If you’ve ever received a speeding ticket while driving out of state, you might wonder if it will follow you home.

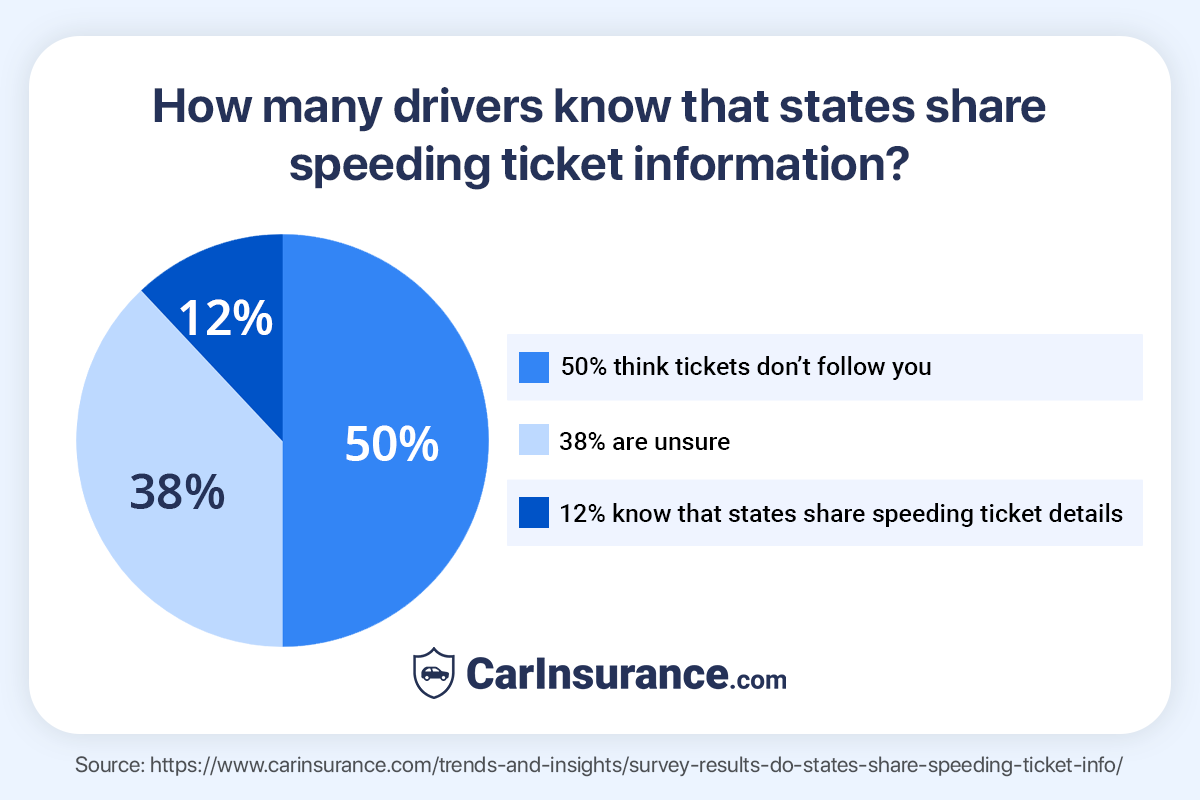

According to a recent poll by CarInsurance.com, the majority of drivers —88% — are unclear or completely unaware of how speeding ticket information is shared between states.

Let’s break down what drivers think and what you should do if you find yourself with an out-of-state ticket.

50% think their ticket won’t follow them to another state

Around 50% of drivers believe that a speeding ticket received in another state simply disappears once they return home, but that’s far from reality.

Most U.S. states are members of the Driver License Compact (DLC) or the Non-Resident Violator Compact (NRVC). These agreements allow states to share information about traffic offenses, including speeding tickets. So, if you get a ticket in Colorado while living in Illinois, your home state will likely be notified, and the consequences can follow.

38% are unsure what happens to out-of-state tickets

38% of drivers simply aren’t sure what happens when they get a ticket outside their home state. This uncertainty can lead to inaction; unfortunately, ignoring the ticket doesn’t make it disappear.

Our data analysis shows that a single speeding ticket can increase your car insurance rates by 39%, or $736 annually.

Speeding remains a major contributor to traffic fatalities. In 2023, it was responsible for 29% of all deaths, claiming the lives of more than 32 people every day, according to the National Safety Council.

12% of drivers know that states share ticket information

Only 12% of drivers who responded to the poll know that most states share speeding ticket information. Even states not officially part of the Driver License Compact (DLC) or Non-Resident Violator Compact (NRVC) still have ways to share traffic violation data with other states.

So, getting a ticket in a non-member state doesn’t mean you’re off the hook; the information can still make its way back to your home state through other channels.

Got a ticket out of state? Here’s what you should do next

Getting pulled over far from home can be frustrating, but an out-of-state speeding ticket should never be ignored. Whether you were on a road trip, business travel or passing through another state, here’s how to handle the situation the right way:

- Don’t ignore the ticket: No matter where it happened, the ticket won’t disappear. Failing to pay the fine could lead to additional fines or license suspension.

- Consider your options: You generally have two choices: pay the ticket or fight the ticket, either by appearing in court or hiring an attorney in that state.

- Notify your insurance company: Your insurer may eventually discover the violation, especially if it is on your driving record. Some policies require you to report violations directly. It’s better to be proactive, especially if you’re shopping for a new policy or your policy is up for renewal.

- Monitor your driving record: Once the ticket is resolved, check with your state’s DMV to see if any points were added, as it can impact your insurance rates.

Final thoughts

Most drivers don’t realize that a speeding ticket from another state can impact their record and insurance premiums. States share traffic violation information, which means your home state and insurer will find out.

It is essential to deal with the ticket and check your driving record to see how it might affect your premiums at policy renewal time.

Resources & Methodology

Sources

National Safety Council. “Motor Vehicle Safety Issues.” Accessed June 2025.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs