CarInsurance.com Insights

- State Farm performed above average in customer satisfaction in most regions of the U.S., according to a J.D. Power auto insurance study.

- The company offers competitive options for high-risk and young teen drivers, including its usage-based insurance program.

- State Farm offers a strong network of local agents to help you select the right coverage and manage your policy, though you can also use the app or website.

State Farm is highly rated for customer satisfaction and its usage-based insurance program, Drive Safe and Save. The Bloomington, Illinois-based auto insurance company received high marks for satisfaction for teens and young adult drivers, making it a solid pick for families.

The company offers a wide range of discounts, including programs for teens and safe drivers, as well as strong digital tools and local agent support. While its rates are slightly higher than those of some competitors, State Farm’s solid claims handling and telematics program make it a top choice for families and loyal policyholders.

To help you decide whether State Farm is the right fit for your car insurance needs, we surveyed current policyholders and analyzed the company’s performance in several key areas.

At a glance

Pros

- Highly rated for customer satisfaction.

- Good discounts for bundling and safe driving.

- Competitive coverage for high-risk drivers.

- Above-average marks for its telematics program.

- Highly rated mobile app.

Cons

- Higher average rates than some other insurers.

- No accident forgiveness option.

- Missing some coverage options, like gap insurance.

Who is State Farm car insurance best for?

State Farm ranked No. 6 in our Best Car Insurance Companies of 2026 study, with a score of 4.0 stars out of 5. State Farm comes highly recommended by its policyholders, so it’s suitable for people looking for customer recommendations and customers with solid financial strength (its AM Best Rating is Superior).

How much does State Farm car insurance cost?

According to our rate analysis, the average rate for State Farm’s full coverage car insurance is $239 per month, which is higher than that of more than half of the other insurers we analyzed.

Please note that your costs will vary depending on several factors, including your age, driving history, location, coverage selection and any applicable discounts for which you may be eligible.

Compare the average monthly premiums for State Farm to those of other top insurers below.

| Company | Full coverage monthly cost |

|---|---|

| Allstate | $267 |

| Farmers | $257 |

| American Family | $159 |

| GEICO | $179 |

| Nationwide | $205 |

| Progressive | $223 |

| State Farm | $239 |

| Travelers | $175 |

| USAA* | $131 |

*USAA is only available to military community members and their families.

State Farm car insurance discounts and savings

Enrolling in State Farm’s Drive Safe & Safe telematics program could save you 10% at enrollment and up to 30% at renewal if you demonstrate safe driving habits and low mileage.

There is also a program called Steer Clear that helps drivers under 25 improve their driving skills and potentially lower their costs.

In addition to Drive Safe & Save, State Farm offers other auto insurance discounts, too:

- Multi-policy (bundle discount)

- Defensive driving course

- Good driver

- Good student

- Away at college

- Driver training

- Loyalty

- Low mileage

- Safety features (such as driver assist technology)

- Passive restraint

- Anti-theft device

Coverage options

State Farm offers the same common coverages you’ll find with other insurers, including:

- Liability, which pays for injuries or damage you cause in an accident.

- Collision, which pays to repair or replace your vehicle if it’s damaged in an accident.

- Comprehensive, which pays to repair or replace your vehicle if it’s damaged by something other than an accident, such as falling objects, fire or vandalism.

State Farm also offers other coverage options, such as:

- Rideshare coverage

- Uninsured & underinsured motor vehicle coverage

- Medical payments coverage

- Emergency road service

- Car rental reimbursement, including travel expenses

My experience getting a quote

Getting a State Farm quote online was very simple and – dare I say it – even enjoyable. The entire process took just five minutes, and State Farm provided excellent service throughout.

As with any insurer, the process begins by entering your name and address. State Farm was able to pull up the vehicles registered to our address, as well as the drivers I wanted to cover (myself and my spouse).

After providing a little more detail about whether each car was owned, leased or financed, State Farm invited me to enroll in its Drive Safe & Save usage-based insurance program. State Farm said signing up would earn me a 10% discount, with the opportunity to save up to 30% by maintaining safe driving habits at renewal time. I declined this option.

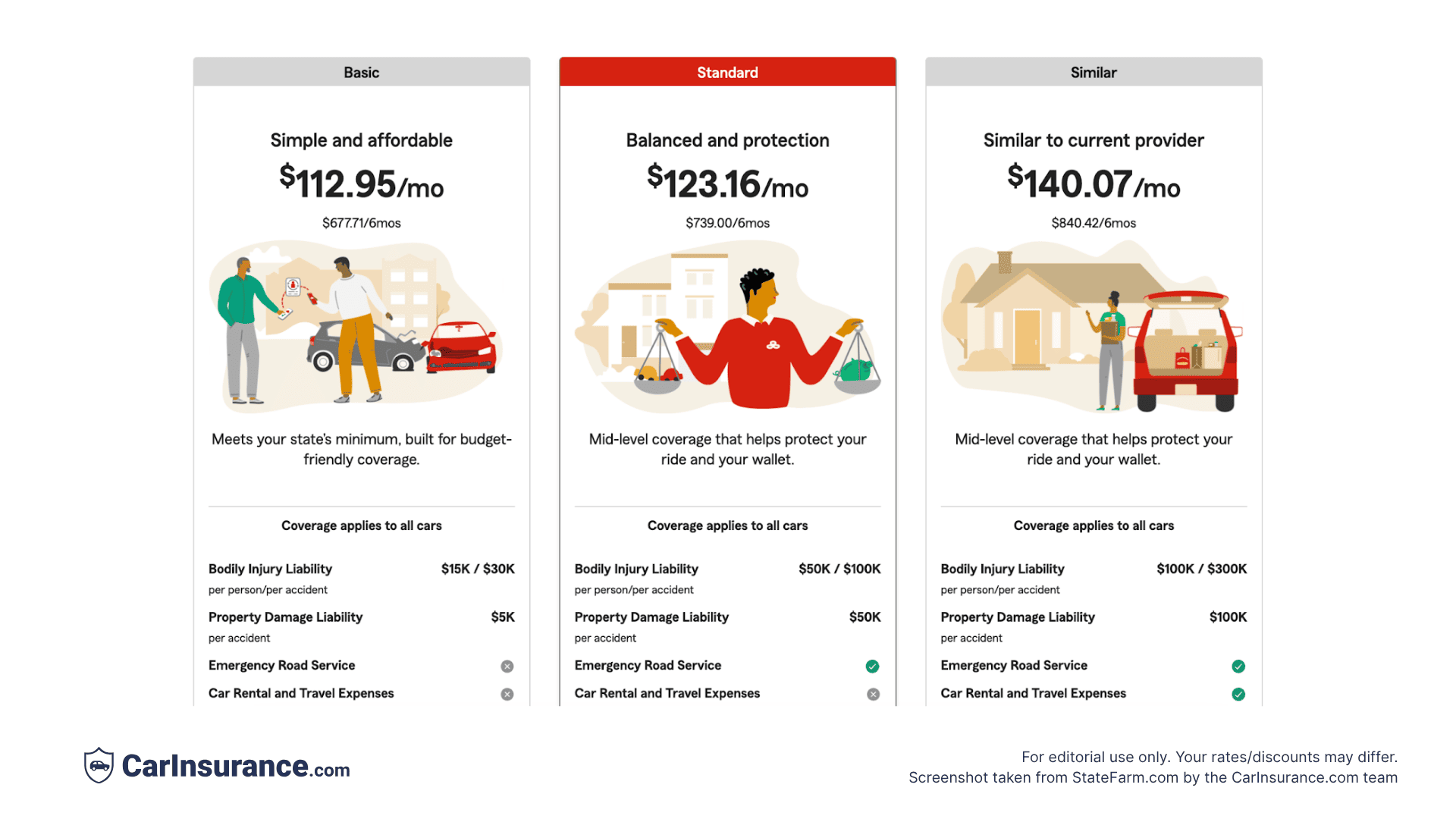

In no time at all, State Farm provided three quotes for three levels of coverage: Basic, state-minimum coverage, which was quoted at $113 per month; Standard coverage, which was quoted at $123 per month and a custom level that was most similar to my current coverage with another provider, at $140 per month.

Scrolling down, I explored what was included with each level of coverage and compared it to the others. For example, the Basic level included 15/30/5 coverage, which is the minimum required in Pennsylvania, where I live. The Standard level offered 50/100/50 coverage and the level similar to what I carry right now is 100/300/100, with roadside assistance and rental car reimbursement included.

A unique feature of the State Farm quote process is that it not only provided me with several options to choose from and the ability to purchase my new policy online, but it also provided me with information about local State Farm agents.

State Farm says every policy comes with a dedicated agent, providing me with multiple options to choose from. Each one included their name, insurance license number, profile photo and contact information so I could get in touch easily.

All in all, State Farm’s quote experience was one of the best of the insurance providers I tried.

State Farm’s claims experience

The way an insurance company handles its claims tells you a lot about what it’s like to be a customer. And since car insurance companies are there to help you on your worst day, when something has happened to you, your passengers or your vehicle, it’s essential to look for an insurance company with a good claims experience.

You can file a claim with State Farm on the website, by contacting your State Farm agent or through the State Farm mobile app.

State Farm performed above average in the J.D. Power 2025 Auto Claims Satisfaction Study with a score of 716. The study average was 700. State Farm also exceeded the study average in J.D. Power’s U.S. Insurance Digital Experience Study, scoring 707; the segment average was 699.

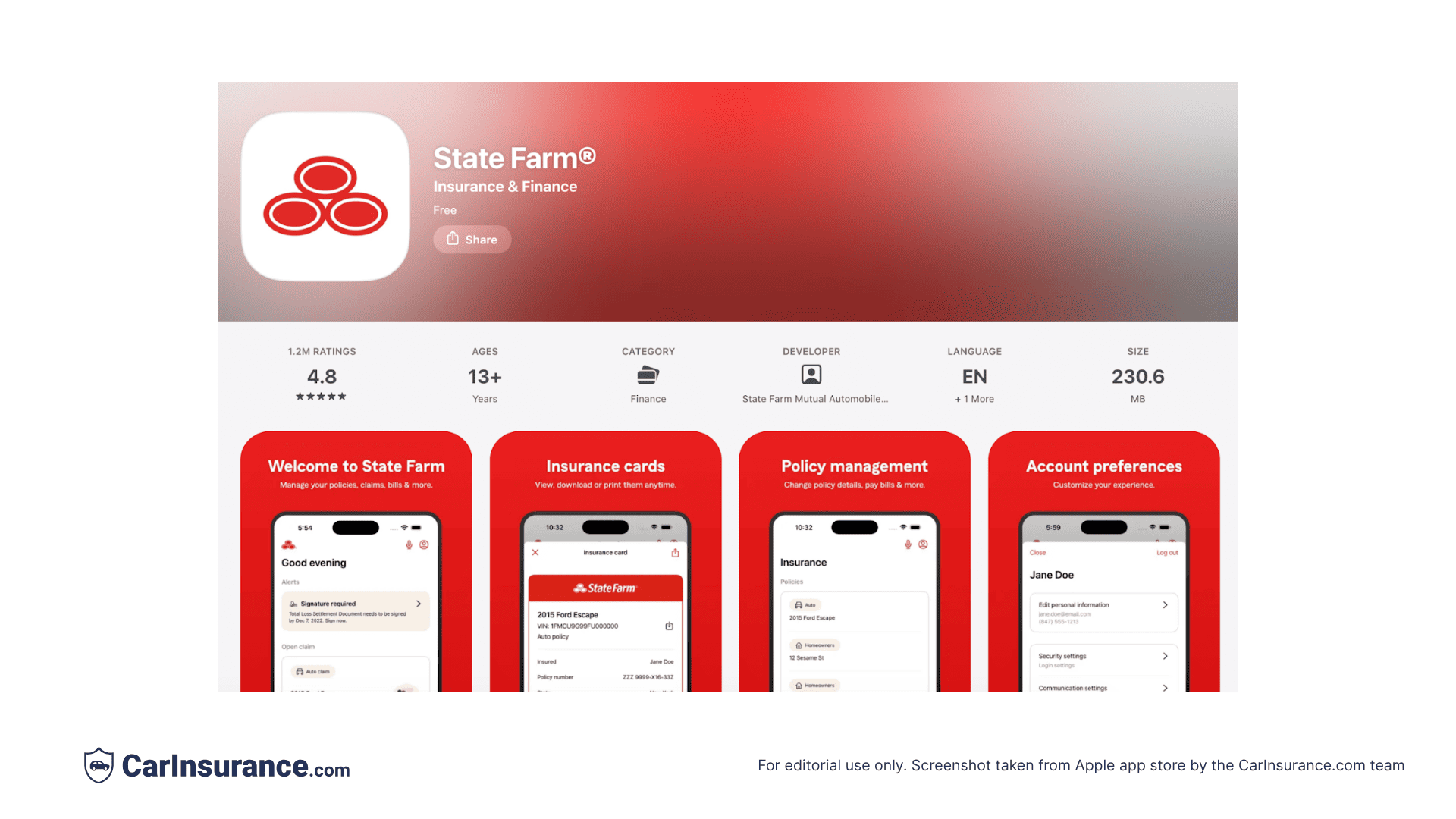

On the iOS App Store, the State Farm app has received 4.8 stars out of 5, based on over 1 million reviews. On the Google Play Store, the app receives 4.6 stars out of 5, with nearly 400,000 reviews as of November 2025.

Screenshot from the iPhone app store preview page.

Screenshot from the Google Play Store page.

State Farm customer satisfaction

State Farm earned a score of 84% in customer satisfaction in our analysis of the top car insurance companies. According to the 2025 U.S. Auto Insurance Study from J.D. Power, State Farm was the top-ranked insurer in the Northwest for customer satisfaction.

According to the complaint index published by the National Association of Insurance Commissioners (NAIC), State Farm receives just under the average number of complaints for an insurer of its size. The baseline index is 1.0 and State Farm’s index is 0.85, meaning it receives 15% fewer complaints than would be expected.

In terms of financial strength, which is an important indicator of a company’s ability to pay out its claims, State Farm received an A++ (Superior) rating – the highest possible – from global credit ratings agency AM Best.

Frequently Asked Questions: State Farm car insurance

Is State Farm insurance cheaper than other car insurance companies?

State Farm’s average monthly rates were not the cheapest among the insurers we analyzed, but they also weren’t the most expensive. Keep in mind that your rates will depend on factors like your driving history, location and the coverage you choose, among other variables.

What discounts does State Farm insurance offer?

State Farm offers standard car insurance discounts like multi-policy, good student, good driver and anti-theft device discounts. It also provides discounts for its usage-based insurance program called Drive Safe & Save and for its Steer Clear safe driving program for drivers under 25.

Does State Farm insurance offer accident forgiveness?

No. State Farm does not offer accident forgiveness coverage. However, if your premiums with State Farm go up after an accident, check with your agent to make sure you’re taking advantage of all eligible discounts.

Does State Farm insurance have gap insurance?

No, State Farm does not offer gap insurance. However, if you finance your car with a loan from State Farm Bank, you can use its Payoff Protector feature if your insurance doesn’t cover the balance remaining on your car loan.

How do I file a claim with State Farm insurance?

You can file a claim with State Farm in several ways: through the State Farm mobile app, online through the website or by calling your State Farm agent. You can follow the progress of your claim with the app or website, too.

How does State Farm insurance rank in customer satisfaction?

According to J.D. Power’s auto insurance satisfaction study, State Farm ranks above average in customer satisfaction for its usage-based insurance program. It also ranks above average in nearly every region in the study, including California, Central, Florida, Mid-Atlantic, New England, New York, North Central, Northwest (where it ranked No. 1), Southeast, Southwest and Texas.

Does State Farm insurance raise rates after an accident or ticket?

As with most insurers, your premiums with State Farm may go up after you’re involved in an accident or receive a ticket. Since State Farm doesn’t offer accident forgiveness coverage, you may want to see if you’re eligible for other discounts, such as for taking a driving safety course.

Is State Farm insurance good for high-risk drivers?

State Farm may be a good option for high-risk drivers, such as those with major violations or DUIs. Rates are usually higher for high-risk drivers, but coverage is often available.

Does State Farm insurance offer telematics or usage-based insurance?

Yes. State Farm’s Drive Safe & Save program tracks your miles and driving habits through an app on your mobile phone. Drivers with low mileage and a record of safe driving habits can save up to 30% when they renew their policy with State Farm.

What types of add-ons does State Farm insurance provide?

State Farm offers a few add-on coverages, such as rideshare insurance, car rental reimbursement and travel expenses coverage.

Can I manage my State Farm insurance policy online?

Yes. Like most insurance companies, State Farm offers digital tools that let you manage your policy online or in the app, including paying bills, changing coverage and viewing claims.

Is State Farm insurance a good insurance company overall?

State Farm is ranked No. 6 in our analysis of the best car insurance companies of 2026. The insurer offers multiple coverage options and provides several ways to save money through discounts. The best way to know if State Farm is a good option for you is to request a quote and compare it to other insurers to find the right fit at the right price.

Sources

- State Farm. “What is rideshare coverage.” Accessed November 2025.

- State Farm. “Car insurance coverage options.” Accessed November 2025.

- State Farm. “Enroll and save with Steer Clear.” Accessed November 2025.

View more

- AM Best. “AM Best Affirms Credit Ratings of State Farm Mutual Automobile Insurance Company and Core Subsidiaries.” Accessed November 2025.

- National Association of Insurance Commissioners. “State Farm Mut Auto Ins Co National Complaint Index Report.” Accessed November 2025.

- J.D. Power. “It’s Now a Buyer’s Market for Auto Insurance, J.D. Power Finds.” Accessed November 2025.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs