in your neighboring states

Compare car insurance quotes in California

In California, drivers can save on car insurance by comparing prices from different companies. Many factors affect how much you pay, like your driving history and the type of car you drive. Luckily, there are plenty of choices to help you find good insurance that fits your budget.

Begin your search for the top car insurance policy in California by getting quotes from multiple insurance providers and comparing them.

In the table below, see an overview of various car insurance companies in California, along with their average annual premiums.

| Company | State Minimum | 50/100/50 | 100/300/100 |

|---|---|---|---|

| GEICO | $367 | $591 | $1,919 |

| Mercury Insurance | $458 | $766 | $2,031 |

| Progressive | $433 | $637 | $2,179 |

| Kemper Insurance | $492 | $803 | $2,429 |

| Travelers | $629 | $954 | $2,460 |

| Auto Club Enterprises (AAA) | $623 | $974 | $2,466 |

| CSAA Insurance (AAA) | $457 | $627 | $2,600 |

| Allstate | $717 | $1,104 | $2,627 |

| State Farm | $569 | $900 | $2,701 |

| Nationwide | $712 | $1,123 | $2,799 |

| Farmers | $774 | $1,280 | $3,035 |

| USAA | $410 | $653 | $1,827 |

Car insurance rates by city in California

Tarzana is the most expensive city in California, with an average car insurance rate of $3,430 a year. Mount Shasta is the cheapest city for California drivers at an average rate of $1,832 annually.

Car insurance rates vary by city in California for several reasons. One of the most significant factors is traffic congestion. Areas with more traffic typically have higher rates of accidents and claims, which leads to higher premiums.

Rates can also be influenced by factors such as uninsured motorist statistics, expenses related to repairs and medical treatment and the city’s overall crime rate.

Below, you’ll see the average annual car insurance cost of major cities in California.

Select your city below to see the insurance company and its average full coverage rates.

How do car insurance rates differ in urban areas compared to rural regions in California?

In California — as in most states — car insurance rates tend to be higher in densely populated urban areas than in sparsely populated rural regions. While every individual’s premium depends on several factors, such as driving record, vehicle type, age, etc., where you live can significantly impact premiums.

Urban areas like Los Angeles or the San Francisco Bay Area have higher population densities. This increases the likelihood of accidents, theft and vandalism, which leads to higher premiums. Rural areas have fewer cars on the road, reducing the chances of collisions and claims and resulting in lower rates.

Cities tend to have higher crime rates, including vehicle theft and vandalism, which drives up insurance premiums. Rural areas typically experience lower crime rates, resulting in lower premiums for comprehensive coverage.

How much is car insurance in California per month?

A full-coverage car insurance policy in California costs $201 monthly for coverage limits of 100/300/100.

Here’s how much you’ll pay in California per month for different coverage limits:

- State minimum liability-only coverage costs $46 a month.

- A liability-only policy with limits of 50/100/50 costs $72 a month.

- Full coverage policy with limits of 100/300/100 and $500 deductible costs $201 per month.

Paying car insurance monthly can offer individuals greater budget flexibility. By spreading the cost over time, they can avoid the strain of a hefty lump sum payment and manage their expenses more comfortably.

Alternatively, paying your car insurance in full upon renewal may earn you a discount. Ultimately, the ideal choice depends on your needs and situation.

Final thoughts on choosing car insurance in California

When it comes to car insurance, one size doesn’t fit all. Drivers prioritize different things. Some value top-notch customer service and are willing to pay extra for it. Others focus on finding the cheapest rates possible. Some look for insurance companies with user-friendly mobile apps for managing claims and payments.

Understanding your needs and finding the best insurance policy at a great price is important. So, take your time and check out different options to find the right policy for you.

Resources & Methodology

Sources

Insurance Institute for Highway Safety. “Teenagers.” Accessed February 2026.

Methodology

CarInsurance.com commissioned Quadrant Information Services to get car insurance rates in California. The average premiums are based on the sample profile of a 40-year-old male and female driving a Honda Accord LX with a good insurance score and a clean driving record.

The rates are for different coverage limits. It includes:

- Full coverage car insurance with a coverage limit of $100,000 in bodily injury per person, $300,000 in bodily injury coverage per accident, $100,000 in property damage coverage per accident and a $500 collision/comprehensive deductible.

- Liability-only car insurance rates with a limit of 50/100/50.

- State minimum coverage limit of 30/60/15.

To evaluate the rates, we have compared 53,409,632 insurance quotes from 75 company groups across 34,588 ZIP codes. The average premiums are for comparison purposes only; your exact rates may vary.

Note: USAA is only available to military community members and their families.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs