CarInsurance.com Insights

- American Family car insurance offers a variety of coverage options, including optional gap insurance and accident forgiveness.

- It’s a good choice for families with teen drivers, as the average premiums for that age group are lower than those of several competitors, and the company offers several different student discounts.

- The company’s mobile app is highly rated, and American Family scored very high in J.D. Power’s 2023 Car Insurance Digital Experience Study.

American Family Insurance offers drivers more than just a catchy jingle and a highly rated mobile app. The Madison, Wis.-based insurer also offers a slew of coverage options and insurance discounts that help you get just the right auto insurance for your needs.

The downside is that American Family only operates in 19 states, so if you live outside of that coverage area, you may need to find a different provider.

To help you learn whether American Family Insurance is the right insurance company for your needs, CarInsurance.com surveyed current policyholders and collected data about the company’s offerings, customer satisfaction ratings, availability and user experience.

At a glance

Pros

- Easy-to-use mobile app for different scenarios.

- DriveMyWay program can offer significant savings

- Lower-than-average customer complaints

- Wide range of available discounts

- Plenty of optional add-ons to customize your coverage

Cons

- Coverage not available in all states

- Lower-than-average customer satisfaction rating in J.D. Power’s auto insurance claims satisfaction study

- Accident forgiveness coverage must be purchased separately

Who is American Family best for?

Ranked No. 7 in our Best Car Insurance Companies of 2025 study, with a score of 4.26 out of 5, American Family is best for:

- Mobile app users

- Families with teen drivers

- Drivers who live in American Family’s coverage areas

Mobile app users: American Family is a good fit for drivers who like to manage their policy and claims digitally. In J.D. Power’s 2025 U.S. Insurance Digital Experience Study, the company ranked No. 3 behind Nationwide and Amica, with a score of 715 out of a possible 1,000 points. The average was 699.

Families with teen drivers: According to our study, drivers rated American Family very highly for customer satisfaction for teen drivers, with a score of 4.36. American Family ranked second in this category, behind Erie Insurance.

Drivers in the company’s coverage areas: American Family offers coverage in the following states:

- Arizona

- Colorado

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- Nevada

- North Dakota

- Ohio

- Oregon

- South Dakota

- Utah

- Washington

- Wisconsin

How much does American Family car insurance cost?

American Family’s average premiums are lower than those of other insurers we surveyed. In our rate analysis, the average monthly premium for full coverage car insurance with American Family was $159 per month.

Your quoted rates may be higher or lower, depending on several factors, including your location, driving history and the type of car you drive, among others. Taking advantage of discounts and savings may help reduce your costs.

| Company | Full coverage monthly cost |

|---|---|

| American Family | $159 |

| Allstate | $267 |

| Farmers | $257 |

| GEICO | $179 |

| Nationwide | $205 |

| Progressive | $223 |

| State Farm | $239 |

| Travelers | $175 |

| USAA* | $131 |

*USAA is only available to military community members and their families.

American Family Insurance discounts and savings

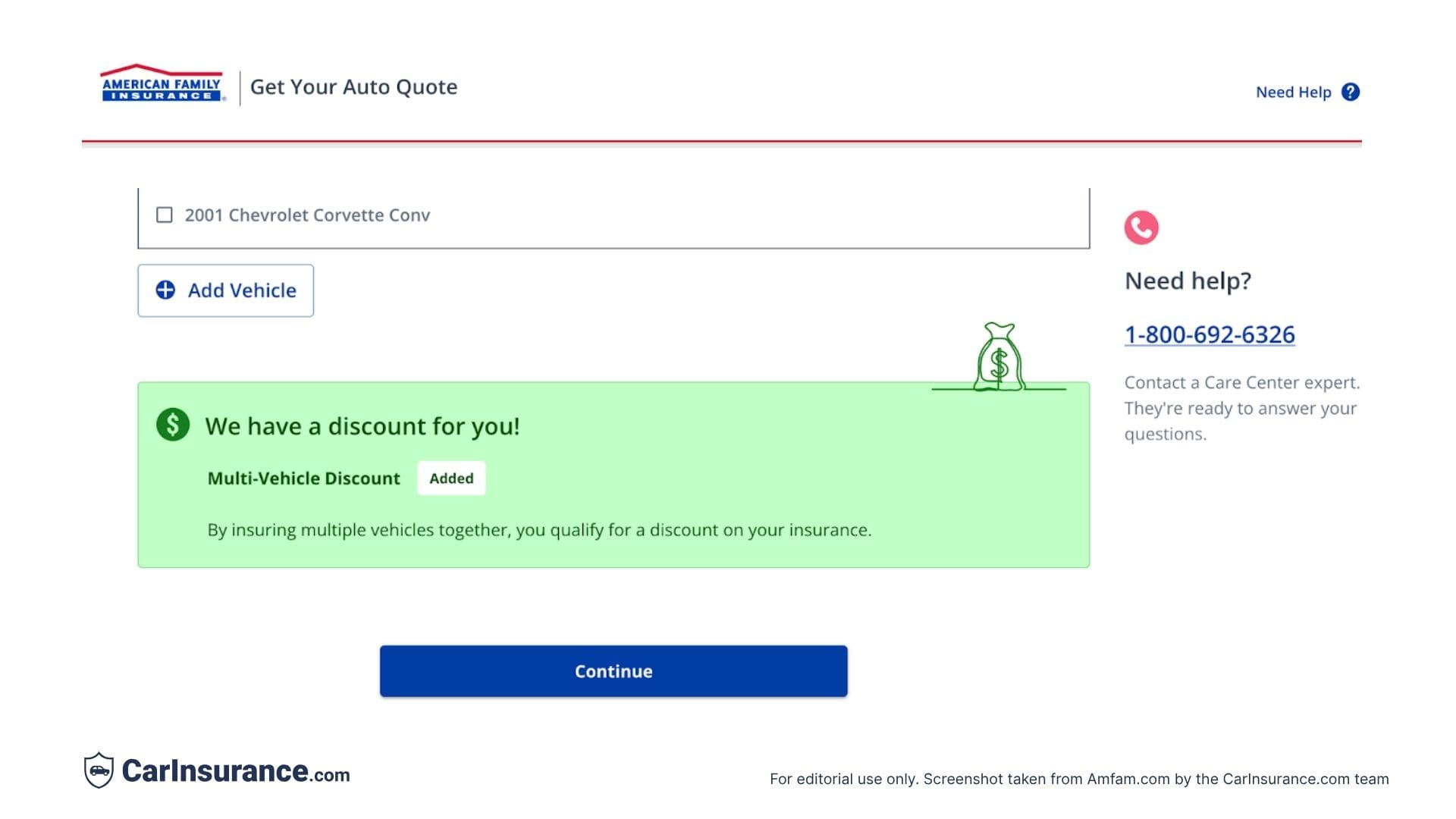

There are multiple ways to save on your insurance premiums with American Family. Bundling your home and auto policies could save you up to 40%, while the DriveMyWay usage-based program can save up to 35%.

During the quote process, see whether you qualify for any of these American Family car insurance discounts:

- Multi-policy

- Multi-vehicle

- Good driver

- Low mileage

- Good student

- Young volunteer (for those under 25 who volunteer)

- Away at school

- Usage-based

- Safety equipment

- Defensive driver

- Loyalty

- Generational (if your parents are customers)

- Pay in full

- Autopay

- Paperless statements

Coverage options

American Family offers standard car insurance coverages, which include:

- Liability: This helps cover costs if you are involved in an accident that injures someone or damages their property.

- Collision: This coverage helps pay for accident-related repairs and damages.

- Comprehensive: You’re protected from other types of damage, such as from storms, fire, theft, animal strikes or vandalism.

- Medical payments: This coverage pays for your medical costs and those of your passengers if you’re injured in an accident as an add-on to your policy.

You can also extend your protection in multiple ways with additional coverages from American Family, which you can purchase for an additional cost:

- Accident forgiveness

- Roadside assistance

- Rental reimbursement

- Gap coverage

- Uninsured/underinsured motorist coverage

MaryBeth’s experience getting a quote

I visited the American Family website to request a quote. I have multiple drivers in my family, and our insurance premiums are becoming increasingly expensive.

I typed in my ZIP code and immediately received the bad news: American Family car insurance isn’t available in my area of Western Pennsylvania.

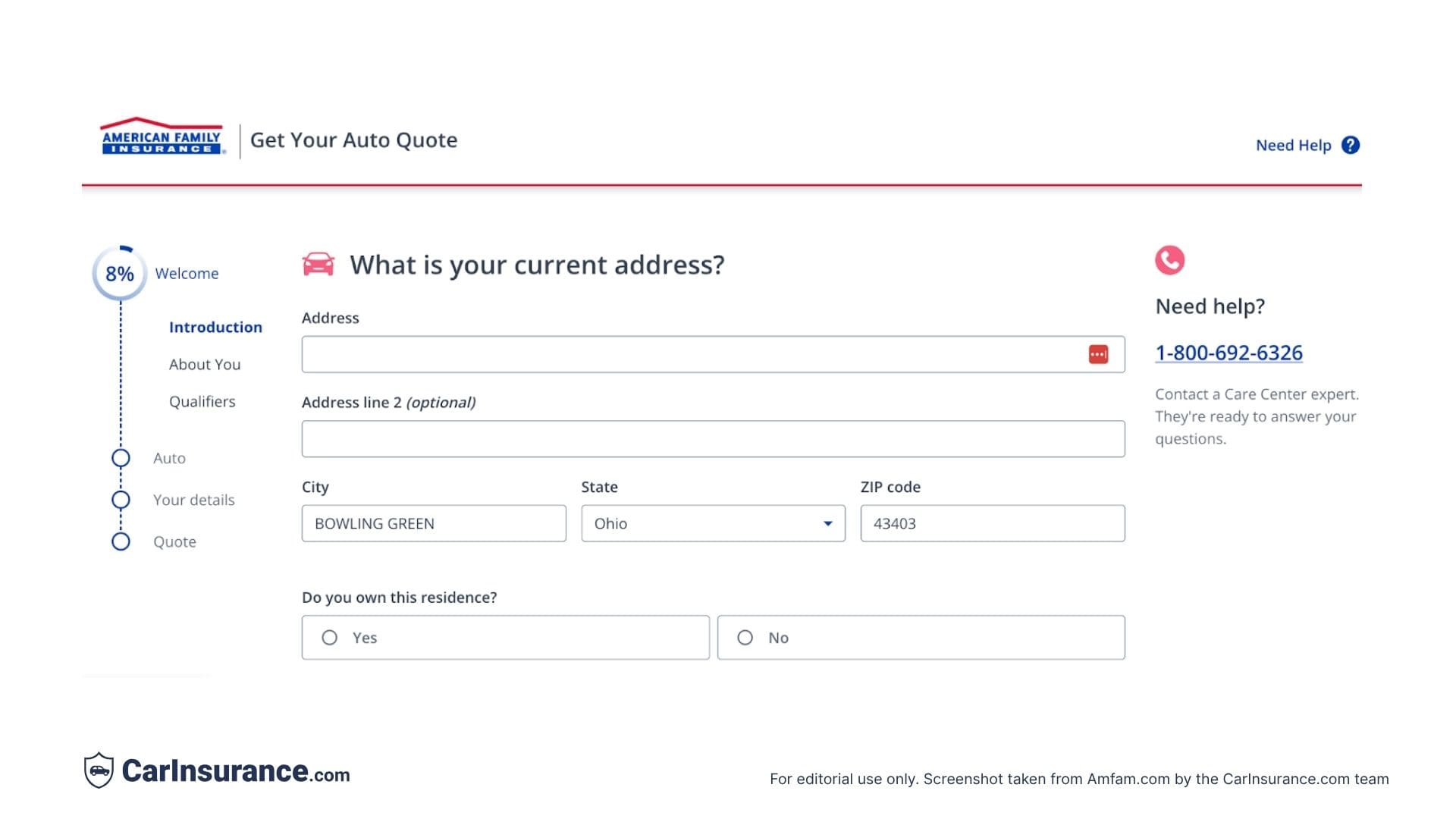

But my curiosity was piqued. What would it be like to get a quote from American Family if they did offer coverage in my area? To find out, I entered the ZIP code of a previous residence in Ohio, and this time, I could move forward. The online quote tool requested more information about my address.

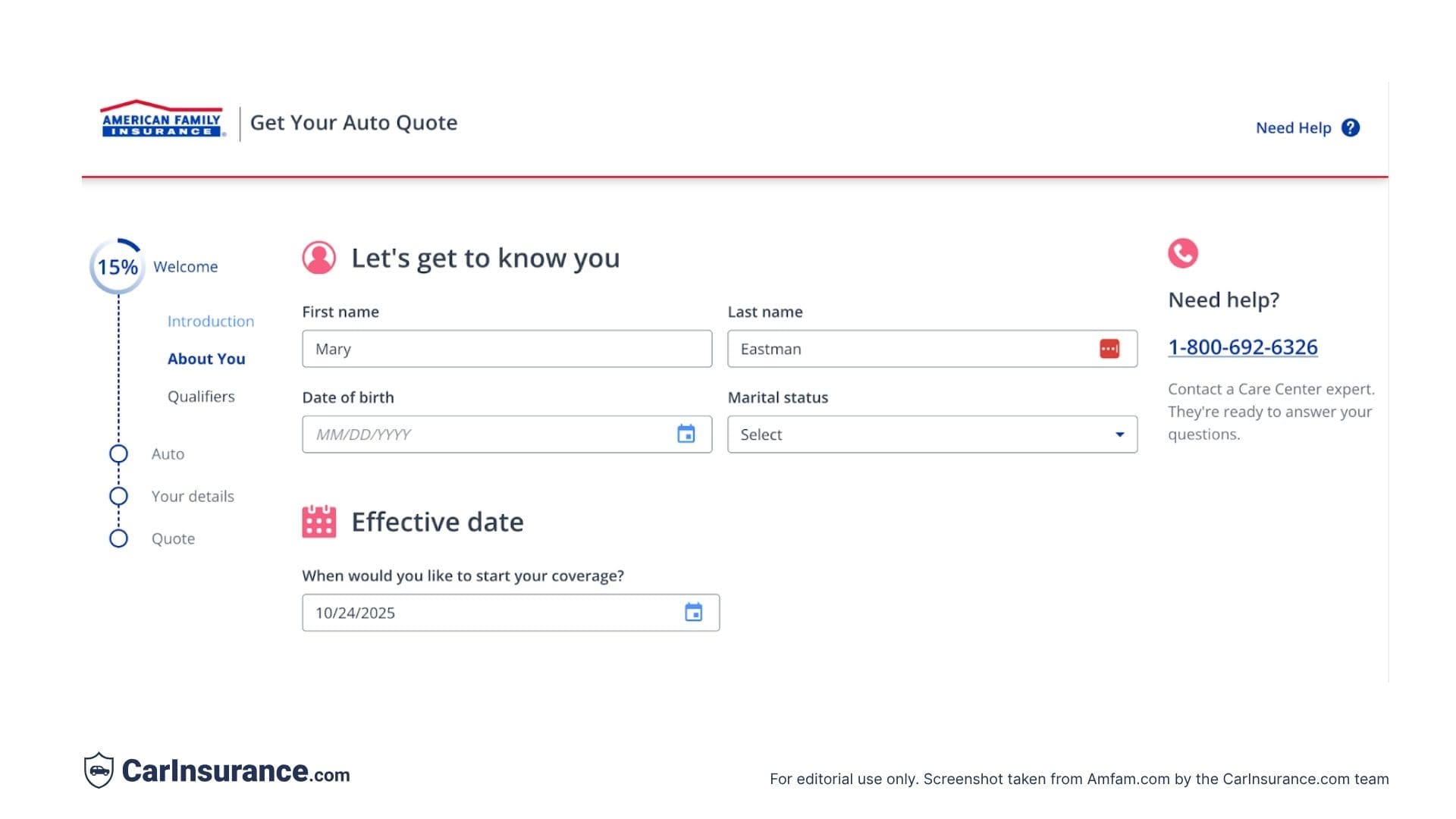

On the next screen, American Family requests additional information, including name, date of birth, marital status and the desired effective date of coverage.

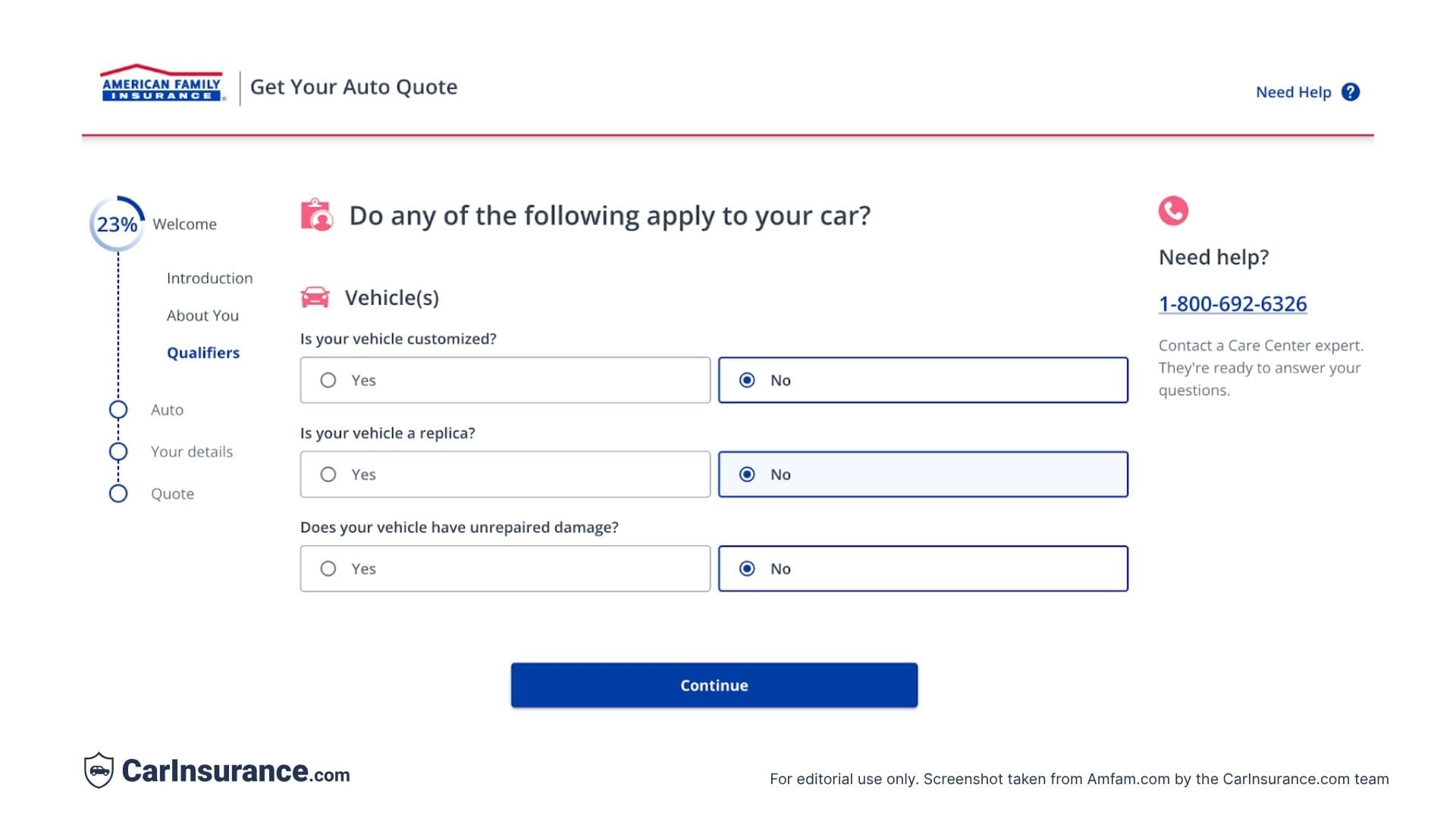

American Family will also ask whether your vehicle is customized or a replica and whether it has unrepaired damage. I answered no to all three.

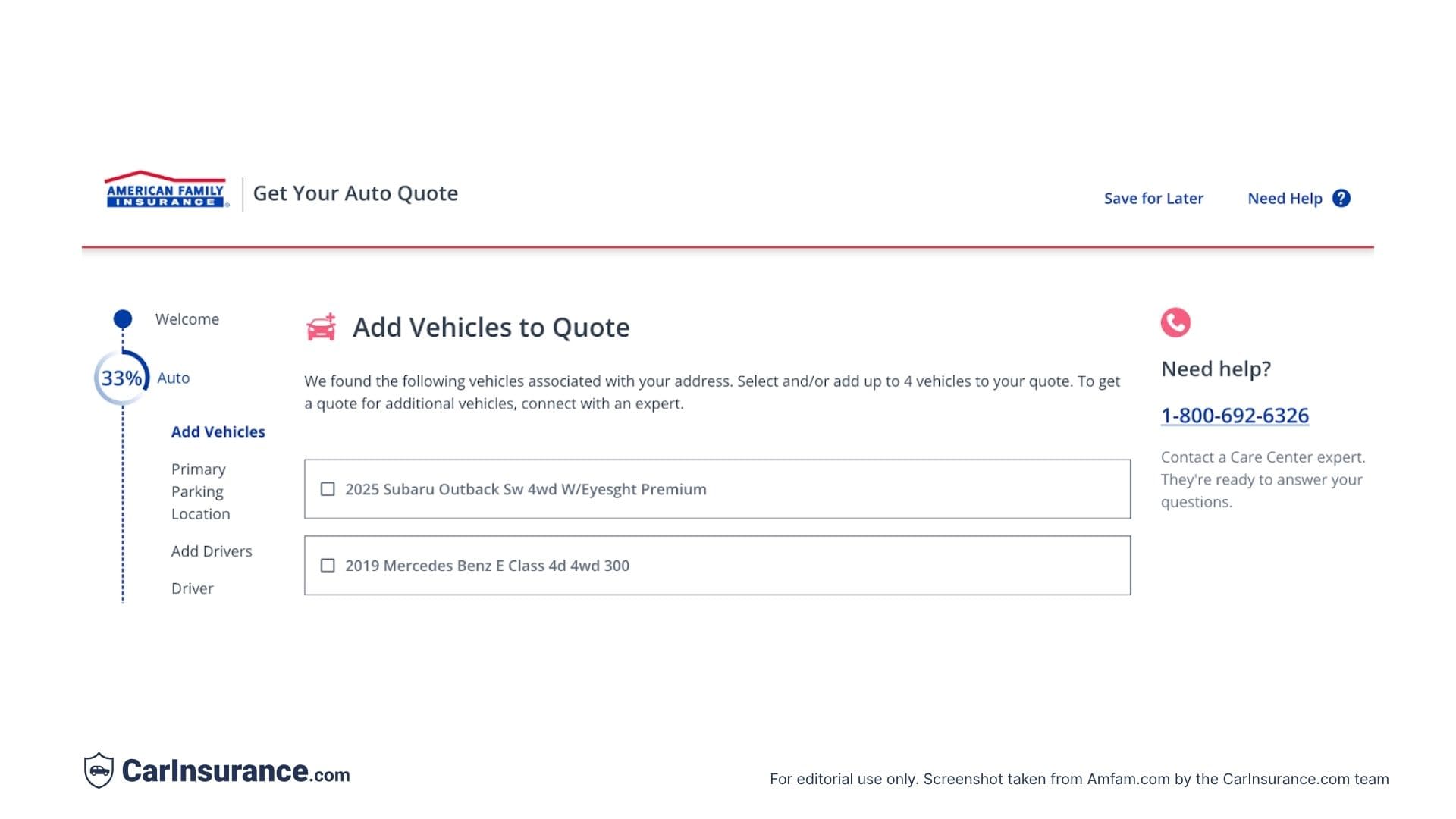

On the next screen, American Family’s online quote tool listed multiple vehicles associated with the address provided. I was able to choose which vehicle I wanted to insure: A 2025 Subaru Outback.

I had the option to receive a multi-vehicle discount if I chose to insure more than one vehicle.

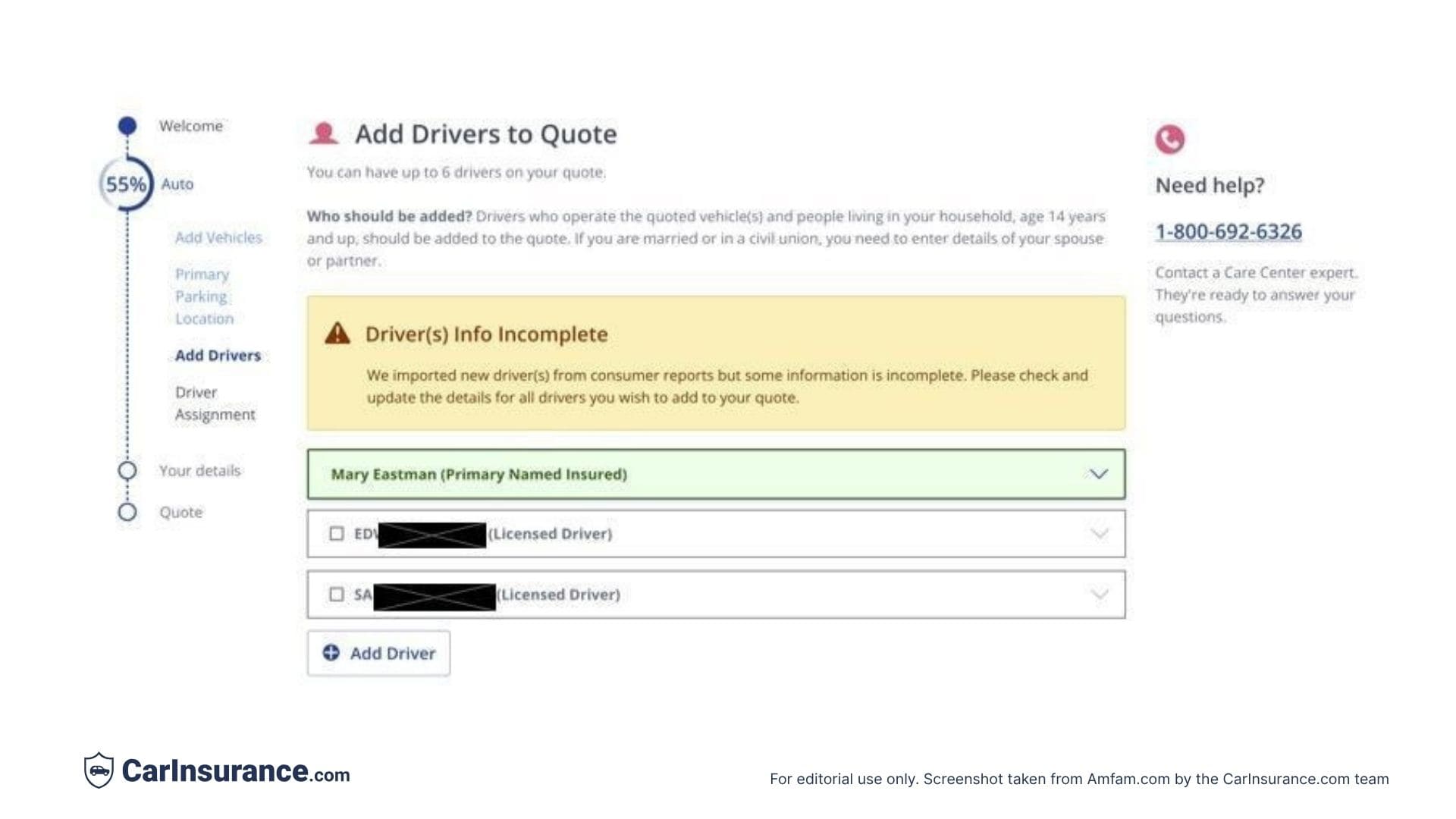

At that point, I was pleased with the ease of getting a detailed quote from American Family. The tool was so effective that it retrieved the names of the current residents at the provided address.

It was a good reminder that I am not eligible for coverage based on my current address in Pennsylvania, so I ended my quote request, pleased with the abbreviated experience.

American Family claims experience

One of the most critical parts of choosing a car insurance provider is how the company handles claims. After all, if you’ve just been in an accident, the last thing you want is another headache.

To file a claim with American Family car insurance, you have multiple options:

- Report a claim with the MyAmFam app

- File a claim online

- File over the phone by calling 1-800-MYAMFAM

- Call your American Family Insurance agent

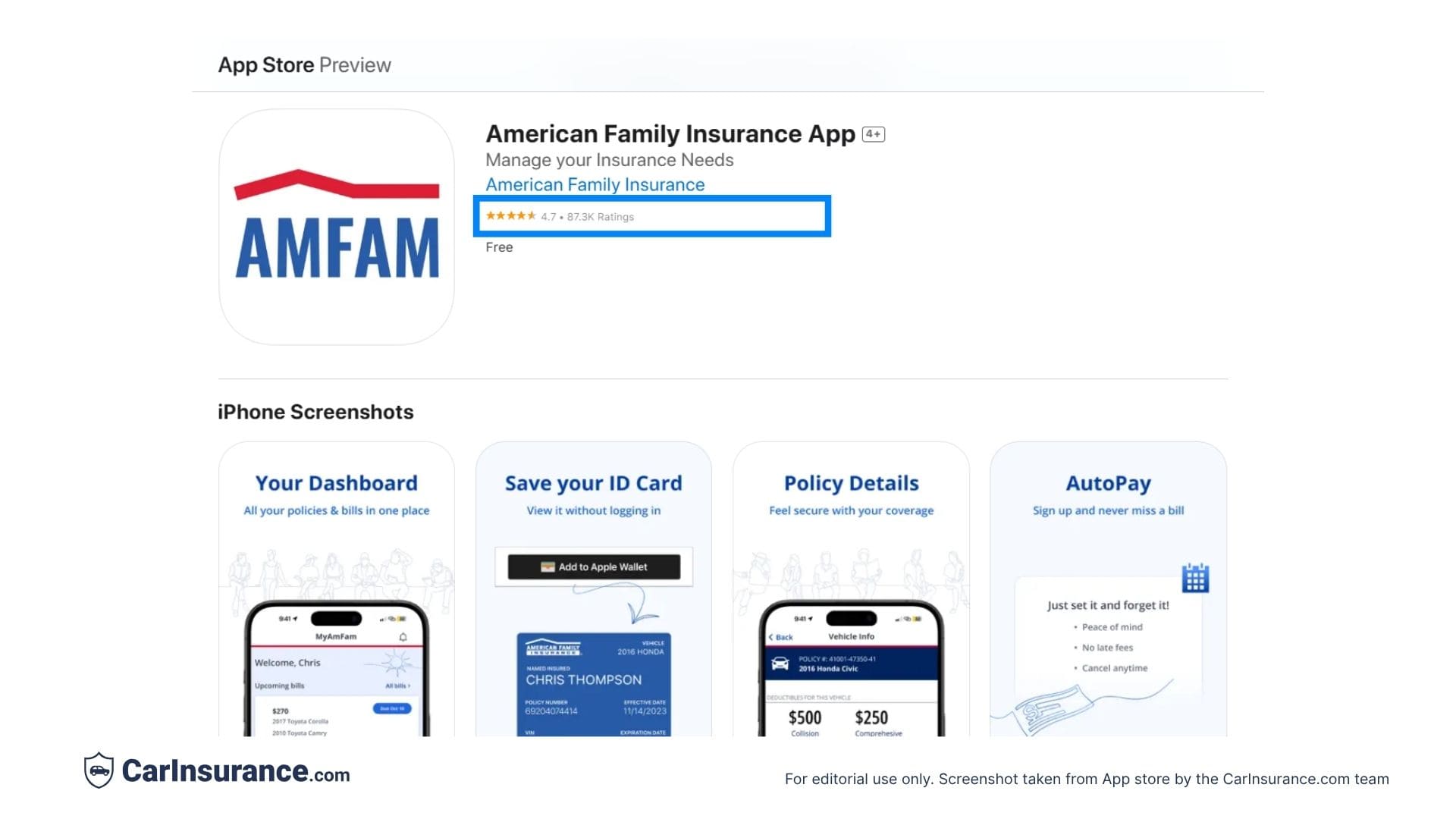

According to American Family, the fastest way to move your claim along is to file using the MyAmFam app. You can also use the app to track the progress of your claim, upload photos of the damage, find a repair shop and rent a car for temporary use.

The MyAmFam app received a 4.7-star rating out of a possible five stars on the App Store for iOS, based on over 87,000 reviews.

On the Google Play Store, the app has a rating of 3.2 stars out of 5, based on over 10,000 reviews. These numbers were as of November 2025.

Positive reviews praised the app for its ease of use, particularly in paying bills and managing coverage. Negative reviews mentioned technical issues, including difficulty logging in.

American Family customer satisfaction

American Family car insurance has a much lower-than-average number of customer complaints. According to the NAIC Complaint Index published by the National Association of Insurance Commissioners, American Family’s car insurance complaint index is 0.26, or about a quarter of the average complaints for insurers of its size.

In the 2025 J.D. Power Auto Claims Satisfaction Study, American Family scored 702, two points higher than the industry average of 700..

A.M. Best gives American Family a Financial Strength Rating (FSR) of A or Excellent. That means you can expect the company to be able to pay out its claims.

Frequently Asked Questions: American Family

Is American Family Insurance cheaper than other car insurance companies?

The average annual premium for American Family car insurance falls in the middle of the premiums for the insurers we studied, according to our rate analysis. Car insurance rates vary based on your driver profile, coverage choices, location and other factors, so it’s best to compare quotes from multiple companies.

What discounts does American Family Insurance offer?

American Family offers standard discounts, such as multi-policy and multi-vehicle discounts. You could also get a loyalty discount based on how long you’ve been a customer, plus discounts for signing up for a new policy early or switching from another carrier. If you sign up for the company’s DriveMyWay program, you could save 10% to 35% based on your driving habits.

Does American Family Insurance offer accident forgiveness?

Yes, American Family offers accident forgiveness as an optional add-on to your policy. This coverage shields your premiums from rising after your first at-fault accident.

Does American Family Insurance have gap insurance?

Yes, you can add American Family’s gap insurance coverage when you purchase your policy. This optional add-on covers the difference between what your car is worth and the amount you’d be reimbursed if the vehicle were totaled.

How do I file a claim with American Family Insurance?

You can file a claim with American Family through the mobile app, online, by phone or with an agent. The company offers 24/7 claim support.

How does American Family Insurance rank in customer satisfaction?

According to J.D. Power, American Family scores above average in customer satisfaction and very highly for digital experience. The NAIC complaint index and AM Best rating show a low number of complaints and excellent financial stability.

Does American Family Insurance raise rates after an accident or ticket?

Like most insurers, American Family usually increases premiums after at-fault accidents or major violations. However, if you bought accident forgiveness coverage, it may help offset the cost.

Is American Family Insurance good for high-risk drivers?

American Family may be more accommodating than some competitors for drivers with DUIs, poor credit or multiple claims. Rates will be higher, but coverage is often available.

Does American Family Insurance offer telematics or usage-based insurance?

Yes. American Family’s DriveMyWay program tracks driving habits and rewards safe driving with discounts.

What types of add-ons does American Family Insurance provide?

Optional coverages include roadside assistance, rental reimbursement, rideshare coverage, new car replacement and accident forgiveness.

Can I manage my American Family Insurance policy online?

Yes. Most insurers, including American Family, provide digital tools like mobile apps for ID cards, bill payment and claims tracking.

Is American Family Insurance a good insurance company overall?

American Family is best suited for families and mobile app users. Whether it’s the right choice depends on your needs, budget and coverage preferences.

Sources

- AM Best. “ AM Best Affirms Credit Ratings for American Family Mutual Insurance Company, S.I., Core Affiliates and American Family Life Insurance Company.” Accessed November 2025.

- J.D. Power. “Satisfaction with Auto Insurance Claims Strained by Higher Deductibles, More Total Losses, J.D. Power Finds.” Accessed November 2025.

- J.D. Power. “Auto Insurer Websites and Apps Become Battleground for New Customers as Policy Shopping Activity Skyrockets, J.D. Power Finds.” Accessed November 2025.

- American Family Insurance. “Auto Insurance Claims.” Accessed November 2025.

- American Family Insurance. “Find an agent near you.” Accessed November 2025.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs