CarInsurance.com Insights

- Hamtramck, Detroit and New Orleans face the highest premiums in the country, driven by a combination of state laws and local risk. Michigan’s no-fault insurance system significantly raises costs, while Louisiana’s exposure to hurricanes and flooding pushes rates even higher.

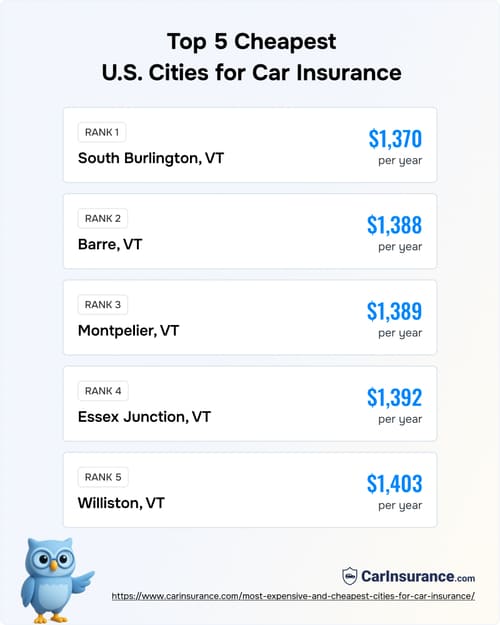

- Vermont cities have lower car insurance rates due to their low density, lower crime rates and an at-fault system. South Burlington, VT averages $1,370/year, $5,652 less than Hamtramck, thanks to fewer cars, accidents and safer roads.

- Natural disasters and weather extremes are reshaping insurance availability and affordability. Climate-driven risks are causing insurers to withdraw or increase premiums in flood, hurricane and wildfire-prone regions, creating new insurance deserts.

- You can’t move for insurance savings alone, but understanding your rate drivers helps you shop smarter. Be sure to compare quotes from different insurers and ask about available discounts to lower your premiums.

Car insurance costs don’t just depend on your driving record or the car you drive: Your city and ZIP code play an equally important role. Rates can vary by thousands of dollars between towns in the same state, reflecting differences in traffic density, accident frequency, crime rates, weather risks and local insurance laws.

As part of CarInsurance.com’s mission to simplify car insurance decisions, our Editor-in-Chief, Laura Longero and her team analyzed these local patterns so drivers can see how their ZIP code or city compares and what factors drive their costs.

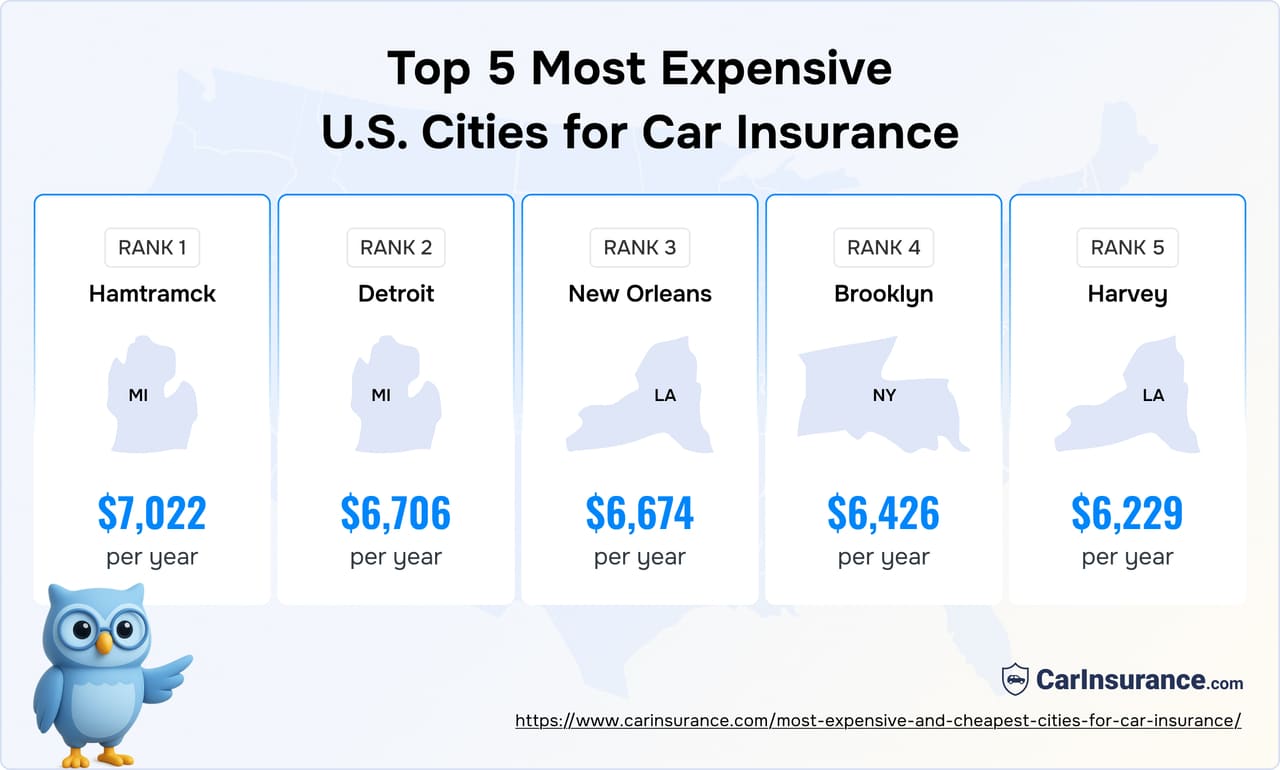

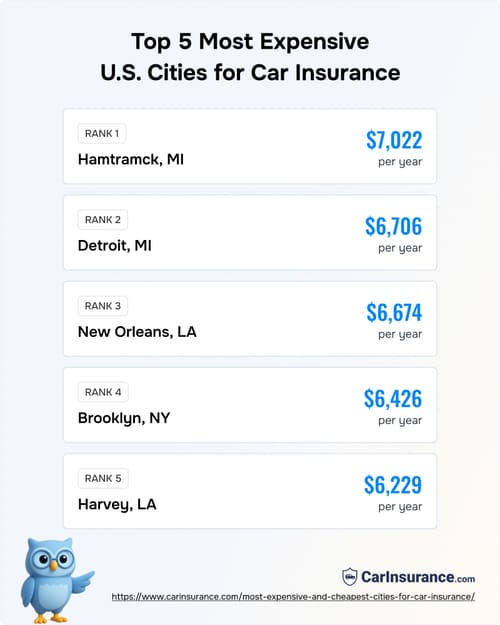

CarInsurance.com’s analysis highlights the sharp divide between the most and least expensive U.S. cities for car insurance. Drivers in urban centers like Hamtramck, Detroit, New Orleans and Brooklyn face some of the highest costs in the nation, while those in smaller Vermont towns pay among the lowest.

The most expensive cities for car insurance in the United States

The cities with the most expensive car insurance rates are located in Michigan and Louisiana. This is no coincidence — the factors driving up premiums are tied to a state’s laws and local conditions.

In Michigan, cities like Hamtramck and Detroit have some of the highest rates in the nation, primarily due to a no-fault insurance system that has mandated unlimited personal injury protection coverage, as well as high rates of uninsured drivers and vehicle theft.

Cities in Louisiana, particularly in the New Orleans metropolitan area, like Harvey, Terrytown and Marrero, are seeing premiums inflated by a high risk of natural disasters like hurricanes, significant urban congestion and a high rate of lawsuits.

“Getting the right amount of money is important, but when we see these nuclear verdicts that are way out of line compared to the injuries and accidents, we’re all paying for it,” Ruiz says.

These factors create a challenging financial environment for drivers, making car insurance a significant financial burden that often exceeds the national average.

Below is a list of the most expensive U.S. cities for car insurance

- Hamtramck, MI: $7,022 per year

- Detroit, MI: $6,706 per year

- New Orleans, LA: $6,674 per year

- Brooklyn, NY: $6,426 per year

- Harvey, LA: $6,229 per year

The table below shows the 25 most expensive cities for car insurance in the U.S.

| Rank | City, state | Annual premium |

|---|---|---|

| 1 | Hamtramck, MI | $7,022 |

| 2 | Detroit, MI | $6,706 |

| 3 | New Orleans, LA | $6,674 |

| 4 | Brooklyn, NY | $6,426 |

| 5 | Harvey, LA | $6,229 |

| 6 | Terrytown, LA | $6,227 |

| 7 | Waggaman, LA | $6,130 |

| 8 | Marrero, LA | $6,021 |

| 9 | Arabi, LA | $6,012 |

| 10 | Chalmette, LA | $5,908 |

| 11 | Violet, LA | $5,901 |

| 12 | Meraux, LA | $5,803 |

| 13 | St. Bernard, LA | $5,739 |

| 14 | Gretna, LA | $5,715 |

| 15 | Egypt Lake-Leto, FL | $5,714 |

| 16 | River Rouge, MI | $5,567 |

| 17 | South Ozone Park, NY | $5,476 |

| 18 | South Richmond Hill, NY | $5,450 |

| 19 | Ozone Park, NY | $5,439 |

| 20 | Ecorse, MI | $5,432 |

| 21 | Howard Beach, NY | $5,429 |

| 22 | St. Albans, NY | $5,424 |

| 23 | Richmond Hill, NY | $5,419 |

| 24 | Boynton Beach, FL | $5,411 |

| 25 | Jamaica, NY | $5,410 |

Cheapest cities for car insurance in the United States

Vermont has some of the most affordable car insurance rates in the United States.

The state’s low population density means fewer cars are on the road, which directly translates to a lower frequency of accidents and claims. Its at-fault insurance system allows insurers to offer competitive premiums.

Vermont’s crime rates are also among the lowest in the country, reducing the risk of vehicle theft and vandalism. The state also has a relatively low rate of uninsured motorists, which helps keep costs down for law-abiding drivers.

Here are the cheapest U.S. cities for car insurance in 2026:

- South Burlington, Vermont: $1,370 per year

- Barre, Vermont: $1,388 per year

- Montpelier, Vermont: $1,389 per year

- Essex Junction, Vermont: $1,392 per year

- Williston, Vermont: $1,403 per year

The table below shows the 25 cheapest U.S. car insurance cities.

| Rank | City, state | Annual premium |

|---|---|---|

| 1 | South Burlington, VT | $1,370 |

| 2 | Barre, VT | $1,388 |

| 3 | Montpelier, VT | $1,389 |

| 4 | Essex Junction, VT | $1,392 |

| 5 | Williston, VT | $1,403 |

| 6 | Shelburne, VT | $1,408 |

| 7 | Colchester, VT | $1,412 |

| 8 | Burlington, VT | $1,413 |

| 9 | Rutland, VT | $1,421 |

| 10 | West Rutland, VT | $1,422 |

| 11 | Brunswick, OH | $1,425 |

| 12 | Meridian, ID | $1,426 |

| 12 | Proctor, VT | $1,426 |

| 14 | East Montpelier, VT | $1,429 |

| 14 | Winooski, VT | $1,429 |

| 16 | Websterville, VT | $1,443 |

| 17 | South Hero, VT | $1,448 |

| 18 | Grand Isle, VT | $1,449 |

| 18 | White River Junction, VT | $1,449 |

| 20 | Quechee, VT | $1,454 |

| 21 | Charlotte, VT | $1,455 |

| 21 | Swanton, VT | $1,455 |

| 23 | Highgate Springs, VT | $1,456 |

| 23 | Norwich, VT | $1,456 |

| 25 | Kuna, ID | $1,457 |

Explore the most and least expensive cities in your state

Top 10 cities where insurance spiked the most

While rising car insurance rates are a national trend, the impact is felt most acutely in specific cities where a combination of factors — traffic, crime and local regulation — create a perfect storm for soaring premiums.

The data reveals a dramatic financial divide, with drivers in some urban centers paying thousands of dollars more per year than the national average.

Brooklyn, New York, has experienced one of the most significant percentage increases in the U.S., with a rise of 128%, according to Brent Buell, Lead Data Analyst at CarInsurance.com. However, CarInsurance.com’s analysis shows that seven of the top 10 cities with the most significant increases are in Louisiana — one of the most expensive states for car insurance.

The table below highlights the cities hardest hit by insurance rate increases.

| Rank | City, state | 2023 premium | 2025 premium | $ Difference | % Difference |

|---|---|---|---|---|---|

| 1 | New Orleans, LA | $2,949 | $6,674 | $3,725 | 126% |

| 2 | Hamtramck, MI | $3,370 | $7,022 | $3,652 | 108% |

| 3 | Brooklyn, NY | $2,814 | $6,426 | $3,612 | 128% |

| 4 | Detroit, MI | $3,280 | $6,706 | $3,426 | 104% |

| 5 | Harvey, LA | $2,824 | $6,229 | $3,405 | 121% |

| 6 | Terrytown, LA | $2,824 | $6,227 | $3,403 | 121% |

| 7 | Marrero, LA | $2,677 | $6,021 | $3,344 | 125% |

| 8 | Waggaman, LA | $2,927 | $6,130 | $3,203 | 109% |

| 9 | Arabi, LA | $3,011 | $6,012 | $3,001 | 100% |

| 10 | Gretna, LA | $2,759 | $5,715 | $2,956 | 107% |

If you are paying higher car insurance premiums, it may be a good time to review your coverage and consider switching to a different insurer. Sophie, CarInsurance.com’s official mascot, can guide you through a step-by-step process to switch car insurance, making the process simpler and more manageable.

What drives insurance rate differences across U.S. cities?

Car insurance rates vary widely across the U.S. Your location — down to your ZIP code — is one of the most significant factors in determining your premium.

Insurance companies use various data to assess a driver’s risk in a particular area. The risk is directly reflected in the cost of coverage.

Key factors driving car insurance rate differences across U.S. cities include:

- Population and traffic density: Cities with a high population and heavy traffic congestion have a greater risk of accidents. More cars on the road lead to more opportunities for collisions, fender-benders and other incidents. The increased risk of claims translates to higher premiums for drivers in urban areas.

- Crime rates: Insurers analyze local crime statistics, particularly those related to vehicle theft and vandalism. If your city or neighborhood has a high rate of these crimes, your comprehensive coverage premiums will be higher to account for the increased likelihood of a claim.

- Cost of living and repair: The cost of labor, medical care and auto parts varies from city to city. In areas with a high cost of living, the expenses associated with a car accident — from vehicle repairs to medical bills — are higher. Insurance companies factor these costs into their premiums to ensure they can cover a potential claim.

- Weather and natural disasters: Cities prone to extreme weather events like hurricanes, floods, hailstorms or severe winter storms face higher insurance rates. Natural disasters increase the risk of vehicle damage, leading to a higher volume of insurance claims and, consequently, higher premiums.

- Local laws: State and local laws also play a role. Some states have higher minimum coverage requirements, which can drive up premiums. For example, states with no-fault insurance laws often have higher rates because insurers must pay for medical expenses regardless of who is at fault for the accident.

“Most of the considerations are risk,” says Janet Ruiz, director of strategic communications for the Insurance Information Institute. “If there are more severe accidents or (increased) accident frequency in your area, you’re exposed to more risk. Your driving miles are your personal risk priced into your policy.”

Rate gap: The car insurance divide between U.S. cities

For millions of drivers, the difference in car insurance premiums can be stark, with some paying hundreds — or even thousands — of dollars more per year just because of their address.

This financial divide, which can be as high as $3,000 annually between cities, reflects insurers’ risk calculations based on location. It’s not just about a driver’s record; it’s about their driving environment.

The reasons for high rates in densely populated urban centers are multifaceted. More cars on the road increase the risk of accidents, from fender-benders in rush-hour traffic to collisions in congested intersections.

City life comes with higher rates of vehicle theft and vandalism, which impacts the cost of comprehensive coverage. Insurers also account for the cost of living — expensive cities have higher labor costs for repairs and inflated medical expenses after an accident, all of which get factored into a driver’s premium.

Drivers in smaller towns or rural areas often benefit from significantly lower premiums. With less traffic and fewer vehicles, the probability of an accident is lower. These areas also tend to have lower crime rates and a more manageable cost of living, reducing the potential expense of claims.

While small-town drivers face other risks, such as extreme weather events, their overall risk profile is often more favorable, resulting in substantial savings. The geographic disparity highlights how a driver’s ZIP code can be as influential as their driving history in determining the final price of their policy.

Rate gap: Detroit vs. Dearborn, Michigan

The difference in car insurance costs between Detroit and its neighboring city, Dearborn, is startling. Detroit drivers pay approximately $1,500 more per year.

Drivers in Detroit may pay $1,500 more per year than drivers in Dearborn, Michigan.

The price gap highlights the role location plays in determining insurance rates, even for geographically close cities. While both cities are located in Michigan — a state known for having some of the highest car insurance rates in the nation due to its no-fault system and other regulations — specific factors drive up premiums in Detroit.

Insurance companies assess risk based on an area’s crime statistics, including vehicle theft and vandalism, as well as the frequency of car accidents. As a larger, more densely populated urban center, Detroit has higher rates of both. Traffic congestion and road conditions, which can lead to more accidents and claims, also play a part.

While Dearborn has a large population, it has a lower risk profile in these areas, translating into lower premiums for residents.

Rate gap: Brooklyn, NY vs. Jersey City, NJ

Even though Brooklyn, New York and Jersey City, New Jersey, are just a few miles apart, their car insurance rates are very different. The annual premium in Brooklyn is $6,426, and in Jersey City, it is $3,414 – Brooklyn residents pay nearly double the cost for car insurance.

Several factors drive the $3,012 gap:

- State insurance laws and regulations

- New York and New Jersey have different insurance systems.

- New Jersey is a “verbal threshold” no-fault state, which allows drivers to limit their right to sue in exchange for lower premiums.

- Population density and traffic risk

- Brooklyn has denser traffic and more registered vehicles per square mile than Jersey City, which increases the risk of accidents.

- More congestion means more claims, and insurers adjust rates accordingly.

- Claim frequency and severity

- Historical claims data indicate higher accident, theft, and vandalism rates in certain parts of New York City compared to Jersey City.

- Insurers charge more in ZIP codes where payouts are consistently higher.

- Litigation and medical costs

- New York tends to have higher medical and litigation costs tied to auto claims.

- Courts in New York often award larger settlements, which insurers take into account when pricing policies.

- Local factors like fraud and theft rates

- Brooklyn has a higher incidence of staged accidents and higher auto theft rates than Jersey City, another driver of premiums.

Although the two cities are close in proximity, differences in state insurance laws, traffic density, claim trends and fraud rates make Brooklyn one of the most expensive places in the U.S. for auto insurance, while Jersey City is more affordable.

See the rate gap in other U.S. cities in the table below.

| City | Premium | City | Premium | Difference |

|---|---|---|---|---|

| Brooklyn, NY | $6,426 | Jersey City, NJ | $3,414 | $3,012 |

| Detroit, MI | $6,706 | Warren, MI | $4,226 | $2,480 |

| Brooklyn, NY | $6,426 | Newark, NJ | $3,968 | $2,458 |

| Detroit, MI | $6,706 | Dearborn, MI | $5,150 | $1,556 |

| Los Angeles, CA | $4,201 | Long Beach, CA | $3,279 | $922 |

| Los Angeles, CA | $4,201 | Pasadena, CA | $3,484 | $717 |

| Dallas, TX | $3,184 | Fort Worth, TX | $2,700 | $484 |

| Chicago, IL | $2,421 | Evanston, IL | $1,938 | $483 |

| Chicago, IL | $2,421 | Oak Park, IL | $2,215 | $206 |

| San Francisco, CA | $3,466 | Daly City, CA | $3,283 | $183 |

| Seattle, WA | $2,581 | Bellevue, WA | $2,406 | $175 |

| Seattle, WA | $2,581 | Tacoma, WA | $2,716 | $135 |

| Miami, FL | $4,901 | Fort Lauderdale, FL | $4,793 | $108 |

| Miami, FL | $4,901 | Hialeah, FL | $4,828 | $73 |

| San Francisco, CA | $3,466 | Oakland, CA | $3,466 | $0 |

Insurance ‘deserts’: Where drivers struggle to find affordable coverage

In insurance “deserts,” drivers face challenges finding affordable and sometimes even available car insurance.

These areas lack access to property and casualty insurance because insurers have either reduced their presence or priced their coverage prohibitively expensive. It can leave residents with limited choices, excessively high premiums, and, in some cases, the inability to get a policy.

Several factors contribute to the creation of insurance deserts. Geographic location is a key determinant because insurers assess risk based on an area’s crime rates, traffic congestion and frequency of accidents.

In urban areas with higher rates of vehicle theft, vandalism and collisions, insurance companies may raise premiums or withdraw from the market entirely, citing the high cost of claims. Climate change is also playing a role. Areas prone to natural disasters like floods, wildfires or hurricanes are seeing insurers pull back as the risk of catastrophic loss becomes too high to be profitable.

“Weather is a huge factor,” Ruiz says. “You see more accidents in bad weather. As climate risk increases with more severe winter storms, hail and flooding that impact insurance rates.”

High insurance costs can make it difficult for drivers in insurance deserts to afford a policy, which is legally required in most states.

Why city location matters more than you think

Where you live is a significant factor in determining your car insurance premium. Insurers use your specific city and your ZIP code to assess risk, which is the primary driver of your rate. The reasons for the disparity are rooted in the differing environments of urban areas versus rural areas.

In dense urban areas, insurers face a higher likelihood of costly claims. Heavy traffic and an increase in cars result in a higher frequency of accidents, ranging from minor fender benders to serious collisions.

Crime rates are also a significant concern. Cities with a higher incidence of vehicle theft, vandalism and break-ins see higher premiums for comprehensive coverage. The cost of living in a city also inflates the price of auto repairs and medical care, directly impacting an insurer’s expenses when a claim is filed.

Conversely, rural and suburban areas typically have lower premiums because the driving risks are significantly reduced. Fewer cars on the road decreases the chance of an accident, and crime rates are often lower, making vehicle theft and vandalism less of a concern.

While drivers in rural areas may face other risks, such as those from extreme weather or wildlife collisions, the overall risk profile is generally more favorable for insurance companies. Location-based risk assessment is why a driver with a clean record could still pay more for car insurance if they live in a major city than a similar driver in a small town.

Resources & Methodology

Sources

- Council for a Better Louisiana. “Understanding the High Costs of Louisiana Auto Insurance.” Accessed January 2026.

- Insurance Information Institute. “What determines the price of an auto insurance policy?” Accessed January 2026.

- PwC. “Climate risk and insurance: the case for resilience.” Accessed January 2026.

- Rocky Mountain Insurance Information Institute. “Cost of Auto Insurance.” Accessed January 2026.

- Smart Choice. “Insurance Deserts: Strategies for Agents in High-Risk Areas.” Accessed January 2026.

Methodology

CarInsurance.com’s analysis combines insurance rate data from Quadrant Information Services with internal research to calculate premiums for 40-year-old male and female drivers with a full-coverage policy, limits of 100/300/100, and $500 deductibles for comprehensive and collision coverage.

This methodology is developed and regularly updated by CarInsurance.com’s data and editorial team to ensure that premium comparisons at the city and ZIP level are consistent and unbiased. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs