CarInsurance.com Insights

- Insurance companies consider teen drivers high risk because of their limited experience behind the wheel, which drives up insurance premiums.

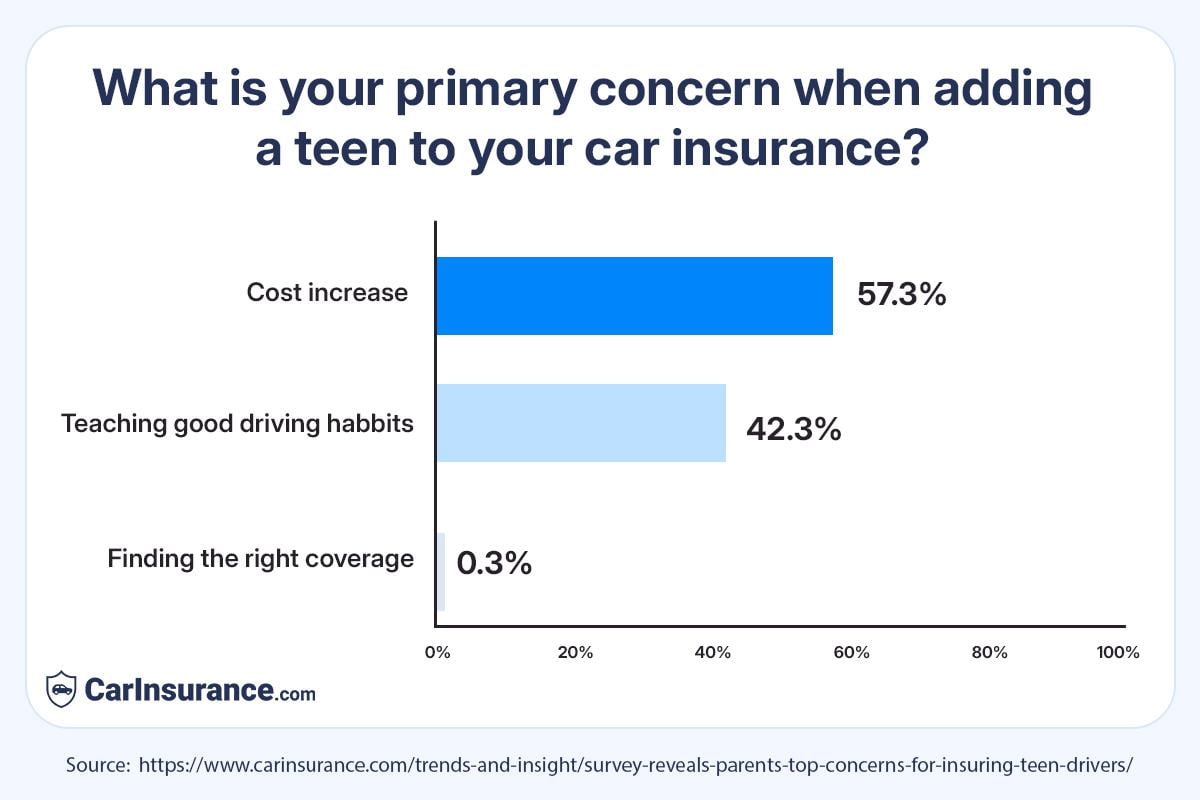

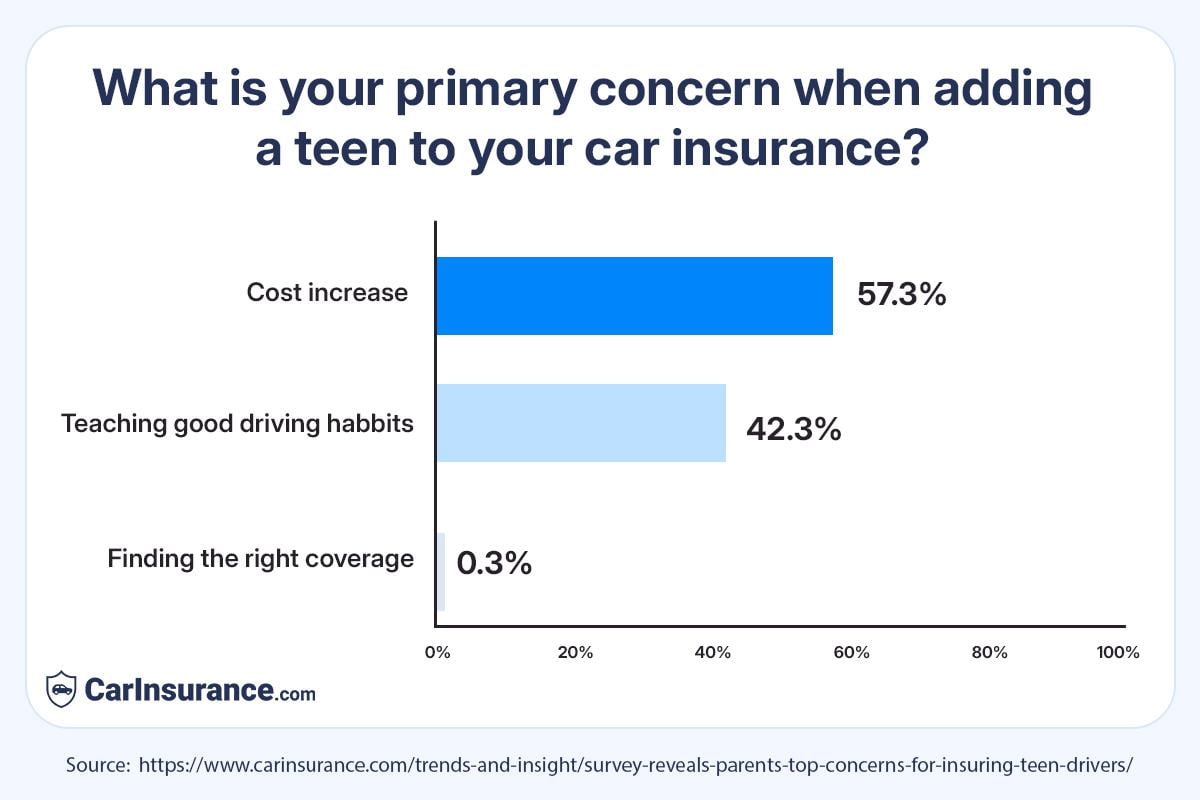

- Based on our poll results, 57% of parents are concerned about the cost increase when adding their teen driver to the family policy.

- 42% of parents are focused on teaching their teens to drive safely and responsibly, almost as big a worry as the increased insurance cost.

When your teen starts driving, it’s a milestone that comes with new responsibilities for both of you. Adding your teen driver to your car insurance is a smart move that helps protect them as they learn to drive.

Our auto insurance experts at CarInsurance.com recently surveyed our readers through a poll and asked about their primary concern when adding a teen to their car insurance.

More than 1,500 people responded, and based on their responses, we found that

- 57% of our readers expressed concern about the potential rise in premiums.

- 42% of parents are concerned about teaching their teens to drive safely.

While cost is a significant factor, there are other important considerations—like teaching your teen safe driving habits and ensuring they have the right coverage.

Let’s examine what parents think about when it comes to insuring their young drivers.

The cost increase is parents’ biggest concern

It’s no surprise that cost is the biggest worry for parents. Insurance companies consider Teen drivers high-risk because they don’t have much experience on the road, which usually results in higher premiums.

More than half of the parents (57%) who responded to the poll said the cost increase was their biggest concern when adding a teen to their car insurance.

For many families, the price of car insurance can go up quite a bit when a teenager joins the policy. It might feel overwhelming, but many parents experience this.

42% of parents are focused on teaching safe driving to their teens

While cost is the primary concern, 42% of parents are focused on helping their teens develop safe and responsible driving habits.

Many parents know that helping their young drivers develop safe driving practices is just as important as keeping them insured.

Understanding traffic laws and avoiding distractions behind the wheel can help ensure that teens are prepared for the responsibility of driving, reducing the risk of accidents.

Experts recommend that parents lead by example and discuss topics like speeding, seat belts and the dangers of distracted driving. Insurance companies even offer discounts for safe driving, so the better a teen’s driving record, the more they can save on premiums.

Less than 1% of parents worry most about finding the right insurance coverage

Surprisingly, just 0.3% of parents said finding the right coverage was their biggest concern. While it’s still essential, it seems to be a secondary issue compared to the price and safety factors.

However, it’s worth mentioning that some insurers offer discounts for teen drivers that can help lower premiums.

How to manage the rising cost of car insurance for teen drivers

Although adding a teen to your policy can increase your rates, there are ways to manage the cost. Insurance companies offer discounts for good students who complete driving training courses and bundling policies (like home and auto insurance together).

It’s worth exploring these options with your insurer to see how much you can save.

Additionally, increasing your deductible or opting for a higher level of coverage could help you find a balance between adequate protection and affordability.

Learn more: The best and cheapest ways to insure teenage drivers

Final thoughts

When it comes to adding a teen to your car insurance, it’s all about balance. While the cost is definitely something many parents worry about, there are simple ways to get adequate coverage at affordable rates.

By teaching your teen safe driving habits, looking for discounts and adjusting your coverage when needed, you can ensure your teen is well-protected without breaking the bank.

Learn more: The safest and most affordable cars for teens

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs