Get car insurance with expert-backed guidance

Whether you’re switching insurers, exploring new coverage or buying for the first time, CarInsurance.com simplifies the process. Our expert-backed tools and data-driven insights help you compare options and choose the right policy — quickly and on your terms.Begin your car insurance journey

From cost calculators to state-specific rates and coverage guides, we’ve made it simple for you to find the right policy. Whether you’re just starting or narrowing down your options, our tools and expert insights will help you make the right decision confidently.Car insurance rates: What can you expect to pay?

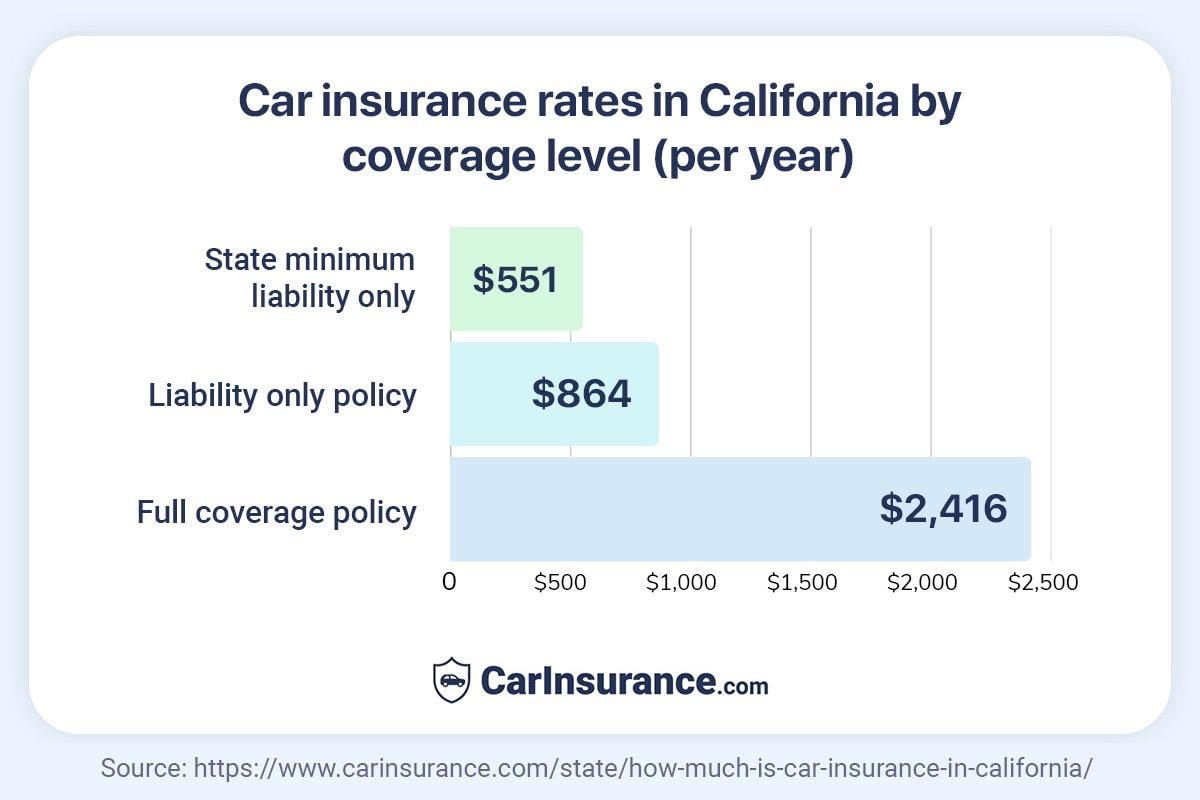

Start your coverage search with the facts. We’ve broken down average costs by coverage level and age group to help you make informed choices from the start — like how full coverage averages $2,513/year, while teen drivers often pay over $7,647/year. Our broader research spans drivers by age, driving history and location, giving you a full picture before you compare.

“Understanding costs up front helps you shop with clarity and avoid surprises,” Laura Longero, Editor-in-chief, CarInsurance.com.

Average cost by age group

Trusted guidance, built over decades

We combine experience, research and real-world insights to help you understand coverage, estimate costs and choose with confidence.

Millions of quotes analyzed; zero guesswork

We analyze millions of quotes and break down how factors like location, age and coverage levels shape your premium so that you can compare insurers with clarity.

How much do you pay for car insurance?

Find out which insurers offer low rates near you| Select your state | COMPANY | AVERAGE ANNUAL RATE |

|---|---|---|

| Alaska | Progressive | $1,752 |

| Alaska | GEICO | $1,818 |

| Alaska | State Farm | $2,523 |

| Alaska | Allstate | $2,791 |

| Alaska | Western National Insurance | $2,832 |

| Alaska | USAA | $1,575 |

| Alabama | Travelers | $1,677 |

| Alabama | GEICO | $1,709 |

| Alabama | Country Financial | $1,840 |

| Alabama | Nationwide | $1,963 |

| Alabama | Auto-Owners | $2,227 |

| Alabama | Progressive | $2,452 |

| Alabama | Allstate | $2,524 |

| Alabama | Farmers | $3,024 |

| Alabama | USAA | $1,556 |

| Arkansas | Travelers | $1,680 |

| Arkansas | GEICO | $1,871 |

| Arkansas | Shelter Insurance | $2,103 |

| Arkansas | Nationwide | $2,673 |

| Arkansas | Southern Farm Bureau | $2,798 |

| Arkansas | Farmers | $2,869 |

| Arkansas | Allstate | $3,745 |

| Arkansas | Alfa Insurance | $3,947 |

| Arkansas | Progressive | $4,017 |

| Arkansas | USAA | $1,527 |

| Arizona | Travelers | $1,707 |

| Arizona | GEICO | $1,796 |

| Arizona | Progressive | $2,114 |

| Arizona | Auto-Owners | $2,258 |

| Arizona | Nationwide | $2,636 |

| Arizona | Allstate | $2,846 |

| Arizona | Farmers | $2,865 |

| Arizona | State Farm | $2,883 |

| Arizona | CSAA Insurance (AAA) | $4,965 |

| Arizona | USAA | $1,880 |

| California | GEICO | $2,038 |

| California | Kemper | $2,584 |

| California | Progressive | $2,684 |

| California | Mercury Insurance | $2,782 |

| California | CSAA Insurance (AAA) | $2,874 |

| California | Auto Club Enterprises (AAA) | $2,967 |

| California | State Farm | $3,078 |

| California | Farmers | $3,409 |

| California | Travelers | $3,604 |

| California | Allstate | $3,922 |

| California | Nationwide | $4,227 |

| California | USAA | $2,080 |

| Colorado | GEICO | $2,249 |

| Colorado | Kemper | $2,486 |

| Colorado | Auto-Owners | $2,725 |

| Colorado | Progressive | $3,045 |

| Colorado | Southern Farm Bureau | $3,298 |

| Colorado | Farmers | $3,615 |

| Colorado | Allstate | $3,970 |

| Colorado | Acuity Insurance | $4,214 |

| Colorado | State Farm | $4,435 |

| Colorado | USAA | $2,201 |

| Connecticut | GEICO | $1,633 |

| Connecticut | Kemper | $1,737 |

| Connecticut | Nationwide | $2,675 |

| Connecticut | Allstate | $3,104 |

| Connecticut | Amica | $3,133 |

| Connecticut | Progressive | $3,265 |

| Connecticut | State Farm | $3,390 |

| Connecticut | Farmers | $3,498 |

| Connecticut | The Hanover | $6,479 |

| Connecticut | USAA | $1,631 |

| Washington, D.C. | GEICO | $1,991 |

| Washington, D.C. | Nationwide | $2,847 |

| Washington, D.C. | Chubb | $3,300 |

| Washington, D.C. | Allstate | $4,591 |

| Washington, D.C. | State Farm | $4,774 |

| Washington, D.C. | Progressive | $4,835 |

| Washington, D.C. | USAA | $1,418 |

| Delaware | GEICO | $1,831 |

| Delaware | Nationwide | $1,936 |

| Delaware | Progressive | $2,629 |

| Delaware | State Farm | $3,008 |

| Delaware | American Family | $3,225 |

| Delaware | Donegal Insurance | $4,076 |

| Delaware | Allstate | $4,700 |

| Delaware | Sentry Insurance | $6,505 |

| Delaware | USAA | $1,788 |

| Florida | Travelers | $2,520 |

| Florida | UAIC | $2,612 |

| Florida | State Farm | $2,681 |

| Florida | GEICO | $2,865 |

| Florida | Nationwide | $3,335 |

| Florida | Mercury Insurance | $4,144 |

| Florida | Allstate | $4,531 |

| Florida | Farmers | $4,777 |

| Florida | National General | $4,961 |

| Florida | Progressive | $6,622 |

| Georgia | Progressive | $1,980 |

| Georgia | GEICO | $2,248 |

| Georgia | Auto-Owners | $2,266 |

| Georgia | Country Financial | $2,545 |

| Georgia | Central Insurance | $2,681 |

| Georgia | Allstate | $3,067 |

| Georgia | Safeway Insurance | $3,412 |

| Georgia | Mercury Insurance | $3,495 |

| Georgia | State Farm | $4,107 |

| Georgia | USAA | $1,728 |

| Hawaii | GEICO | $1,251 |

| Hawaii | Progressive | $1,279 |

| Hawaii | Farmers | $1,746 |

| Hawaii | Island Insurance | $1,936 |

| Hawaii | State Farm | $2,312 |

| Hawaii | Allstate | $2,379 |

| Hawaii | USAA | $1,141 |

| Iowa | Travelers | $1,449 |

| Iowa | Auto-Owners | $1,772 |

| Iowa | GEICO | $1,871 |

| Iowa | State Farm | $2,005 |

| Iowa | West Bend Insurance Company | $2,036 |

| Iowa | IMT Insurance | $2,066 |

| Iowa | Progressive | $2,079 |

| Iowa | Allstate | $3,046 |

| Iowa | Iowa Farm Bureau | $3,212 |

| Iowa | Grinnell Mutual | $3,670 |

| Iowa | USAA | $1,319 |

| Idaho | GEICO | $1,308 |

| Idaho | State Farm | $1,452 |

| Idaho | Auto-Owners | $1,558 |

| Idaho | Farmers | $1,636 |

| Idaho | Travelers | $1,756 |

| Idaho | Nationwide | $1,802 |

| Idaho | Idaho Farm Bureau | $2,272 |

| Idaho | Allstate | $2,525 |

| Idaho | Sentry Insurance | $2,947 |

| Idaho | USAA | $777 |

| Illinois | GEICO | $1,451 |

| Illinois | Travelers | $1,455 |

| Illinois | Auto Club Group – ACG (AAA) | $1,834 |

| Illinois | Erie Insurance | $2,018 |

| Illinois | Auto-Owners | $2,031 |

| Illinois | Country Financial | $2,060 |

| Illinois | Progressive | $2,166 |

| Illinois | Allstate | $2,869 |

| Illinois | USAA | $1,638 |

| Indiana | GEICO | $1,175 |

| Indiana | Travelers | $1,475 |

| Indiana | Progressive | $1,648 |

| Indiana | Auto-Owners | $1,889 |

| Indiana | Indiana Farmers Insurance | $2,060 |

| Indiana | Farmers | $2,190 |

| Indiana | Indiana Farm Bureau | $2,662 |

| Indiana | Allstate | $2,680 |

| Indiana | USAA | $921 |

| Kansas | Travelers | $1,844 |

| Kansas | GEICO | $1,996 |

| Kansas | Nationwide | $2,119 |

| Kansas | Progressive | $2,203 |

| Kansas | Shelter Insurance | $2,312 |

| Kansas | Farmers | $2,363 |

| Kansas | State Farm | $2,897 |

| Kansas | Allstate | $3,447 |

| Kansas | Iowa Farm Bureau | $4,331 |

| Kansas | USAA | $1,375 |

| Kentucky | Travelers | $1,813 |

| Kentucky | GEICO | $2,259 |

| Kentucky | Shelter Insurance | $2,538 |

| Kentucky | Auto-Owners | $2,549 |

| Kentucky | Progressive | $3,063 |

| Kentucky | Kentucky Farm Bureau | $3,473 |

| Kentucky | State Farm | $3,827 |

| Kentucky | Allstate | $4,571 |

| Kentucky | Farmers | $5,954 |

| Kentucky | USAA | $1,619 |

| Louisiana | Southern Farm Bureau | $2,223 |

| Louisiana | GEICO | $3,347 |

| Louisiana | Progressive | $4,218 |

| Louisiana | Farmers | $4,627 |

| Louisiana | Safeway Insurance | $4,679 |

| Louisiana | State Farm | $4,761 |

| Louisiana | Auto Club Enterprises (AAA) | $4,853 |

| Louisiana | Louisiana Farm Bureau | $5,169 |

| Louisiana | Allstate | $9,726 |

| Louisiana | USAA | $2,696 |

| Massachusetts | Plymouth Rock Assurance | $1,719 |

| Massachusetts | GEICO | $1,817 |

| Massachusetts | Safety Insurance | $2,189 |

| Massachusetts | Progressive | $2,490 |

| Massachusetts | Amica | $2,491 |

| Massachusetts | Farmers | $2,807 |

| Massachusetts | Arbella Insurance | $2,807 |

| Massachusetts | Travelers | $2,962 |

| Massachusetts | Allstate | $3,388 |

| Massachusetts | USAA | $1,658 |

| Maryland | GEICO | $1,545 |

| Maryland | Nationwide | $1,834 |

| Maryland | Erie Insurance | $1,906 |

| Maryland | Travelers | $1,957 |

| Maryland | State Farm | $2,415 |

| Maryland | Progressive | $2,588 |

| Maryland | Penn National Insurance | $3,129 |

| Maryland | Allstate | $4,019 |

| Maryland | USAA | $1,311 |

| Maine | Travelers | $964 |

| Maine | Auto-Owners | $1,060 |

| Maine | GEICO | $1,441 |

| Maine | Progressive | $1,454 |

| Maine | Allstate | $2,056 |

| Maine | MMG Insurance | $2,073 |

| Maine | Farmers | $2,196 |

| Maine | State Farm | $2,357 |

| Maine | Frankenmuth Insurance | $2,415 |

| Maine | USAA | $997 |

| Michigan | GEICO | $1,827 |

| Michigan | Travelers | $2,182 |

| Michigan | Auto-Owners | $2,877 |

| Michigan | Auto Club Group – ACG (AAA) | $2,935 |

| Michigan | Progressive | $3,165 |

| Michigan | Michigan Farm Bureau | $3,870 |

| Michigan | Pioneer State Mutual | $3,996 |

| Michigan | Frankenmuth Insurance | $4,312 |

| Michigan | State Farm | $4,477 |

| Michigan | USAA | $1,811 |

| Minnesota | Travelers | $1,776 |

| Minnesota | Auto-Owners | $1,864 |

| Minnesota | Auto Club Group – ACG (AAA) | $2,035 |

| Minnesota | State Farm | $2,404 |

| Minnesota | Nationwide | $2,515 |

| Minnesota | Allstate | $2,883 |

| Minnesota | North Star Mutual | $3,161 |

| Minnesota | GEICO | $3,406 |

| Minnesota | Western National Insurance | $4,298 |

| Minnesota | USAA | $1,713 |

| Missouri | Travelers | $1,687 |

| Missouri | GEICO | $1,861 |

| Missouri | Shelter Insurance | $2,149 |

| Missouri | Missouri Farm Bureau | $2,801 |

| Missouri | Auto Club Enterprises (AAA) | $2,969 |

| Missouri | Nationwide | $3,067 |

| Missouri | Progressive | $3,934 |

| Missouri | USAA | $1,269 |

| Mississippi | Travelers | $1,885 |

| Mississippi | Shelter Insurance | $2,346 |

| Mississippi | Nationwide | $2,559 |

| Mississippi | GEICO | $2,637 |

| Mississippi | Progressive | $2,687 |

| Mississippi | Southern Farm Bureau | $2,743 |

| Mississippi | Allstate | $2,992 |

| Mississippi | Safeway Insurance | $3,518 |

| Mississippi | USAA | $1,405 |

| Montana | State Farm | $1,914 |

| Montana | Nationwide | $2,180 |

| Montana | Kemper | $2,692 |

| Montana | GEICO | $2,821 |

| Montana | Farmers | $2,984 |

| Montana | Progressive | $3,101 |

| Montana | Allstate | $3,322 |

| Montana | USAA | $1,276 |

| North Carolina | Erie Insurance | $1,168 |

| North Carolina | Progressive | $1,480 |

| North Carolina | State Farm | $1,714 |

| North Carolina | Nationwide | $2,452 |

| North Carolina | Farmers | $2,479 |

| North Carolina | North Carolina Farm Bureau | $2,795 |

| North Carolina | Penn National Insurance | $2,797 |

| North Carolina | GEICO | $3,233 |

| North Carolina | Utica National Insurance Group | $3,496 |

| North Carolina | Allstate | $4,643 |

| North Dakota | American Family | $1,238 |

| North Dakota | Nationwide | $1,250 |

| North Dakota | GEICO | $1,933 |

| North Dakota | Progressive | $2,046 |

| North Dakota | Auto-Owners | $2,446 |

| North Dakota | North Star Mutual | $2,583 |

| North Dakota | Nodak Insurance | $2,614 |

| North Dakota | State Farm | $2,704 |

| North Dakota | Allstate | $2,884 |

| North Dakota | USAA | $1,088 |

| Nebraska | Farmers Mutual of Nebraska | $1,605 |

| Nebraska | Auto-Owners | $1,638 |

| Nebraska | Shelter Insurance | $2,346 |

| Nebraska | Progressive | $2,515 |

| Nebraska | Allstate | $2,824 |

| Nebraska | GEICO | $2,859 |

| Nebraska | Iowa Farm Bureau | $4,829 |

| Nebraska | USAA | $1,797 |

| New Hampshire | The Hanover | $1,144 |

| New Hampshire | GEICO | $1,206 |

| New Hampshire | Auto-Owners | $1,377 |

| New Hampshire | Nationwide | $1,475 |

| New Hampshire | MMG Insurance | $1,606 |

| New Hampshire | Progressive | $1,859 |

| New Hampshire | Allstate | $1,904 |

| New Hampshire | State Farm | $2,280 |

| New Hampshire | Farmers | $2,784 |

| New Hampshire | USAA | $1,036 |

| New Jersey | NJM | $2,134 |

| New Jersey | Selective Insurance | $2,232 |

| New Jersey | Plymouth Rock Assurance | $2,400 |

| New Jersey | GEICO | $2,487 |

| New Jersey | Travelers | $2,579 |

| New Jersey | Farmers | $2,712 |

| New Jersey | Progressive | $3,071 |

| New Jersey | Allstate | $3,206 |

| New Jersey | State Farm | $3,819 |

| New Jersey | The Hanover | $5,557 |

| New Mexico | GEICO | $1,502 |

| New Mexico | Central Insurance | $1,952 |

| New Mexico | Progressive | $2,046 |

| New Mexico | Nationwide | $2,547 |

| New Mexico | State Farm | $2,640 |

| New Mexico | Farmers | $2,765 |

| New Mexico | Allstate | $2,995 |

| New Mexico | Kemper | $3,449 |

| New Mexico | Iowa Farm Bureau | $3,743 |

| New Mexico | USAA | $1,254 |

| Nevada | Travelers | $2,222 |

| Nevada | GEICO | $2,769 |

| Nevada | American Family | $2,848 |

| Nevada | Mercury Insurance | $3,036 |

| Nevada | Farmers | $3,712 |

| Nevada | Progressive | $3,739 |

| Nevada | State Farm | $3,875 |

| Nevada | Allstate | $4,102 |

| Nevada | CSAA Insurance (AAA) | $7,558 |

| Nevada | USAA | $1,946 |

| New York | Progressive | $1,448 |

| New York | GEICO | $2,218 |

| New York | NYCM Insurance | $2,343 |

| New York | Erie Insurance | $2,415 |

| New York | State Farm | $2,930 |

| New York | Allstate | $3,005 |

| New York | Travelers | $4,010 |

| New York | The Hanover | $4,311 |

| New York | Chubb | $4,486 |

| New York | USAA | $1,911 |

| Ohio | Grange Insurance | $1,314 |

| Ohio | GEICO | $1,522 |

| Ohio | Erie Insurance | $1,541 |

| Ohio | Auto-Owners | $1,694 |

| Ohio | Progressive | $1,756 |

| Ohio | Westfield Insurance | $1,860 |

| Ohio | Allstate | $1,922 |

| Ohio | Cincinnati Insurance | $2,086 |

| Ohio | Farmers | $2,103 |

| Ohio | Travelers | $2,353 |

| Ohio | USAA | $1,062 |

| Oklahoma | GEICO | $2,066 |

| Oklahoma | Progressive | $2,341 |

| Oklahoma | Shelter Insurance | $2,475 |

| Oklahoma | AFR Insurance | $2,671 |

| Oklahoma | Mercury Insurance | $2,871 |

| Oklahoma | State Farm | $2,946 |

| Oklahoma | Farmers | $3,020 |

| Oklahoma | Allstate | $3,457 |

| Oklahoma | Oklahoma Farm Bureau | $3,866 |

| Oklahoma | USAA | $1,542 |

| Oregon | Oregon Mutual Insurance | $1,172 |

| Oregon | Travelers | $1,657 |

| Oregon | Nationwide | $1,836 |

| Oregon | Country Financial | $1,886 |

| Oregon | GEICO | $1,993 |

| Oregon | State Farm | $2,383 |

| Oregon | Farmers | $2,587 |

| Oregon | Progressive | $3,584 |

| Oregon | USAA | $1,523 |

| Pennsylvania | Travelers | $1,423 |

| Pennsylvania | Nationwide | $1,809 |

| Pennsylvania | Erie Insurance | $1,848 |

| Pennsylvania | Allstate | $2,533 |

| Pennsylvania | Westfield Insurance | $2,660 |

| Pennsylvania | Donegal Insurance | $2,715 |

| Pennsylvania | State Farm | $2,795 |

| Pennsylvania | GEICO | $2,974 |

| Pennsylvania | Progressive | $3,600 |

| Pennsylvania | USAA | $1,958 |

| Rhode Island | Travelers | $2,141 |

| Rhode Island | State Farm | $2,162 |

| Rhode Island | Progressive | $2,369 |

| Rhode Island | Nationwide | $2,866 |

| Rhode Island | American Family | $2,924 |

| Rhode Island | GEICO | $2,982 |

| Rhode Island | Allstate | $3,181 |

| Rhode Island | Amica | $3,293 |

| Rhode Island | Farmers | $3,939 |

| Rhode Island | USAA | $1,399 |

| South Carolina | Auto-Owners | $1,715 |

| South Carolina | Nationwide | $2,130 |

| South Carolina | Southern Farm Bureau | $2,310 |

| South Carolina | Travelers | $2,342 |

| South Carolina | GEICO | $2,417 |

| South Carolina | Progressive | $2,666 |

| South Carolina | Allstate | $2,806 |

| South Carolina | State Farm | $3,133 |

| South Carolina | USAA | $1,772 |

| South Dakota | Farmers Mutual of Nebraska | $1,499 |

| South Dakota | Progressive | $2,249 |

| South Dakota | Allstate | $2,335 |

| South Dakota | Nationwide | $2,442 |

| South Dakota | Farmers | $2,796 |

| South Dakota | State Farm | $2,814 |

| South Dakota | Auto-Owners | $2,891 |

| South Dakota | North Star Mutual | $3,228 |

| South Dakota | GEICO | $3,318 |

| South Dakota | Iowa Farm Bureau | $4,708 |

| South Dakota | USAA | $2,041 |

| Tennessee | Travelers | $1,657 |

| Tennessee | GEICO | $1,673 |

| Tennessee | Erie Insurance | $2,004 |

| Tennessee | Farm Bureau Insurance of Tennessee | $2,067 |

| Tennessee | Farmers | $2,190 |

| Tennessee | Nationwide | $2,373 |

| Tennessee | Progressive | $2,661 |

| Tennessee | State Farm | $3,073 |

| Tennessee | Allstate | $3,242 |

| Tennessee | USAA | $1,271 |

| Texas | Texas Farm Bureau | $1,339 |

| Texas | Redpoint Insurance | $1,890 |

| Texas | State Farm | $2,264 |

| Texas | Auto Club Enterprises (AAA) | $2,318 |

| Texas | GEICO | $2,746 |

| Texas | Progressive | $2,916 |

| Texas | Allstate | $4,258 |

| Texas | Farmers | $4,260 |

| Texas | USAA | $1,692 |

| Utah | Nationwide | $1,188 |

| Utah | GEICO | $1,397 |

| Utah | Auto-Owners | $1,953 |

| Utah | United Insurance Co | $2,531 |

| Utah | Progressive | $2,622 |

| Utah | Farmers | $2,752 |

| Utah | Allstate | $2,879 |

| Utah | Iowa Farm Bureau | $3,138 |

| Utah | State Farm | $4,444 |

| Utah | USAA | $1,354 |

| Virginia | Travelers | $1,213 |

| Virginia | Virginia Farm Bureau | $1,216 |

| Virginia | GEICO | $1,581 |

| Virginia | Erie Insurance | $1,736 |

| Virginia | Auto-Owners | $1,979 |

| Virginia | Allstate | $2,490 |

| Virginia | Progressive | $2,525 |

| Virginia | State Farm | $2,529 |

| Virginia | Farmers | $5,319 |

| Virginia | USAA | $1,181 |

| Vermont | Progressive | $980 |

| Vermont | State Farm | $1,410 |

| Vermont | Auto-Owners | $1,501 |

| Vermont | Nationwide | $1,554 |

| Vermont | GEICO | $1,582 |

| Vermont | Co-operative Insurance Companies | $1,648 |

| Vermont | Allstate | $1,674 |

| Vermont | Vermont Mutual | $1,950 |

| Vermont | USAA | $1,038 |

| Washington | American Family | $1,752 |

| Washington | GEICO | $1,998 |

| Washington | Travelers | $2,164 |

| Washington | Farmers | $2,232 |

| Washington | Nationwide | $2,408 |

| Washington | Allstate | $2,478 |

| Washington | State Farm | $2,522 |

| Washington | PEMCO | $2,527 |

| Washington | Progressive | $2,587 |

| Washington | USAA | $1,058 |

| Wisconsin | Travelers | $1,284 |

| Wisconsin | GEICO | $1,376 |

| Wisconsin | Nationwide | $1,825 |

| Wisconsin | West Bend Insurance Company | $1,844 |

| Wisconsin | Erie Insurance | $1,951 |

| Wisconsin | Acuity Insurance | $2,464 |

| Wisconsin | Farmers | $2,664 |

| Wisconsin | Allstate | $2,923 |

| Wisconsin | Progressive | $3,563 |

| Wisconsin | USAA | $1,176 |

| West Virginia | GEICO | $1,934 |

| West Virginia | Erie Insurance | $2,092 |

| West Virginia | Westfield Insurance | $2,620 |

| West Virginia | State Farm | $2,801 |

| West Virginia | Farmers | $2,801 |

| West Virginia | Progressive | $2,974 |

| West Virginia | Allstate | $3,819 |

| West Virginia | USAA | $1,451 |

| Wyoming | American National | $827 |

| Wyoming | Farmers | $1,623 |

| Wyoming | State Farm | $1,641 |

| Wyoming | Allstate | $3,159 |

| Wyoming | GEICO | $3,211 |

| Wyoming | USAA | $1,441 |

Behind the numbers: What exactly drives insurance decisions

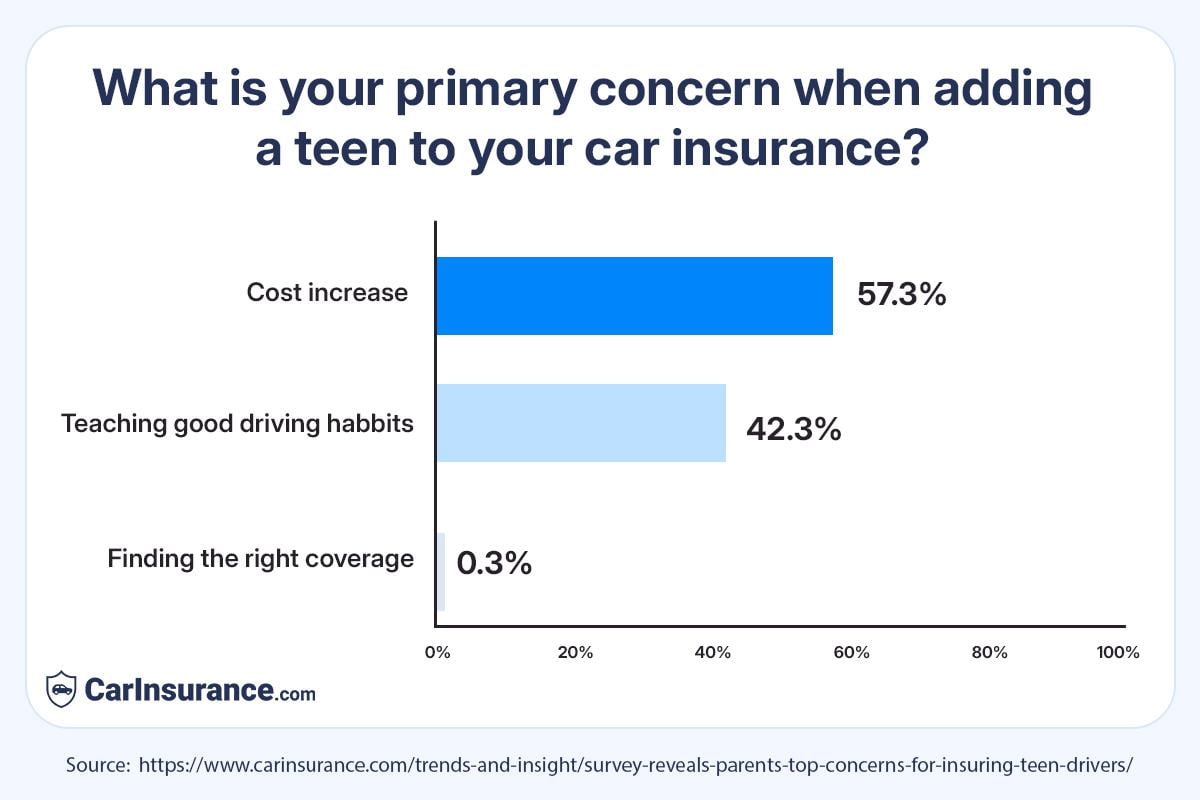

primarily due to insurance rate increase.

when adding a teen to their policy.

Expert advice you can count on

Behind every guide, calculator and recommendation is a team of licensed insurance agents, researchers and editors focused on helping you make smart coverage choices.

The latest stories from our experts

Stay up-to-date with expert-reviewed articles and insights on rates, coverage and smart shopping.

Passenger seat belt ticket: Who gets fined and does it affect insurance?

New Jersey driving points system: Suspension rules & surcharges

Failure to carry proof of insurance: Fines, penalties and what to do

How to lower your car insurance costs: Proven ways to save on coverage

Commute vs. pleasure use on car insurance: How it affects your rate

Do you have to add your spouse to your car insurance policy?

The latest research: Actionable insurance insights

Our team tracks pricing trends, driver behaviors and policy changes across the country so you stay informed, aware of savings opportunities and ahead of the curve.

Making headlines

We’re proud to be a trusted source for journalists and leading news outlets nationwide, including top financial and consumer publications.Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQsFrequently asked questions

Answers to common questions about car insurance, coverage types and how to choose what’s right for you.What is car insurance?

Car insurance is a contract between you and an insurance company that provides financial protection in case of an accident or if your car is damaged by other means, such as severe weather. The contract outlines how much the insurance company pays out for vehicle repairs and medical bills.

How does car insurance work?

State minimum liability car insurance requirements determine how much coverage to purchase in order to drive legally in each state. If you cause an accident, a claim is filed with your insurance company to help pay for property damage you caused or medical bills for the people you injured.

If you are hit, the other driver’s liability insurance would pay to fix the damage to your vehicle and for your medical expenses.

Collision coverage is optional and pays for damage to your car after an accident, regardless of who is at fault.

Comprehensive insurance covers damage to your vehicle from incidents other than collisions.

What are the different types of car insurance?

Liability insurance is mandatory in most states and covers the cost of medical bills for people you injure and damage to others’ property up to the coverage limits on your policy. Liability insurance does not cover damage to your car.

Comprehensive coverage pays to repair damage from hail, flooding, fire, falling objects and animal collisions. Collision insurance covers your vehicle for damage after a collision with a car or object.

Why get multiple car insurance quotes?

The price for an auto policy can differ by hundreds of dollars among insurance companies. That’s why comparing car insurance quotes from multiple companies is one of the most effective ways to save money.

If you don’t shop around, you won’t know what the cheapest price is for the coverage you need. You should compare auto insurance quotes from at least three companies, and at least once a year, for the same amount of coverage to be sure you’re getting the most affordable rate for your driver profile.

How will buying car insurance help you?

If you have a car accident and don’t have insurance, you will have to pay for all of the expenses out of pocket. Even minor accidents can cause thousands of dollars in damage. Major accidents with multiple injuries could bankrupt you without the proper amount of auto insurance coverage.

Most states require that drivers carry auto insurance to drive legally. If you are cited for driving without insurance, you may face penalties such as fees, license and/or registration suspension or jail time.

Buying auto insurance gives you peace of mind. Liability car insurance pays for the damage you cause to other vehicles and for the medical expenses of those you injure. And if you are hit, the other driver’s liability coverage would pay to fix your car.

Collision coverage pays to repair your car after an accident regardless of fault, and comprehensive coverage pays to replace your car if it’s stolen or to repair damage from hail, fire, flooding, vandalism, animal strikes and falling objects.