CarInsurance.com Insights

- The Honda CR-V is the cheapest SUV to insure, with an average annual cost of $1,932.

- The Honda HR-V and Volkswagen Tiguan are also relatively inexpensive to insure, with an average annual premium of $1,936 and $1,979, respectively.

- The national average rate for full coverage car insurance for an SUV is $2,316 annually.

If you’re in the market for an SUV, you should understand how much it costs to insure a sport utility vehicle and where to find the cheapest insurance. This information will allow you to budget the insurance price into your total cost of ownership and ensure you don’t pay more for insurance than you should.

This guide lists the least-expensive SUVs to insure, the insurance companies offering the cheapest policies and suggestions on how to save on your premiums.

Which are the cheapest SUVs to insure?

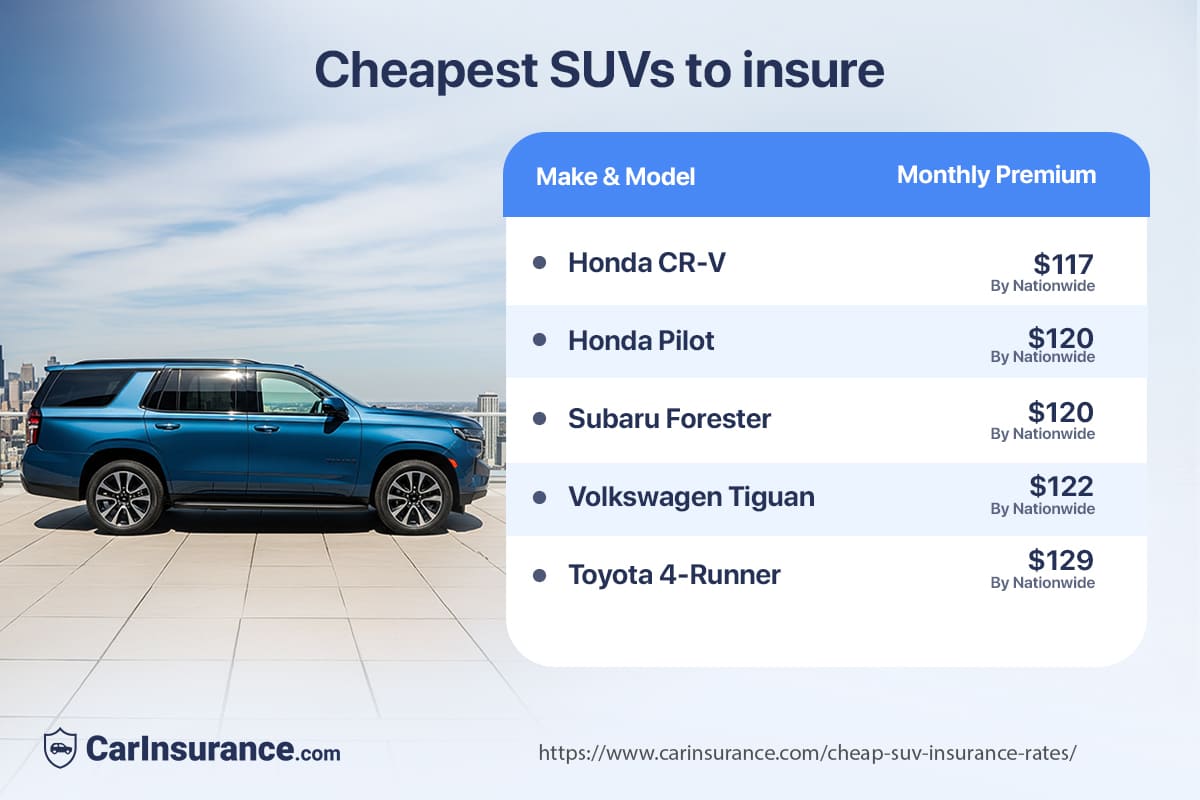

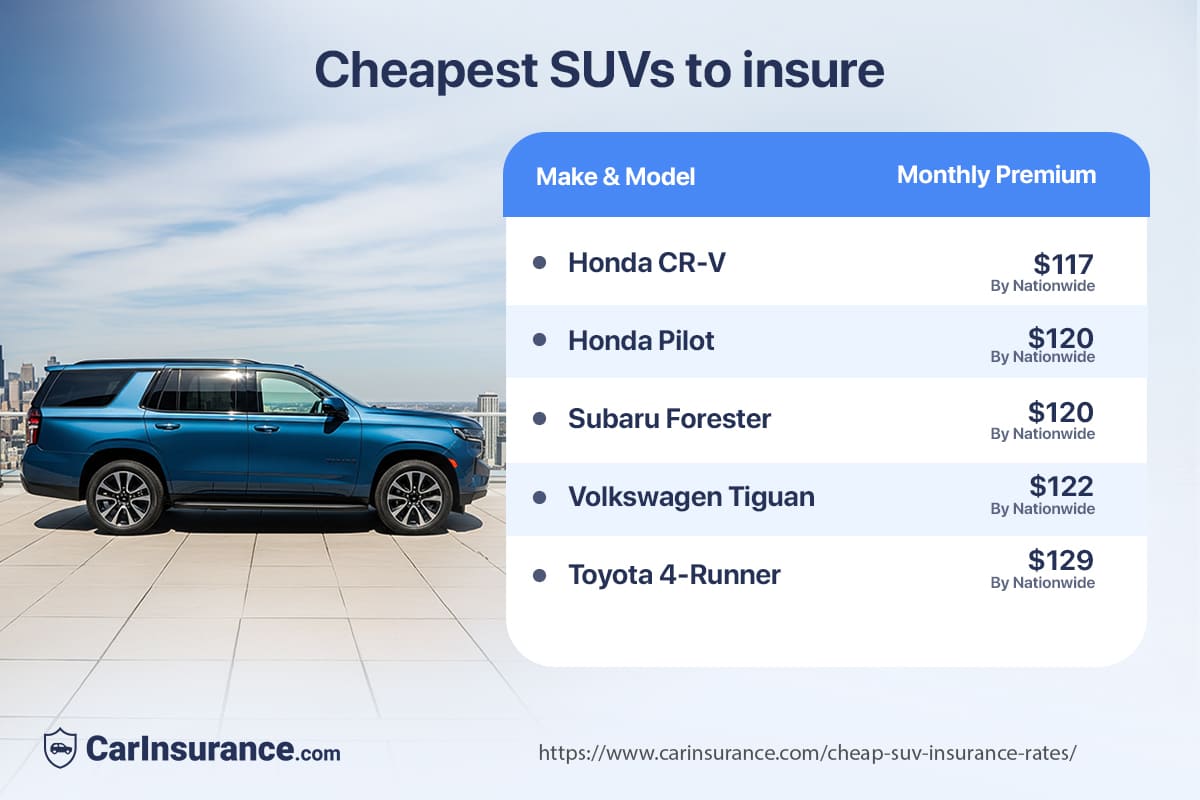

Below is a list of the cheapest SUVs to insure in 2026:

No. 1: Honda CR-V

- Cost: $1,932 per year, $161 per month

No. 2: Honda HR-V

- Cost: $1,936 per year, $161 per month

No. 3: Volkswagen Tiguan

- Cost: $1,979 per year, $165 per month

No. 4: Chevrolet TrailBlazer

- Cost: $2,012 per year, $168 per month

No. 4: Subaru Forester (Tie)

- Cost: $2,013 per year, $168 per month

Sub-compact SUVs have smaller engines and a whole suite of safety features, which makes them cheaper to insure than most other vehicles, including sedans, trucks and luxury SUVs. Insurance companies often charge lower rates for compact SUVs than regular SUVs because they are less likely to cause damage to other cars in an accident.

“Compact SUVs tend to be smaller, lighter and have less horsepower than their full-size counterparts,” says Joyce Ann Guiterrez, an automotive expert with 4WheelOnline.com, an aftermarket truck parts retailer. “This means they’re less likely to cause damage in an accident and are easier to control.”

Do insurance companies consider the size of an SUV when setting policy prices?

Insurance companies calculate premiums based on varying factors, such as the likelihood of theft, engine size, overall vehicle safety, repair costs and total value. When it comes to the size of an SUV, insurance companies tend to increase premiums from a smaller SUV to a midsize and full-size SUV.

For example, the relatively small Honda CR-V’s average annual premium costs $1,932. By comparison, a full-size Chevrolet Tahoe costs an average of $2,462 annually to insure.

Learn more about average premium rate differences and the cheapest insurance companies in the following SUV rankings.

What is the cheapest small SUV to insure?

According to our analysis, the Honda CR-V is the cheapest small SUV to insure, with an annual rate of $1,402 through Nationwide. The table below highlights how other vehicles, such as the Subaru Forester, Volkswagen Tiguan and Hyundai Tucson, compare.

| Make model | Company | Annual rates | Six-month rates | Monthly rates |

|---|---|---|---|---|

| Honda CR-V | Nationwide | $1,402 | $701 | $117 |

| Subaru Forester | Nationwide | $1,444 | $722 | $120 |

| Volkswagen Tiguan | Nationwide | $1,465 | $733 | $122 |

| Hyundai Tucson | Geico | $1,613 | $807 | $134 |

| Mazda CX-5 | Geico | $1,637 | $819 | $136 |

| Chevrolet Equinox | Nationwide | $1,667 | $833 | $139 |

| Toyota RAV4 | State Farm | $1,671 | $836 | $139 |

| Kia Sportage | Geico | $1,680 | $840 | $140 |

| Mazda CX-50 | Geico | $1,714 | $857 | $143 |

| GMC Terrain | State Farm | $1,725 | $863 | $144 |

| Jeep Compass | Progressive | $1,842 | $921 | $154 |

| Nissan Rogue | State Farm | $1,895 | $947 | $158 |

| Mitsubishi Eclipse Cross | State Farm | $1,902 | $951 | $158 |

| Dodge Hornet | State Farm | $2,024 | $1,012 | $169 |

What is the cheapest midsize SUV to insure?

The Honda Pilot is the cheapest midsize SUV to insure, with an average annual rate of $1,444 from Nationwide. The table below highlights how other vehicles like the Subaru Ascent, Toyota Highlander and Chevrolet Traverse compare to the Pilot.

| Make Model | Company | Annual rates | Six-month rates | Monthly rates |

|---|---|---|---|---|

| Honda Pilot | Nationwide | $1,444 | $722 | $120 |

| Toyota 4Runner | Nationwide | $1,547 | $773 | $129 |

| Subaru Ascent | Nationwide | $1,649 | $824 | $137 |

| Volkswagen Atlas | Nationwide | $1,666 | $833 | $139 |

| Toyota Highlander | Progressive | $1,672 | $836 | $139 |

| Chevrolet Traverse | Geico | $1,742 | $871 | $145 |

| Volkswagen Atlas Cross Sport | State Farm | $1,809 | $905 | $151 |

| Hyundai Santa Fe | Geico | $1,864 | $932 | $155 |

| Mazda CX-90 | Progressive | $1,865 | $932 | $155 |

| Ford Bronco | State Farm | $1,889 | $944 | $157 |

| Hyundai Palisade | Nationwide | $1,904 | $952 | $159 |

| Kia Telluride | Nationwide | $1,919 | $960 | $160 |

| Kia Sorento | Geico | $1,924 | $962 | $160 |

| Toyota Grand Highlander | Progressive | $1,931 | $966 | $161 |

| Jeep Grand Cherokee | State Farm | $1,934 | $967 | $161 |

| Jeep Grand Cherokee L | State Farm | $1,962 | $981 | $163 |

| GMC Acadia | Geico | $2,035 | $1,018 | $170 |

| Toyota Land Cruiser | State Farm | $2,512 | $1,256 | $209 |

What is the cheapest full-size SUV to insure?

The Chevrolet Tahoe is the cheapest full-size SUV to insure, with an average annual rate of $1,680 through Nationwide. The table below highlights how vehicles like the Ford Expedition and the GMC Yukon compare to the Tahoe.

| Make model | Company | Annual rates | Six-month rates | Monthly rates |

|---|---|---|---|---|

| Chevrolet Tahoe | Nationwide | $1,680 | $840 | $140 |

| Ford Expedition | Nationwide | $1,708 | $854 | $142 |

| GMC Yukon | Nationwide | $1,742 | $871 | $145 |

| Chevrolet Suburban | Nationwide | $1,811 | $906 | $151 |

| Nissan Armada | State Farm | $2,088 | $1,044 | $174 |

| Toyota Sequoia | Progressive | $2,328 | $1,164 | $194 |

| Jeep Wagoneer | State Farm | $2,471 | $1,236 | $206 |

Why are smaller SUVs cheaper to insure?

Small SUVs are cheaper to insure because they are smaller with smaller engines, have advanced safety features and are easier to maneuver in traffic.

“If you go with a midsize SUV, such as a Toyota RAV4 or Honda CR-V, your rates will be lower. However, if you choose an extended automobile like the Ford Excursion, you can anticipate spending more on insurance,” Guiterrez says. “These automobiles are harder to handle in traffic and are more prone to accident involvement. Shorter SUVs are easier to maneuver and less likely to roll over, so they typically have lower insurance rates than longer SUVs.”

Why are large SUVs costlier to insure than other vehicles?

Large SUVs are typically more expensive to insure than smaller vehicles because they cause more extensive damage in an accident.

Let’s take a look at why large SUVs can be pricey to insure:

- Rollover risk: SUVs are more likely to be in a rollover accident because they’re bigger.

- Claim rate: Large SUVs can cause more damage in an accident, which translates to pricier claims and higher insurance rates overall.

- Costly repairs: The expensive finishes and high-tech features on luxury SUVs are expensive to repair or replace.

“Larger SUVs are more expensive to insure because they are more likely to cause damage in the event of a collision,” Guiterrez says. “SUV drivers also usually have less driving experience than smaller car drivers, leading to more accidents.”

How do insurance rates differ for gas, hybrid and electric SUVs?

“EV insurance tends to be more costly since repairs are pricier, fewer repair shops are available and there is a cybersecurity risk,” says Kristopher Barber, founder and principal attorney of the Texas-based Barber Law Firm. “EVs are also pricier and have additional complex technology, including autonomous driving features, which contribute to additional potential liability.”

Insuring an electric SUV or hybrid SUV is more expensive than insuring a gas-powered one. For example, a gas-powered Hyundai Kona costs $2,048 annually to insure, while the electric version costs $2,276 per year for identical coverage. Similarly, a gas-powered Honda CR-V costs $1,932 to insure for a year, while the hybrid version costs $2,164.

Which companies offer the cheapest car insurance for SUVs?

Nationwide offers the cheapest SUV insurance rates, starting at an annual average premium of $1,402 for a Honda CR-V. Progressive follows at an average annual rate of $1,578 for a Volkswagen Taos.

See the table below for the top insurance companies’ average annual SUV premiums.

| Make model | Company | Annual rates | Six-month rates | Monthly rates |

|---|---|---|---|---|

| Buick Enclave | State Farm | $2,138 | $1,069 | $178 |

| Buick Encore GX | State Farm | $1,732 | $866 | $144 |

| Buick Envision | State Farm | $1,818 | $909 | $151 |

| Chevrolet Blazer | Geico | $1,888 | $944 | $157 |

| Chevrolet Equinox | Nationwide | $1,667 | $833 | $139 |

| Chevrolet Suburban | Nationwide | $1,811 | $906 | $151 |

| Chevrolet Tahoe | Nationwide | $1,680 | $840 | $140 |

| Chevrolet TrailBlazer | State Farm | $1,675 | $837 | $140 |

| Chevrolet Traverse | Geico | $1,742 | $871 | $145 |

| Chevrolet Traverse Limited | Geico | $1,803 | $902 | $150 |

| Chevrolet Trax | Geico | $1,656 | $828 | $138 |

| Dodge Durango | State Farm | $2,102 | $1,051 | $175 |

| Dodge Hornet | State Farm | $2,024 | $1,012 | $169 |

| Ford Bronco | State Farm | $1,889 | $944 | $157 |

| Ford Bronco Sport | State Farm | $1,734 | $867 | $144 |

| Ford Edge | Nationwide | $1,770 | $885 | $147 |

| Ford Escape | State Farm | $1,631 | $815 | $136 |

| Ford Expedition | Nationwide | $1,708 | $854 | $142 |

| Ford Explorer | Nationwide | $1,984 | $992 | $165 |

| GMC Acadia | Geico | $2,035 | $1,018 | $170 |

| GMC Terrain | State Farm | $1,725 | $863 | $144 |

| GMC Yukon | Nationwide | $1,742 | $871 | $145 |

| Honda CR-V | Nationwide | $1,402 | $701 | $117 |

| Honda HR-V | Geico | $1,601 | $801 | $133 |

| Honda Passport | State Farm | $1,768 | $884 | $147 |

| Honda Pilot | Nationwide | $1,444 | $722 | $120 |

| Hyundai Kona | Geico | $1,631 | $815 | $136 |

| Hyundai Palisade | Nationwide | $1,904 | $952 | $159 |

| Hyundai Santa Fe | Geico | $1,864 | $932 | $155 |

| Hyundai Tucson | Geico | $1,613 | $807 | $134 |

| Jeep Compass | Progressive | $1,842 | $921 | $154 |

| Jeep Grand Cherokee | State Farm | $1,934 | $967 | $161 |

| Jeep Grand Cherokee L | State Farm | $1,962 | $981 | $163 |

| Jeep Grand Wagoneer | Progressive | $2,790 | $1,395 | $232 |

| Jeep Wagoneer | State Farm | $2,471 | $1,236 | $206 |

| Jeep Wrangler | Nationwide | $1,751 | $876 | $146 |

| Kia Seltos | Progressive | $1,740 | $870 | $145 |

| Kia Sorento | Geico | $1,924 | $962 | $160 |

| Kia Sportage | Geico | $1,680 | $840 | $140 |

| Kia Telluride | Nationwide | $1,919 | $960 | $160 |

| Mazda CX-30 | Geico | $1,596 | $798 | $133 |

| Mazda CX-5 | Geico | $1,637 | $819 | $136 |

| Mazda CX-50 | Geico | $1,714 | $857 | $143 |

| Mazda CX-90 | Progressive | $1,865 | $932 | $155 |

| Mini Cooper Countryman | Nationwide | $1,581 | $791 | $132 |

| Mitsubishi Eclipse Cross | State Farm | $1,902 | $951 | $158 |

| Mitsubishi Outlander | State Farm | $1,866 | $933 | $156 |

| Mitsubishi Outlander Sport | Geico | $1,984 | $992 | $165 |

| Nissan Armada | State Farm | $2,088 | $1,044 | $174 |

| Nissan Murano | Nationwide | $1,741 | $870 | $145 |

| Nissan Pathfinder | Geico | $1,897 | $948 | $158 |

| Nissan Rogue | State Farm | $1,895 | $947 | $158 |

| Subaru Ascent | Nationwide | $1,649 | $824 | $137 |

| Subaru Crosstrek | State Farm | $1,659 | $830 | $138 |

| Subaru Forester | Nationwide | $1,444 | $722 | $120 |

| Toyota 4Runner | Nationwide | $1,547 | $773 | $129 |

| Toyota Corolla Cross | Geico | $1,694 | $847 | $141 |

| Toyota Grand Highlander | Progressive | $1,931 | $966 | $161 |

| Toyota Highlander | Progressive | $1,672 | $836 | $139 |

| Toyota Land Cruiser | State Farm | $2,512 | $1,256 | $209 |

| Toyota RAV4 | State Farm | $1,671 | $836 | $139 |

| Toyota Sequoia | Progressive | $2,328 | $1,164 | $194 |

| Volkswagen Atlas | Nationwide | $1,666 | $833 | $139 |

| Volkswagen Atlas Cross Sport | State Farm | $1,809 | $905 | $151 |

| Volkswagen Taos | Progressive | $1,578 | $789 | $132 |

| Volkswagen Tiguan | Nationwide | $1,465 | $733 | $122 |

How has the cost of SUV insurance changed over time?

The cost of insuring a vehicle has risen dramatically in the wake of the COVID-19 pandemic. As drivers returned to the roads, accidents increased, and the cost of vehicles, parts, and repairs soared with inflation.

According to the U.S. Bureau of Labor, the cost of car insurance rose 17.4% year over year from 2022 to 2023 and 17.8% year over year from 2023 to 2024. Rates continued to rise in 2025, up 11% year over year in March.

How much is insurance for an SUV for an 18-year-old vs. a 40-year-old?

Insurers consider your age when determining insurance premiums. Younger drivers pay more for car insurance than experienced drivers. For example, a 40-year-old pays an average of $1,932 annually to insure a Honda CR-V. In contrast, an 18-year-old pays an average of $7,038 annually to insure the exact same vehicle.

The table below highlights differences in rates for SUVS for male drivers at age 18 vs. 40.

| Make model | Annual rates | Six-month rates | Monthly rates |

|---|---|---|---|

| Honda CR-V | $7,038 | $3,519 | $586 |

| Honda HR-V | $7,156 | $3,578 | $596 |

| Subaru Forester | $7,188 | $3,594 | $599 |

| Volkswagen Tiguan | $7,293 | $3,647 | $608 |

| Chevrolet TrailBlazer | $7,327 | $3,663 | $611 |

| Mazda CX-5 | $7,352 | $3,676 | $613 |

| Subaru Crosstrek | $7,397 | $3,699 | $616 |

| Honda Pilot | $7,501 | $3,751 | $625 |

| Hyundai Kona | $7,588 | $3,794 | $632 |

| Hyundai Tucson | $7,598 | $3,799 | $633 |

| Kia Sportage | $7,602 | $3,801 | $633 |

| Kia Seltos | $7,617 | $3,808 | $635 |

| Mazda CX-30 | $7,639 | $3,820 | $637 |

| Jeep Wrangler | $7,649 | $3,824 | $637 |

| Toyota Corolla Cross | $7,661 | $3,830 | $638 |

| Volkswagen Taos | $7,670 | $3,835 | $639 |

| Toyota RAV4 | $7,671 | $3,835 | $639 |

| Ford Escape | $7,683 | $3,842 | $640 |

| Chevrolet Equinox | $7,753 | $3,877 | $646 |

| Honda Passport | $7,774 | $3,887 | $648 |

| Subaru Ascent | $7,779 | $3,889 | $648 |

| Mini Cooper Countryman | $7,839 | $3,920 | $653 |

| Buick Encore GX | $7,840 | $3,920 | $653 |

| Ford Bronco Sport | $7,845 | $3,923 | $654 |

| Chevrolet Trax | $7,848 | $3,924 | $654 |

| Ford Edge | $7,925 | $3,962 | $660 |

| Volkswagen Atlas | $8,016 | $4,008 | $668 |

| Ford Bronco | $8,050 | $4,025 | $671 |

| Jeep Compass | $8,083 | $4,041 | $674 |

| Volkswagen Atlas Cross Sport | $8,113 | $4,057 | $676 |

| Mazda CX-50 | $8,176 | $4,088 | $681 |

| Toyota Highlander | $8,187 | $4,093 | $682 |

| GMC Terrain | $8,207 | $4,103 | $684 |

| Kia Sorento | $8,221 | $4,110 | $685 |

| Nissan Murano | $8,239 | $4,119 | $687 |

| Toyota 4Runner | $8,318 | $4,159 | $693 |

| Chevrolet Traverse | $8,361 | $4,181 | $697 |

| Hyundai Santa Fe | $8,400 | $4,200 | $700 |

| Hyundai Palisade | $8,472 | $4,236 | $706 |

| Kia Telluride | $8,495 | $4,247 | $708 |

| Chevrolet Blazer | $8,504 | $4,252 | $709 |

| Nissan Pathfinder | $8,541 | $4,271 | $712 |

| Nissan Rogue | $8,564 | $4,282 | $714 |

| Buick Envision | $8,587 | $4,293 | $716 |

| Ford Explorer | $8,653 | $4,327 | $721 |

| Jeep Grand Cherokee | $8,662 | $4,331 | $722 |

| Jeep Grand Cherokee L | $8,771 | $4,386 | $731 |

| Toyota Grand Highlander | $8,810 | $4,405 | $734 |

| GMC Acadia | $8,823 | $4,411 | $735 |

| Mitsubishi Outlander Sport | $8,835 | $4,418 | $736 |

| Mitsubishi Outlander | $8,951 | $4,475 | $746 |

| Chevrolet Traverse Limited | $8,966 | $4,483 | $747 |

| Dodge Hornet | $8,995 | $4,497 | $750 |

| Chevrolet Tahoe | $9,025 | $4,512 | $752 |

| Dodge Durango | $9,049 | $4,525 | $754 |

| Mitsubishi Eclipse Cross | $9,074 | $4,537 | $756 |

| Chevrolet Suburban | $9,085 | $4,542 | $757 |

| Buick Enclave | $9,135 | $4,567 | $761 |

| GMC Yukon | $9,391 | $4,695 | $783 |

| Ford Expedition | $9,397 | $4,699 | $783 |

| Mazda CX-90 | $9,569 | $4,785 | $797 |

| Nissan Armada | $9,651 | $4,826 | $804 |

| Toyota Sequoia | $10,323 | $5,161 | $860 |

| Jeep Wagoneer | $10,899 | $5,450 | $908 |

| Toyota Land Cruiser | $12,190 | $6,095 | $1,016 |

| Jeep Grand Wagoneer | $13,547 | $6,773 | $1,129 |

| Make model | Annual rates | Six-month rates | Monthly rates |

|---|---|---|---|

| Honda CR-V | $1,932 | $966 | $161 |

| Honda HR-V | $1,936 | $968 | $161 |

| Volkswagen Tiguan | $1,979 | $990 | $165 |

| Chevrolet TrailBlazer | $2,012 | $1,006 | $168 |

| Subaru Forester | $2,013 | $1,007 | $168 |

| Mazda CX-5 | $2,021 | $1,010 | $168 |

| Hyundai Kona | $2,048 | $1,024 | $171 |

| Hyundai Tucson | $2,062 | $1,031 | $172 |

| Volkswagen Taos | $2,064 | $1,032 | $172 |

| Subaru Crosstrek | $2,064 | $1,032 | $172 |

| Toyota Corolla Cross | $2,066 | $1,033 | $172 |

| Kia Sportage | $2,069 | $1,035 | $172 |

| Honda Pilot | $2,076 | $1,038 | $173 |

| Toyota RAV4 | $2,085 | $1,043 | $174 |

| Mazda CX-30 | $2,086 | $1,043 | $174 |

| Chevrolet Equinox | $2,090 | $1,045 | $174 |

| Kia Seltos | $2,094 | $1,047 | $174 |

| Chevrolet Trax | $2,102 | $1,051 | $175 |

| Jeep Wrangler | $2,104 | $1,052 | $175 |

| Ford Escape | $2,113 | $1,057 | $176 |

| Honda Passport | $2,142 | $1,071 | $179 |

| Mini Cooper Countryman | $2,145 | $1,073 | $179 |

| Buick Encore GX | $2,145 | $1,073 | $179 |

| Subaru Ascent | $2,172 | $1,086 | $181 |

| Ford Bronco Sport | $2,173 | $1,086 | $181 |

| Jeep Compass | $2,174 | $1,087 | $181 |

| Volkswagen Atlas | $2,178 | $1,089 | $181 |

| Ford Edge | $2,190 | $1,095 | $183 |

| GMC Terrain | $2,201 | $1,100 | $183 |

| Volkswagen Atlas Cross Sport | $2,209 | $1,105 | $184 |

| Nissan Murano | $2,234 | $1,117 | $186 |

| Ford Bronco | $2,242 | $1,121 | $187 |

| Mazda CX-50 | $2,247 | $1,124 | $187 |

| Toyota Highlander | $2,253 | $1,126 | $188 |

| Toyota 4Runner | $2,260 | $1,130 | $188 |

| Kia Sorento | $2,271 | $1,136 | $189 |

| Chevrolet Traverse | $2,283 | $1,142 | $190 |

| Chevrolet Blazer | $2,293 | $1,146 | $191 |

| Nissan Pathfinder | $2,311 | $1,155 | $193 |

| Nissan Rogue | $2,314 | $1,157 | $193 |

| Hyundai Santa Fe | $2,316 | $1,158 | $193 |

| Buick Envision | $2,338 | $1,169 | $195 |

| Ford Explorer | $2,357 | $1,179 | $196 |

| Hyundai Palisade | $2,360 | $1,180 | $197 |

| Kia Telluride | $2,367 | $1,184 | $197 |

| Jeep Grand Cherokee | $2,371 | $1,185 | $198 |

| Jeep Grand Cherokee L | $2,401 | $1,201 | $200 |

| Mitsubishi Outlander Sport | $2,401 | $1,201 | $200 |

| Mitsubishi Outlander | $2,417 | $1,208 | $201 |

| GMC Acadia | $2,420 | $1,210 | $202 |

| Toyota Grand Highlander | $2,442 | $1,221 | $204 |

| Mitsubishi Eclipse Cross | $2,444 | $1,222 | $204 |

| Dodge Hornet | $2,452 | $1,226 | $204 |

| Chevrolet Tahoe | $2,462 | $1,231 | $205 |

| Dodge Durango | $2,482 | $1,241 | $207 |

| Chevrolet Traverse Limited | $2,482 | $1,241 | $207 |

| Buick Enclave | $2,491 | $1,246 | $208 |

| Chevrolet Suburban | $2,508 | $1,254 | $209 |

| GMC Yukon | $2,582 | $1,291 | $215 |

| Ford Expedition | $2,605 | $1,303 | $217 |

| Nissan Armada | $2,660 | $1,330 | $222 |

| Mazda CX-90 | $2,680 | $1,340 | $223 |

| Toyota Sequoia | $2,839 | $1,420 | $237 |

| Jeep Wagoneer | $3,030 | $1,515 | $252 |

| Toyota Land Cruiser | $3,475 | $1,738 | $290 |

| Jeep Grand Wagoneer | $3,747 | $1,873 | $312 |

New vs used SUVs: Which are cheaper to insure?

Generally, used cars are less expensive to insure due to their lower value and the fact that new cars depreciate as soon as you drive them off the lot. However, insurance costs vary based on your unique situation, which could lead to higher costs for insuring a used SUV.

Factors that affect the insurance rate for your SUV

Insurance companies consider many factors when determining premiums for your SUV. Some of these include:

- Your driving record

- How often you use the car

- Where you live

- Your age

- Your gender

- Your credit history

How can you save monthly on SUV car insurance?

There are a handful of ways you can trim some dollars off your car insurance premiums. For instance, you can look for discounts by bundling your auto insurance with homeowners insurance through the same company or signing up for autopay or paperless statements.

Other ways you can save on car insurance for an SUV include staying accident-free and remaining a loyal customer with the same insurer.

Before you buy insurance for an SUV, check these items off your list:

- Shop around: The beauty of car insurance shopping is that you can hop on another policy with another insurance company anytime. Get at least three quotes with the same coverage and amounts and ask about discounts.

- Do your research: You’ll want to see precisely what coverage you need. Look at your state’s minimum insurance requirements. And if you took out an auto loan or are leasing your car, you’ll be required to carry full coverage insurance.

- Consider your lifestyle and budget: If you put a lot of miles on your car, then a mileage-based policy won’t be for you. Do you intend to use your SUV as a commuter? Will you be taking it off-roading on weekend adventures?

Trucks vs. SUVs vs. sedans: Which are cheaper to insure?

On average, it costs $2,667 per year to insure a truck. That’s higher than the average cost to insure an SUV at $2,316 per year or the average cost to insure a sedan at $2,409 annually.

Final thoughts on cheap insurance for SUVs

When shopping for insurance for your SUV, consider what you use your car for, how often you drive, and your personal budget. If you want cheaper car insurance rates, opt for a subcompact SUV with a smaller engine and the latest safety features.

Frequently asked questions on SUVs

Does SUV insurance cost more for new models than older models?

Typically, SUV insurance costs more for new models due to a higher underlying value and replacement cost. Older SUVs may be more affordable to insure.

What are the most expensive SUVs to insure?

Some of the more expensive SUVs to insure include the Jeep Grand Wagoneer, Toyota Land Cruiser and Toyota Sequoia.

Are crossover SUVs cheaper to insure than traditional SUVs?

Yes, smaller SUVs are cheaper to insure than larger SUVs.

Does the weight of an SUV affect its insurance premium?

Generally, full-sized SUVs are more expensive to insure than smaller SUVs.

Does modifying an SUV (e.g., lift kits, custom wheels) increase insurance costs?

Yes, modifying an SUV often increases car insurance costs. The size of the increase varies depending on the situation, but it is typically significant because it creates higher repair costs.

Resources & Methodology

Sources

Insurance Information Institute. “What determines the price of an auto insurance policy?” Accessed December 2025.

Methodology

CarInsurance.com commissioned Quadrant Information Services to get car insurance rates. The rates are based on the sample profiles of 40-year-old male and female drivers carrying full coverage policies with limits of 100/300/100 and $500 collision and comprehensive deductibles. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs