The type of vehicle you own is one of the main factors insurance companies consider when determining your insurance rates. For instance, a family sedan with a small engine, advanced safety features and low repair costs.

But which makes and models have the cheapest insurance costs?

We found the least expensive vehicle to insure is the Honda CR-V, which costs $966 for six months or $161 per month.

Whether you’re buying your first car or looking to cut insurance costs, these models offer the right mix of affordability and safety features.

Cheapest cars to insure in 2025

To find the cheapest vehicles to insure, we compared car insurance rates in every state for approximately 3,000 different vehicle models to find the cheapest vehicles to insure in 2025.

The cheapest cars to insure in 2025 are:

- Honda CR-V

- Honda HR-V

- Volkswagen Tiguan

- Hyundai Venue

- Chevrolet Trailblazer

See the table below for the cheapest vehicles to insure in 2025.

| Cheapest model | Vehicle type | Six-month rates |

|---|---|---|

| Honda CR-V | SUV | $966 |

| Honda HR-V | SUV | $968 |

| Volkswagen Tiguan | SUV | $990 |

| Hyundai Venue | SUV | $1,000 |

| Chevrolet Trailblazer | SUV | $1,006 |

| Subaru Forester | SUV | $1,007 |

| Mazda CX-5 | SUV | $1,010 |

| Chevrolet Express | Van | $1,018 |

| Subaru Outback | Station wagon | $1,021 |

| Hyundai Kona | SUV | $1,024 |

| Hyundai Tucson | SUV | $1,031 |

| Volkswagen Taos | SUV | $1,032 |

| Subaru Crosstrek | SUV | $1,032 |

| Toyota Corolla Cross | SUV | $1,033 |

| Kia Sportage | SUV | $1,035 |

| Honda Pilot | SUV | $1,038 |

| Honda Odyssey | Minivan | $1,040 |

| Toyota RAV4 | SUV | $1,043 |

| Mazda CX-30 | SUV | $1,043 |

| Chevrolet Equinox | SUV | $1,045 |

| Kia Seltos | SUV | $1,047 |

Honda CR-V

- Average monthly insurance cost: $161

- Average six-month insurance cost: $966

- Reasons supporting relatively cheap rates: Ample safety features, including standard Honda Sensing.

The CR-V wasn’t the only Honda vehicle that landed on our list – four Hondas in the top 20 cheapest cars to insure this year (the most of any car manufacturer), including two CR-V and the HR-V trim levels.

“In addition to having the latest advanced driver assist features, the Honda CR-V has traditionally received high marks from NHTSA and the IIHS, thanks to the automaker’s proprietary Advanced Compatibility Engineering (ACE) design. ACE is a uniquely engineered network of front frame structures that absorbs and deflects crash energy, meaning Honda vehicles, like the CR-V, hold up well structurally in the event of an accident,” says Carl Anthony, managing editor of Automoblog and AutoVision News.

The CR-V comes with standard forward collision mitigation, which warns of an impending collision and applies the brakes if necessary, lane-keeping assist, adaptive cruise control, and automatic high beams. Cars with advanced safety features tend to be involved in fewer accidents, preventing claims and lowering insurance costs.

However, the CR-V comes in a few trim levels, each with varying insurance costs. Below is a closer look at the average six-month premiums based on the exact model:

| Make model | Trim | Six-month rates |

|---|---|---|

| Honda CR-V | CR-V EX | $971 |

| Honda CR-V | CR-V EX-L | $980 |

| Honda CR-V | CR-V LX | $974 |

Honda HR-V

- Average monthly insurance cost: $161

- Average six-month insurance cost: $968

- Reasons supporting relatively cheap rates: Low MSRP, advanced safety features, like Honda Sensing, and basic interiors

The Honda HR-V is the second Honda crossover to make this list. Like the CR-V, it has advanced safety features and a relatively low MSRP, which lowers insurance costs.

The exact model can impact your insurance costs if you are in the market for a Honda HR-V. The table below breaks down the average costs by model.

| Make model | Trim | Six-month rates |

|---|---|---|

| Honda HR-V | HR-V EX-L | $996 |

| Honda HR-V | HR-V LX | $946 |

| Honda HR-V | HR-V Sport | $962 |

Read about the cheapest Honda models to insure

Volkswagen Tiguan

- Average monthly insurance cost: $165

- Average six-month insurance cost: $990

- Reasons supporting relatively cheap rates: Advanced safety features

The Volkswagen Tiguan boasts a lengthy list of safety features. These include a rear-view camera system, safety cage, Intelligent Crash Response System, automatic post-collision braking system and more. Additionally, it offers IQ Drive, which assists drivers in making smart moves on the road. All of these safety features help make this vehicle more affordable to insure.

As with all vehicles, the exact model impacts your premiums. The table below highlights the average premiums by model:

| Make model | Trim | Six-month rates |

|---|---|---|

| Volkswagen Tiguan | Tiguan S | $981 |

| Volkswagen Tiguan | Tiguan SE | $976 |

| Volkswagen Tiguan | Tiguan SE R-Line Black | $1,011 |

Read about the cheapest Volkswagen models to insure

Hyundai Venue

- Average monthly insurance cost: $167

- Average six-month insurance cost: $1,000

- Reasons supporting relatively cheap rates: Low MSRP, relatively small engine, basic interiors, and advanced safety features.

Insurers love small engines since they tend to be involved in fewer accidents. Their basic interiors keep repair costs low. The car also has standard advanced safety features, including forward-collision avoidance assist with pedestrian detection, lane-keeping assist and driver attention warning.

“The Hyundai is not particularly powerful. The power-to-weight ratio is such that an experienced driver should be able to handle the car in a variety of situations,” says Brian Moody, executive editor for Autotrader and Kelley Blue Book.

Since the exact model can impact your insurance costs, see how the different price points break down in the table below.

| Make model | Trim | Six-month rates |

|---|---|---|

| Hyundai Venue | Venue Limited | $993 |

| Hyundai Venue | Venue SE | $1,007 |

| Hyundai Venue | Venue SEL | $993 |

Read about the cheapest Hyundai models to insure

Chevrolet Trailblazer

- Average monthly insurance cost: $168

- Average six-month insurance cost: $1,006

- Reasons supporting relatively cheap rates: Low MSRP, relatively small engine and advanced safety features.

The Chevrolet Trailblazer offers an undeniably attractive starting MSRP of $23,000. The relatively low price point for a vehicle packed with safety features leads to an affordable insurance premium.

A few of the many safety features include forward collision alerts, automatic emergency braking, lane departure warnings and following distance indicators.

This vehicle comes with many different levels and features. Typically, adding more features leads to higher insurance costs. See how the different price points break down in the table below.

| Make model | Trim | Six-month rates |

|---|---|---|

| Chevrolet Trailblazer | Trailblazer ACTIV | $1,020 |

| Chevrolet Trailblazer | Trailblazer LS | $988 |

| Chevrolet Trailblazer | Trailblazer LT | $1,010 |

| Chevrolet Trailblazer | Trailblazer RS | $1,019 |

Read about the cheapest Chevrolet models to insure

Why does your car model affect insurance rates?

Insurance companies love statistics and use them extensively in their premium-setting algorithms. Unfortunately, statistics show that certain vehicle types are involved in more accidents and claims, while others are involved in far fewer accidents that result in a claim.

“Repair and replacement costs are a huge factor for insurance rates,” says Zach Lazzari, founder at Cross Border Coverage. “For example, some vehicles have very high repair costs for common fender bender damage. Entire panels may require replacements on one vehicle while others can be fixed with a simple dent remover and some fresh paint.”

Cars with lower insurance costs are often family-friendly vehicles. They typically have smaller engines, come equipped with strong safety features, and are frequently driven by parents, who tend to be more cautious on the road. This combination leads to fewer accidents, which helps keep insurance rates down.

Safety features such as airbags, lane departure, backup cameras and automatic restraint systems are all factored into an insurance premium and typically push your insurance rate down. Minivans and SUVs are good examples and often come with some of the lowest insurance premiums on our list.

Which types of cars have the most affordable car insurance?

Ultimately, the vehicle type will impact your insurance rates. Insurers consider a wide variety of risk factors and certain vehicle types have more risk than others. In the table below, see which types of cars are more affordable than others, along with their six-month premiums.

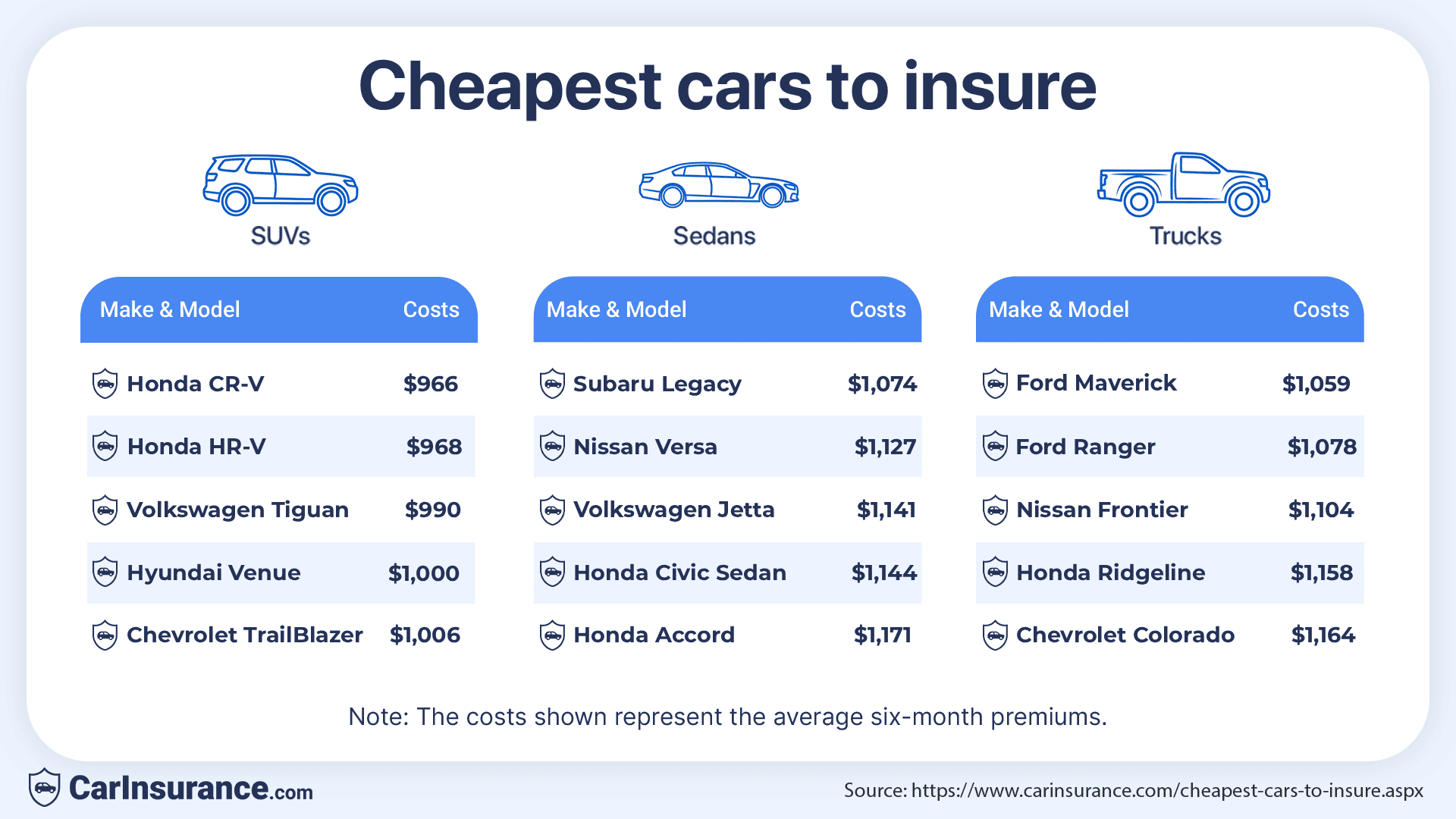

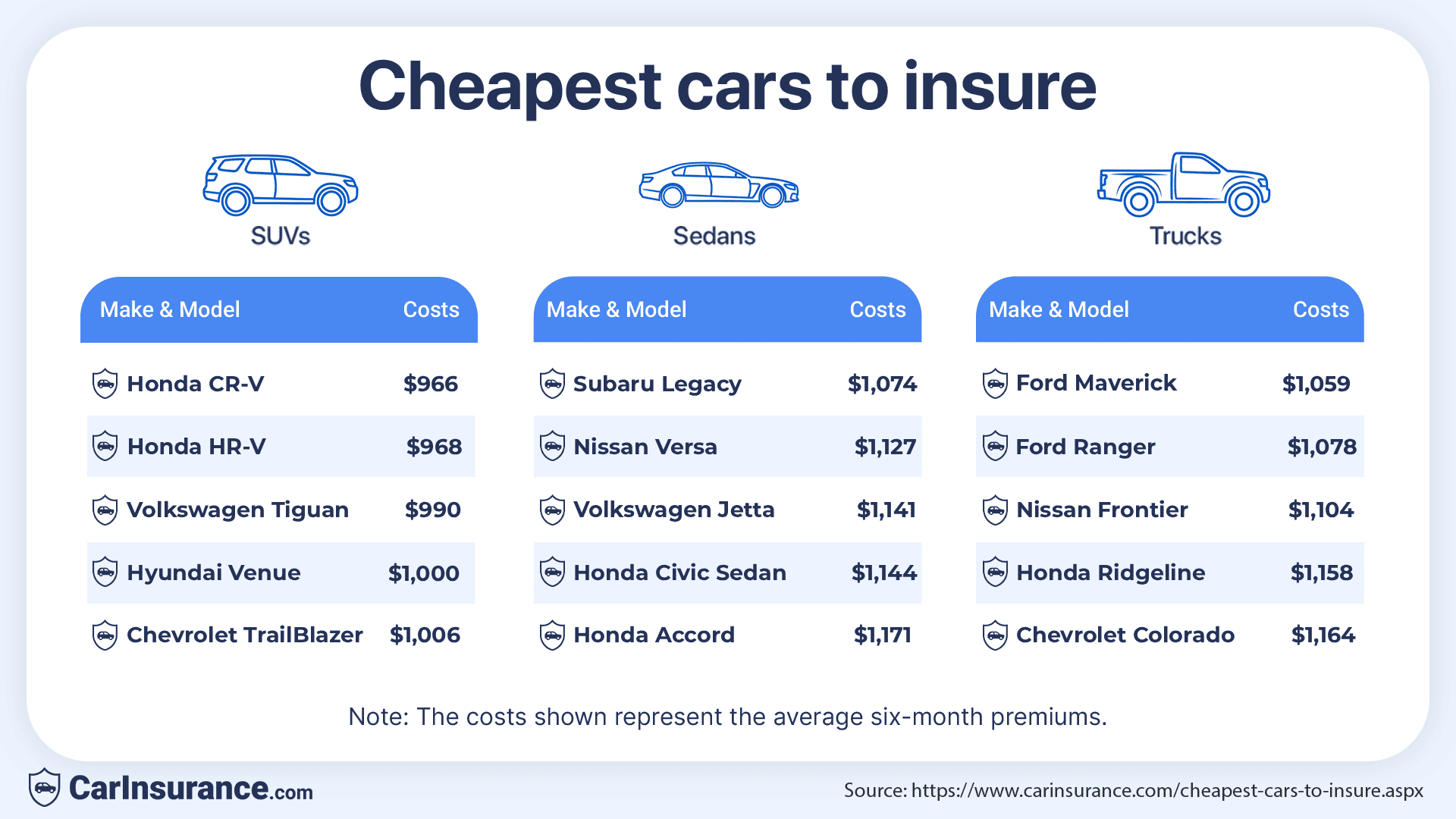

Cheapest SUVs to insure

The cheapest SUVs to insure are as follows:

- Honda CR-V: Average cost of $966 per six-month premium.

- Honda HR-V: Average cost of $968 per six-month premium.

- Volkswagen Tiguan: Average cost of $990 per six-month premium.

- Hyundai Venue: Average cost of $1,000 per six-month premium.

- Chevrolet TrailBlazer: Average cost of $1,006 per six-month premium.

Cheapest sedans to insure

Some of the cheapest sedans to insure include:

- Subaru Legacy: Average cost of $1,074 per six-month premium.

- Nissan Versa: Average cost of $1,127 per six-month premium.

- Volkswagen Jetta: Average cost of $1,141 per six-month premium.

- Honda Civic Sedan: Average cost of $1,144 per six-month premium.

- Honda Accord: Average cost of $1,171 per six-month premium.

Cheapest trucks to insure

Some of the cheapest trucks to insure include:

- Ford Maverick: Average cost of $1,059 per six-month premium.

- Ford Ranger: Average cost of $1,078 per six-month premium.

- Nissan Frontier: Average cost of $1,104 per six-month premium.

- Honda Ridgeline: Average cost of $1,158 per six-month premium.

- Chevrolet Colorado: Average cost of $1,164 per six-month premium.

Cheapest cars to insure in every state

Car insurance costs vary based on where you live. The table below highlights the average rates for each state’s cheapest cars to insure.

Select your location and vehicle type to see which makes and models are the cheapest to insure, with average six-month rates.

Cheapest cars to insure by company

Every car insurance company determines rates differently, leading to different premiums across the industry. The table below shows the average premiums for the cheapest rates by vehicle and company.

Select your state and vehicle type to see which insurance companies offer the cheapest car insurance, with the lowest average six-month rates.

Cheapest cars to insure for New & Young Drivers

Most insurance companies carefully consider a driver’s age before determining premiums. In most cases, young drivers pay significantly more than experienced drivers. However, for new drivers, some cars are cheaper to insure than others.

The table below highlights the cheapest cars to insure for young drivers by state.

Select your state and vehicle type to see the cheapest cars to insure for 18-year-olds, with average six-month rates.

Note: Rates are based on insurance costs for 18-year-old drivers.

Tips for choosing the cheapest cars to insure

The vehicle you choose will impact how much you pay for car insurance. Avoiding sports and luxury cars is an excellent way to save money on your insurance costs.

“Avoid new vehicles that have a high value and high repair costs,” Lazzari says. “Mid-size SUVs and sedans that are proven, reliable and have a robust parts market are ideal.”

Here are a few more tips for finding cheap cars for insurance:

- Avoid EVs: While EVs may be the future of cars, they are still expensive to insure. This is mainly due to the battery and repair costs. Repair costs can be higher as they often require specially trained mechanics to work on them.

- Avoid luxury and sports cars: Sports cars are designed for speed, often leading to accidents and claims. A large engine under the hood will always lead to a massive insurance premium.

- Avoid cars that thieves target: If your vehicle is popular with car thieves, you will pay more for coverage, regardless of whether you have ever had a car stolen. Insurers have to replace your vehicle if it is stolen, so if your car is a higher theft risk, they will charge you for it.

- Consider a used car: If you are looking for a cheap car to insure, consider an older vehicle. Older technology, more affordable repair costs and a lower sticker price make used cars cheaper to insure than a brand-new one.

Which trim and model features make a car cheaper to insure?

If you are hoping to save some money on your car insurance, look for these trim levels and model features:

- Trim: Most vehicles come in a few different trim levels. For example, the 2022 Honda Civic has four trims: the LX, Sport, EX and Touring models. Choose the base-level vehicle if a low insurance premium is your most significant consideration. This will be the lowest-priced trim with the least expensive features.

- Advanced safety features: Look for a trim level with advanced safety features as standard equipment. Many car makers have made their advanced safety systems standard across all trim levels, including the base model.

- Security systems: A stolen car means your insurer must pay for a replacement vehicle. They will discount your premium if your vehicle has an anti-theft device installed. The discount may be even more significant for GPS tracking devices.

Resources & Methodology

Sources

- National Insurance Crime Bureau (NICB). “Hot Wheels.” Accessed September 2025.

- Recurrent. “Costs to Replace an EV Battery and How to Avoid It.” Accessed September 2025.

- The New York Post. “This pickup truck was the most-stolen vehicle of 2021.” Accessed September 2025.

- Kelly Blue Book. “New and Used Car Price Values, Expert Car Reviews.” Accessed September 2025.

Methodology

CarInsurance.com commissioned Quadrant Information Services to calculate average auto insurance rates for around 3,000 car models.

Averages are calculated using data from seven large carriers, such as Allstate, AmTrust, Farmers, GEICO, Nationwide, Progressive and State Farm, in every state. The rankings were based on each car model’s best-performing standard set of features.

Averages are based on full coverage for a single 40-year-old male who commutes 12 miles to work each day, with policy limits of 100/300/50 ($100,000 for injury liability for one person, $300,000 for all injuries and $50,000 for property damage in an accident) and a $500 deductible on collision and comprehensive coverage.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs