CarInsurance.com Insights

- Farmers customers have far fewer complaints about their experience with Farmers auto insurance than the industry average, according to the NAIC Complaint Index.

- Based on a CarInsurance.com rate analysis, Farmers was ranked 10th, with a score of 3.81.

- Farmers’ usage-based insurance program received the second-most number of points in the J.D. Power 2025 U.S. Auto Insurance Study.

Based in Woodland Hills, California, and serving all 50 states plus Washington, D.C., Farmers offers more than 20 possible car insurance discounts as well as a wide range of coverage options. Farmers is one of the top 10 car insurance companies in the U.S. by market share. But just because a company is big doesn’t mean it’s the right fit for you.

To help you decide, CarInsurance.com’s Farmers auto insurance review surveyed current policyholders to determine their satisfaction with their car insurance experience.

At a glance

Pros

- Farmers is available in all 50 states

- More than 20 available discount options

- Offers a variety of coverage, including special add-ons

- Highly rated for claims handling

- Low number of consumer complaints

Cons

- Rates are expensive

- Using Farmers’ telematics program, Signal, could actually raise your rates if you have poor driving habits

- Accident forgiveness is an add-on you can purchase, not an automatic feature

Who is Farmers car insurance best for?

Ranked No. 10 in our Best Car Insurance Companies of 2025 study, with a score of 3.81 out of 5, Farmers car insurance offers the best claims handling of the insurers we studied. Filing a claim in the Farmers mobile app is simple, and Farmers scored below the industry average in J.D. Power’s 2025 Auto Claims Satisfaction Study.

How much does Farmers car insurance cost?

The average monthly premium for car insurance with Farmers is $257, according to our findings. Of course, the amount you pay could be higher or lower depending on a variety of factors, including your driving history, where you live, which coverage options you choose, and which discounts you qualify for.

Keep in mind, too, that sometimes you really do get what you pay for: a higher premium can sometimes correlate with a better customer experience, which can make all the difference when it comes time to file a claim.

| Company | Full coverage monthly cost |

|---|---|

| Allstate | $267 |

| Farmers | $257 |

| American Family | $159 |

| GEICO | $179 |

| Nationwide | $205 |

| Progressive | $223 |

| State Farm | $239 |

| Travelers | $175 |

| USAA* | $131 |

*USAA is only available to military community members and their families.

Farmers car insurance discounts and savings

Farmers offers an extensive range of car insurance discounts, especially for families. When I requested a quote from Farmers, I was eligible for five discounts before I even selected whether to use paperless statements or autopay.

- Multi-policy (bundling home and auto, for example)

- Loyalty

- E-policy (paperless statements)

- Good payer (no late charges in the previous 12 months)

- Autopay

- Good student

- Distant student (living away at school without a vehicle)

- Shared family car (when there are more drivers than cars, and a driver is age 20 or younger)

- Youthful driver (generational loyalty discount for drivers under 25 who live with a Farmers policyholder)

- On your own (drivers under 30 who have recently lived with a Farmers policyholder and now are living on their own

- Signal (safe-driving program with telematics app)

- Accident-free for the past five years

- Affinity (membership in specific organizations)

- Senior defensive driver (for those over 55 who have completed a safe driving course)

- Homeowner (may be eligible even without bundling home and auto)

- Anti-theft equipment

Coverage options

Farmers offers the typical car insurance coverages you’d expect, including:

- Liability: Usually required by law in most states, liability coverage helps pay for other people’s injuries or property damage when you’re at fault in an accident.

- Collision: Covers repairs to your vehicle if you’ve been in a crash.

- Comprehensive: Covers other things that could happen to your vehicle, like theft, fire, vandalism or storm damage.

You can customize your Farmers policy with other coverage options, too, such as:

- Medical payments: Covers medical costs for you and your passengers if you’re in an accident.

- Roadside assistance: Help with towing, fixing a flat, and other emergency needs.

- Uninsured/underinsured motorist: Farmers offers coverage that helps pay for injuries or property damage caused by another driver who is insufficiently insured.

- Personal injury protection: Also called PIP, this coverage helps when you’re out of work due to an accident, paying for lost wages or rehab.

Farmers claims experience

The primary purpose of insurance is to provide protection in the event of an unexpected occurrence. To file an auto insurance claim with Farmers, log in to your account on the Farmers website or app, or call a claims representative at 1-800-435-7764. You can also schedule a tow, roadside assistance or glass repair online.

The Farmers mobile app receives high ratings, with 4.8 out of 5 stars on the iOS App Store, based on 22,000 reviews, and 4.7 out of 5 stars on the Google Play Store, based on almost 10,000 reviews as of November 2025.

Farmers scored below average in J.D. Power’s 2025 U.S. Auto Claims Satisfaction Study, receiving 690 out of a possible 1,000 points. The study average was 700.

Farmers customer satisfaction

In terms of general customer satisfaction, Farmers rates in the middle of the pack of the insurers we studied. Farmers didn’t score as highly as some of its competitors in the 2025 U.S. Auto Insurance Study from J.D. Power, receiving an average of 626 points out of a possible 1,000 points across all regions. However, customer satisfaction scores were down across the board during the study year, with more than a third of all study respondents – regardless of their insurer – reporting dissatisfaction.

When we examine the complaint index published by the National Association of Insurance Commissioners (NAIC), Farmers receives significantly fewer complaints than other car insurance companies. The baseline index is 1.0; the Farmers’ complaint index is 0.36, meaning it receives only a third of the average number of complaints for the auto insurance industry.

AM Best, which measures the financial strength of insurance companies, gives Farmers an A (Excellent) credit rating. That means Farmers should be financially strong enough to pay out on all its insurance claims.

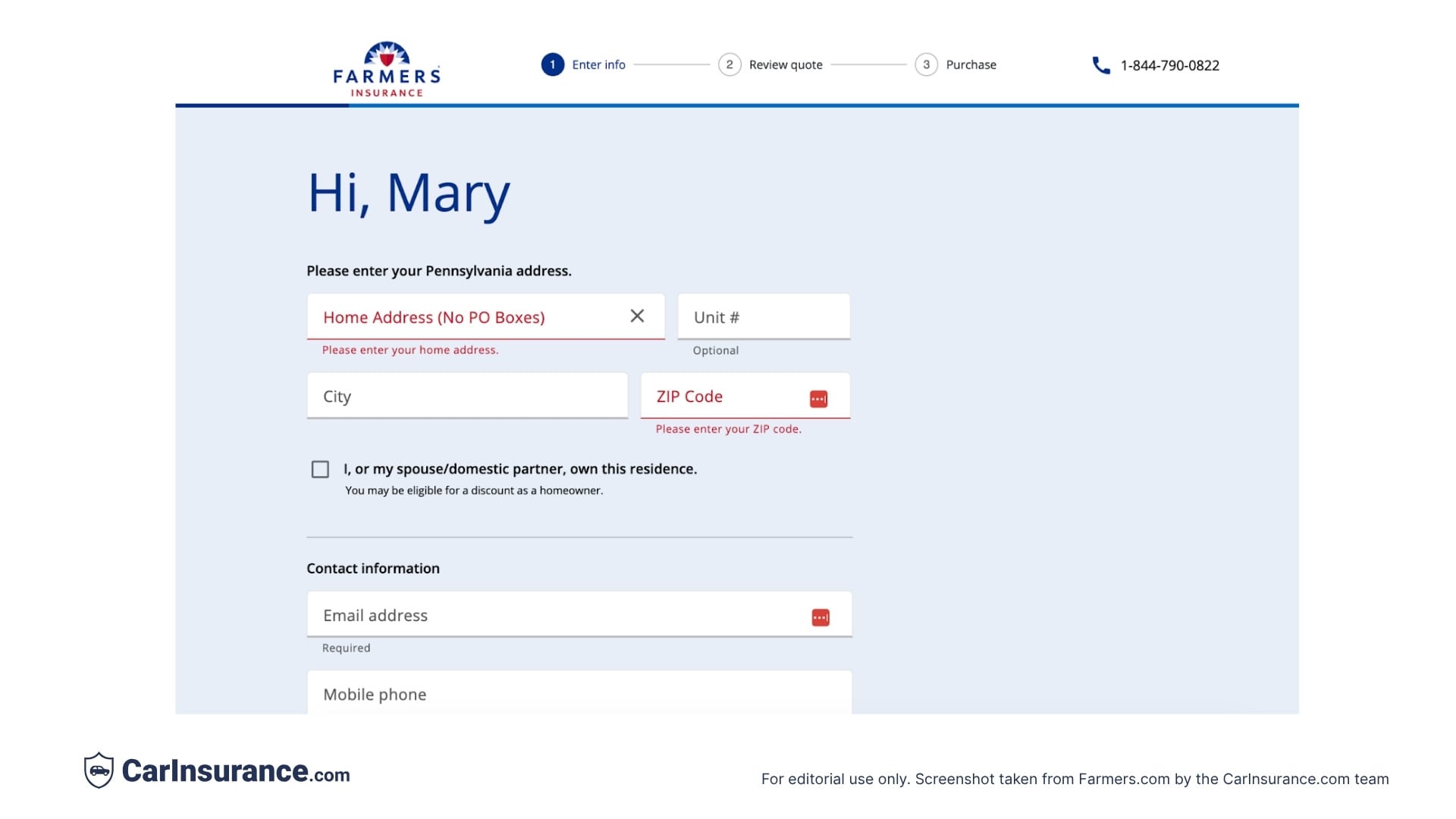

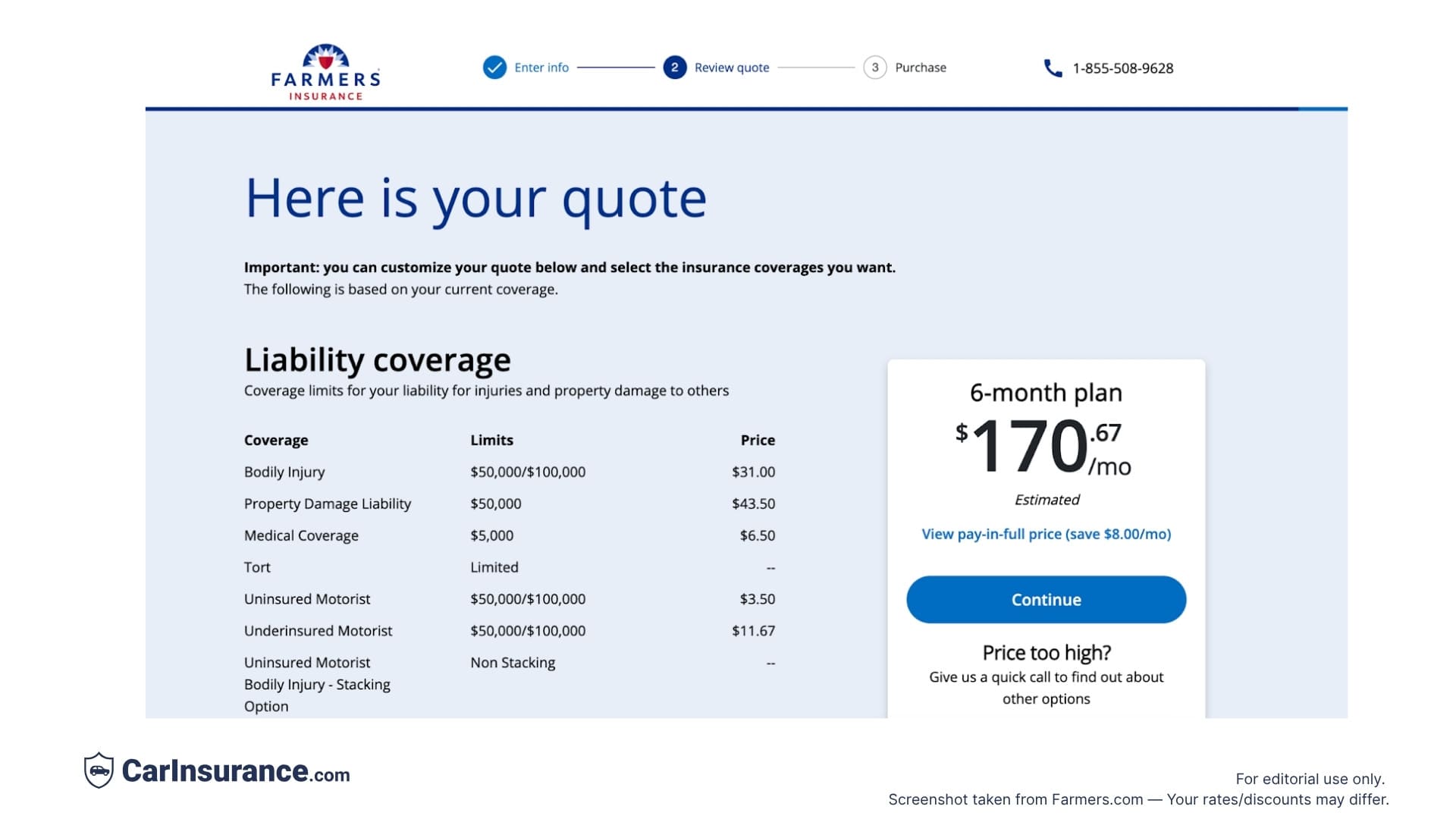

My experience getting a quote

I’ve been shopping for car insurance quotes lately, as my current policy has gotten very expensive with two college-age drivers in the family. Requesting a quote with Farmers was very streamlined and straightforward. I started by entering my ZIP code, and then some basic information about myself.

I Got an Insurance Quote Online From Farmers: Here’s What Happened | Expert Review

This video shows you exactly what Farmer’s online car insurance quote process looks like. Our insurance expert walks through each step, from entering basic information to reviewing coverage options, so you know what to expect. Watch to get a clearer idea of how simple and transparent the experience is before you start your own quote journey.

Farmers was able to pull up the vehicles registered to our address. I selected to insure my car, a 2025 Subaru Outback, and my husband’s 2015 Chevy Colorado.

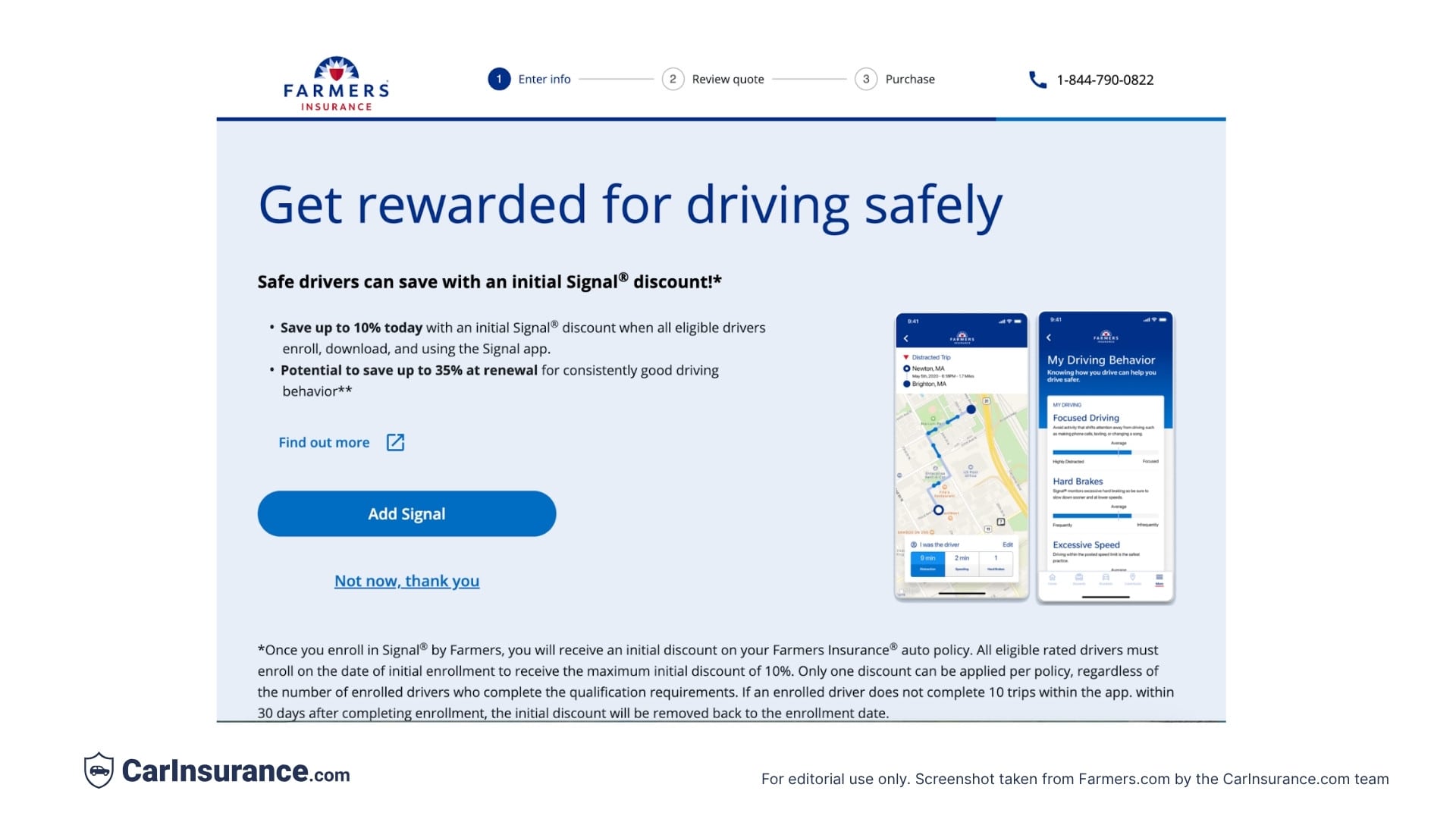

Next, Farmers asked for more information about the four drivers in our household: marital status, accident history, occupation (for my husband and I) and GPA (for my kids). Farmers offered a 10% discount for signing up with Signal, its safe-driving program, with the chance to save up to 35% at renewal. I declined it for this quote.

I also declined the chance to bundle my home insurance and other policies, but if I had, I would have been eligible for more discounts. I still qualified for five other discounts:

- Welcome

- Homeowner

- Anti-theft device

- Multi-car

- Good student

My initial quote for two cars and four drivers (two of whom have had their license for less than three years, and one of whom has a speeding ticket on his record) was $150 per month for 50/100/50 coverage. I opted to add on roadside assistance, rental car coverage and Farmers declining deductible feature; those brought my monthly quoted premium to $170.

Overall, the whole process took nine minutes – including taking screenshots for this article – and the price was very competitive compared to my current policy with GEICO.

Frequently Asked Questions: Farmers

Is Farmers Insurance cheaper than other car insurance companies?

The average annual rate for Farmers is not the cheapest of the insurers we studied. Since car insurance rates vary based on your unique profile, including your driving history, location, and other factors, the best way to find out how much you’ll pay with Farmers is to request a quote and compare it to other companies.

What discounts does Farmers Insurance offer?

Farmers offers 20 different kinds of discounts, including common ones like multi-policy, safe driver, good student, and paperless statements. It also offers unique discounts that reward customer loyalty or for using Signal, its telematics program.

Does Farmers Insurance offer accident forgiveness?

Yes, you can add accident forgiveness as a coverage option with Farmers for an additional fee. You’ll get one at-fault accident forgiven every three years with this coverage.

Does Farmers Insurance have gap insurance?

Yes, Farmers offers gap coverage, which helps pay the difference between the value of your car and the amount remaining on your car loan if the vehicle is totaled. Farmers also offers another way to protect yourself if your new vehicle is damaged, called New Car Replacement Coverage. With this add-on, if you total your new or nearly new car, Farmers may pay to replace it with a new or newer car.

How do I file a claim with Farmers Insurance?

You can file an auto insurance claim online, through the Farmers app, or over the phone. It takes just a couple of minutes, and you can track the progress of your claim by logging in to your account.

How does Farmers Insurance rank in customer satisfaction?

According to J.D. Power’s auto insurance satisfaction study, Farmers ranks very highly for its usage-based insurance program, but tends to perform below the study average in most places aside from Florida.

Does Farmers Insurance raise rates after an accident or ticket?

Like most insurance companies, Farmers may raise your insurance premium after at-fault accidents or major violations. However, using its accident forgiveness coverage or safe-driving program could help offset a price increase.

Is Farmers Insurance good for high-risk drivers?

Farmers may be more accommodating than some competitors for drivers with DUIs, poor credit, or multiple claims. Rates will be higher, but coverage is often available.

Does Farmers Insurance offer telematics or usage-based insurance?

Yes. Farmers Signal program uses an app to track your driving habits, and safe driving can earn discounts and rewards.

What types of add-ons does Farmers Insurance provide?

You may be able to add coverage options like accident forgiveness, roadside assistance, rideshare coverage, new car replacement and OEM parts.

Can I manage my policy online with Farmers Insurance?

Yes. Farmers, like most insurers, offers online and mobile app tools to help you manage your policy, track your claims, and pay your premiums.

Is Farmers Insurance a good insurance company overall?

Farmers offers a variety of discounts and coverage options, especially for families with younger drivers. Whether it’s right for you depends on your needs, budget, and preferences. Request quotes from multiple companies to determine which one best suits your situation.

Sources

- AM Best. “AM Best Affirms Credit Ratings of Members of Farmers Insurance Group.” Accessed February 2026.

- J.D. Power. “It’s Now a Buyer’s Market for Auto Insurance, J.D. Power Finds.” Accessed February 2026.

- J.D. Power. “Satisfaction with Auto Insurance Claims Strained by Higher Deductibles, More Total Losses, J.D. Power Finds.” Accessed February 2026.

- Farmers. “Steps to filing an auto claim.” Accessed February 2026.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs