CarInsurance.com Insights

- You can get insurance even with a permit. Most teens are covered under a parent’s existing policy, which avoids extra costs until they get their full license.

- Most states allow you to apply for a learner’s permit when you turn 15, but requirements differ depending on where you live.

- Even though most family policies extend to permit drivers, it’s wise to notify your insurance company about the change in driving status and get written confirmation to avoid coverage gaps.

- Your permit comes with certain driving restrictions. For instance, a licensed adult must accompany you, and violating the terms may void coverage.

- Many insurers reward academic achievement and completion of a driver’s education course, which also helps reduce the risk of accidents. You should ask your insurer which discounts apply specifically to teen drivers.

If you have a learner’s permit, you may be wondering whether you need car insurance and how it works before you get your license. The answer is yes — drivers with permits must be covered by an insurance policy anytime they’re behind the wheel. In most cases, permit holders covered by a parent’s or guardian’s existing policy, which is the simplest and most affordable option.

However, in certain situations, such as if you’re an adult learner or don’t live with a parent, you may need your own policy. Understanding how insurance works with a learner’s permit ensures you stay legal, protected and prepared as you work toward earning your driver’s license.

A learner’s permit is a restricted license that allows first-time drivers to practice before earning a driver’s license. You must obtain a driver’s permit before legally driving a car. They’re called driver’s permits, learner’s licenses, provisional licenses or minor permits.

With a permit, you can drive under restricted circumstances as long as a fully licensed adult driver accompanies you. Eventually, you will graduate with a full driver’s license. In most states, you can apply for a learner’s permit once you are 15, although this minimum age varies by state.

How do you get car insurance with a learner’s permit?

When you need to get car insurance with a learner’s permit, there are two options: Buy an individual or standalone policy or be covered under a parent’s policy. However, you must be the age of majority in your state to get your own auto insurance policy.

“Most young drivers with a learner’s permit are likely covered under their parent’s policy, and premiums shouldn’t increase until they are legally licensed,” says Carole Walker, executive director of the Rocky Mountain Insurance Information Association.

Auto insurance companies won’t insure teens younger than the age of majority in your state because an auto policy is a legally binding contract, which you can’t enter until you’re an adult. And if you get your own policy, you’ll be paying high rates.

How much does car insurance for learner drivers cost?

Full coverage car insurance is about three times more expensive than liability-only coverage for 16- and 17-year-old learner drivers.

For 16-year-olds, liability-only coverage with limits of 50/100/50 costs $3,333 per year while full coverage costs $9,825. For 17-year-olds, 50/100/50 liability-only coverage runs $2,755 annually and full coverage is $8,162.

See other rates in the table below.

| Driver’s age | State minimum liability | Liability-only 50/100/50 | Full coverage 100/300/100 |

|---|---|---|---|

| 16-year-old | $2,690 | $3,333 | $9,825 |

| 17-year-old | $2,223 | $2,755 | $8,162 |

Which companies offer car insurance for learner drivers?

Every car insurance company has different rules surrounding car insurance for learner drivers. If you’re younger than 18, you can’t buy car insurance on your own.

If you are a newly licensed driver who’s still a minor and your parents already have a policy, they should add you to their car insurance policy — you can’t purchase car insurance on your own until you’re the age of majority in your state.

Below are some insurers’ rules for learner drivers:

- GEICO: GEICO allows learner’s permit drivers to be added to an existing policy. But the company won’t offer car insurance to individuals without a driver’s license.

- Progressive: Progressive allows learner’s permit drivers to be added to existing policies or obtain their own policy.

- State Farm: State Farm allows learner’s permit drivers to be added to existing policies or obtain their own policy.

- Allstate: Allstate allows learner’s permit drivers to be added to existing policies or obtain their own policy.

- Nationwide: Nationwide allows learner’s permit drivers to be added to existing policies or obtain their own policy.

What are the car insurance requirements for new drivers in each state?

Driving rules vary from state to state. But every state requires a minimum level of liability coverage, including bodily injury liability and property damage liability coverage.

In the table below, see the minimum car insurance requirements for drivers in each state.

| State | Minimum liability coverage limits | Other insurance required (if any) |

|---|---|---|

| Alabama | 25/50/25 | |

| Alaska | 50/100/25 | |

| Arizona | 25/50/15 | |

| Arkansas | 25/50/25 | |

| California | 30/60/15 | |

| Colorado | 25/50/15 | |

| Connecticut | 25/50/25 | UM/UIM |

| Delaware | 25/50/10 | PIP |

| Washington, D.C. | 25/50/10 | UM, UMPD |

| Florida* | 0/0/10 | PIP |

| Georgia | 25/50/25 | |

| Hawaii | 20/40/10 | PIP |

| Idaho | 20/50/15 | |

| Illinois | 25/50/20 | UM |

| Indiana | 25/50/25 | UM/UIM |

| Iowa | 20/40/15 | |

| Kansas | 25/50/25 | UM/UIM, PIP |

| Kentucky | 25/50/25 | PIP |

| Louisiana | 15/30/25 | |

| Maine | 50/100/25 | UM/UIM, MedPay |

| Maryland***** | 30/60/15 | UM/UIM, UMPD, PIP |

| Massachusetts | 20/40/5 | UM, PIP |

| Michigan | 20/40/10 | PIP, PPI |

| Minnesota | 30/60/10 | UM/UIM, PIP |

| Mississippi | 25/50/25 | |

| Missouri | 25/50/25 | UM |

| Montana | 25/50/20 | |

| Nebraska | 25/50/25 | UM/UIM |

| Nevada | 25/50/20 | |

| New Hampshire** | 25/50/25 | UM/UIM, MedPay |

| New Jersey****** | 15/30/5 | UM/UIM, PIP |

| New Mexico | 25/50/10 | |

| New York | 25/50/10 | UM, PIP |

| North Carolina | 50/100/50 | UM, UIM |

| North Dakota | 25/50/25 | UM/UIM, PIP |

| Ohio | 25/50/25 | |

| Oklahoma | 25/50/25 | |

| Oregon | 25/50/20 | UM, PIP |

| Pennsylvania | 15/30/5 | PIP (First Party Benefits) |

| Rhode Island*** | 25/50/25 | |

| South Carolina | 25/50/25 | UM, UMPD |

| South Dakota | 25/50/25 | UM/UIM |

| Tennessee | 25/50/25 | |

| Texas | 30/60/25 | |

| Utah | 30/65/25 | UM, PIP |

| Vermont | 25/50/10 | UM/UIM, UMPD |

| Virginia | 50/100/25 | UM/UIM, UMPD |

| Washington | 25/50/10 | |

| West Virginia | 25/50/25 | UM, UMPD |

| Wisconsin | 25/50/10 | UM, UIM, MedPay |

| Wyoming | 25/50/20 |

Minimum liability car insurance requirements by state

* Florida doesn’t require bodily injury liability coverage, but many insurers only offer policies with minimum amounts of 10/20 of bodily injury coverage.

** Auto insurance isn’t mandatory in New Hampshire, but if you choose to buy insurance, these are the minimum amounts.

*** Rhode Island doesn’t require drivers to buy UM/UIM coverage if buying minimum liability coverage. If you buy higher liability limits, UM is required.

***** Full PIP can be waived in Maryland for a limited PIP option.

******In New Jersey, a basic policy with lower limits also is available. Still, it should only be considered by those with few family responsibilities and few real assets and is not recommended.

People also ask

As a new driver gets on the road, having questions about car insurance is natural. Explore answers to your questions below.

Our child is in the U.S. and wants to apply for a permit. As parents living in Europe, we have to assume liability. Is there any insurance we could buy for the risk? If yes, where?

International students can usually drive in the U.S. as long as they have a driver’s license from their country. If your child needs a U.S. driver’s license, he or she can contact the Designated School Official (DSO) to help him or her get a permit.

Your child will have to pass vision, written and driving tests to get a driver’s license in the U.S. Learn which documents are required to apply for a driver’s license and car insurance in the U.S.

My friend got in a car accident while driving someone else’s car and he only had a permit. He is 17 years old, so what will happen to his permit?

In most cases, a 17-year-old with a learner’s permit may be required to have a licensed adult (typically 21 or older) in the car when driving. If the permit driver violates these restrictions, they could face legal consequences such as fines, license suspension or other penalties.

The car owner’s insurance typically covers the damages resulting from an accident as long as the driver has permission to use the vehicle. However, if the permit driver was driving without the owner’s permission, this could complicate matters.

Can I supervise a permit driver? I have a restricted license due to a suspension for owing child support.

You may not be able to supervise a permit driver if you have a restricted license due to a suspension for owing child support.

If your license has been suspended due to nonpayment of child support, you may qualify for a restricted driving permit or a hardship license. Still, this license only allows you to drive to and from work, school, medical appointments and child visitation. Many states even assign a nighttime curfew.

What types of car insurance are offered to learner drivers?

Insurers don’t typically sell car insurance policies to drivers with a learner’s permit on their own.

“In some cases, the car insurance company might require you to start the policy with a driver who has a valid license until you have your own license,” Walker says. “So, you’ll need to shop around for a higher-risk or non-standard company. An independent agent will likely be your best bet.”

Should I buy a separate car insurance policy for my car if I only have a learner’s permit?

Purchasing a separate policy for a driver with a learner’s permit is allowed in most states after they’ve reached the age of majority; this is 18 in most states, so young teens won’t qualify.

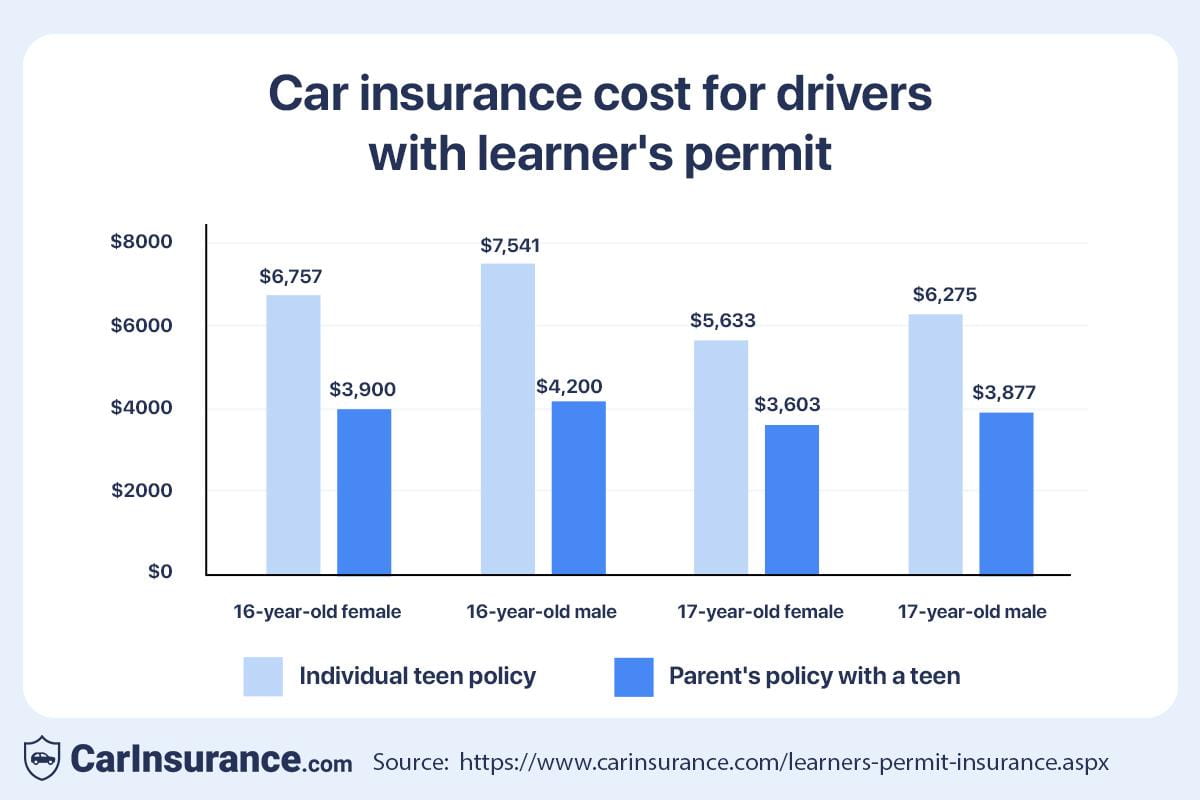

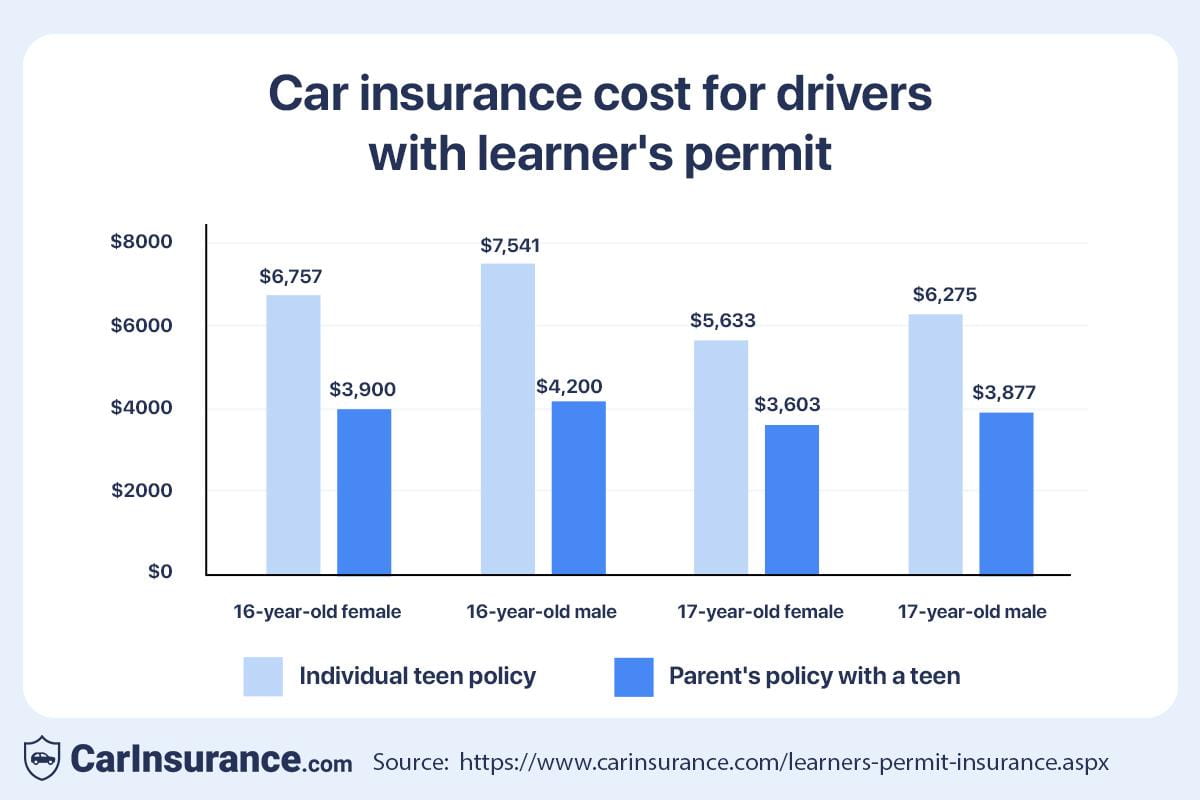

“However, the most cost-effective method is to add the permitted driver to an existing family policy,” says Mark Friedlander, director of corporate communications for the Insurance Information Institute. “A standalone policy could cost you 50 to 100 percent more than adding a permitted driver to an existing family policy.”

Michael Dinich, a personal finance expert, agrees.

“I don’t recommend getting your own separate policy from your parents or family if you only have a learner’s permit. Premiums for brand-new, inexperienced drivers are exorbitantly high,” Dinich says. “It makes far more financial sense to be added to your parents’ existing auto policy as an endorsed driver during the learner’s permit phase.”

How learner drivers can save money on car insurance

Car insurance for learner drivers doesn’t have to be expensive. In fact, because learners drive under supervision and typically log fewer miles, insurers often consider them lower risk than newly licensed teens driving alone. Still, parents and guardians can take several steps to keep costs manageable while the learner gains experience.

Start by keeping the learner on an existing family policy rather than buying a separate one. Adding a permit driver to a parent’s policy is almost always cheaper than purchasing stand-alone coverage and many insurers won’t issue an individual policy to a driver who hasn’t earned a full license yet.

Encourage the learner to complete an accredited driver’s education or defensive driving course. Most major insurers — including State Farm, Allstate and GEICO — offer discounts of 5% to 15% for successfully completing approved training.

Maintaining good grades can also qualify young drivers for a “good student” discount, often lowering premiums by another 10%.

Families can also save by choosing the right vehicle for practice. Opt for cars with strong safety ratings, low repair costs and moderate horsepower, since these factors directly influence insurance premiums. Avoid high-performance models, which are costlier to insure.

Finally, maintain a clean driving record and consistent coverage during the learner phase.

Continuous insurance history helps secure better rates once the driver is licensed and ready for their own policy.

“New drivers should get quotes from multiple companies to compare,” says Ryan McEachron, CEO of ISU Insurance Services. “When shopping around, check companies’ ratings and be sure the policy meets your state’s minimum requirements. The cheapest option isn’t always the best if coverage is lacking.”

Frequently Asked Questions: Car insurance with a permit

Do drivers with learner’s permits need car insurance in California?

All vehicles in California must be insured before they can be driven on the state’s roads. It is illegal for anyone to drive who is not insured. California also requires liability insurance to register a vehicle.

Who can be in the car with a learner’s permit driver?

There are many restrictions on those with a driving permit. Laws vary from state to state. But in many places, a driver with a learner’s permit must be accompanied by a fully licensed adult.

Do parents need to tell their insurance company about a learner driver?

Yes. It’s a good idea to notify your insurance company as soon as someone in your household gets a learner’s permit. Many insurers automatically cover permit drivers, but some require formal notice to avoid gaps in coverage or claim issues later.

Does car insurance cost more when you add a learner driver?

Not immediately. Most insurers don’t charge extra for a learner driver since they’re still supervised. However, rates typically rise once the driver earns a full license and begins driving independently.

Can a learner driver get their own car insurance policy?

Usually not. Most insurers won’t issue a stand-alone policy to someone with only a learner’s permit. Instead, you’ll need to be added to an existing policy until you get a full driver’s license, at which point you can apply for your own policy.

Does car insurance cost more when you add a learner driver?

Not immediately. Most insurers don’t charge extra for a learner driver since they’re still supervised. However, rates typically rise once the driver earns a full license and begins driving independently.

What kind of insurance coverage applies to a learner driver?

A learner driver is protected by the same liability, collision and comprehensive coverage as the policyholder. That means any accident while practicing will fall under the primary driver’s policy limits and deductibles.

What happens to car insurance when the learner gets a full license?

Once the learner becomes a licensed driver, they must be formally added to the household’s policy as a rated driver. Premiums may increase based on their age, driving experience and location, but discounts for driver education or good grades can help lower costs.

Does a learner driver need insurance for a driving test?

Yes. The car used for the driving test must be insured and meet state registration requirements. The learner driver doesn’t need a separate policy, but they must be covered under the vehicle owner’s insurance during the test.

Your next move: Securing car insurance for learner drivers

When you learn to drive a car, it opens a new world of possibilities. You need car insurance to drive, but companies may require you to be added to a parent’s policy if you are going to drive their car with a permit. Don’t hit the road without confirming that you are, in fact, covered by your parent’s insurance policy.

Resources & Methodology

Sources

- Florida Highway Safety and Motor Vehicles “Licensing Requirements for Teens, Graduated Driver License Laws and Curfews.” Accessed December 2025.

- California Department of Insurance. “Automobile Insurance Information Guide.” Accessed December 2025.

- Colorado Department of Revenue. “Registration Requirements.” Accessed December 2025.

- Delaware Division of Motor Vehicles. “Vehicle Services Titling.” Accessed December 2025.

- Massachusetts Registry of Motor Vehicles. “Identity Requirements for Vehicle Registration.” Accessed December 2025.

Methodology

CarInsurance.com commissioned Quadrant Information Services to get car insurance rates. The rates are based on the sample profiles of 16- and 17-year-old male and female drivers. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs