CarInsurance.com Insights

- The cheapest truck to insure is the Jeep Gladiator with an average annual premium of $2,460.

- Travelers offers the most affordable coverage for trucks. Its average annual cost for the Jeep Gladiator is $1,624, according to our analysis.

- On average, trucks cost $2,892 per year to insure, compared to $3,781 for sedans and $2,976 for SUVs. While trucks are often considered more expensive to insure, current data shows that sedans and SUVs typically carry higher average premiums.

Whether you currently own a truck or are considering purchasing one, understanding car insurance premiums and ways to save should factor into your vehicle budget. The cheapest truck to insure in 2026 is the Jeep Gladiator with an average yearly premium of $2,460.

“Trucks are generally more expensive to insure than cars because the value of the truck is higher,” says Lauren McKenzie, senior agent with A Plus Insurance. “Drivers should consider its value and get an idea of what they should expect to pay for insurance on the vehicle before purchasing. Oftentimes, the cost for full coverage insurance on a truck may be the same, if not more than the cost of the loan payments.”

Learn more about the cheapest trucks to insure with a ranking of the most affordable car insurance companies, the lowest average annual premiums and tips for saving on premiums.

Which are the cheapest trucks to insure, by make and model?

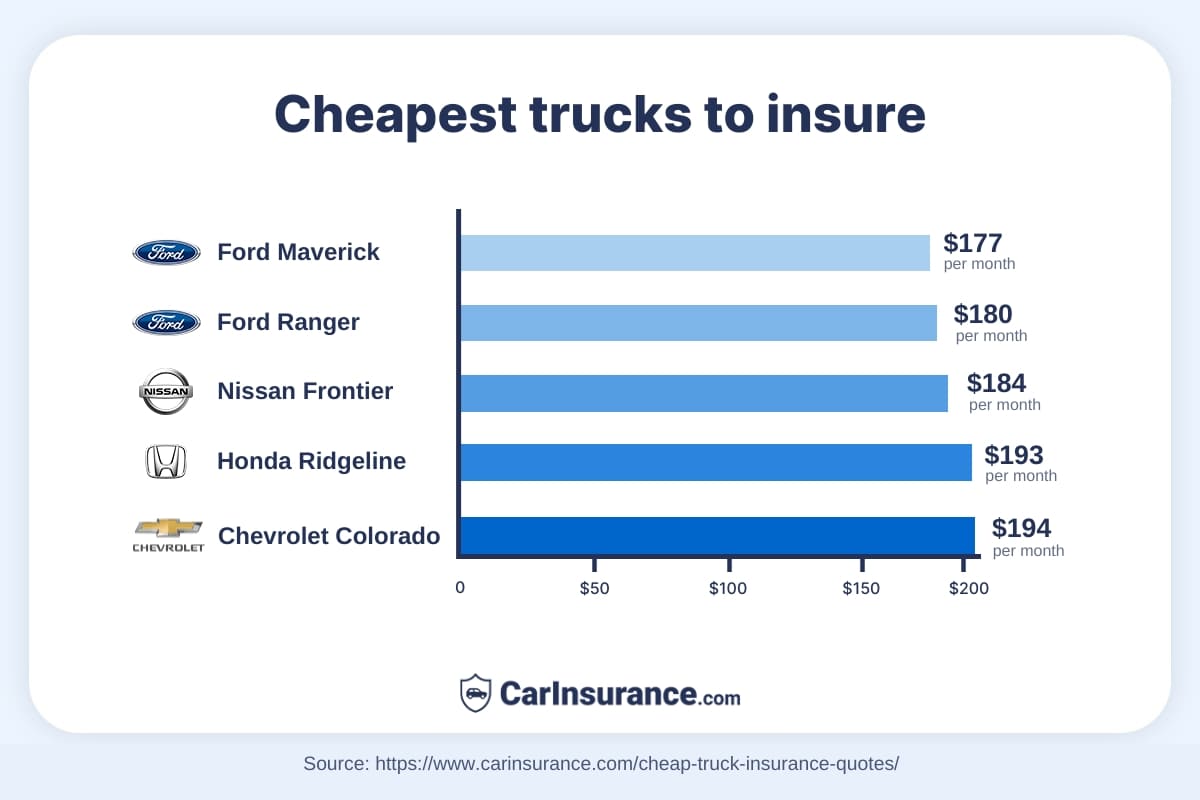

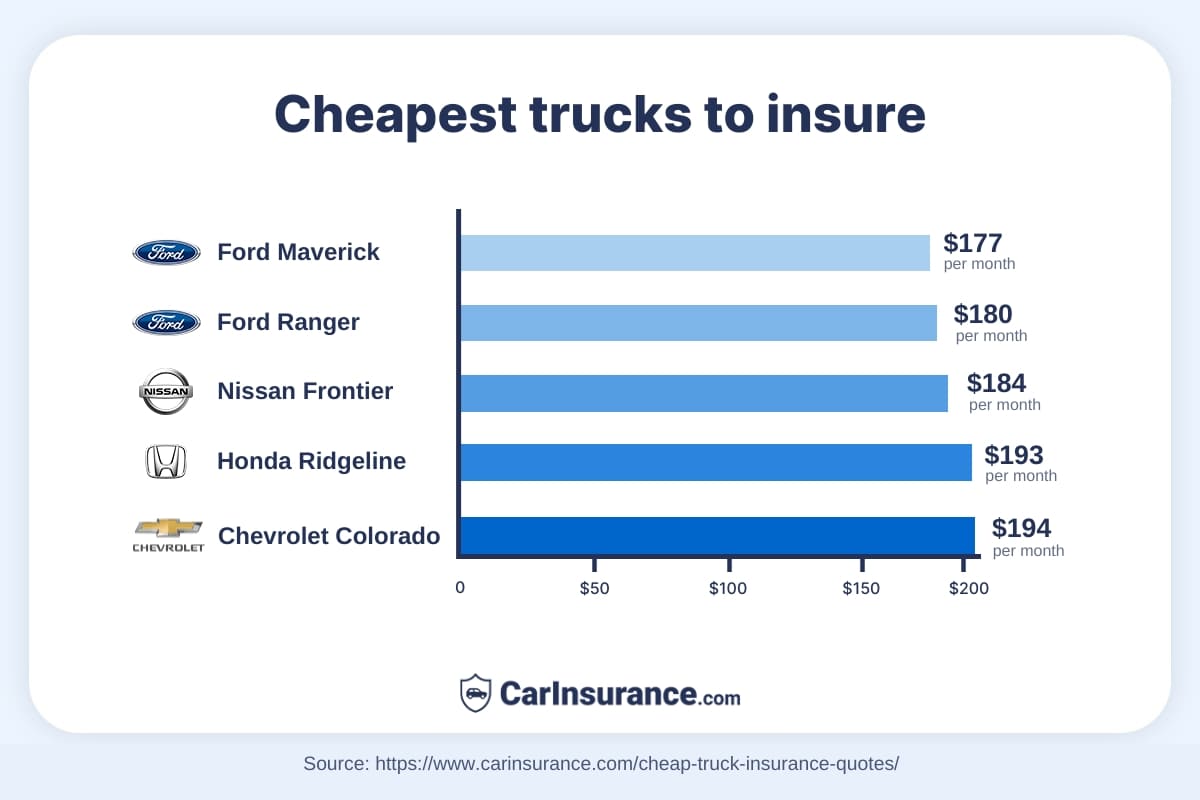

Jeep Gladiator is the most affordable truck to insure, with an average yearly premium of $2,460. The Ford Maverick comes in second, with an average insurance cost of $2,488 per year. The Nissan Frontier is the third-cheapest, with an average annual premium of $2,539.

The 5 cheapest trucks to insure are as follows:

No. 1: Jeep Gladiator

- Cost: $2,460 per year, $205 per month

No. 2: Ford Maverick

- Cost: $2,488 per year, $207 per month

No. 3: Nissan Frontier

- Cost: $2,539 per year, $212 per month

No. 4: Toyota Tacoma

- Cost: $2,542 per year, $212 per month

No. 5: Chevrolet Colorado

- Cost: $2,546 per year, $212 per month

How much is truck insurance?

Nationwide, truck owners spend an average of $2,892 per year for car insurance. There are ways to save on premiums, especially if you’re looking for a new or new-to-you truck.

What are the car insurance requirements for trucks?

In general, car and truck insurance requirements are the same. According to McKenzie, differences typically arise when leasing a vehicle versus financing or when the lender mandates specific deductibles. She says that differences in coverage result from the terms of the loan or lease agreement, rather than the type of vehicle.

Car insurance requirements include carrying either liability insurance or comprehensive coverage, opting for medical or collision coverage and ensuring a financed vehicle is fully covered.

Average annual insurance rates from top insurance companies for trucks

Insurance rates can vary not just by model but also by insurer. We’ve identified the cheapest trucks to insure and the insurance companies offering that average rate. Among the carriers we analyzed, Travelers stands out as the overall cheapest car insurance company for trucks.

The table below shows the average monthly, six-month, and annual rates for the cheapest trucks from different insurers.

| Make and model of truck | Cheapest company | Annual rates | Six-month rates | Monthly rates |

|---|---|---|---|---|

| Chevrolet Colorado | Travelers | $1,728 | $864 | $144 |

| Chevrolet Silverado 1500 | Travelers | $1,865 | $932 | $155 |

| Chevrolet Silverado HD | Travelers | $1,842 | $921 | $154 |

| Chevrolet Silverado ZR2 | Travelers | $1,848 | $924 | $154 |

| Ford F-150 | Travelers | $1,757 | $879 | $146 |

| Ford F-150 Raptor | Travelers | $1,876 | $938 | $156 |

| Ford Maverick | Travelers | $1,648 | $824 | $137 |

| Ford Ranger | Travelers | $1,766 | $883 | $147 |

| Ford Ranger Raptor | Travelers | $1,780 | $890 | $148 |

| Ford Super Duty | Travelers | $2,025 | $1,012 | $169 |

| GMC Canyon | Travelers | $1,614 | $807 | $135 |

| GMC Sierra 1500 | Travelers | $1,912 | $956 | $159 |

| GMC Sierra HD | Travelers | $1,899 | $949 | $158 |

| Honda Ridgeline | Travelers | $1,670 | $835 | $139 |

| Hyundai Santa Cruz | Travelers | $1,780 | $890 | $148 |

| Jeep Gladiator | Travelers | $1,624 | $812 | $135 |

| Nissan Frontier | Travelers | $1,872 | $936 | $156 |

| Ram 1500 | Travelers | $1,842 | $921 | $153 |

| Ram HD | Travelers | $1,994 | $997 | $166 |

| Toyota Tacoma | Travelers | $1,761 | $881 | $147 |

| Toyota Tundra | Travelers | $1,931 | $965 | $161 |

How has the cost of truck insurance changed over time?

The cost of insuring a vehicle has risen dramatically in the wake of the COVID-19 pandemic. As drivers returned to the roads, accidents increased, and the cost of vehicles, parts and repairs soared with inflation.

According to the U.S. Bureau of Labor, the cost of car insurance rose 17.4% year over year from 2022 to 2023 and 17.8% year over year from 2023 to 2024. Rates continued to rise in 2025, up 11% year over year in March.

How much is insurance for a truck for an 18-year-old vs. a 40-year-old?

New drivers tend to pay more for car insurance than drivers with more miles on the road. This holds for truck insurance costs. For example, a 40-year-old pays an average of $2,488 annually to insure a Ford Maverick. In contrast, an 18-year-old pays an average of $8,206 annually to insure the same truck.

The table below highlights the significant differences between costs for 18-year-old and 40-year-old male drivers.

| Make model | Annual rates | Six-month rates | Monthly rates |

|---|---|---|---|

| Jeep Gladiator | $8,114 | $4,057 | $676 |

| Ford Maverick | $8,206 | $4,103 | $684 |

| Toyota Tacoma | $8,260 | $4,130 | $688 |

| GMC Canyon | $8,305 | $4,153 | $692 |

| Honda Ridgeline | $8,310 | $4,155 | $693 |

| Chevrolet Colorado | $8,343 | $4,171 | $695 |

| Nissan Frontier | $8,361 | $4,181 | $697 |

| Hyundai Santa Cruz | $8,365 | $4,183 | $697 |

| Ford Ranger | $8,485 | $4,243 | $707 |

| Ford F-150 | $8,748 | $4,374 | $729 |

| Ram 1500 | $8,837 | $4,419 | $736 |

| Chevrolet Silverado 1500 | $8,973 | $4,487 | $748 |

| Toyota Tundra | $8,996 | $4,498 | $750 |

| GMC Sierra 1500 | $9,089 | $4,544 | $757 |

| Chevrolet Silverado HD | $9,204 | $4,602 | $767 |

| Ford Ranger Raptor | $9,406 | $4,703 | $784 |

| Chevrolet Silverado ZR2 | $9,564 | $4,782 | $797 |

| GMC Sierra HD | $9,668 | $4,834 | $806 |

| Ford F-150 Raptor | $9,729 | $4,864 | $811 |

| Ford Super Duty | $9,789 | $4,894 | $816 |

| Ram HD | $9,850 | $4,925 | $821 |

| Make model | Annual rates | Six-month rates | Monthly rates |

|---|---|---|---|

| Jeep Gladiator | $2,460 | $1,230 | $205 |

| Ford Maverick | $2,488 | $1,244 | $207 |

| Nissan Frontier | $2,539 | $1,269 | $212 |

| Toyota Tacoma | $2,542 | $1,271 | $212 |

| Chevrolet Colorado | $2,546 | $1,273 | $212 |

| Honda Ridgeline | $2,547 | $1,273 | $212 |

| GMC Canyon | $2,558 | $1,279 | $213 |

| Ford Ranger | $2,564 | $1,282 | $214 |

| Hyundai Santa Cruz | $2,613 | $1,307 | $218 |

| Ram 1500 | $2,691 | $1,345 | $224 |

| Ford F-150 | $2,696 | $1,348 | $225 |

| Chevrolet Silverado 1500 | $2,724 | $1,362 | $227 |

| Toyota Tundra | $2,777 | $1,388 | $231 |

| GMC Sierra 1500 | $2,793 | $1,396 | $233 |

| Chevrolet Silverado HD | $2,806 | $1,403 | $234 |

| Ford Ranger Raptor | $2,871 | $1,436 | $239 |

| Chevrolet Silverado ZR2 | $2,948 | $1,474 | $246 |

| GMC Sierra HD | $2,959 | $1,479 | $247 |

| Ford F-150 Raptor | $3,004 | $1,502 | $250 |

| Ram HD | $3,012 | $1,506 | $251 |

| Ford Super Duty | $3,018 | $1,509 | $251 |

New vs. used trucks: Which are cheaper to insure?

Generally, insuring an older truck is more affordable than insuring a new truck. However, vehicle age is just one of many factors that insurers consider when setting rates. Make and model also make a difference, as does your chosen carrier.

If you want to keep insurance costs low, “avoid new vehicles that have a high value and high repair costs,” says Zach Lazzari, founder of Cross Border Coverage, which sells Mexican car insurance to U.S. drivers traveling south of the border.

Factors that affect the insurance rate for your truck

Insurance companies consider personal variables and assess risks when determining a driver’s premium. These may include vehicle value, theft, safety features, how often you drive your vehicle, your credit and the type and amount of your insurance coverage.

“Many factors impact truck insurance rates, aside from just the cost of the truck itself. Some factors include the location (the number of accidents and claims in your area and surrounding areas), weather and driver demographics such as age, gender and driving history,” McKenzie says. “Other factors that impact the cost of truck insurance rates are the value of the truck and the cost it would take to repair or replace the truck, such as truck parts.”

How can you save money on truck insurance?

Finding the cheapest car insurance for your truck is one way to save, so shop around. Our CarInsurance.com rate analysis has shown that some of the best insurance companies for truck owners are Travelers, Erie Insurance and Auto-Owners, but it may be worth it to contact other top insurers for a personalized rate.

It also helps to know what premiums you’ll pay when you’re in the market for a new truck. This can help ensure you keep costs within your budget. And, bundling your insurance needs — auto, home and other vehicles you own — can save you money.

“Drivers who maintain continuous coverage, rather than letting their insurance policies lapse or cancel, will be offered cheaper premiums when searching for new auto insurance. Consider different coverage options such as deductibles and leave off any extra coverages that may not be needed to cut the cost down,” McKenzie says.

Trucks vs. SUVs vs. sedans: Which are cheaper to insure?

On average, it costs $2,892 per year to insure a truck. That’s higher than the average cost to insure an SUV at $2,976 per year or the average cost to insure a sedan at $3,781 annually.

Final thoughts

In general, small to midsize trucks are often less expensive to insure than larger trucks. Maintaining a clean driving record, shopping around for rate quotes and bundling your policies can save money on insurance.

If you drive a larger truck model, you may pay more for premiums, but you may also want to consider a commercial policy if you use your vehicle for work, services or hauling large equipment.

FAQs

Does the size and weight of a truck affect insurance costs?

Yes, the size of the truck might impact insurance costs. For example, the relatively small Ford Maverick is the most affordable truck to insure.

Are 4×4 trucks more expensive to insure than 2WD trucks?

In some cases, 4×4 trucks are more expensive to insure, more costly to repair and hold their value longer.

Can I insure my truck under personal auto insurance if I use it for business?

No. You’ll need commercial auto insurance if you drive your truck for commercial purposes.

Do safety features in trucks lower insurance costs?

Insurance companies consider several factors when determining rates, including a vehicle’s safety ratings and crash-test performance from agencies like the IIHS and NHTSA. Safety features like blind-side monitoring and crash-avoidance systems have been shown to reduce the risk of accidents, which can lead to lower rates. However, those savings may be mitigated by the higher cost of repairing and replacing these high-tech components.

Resources & Methodology

Methodology

CarInsurance.com commissioned Quadrant Information Services to get car insurance rates. The rates are based on the sample profiles of 40-year-old male and female drivers carrying full coverage policies with limits of 100/300/100 and $500 collision and comprehensive deductibles. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs