CarInsurance.com Insights

- Gap insurance pays the difference between your car’s current value and your remaining loan balance if it’s totaled or stolen.

- It’s not required by law, but some lenders or leasing companies may ask you to purchase it.

- Gap insurance makes the most sense if you made a small down payment, took a long-term loan, leased your car or bought a vehicle that loses value quickly.

- Dealerships sell gap coverage, but you can often find better rates through your auto insurer or credit union.

- Once your loan balance drops below your car’s actual value, you no longer need gap coverage; you can cancel the gap coverage policy.

The moment you drive a new car off the lot, its value begins to drop, often by as much as 30% within the first two years.

Now imagine totaling that car in an accident six months later, your standard insurance pays what the car is worth today, not what you still owe on it. That gap between your loan balance and your car’s value is what gap insurance covers.

But here’s the real question: Is paying extra for this coverage actually worth it, or is it just another add-on?

The answer isn’t the same for everyone. Whether this add-on makes sense for you depends on your down payment, loan terms and how quickly your vehicle depreciates in value. Some drivers absolutely need it, and others are better off skipping it entirely and pocketing the savings.

This guide will help you decide if gap insurance is a smart financial move for your situation.

When is gap insurance worth the money?

Consider getting gap insurance in the following situations:

- Low down payment (under 20%): If you paid less than 20% of the car’s price as a down payment, there’s a good chance you’ll owe more than the car is worth in the initial years of your loan term. Gap insurance steps in to cover that difference if your vehicle is totaled or stolen.

- Long loan term (60+ months): A longer loan term means you’re paying off the loan over an extended period, and the car’s value will depreciate faster.

- Leasing: Leased cars are some of the fastest depreciating assets, and leases often come with a bigger gap between what you owe and the car’s value. Many lease agreements include gap insurance by default, but if yours doesn’t, buying it separately is a good idea.

- You bought a car that loses value quickly: Luxury cars, electric vehicles and some newer models drop in value faster than other cars. If your vehicle is known for high depreciation, you’re more likely to owe more than it’s worth during the first few years.

- You’re in a financially tight situation: Totaling your car doesn’t mean your loan disappears. If your insurance payout falls short, you’re still on the hook. Gap insurance protects you from that unexpected financial burden.

You can cancel gap coverage once your loan balance is lower than your vehicle’s value. Learn more about how you can cancel your gap insurance coverage and get a refund on unused premiums.

Gap insurance, yay or nay: Reddit user shares their experience

Quick check: Do you need gap insurance?

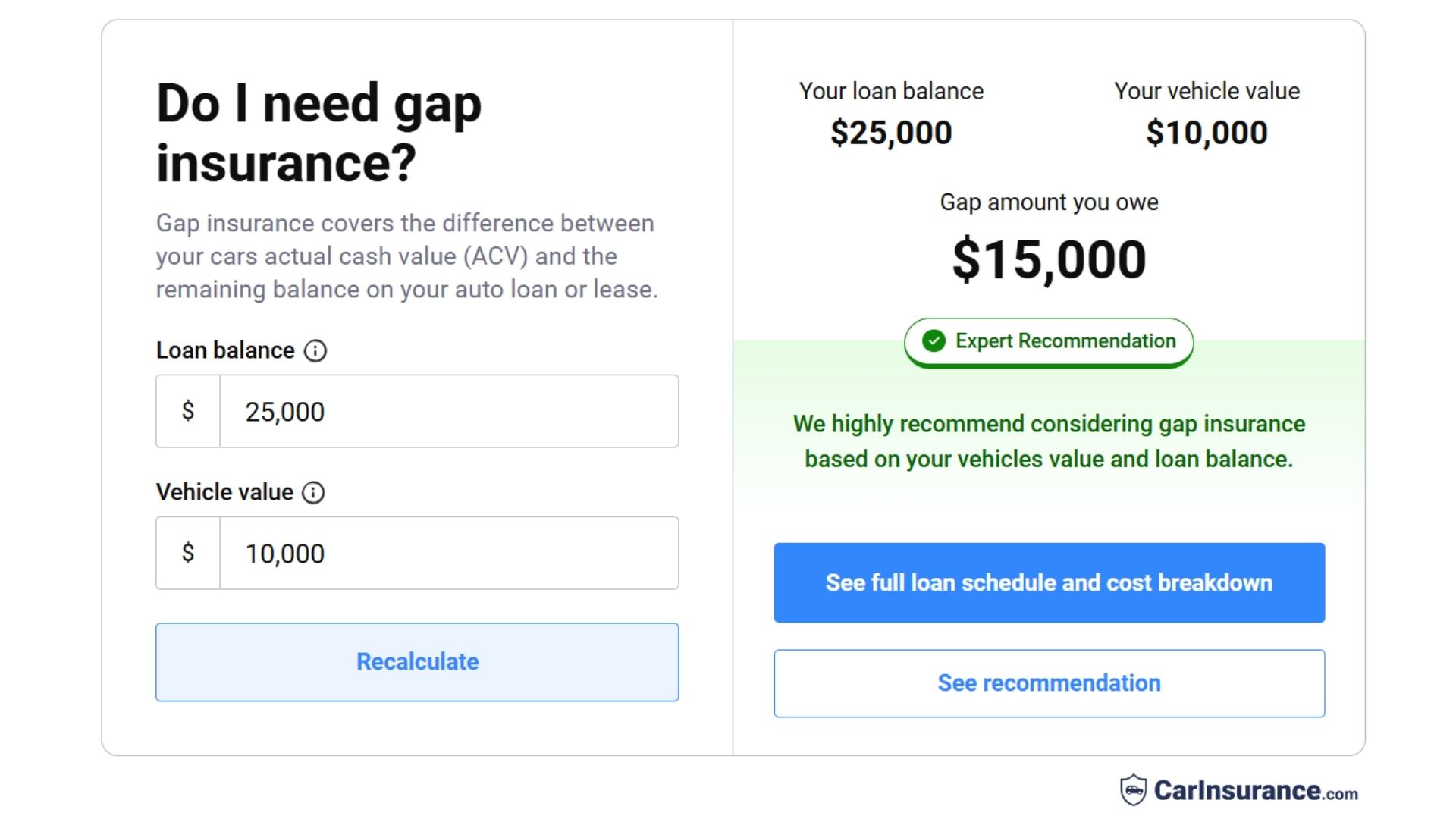

Compare your current loan balance to your car’s estimated market value using CarInsurance.com’s gap insurance calculator. If you owe significantly more than the vehicle is worth, especially during the first few years of ownership, when depreciation is steepest (often 10-20% in the first year alone), gap coverage is likely a smart choice.

For instance, if your car is totaled and you owe $25,000 on the loan but the vehicle is only worth $15,000, you’re left with a $10,000 gap. Your standard auto insurance will pay the car’s actual cash value, which is $15,000, but you’ll still owe the lender the remaining $10,000 for a car you can no longer drive.

Gap insurance covers that difference, protecting you from paying thousands of dollars out of pocket on a totaled vehicle.

When should I skip gap insurance?

You should skip gap insurance if you made a big down payment, have a short loan term, or are close to paying off your loan. It also doesn’t make sense if you’ve paid off your car or your insurance already includes similar coverage.

If there’s little or no gap between what you owe and what your vehicle is worth, gap insurance probably isn’t worth the extra cost.

Where can you buy gap insurance?

You can buy gap insurance from several places, and each option has its own advantages:

- Car dealerships: Convenient to buy at the time of purchase or lease, but often the most expensive option since the cost may be rolled into your loan.

- Auto insurance companies: Usually cheaper than dealerships and easy to manage as an add-on to your existing auto policy.

- Banks and credit unions: Often offer gap insurance with auto loans at competitive rates.

- Third-party insurance providers: Can provide flexible terms and standalone policies, but coverage details may vary.

It’s a good idea to compare costs and coverage limits before choosing where to buy gap insurance.

Frequently Asked Questions: Gap insurance

Is gap insurance required by law?

Gap insurance is not required by law, but it may be required by a lender or leasing company as part of a financing agreement. It is an optional form of coverage that helps pay the difference between what your car is worth and what you still owe on your loan if the vehicle is totaled or stolen. This can be especially useful for new cars that depreciate quickly or for buyers who made a small down payment or have a long loan term.

What happens if my car is totaled and I don’t have gap insurance?

If your car is totaled and you don’t have gap insurance, your auto insurer will pay only the car’s actual cash value (ACV) at the time of the loss, minus your deductible. ACV reflects depreciation, not what you originally paid. If you owe more on your auto loan or lease than the ACV payout, you are responsible for paying the remaining balance out of pocket.

Does gap insurance cover my car insurance deductible?

No, standard gap insurance does not cover your collision or comprehensive insurance deductible. It only covers the difference between what you owe on your loan and your car’s actual cash value.

What’s the right decision for you?

Gap insurance can be really helpful if you owe more on your car than it’s worth. If your car gets totaled or stolen, it covers the difference, so you’re not on the hook for paying off a loan for a car you no longer have. For many people, a gap insurance policy offers a safety net and peace of mind.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs