CarInsurance.com Insights

- USAA offers low average rates and unique military discounts on car insurance, including a deployment discount of up to 60%.

- The company has superior financial strength ratings and scores very high for customer service and claims satisfaction.

- To be eligible for USAA auto insurance, you must qualify for membership in USAA, which is exclusively for military members and their families.

The United Services Automobile Association, better known as USAA, is highly rated for customer satisfaction, financial strength and military discounts. It received the highest number of points in our ratings analysis and offered the lowest average rates of the companies we studied.

Although USAA has much to recommend it, there is an important consideration: its auto insurance offerings are only available to active-duty service members, veterans, precommissioned officers, employees of specific federal agencies and their families.

We surveyed current customers, analyzed USAA’s auto insurance offerings, available discounts and claims performance, and evaluated data from credit ratings agencies and the NAIC to provide an in-depth review of this company.

At a glance

Pros

- Very low average rates

- High customer satisfaction ratings

- Cheap rates for drivers who have been in an accident

- Unique discounts for military members

Cons

- Eligibility is limited to military members and their families

- Few add-on coverage options are available

Who is USAA car insurance best for?

USAA was not rated in our Best Car Insurance Companies of 2026 study, as the insurer’s policies aren’t available to everyone. However, USAA received the second-highest score, after Travelers, at 4.53 out of 5, and the highest customer satisfaction score, at 4.45 out of 5.

We found USAA to be the best car insurance company for military members and their families, thanks to the affordable rates, military-focused discounts and excellent customer service.

How much does USAA car insurance cost?

In our ratings analysis, USAA had the lowest average monthly premium for full coverage at $131. That average rate was lower than every other insurance company in our study.

Your premiums with USAA, if you qualify for coverage, may differ because car insurance is priced according to your unique driver profile. Your history of accidents and claims, age, gender, location, vehicle type and other factors will influence your costs.

Compare the average monthly premiums for USAA to those of other top insurers below.

| Company | Full coverage monthly cost |

|---|---|

| Allstate | $267 |

| Farmers | $257 |

| American Family | $159 |

| GEICO | $179 |

| Nationwide | $205 |

| Progressive | $223 |

| State Farm | $239 |

| Travelers | $175 |

| USAA* | $131 |

*USAA is only available to military community members and their families.

USAA car insurance discounts and savings

You have several options for securing a lower rate with USAA. The company offers a telematics program called SafePilot, which uses a mobile app to track your driving behavior.

Enrolling in the program saves you 10% off the bat and up to 30% when it’s time to renew your policy. Another program, SafePilot Miles, rewards you with 20% savings for lower miles and 20% for safe driving.

USAA also offers other car insurance discounts, like:

- Up to 10% for bundling multiple policies together, like home and auto

- Multi-vehicle discounts

- New vehicle discount

- Anti-theft device discount

- Good student discount

- Good driver discount

- MyUSAA Legacy Discount, saving up to 10% if your parents were USAA members

- Up to 15% savings for garaging your vehicle on base

You could also save up to 60% on your rate if you’re deployed and place your vehicle in storage.

Coverage options

USAA offers four main types of coverage:

- Liability: Most states require a minimum level of liability coverage for all drivers. This coverage pays for injuries and property damage you cause in an accident.

- Comprehensive: This coverage pays to repair or replace your vehicle if it’s damaged by falling objects, fire, striking an animal or hail.

- Collision: Collision coverage pays to repair your car if it’s damaged while you’re driving it, such as if you’re in an accident. Both collision and comprehensive are usually required if you lease or finance your car.

- Uninsured/underinsured motorist: These coverages help cover costs if you’re in an accident caused by a driver with insufficient car insurance.

USAA also offers three other coverage options: roadside assistance, car rental reimbursement and car replacement assistance. Car replacement assistance is designed to provide a 20% boost of your car’s actual cash value if your vehicle is totaled.

My experience getting a quote

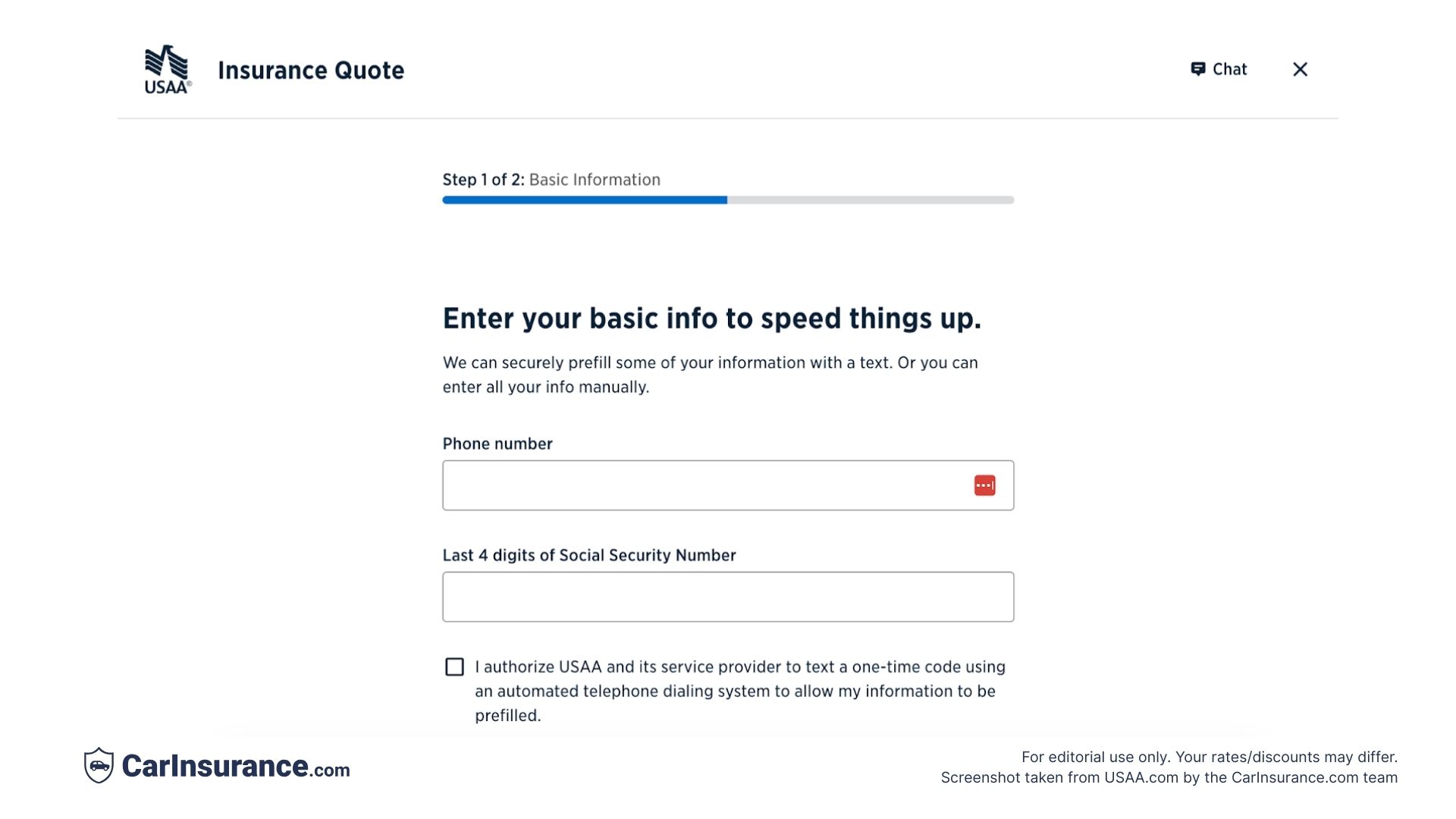

To obtain a quote with USAA, I began the process online. USAA asked for some basic details: my ZIP code and desired policy (auto, home, renters or a combination).

I then had the option to provide my phone number and the last four digits of my Social Security number to have my information pre-filled for me via text authorization, or to enter the information manually.

That option only filled in my street address and legal name, so it didn’t save me any time.

Next, I filled in my gender, marital status, and country of citizenship. The following screen asked whether I had served in the U.S. Armed Forces, with the option to reply “yes,” “no,” “I’m enlisting,” or “I’m commissioning.” Two other options were “I’ve served with NOAA/USPHS” and “I’ve served in a U.S. Federal Agency.”

I have not served in the Armed Forces, with the National Oceanic and Atmospheric Administration or with a U.S. government agency, so I entered “no.” If you haven’t served, USAA will ask you if a family member has: your spouse, parent, child, sibling, or someone else.

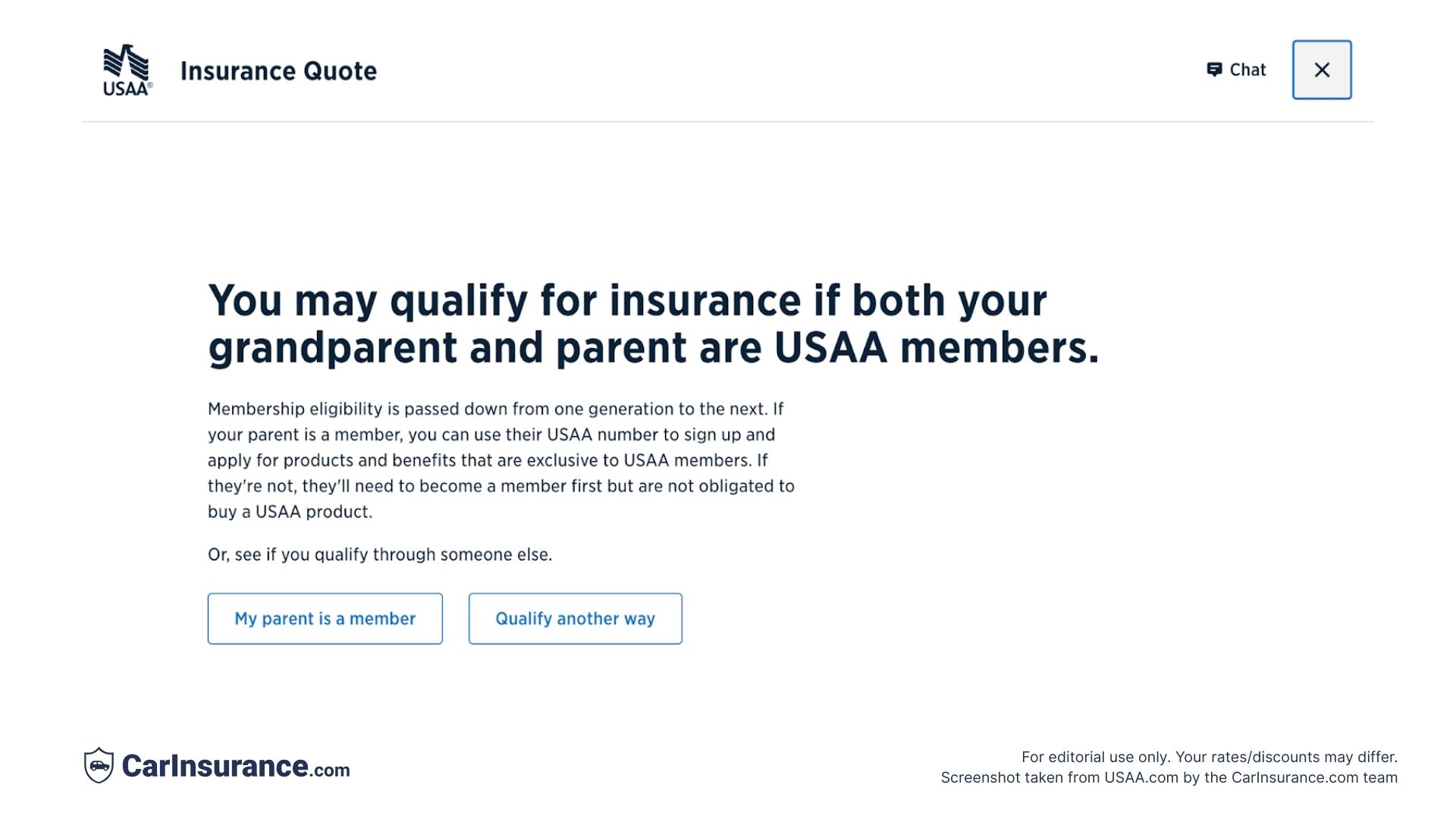

Both grandfathers, an aunt and an uncle served, so I selected “someone else.” USAA notes that membership is “passed down from one generation to the next,” so even though a grandfather served, I’d need both my grandparent and a parent to be members to qualify.

Since that wasn’t the case for me, I tried to see if I could qualify in another way, but it wasn’t in the cards.

However, I did appreciate that even though I didn’t qualify for USAA membership, the company didn’t leave me without options. USAA offered to provide quotes from nationally known companies through its USAA Insurance Agency.

USAA claims experience

In the J.D. Power 2025 U.S. Auto Claims Satisfaction Study, USAA received 741 out of a possible 1,000 points. Although it was the second-highest score in the study (behind only Erie Insurance with 743), USAA was not ranked because the company didn’t meet the study’s award criteria.

However, USAA’s consistently high ratings (it tied for third in 2023 and was the fifth-highest in 2024) do indicate an overall high level of satisfaction with the claims experience.

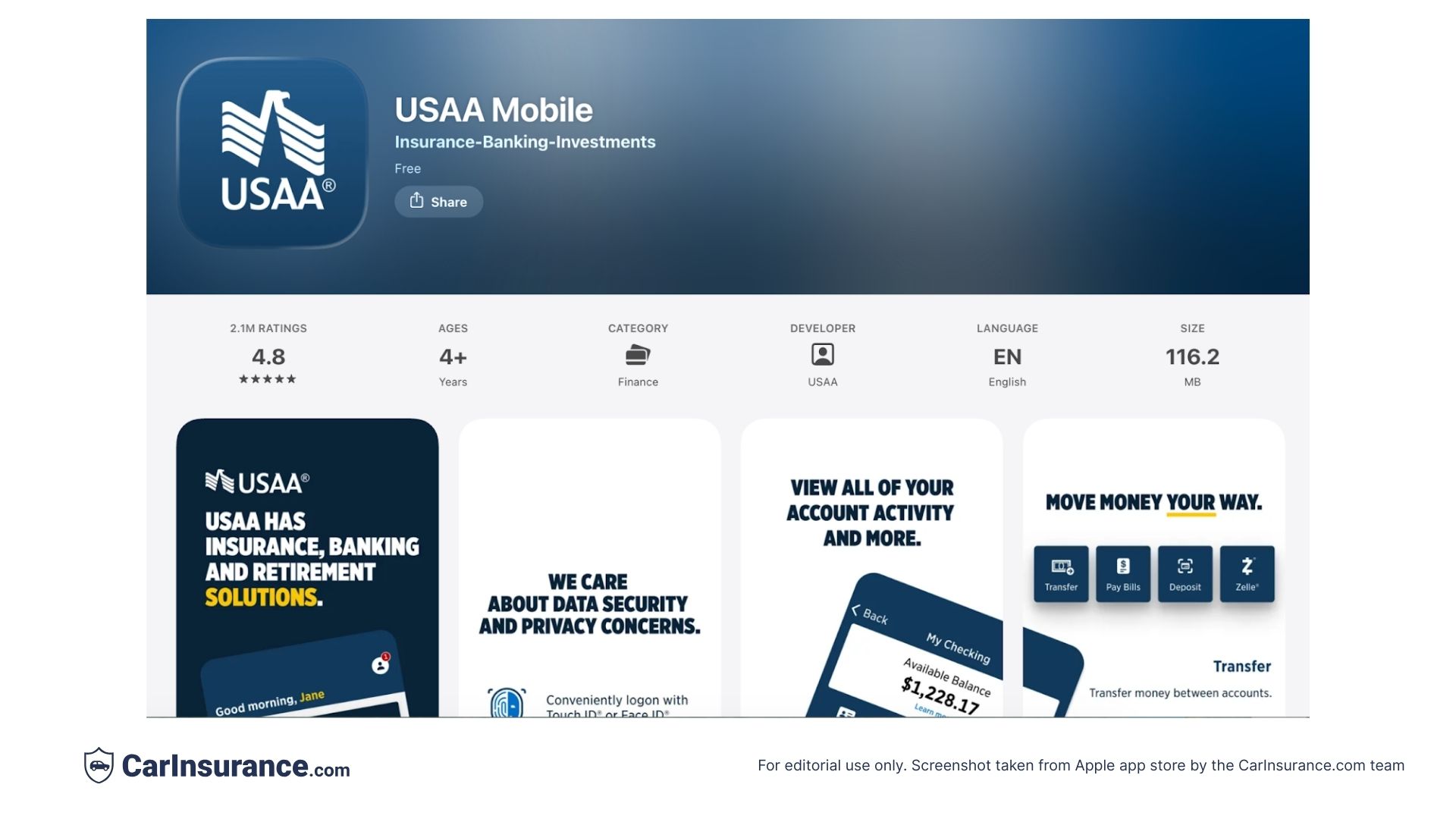

To file a claim with USAA, begin online or on the USAA mobile app. After providing details about the incident, you’ll be able to track the progress of your claim in your USAA account.

USAA’s mobile app is highly rated, boasting a 4.8-star rating (out of 5) on the iOS App Store, based on more than 2 million reviews. On the Google Play Store, the USAA mobile app has a 4.7 rating, with over 400,000 reviews and 10 million downloads as of November 2025.

Screenshot from the iPhone app store preview page.

Screenshot from the Google Play store page.

USAA customer satisfaction

USAA received the highest customer satisfaction rating in our study: 4.45 out of 5. The company also received the highest score for customer satisfaction in every region of the J.D. Power 2025 U.S. Auto Insurance Study.

According to the NAIC Complaint Index, published by the National Association of Insurance Commissioners, USAA received approximately one-third more complaints than expected for an insurance company of its size.

USAA’s financial strength rating (FSR) from AM Best is A++ (Superior), the highest rating that the credit rating agency gives out. An A++ rating indicates the company has a robust balance sheet and can reliably pay its claims.

Frequently Asked Questions: USAA

Is USAA insurance cheaper than other car insurance companies?

In our ratings analysis, USAA had the very cheapest average rate for full coverage car insurance at $131 per month. Your rate with USAA may vary depending on your driving history, age, location, vehicle, coverage selections and even credit score or gender in some places.

What discounts does USAA insurance offer?

USAA offers standard car insurance discounts such as multi-policy, good student, good driver and anti-theft device discounts. It also offers discounts for enrolling in SafePilot, the company’s telematics program and further discounts for good driving behavior.

Does USAA insurance offer accident forgiveness?

Yes, USAA does not offer accident forgiveness coverage.

Does USAA insurance have GAP insurance?

No, USAA does not offer gap insurance. However, USAA does offer car replacement assistance, which provides an additional 20% to your claims settlement check if your car is totaled.

How do I file a claim with USAA insurance?

Start the claims process online or by logging in to your USAA mobile app account. You’ll also be able to track your claim progress, upload documents and contact your claims adjuster using these digital tools.

How does USAA insurance rank in customer satisfaction?

USAA received the highest customer satisfaction rating in every market, according to the J.D. Power 2025 U.S. Auto Insurance Study. In our analysis, USAA received the highest score among all the insurers we reviewed, with a rating of 4.45 out of 5.

Does USAA insurance raise rates after an accident or ticket?

Like most insurers, USAA may raise your rates after an accident, ticket, DUI or other violation. Driving-related tickets or accidents could affect your policy rates for about three years, according to USAA.

Is USAA insurance good for high-risk drivers?

In our analysis, USAA had the second-cheapest rates for drivers with an at-fault accident on their record, but higher rates for a DUI. USAA may be a good choice for high-risk drivers; however, you should request a quote to determine what coverage you may qualify for and at what price.

Does USAA insurance offer telematics or usage-based insurance?

Yes. USAA offers two telematics programs: SafePilot and SafePilot Miles. With SafePilot, you could save 10% at enrollment and up to 30% at renewal with safe driving. SafePilot Miles is a similar program for drivers with low mileage, offering 20% savings for driving fewer miles and an additional 20% savings for safe driving at policy renewal.

What types of add-ons does USAA insurance provide?

USAA offers three add-ons: Rental car reimbursement, which pays you back if you need a rental car while yours is in the shop, new car replacement coverage and roadside assistance. You can also buy umbrella insurance through USAA for further protection.

Can I manage my USAA insurance policy online?

Yes. USAA, like other major insurance companies, offers digital tools to help you manage your policy, including the USAA website and mobile app.

Is USAA insurance a good insurance company overall?

USAA is very highly rated for customer satisfaction and financial strength, making it a strong contender for your business. However, since USAA car insurance is only available to military members and their families, you’ll need to meet membership qualifications if you want to purchase a policy.

Sources

- AM Best. “AM Best Affirms Credit Ratings of United Services Automobile Association, Its Subsidiaries and USAA Capital Corporation.” Accessed February 2026.

- J.D. Power. “It’s Now a Buyer’s Market for Auto Insurance, J.D. Power Finds.” Accessed February 2026.

- USAA. “Auto and property insurance claims.” Accessed February 2026.

- USAA. “Types of car insurance coverage.” Accessed February 2026.

- USAA. “Car insurance discounts.” Accessed February 2026.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs