CarInsurance.com Insights

- You could save an average of 13% on car insurance simply by bundling your home and auto policies together with the same insurer.

- Raising your deductible from $250 to $500 could save an average of $282 per year.

- Dropping unnecessary coverages can save you hundreds of dollars per year, depending on your vehicle and risk profile.

- Discounts are a great way to save money on your car insurance policy.

- The most effective way to lower your car insurance costs is to periodically shop around and switch insurance providers when a better deal pops up.

You can’t skip buying car insurance, but you can control some factors that make it more expensive. Carefully reviewing your insurance policy and shopping around for lower rates can save you hundreds, if not thousands, of dollars per year.

Your coverage choices and driving habits each play an important role in the price of your car insurance, so we’ll go over how to make meaningful changes that can lower your costs. Discounts are an underrated way for drivers to bring their premiums down even further, so we’ll review a few you may not have considered.

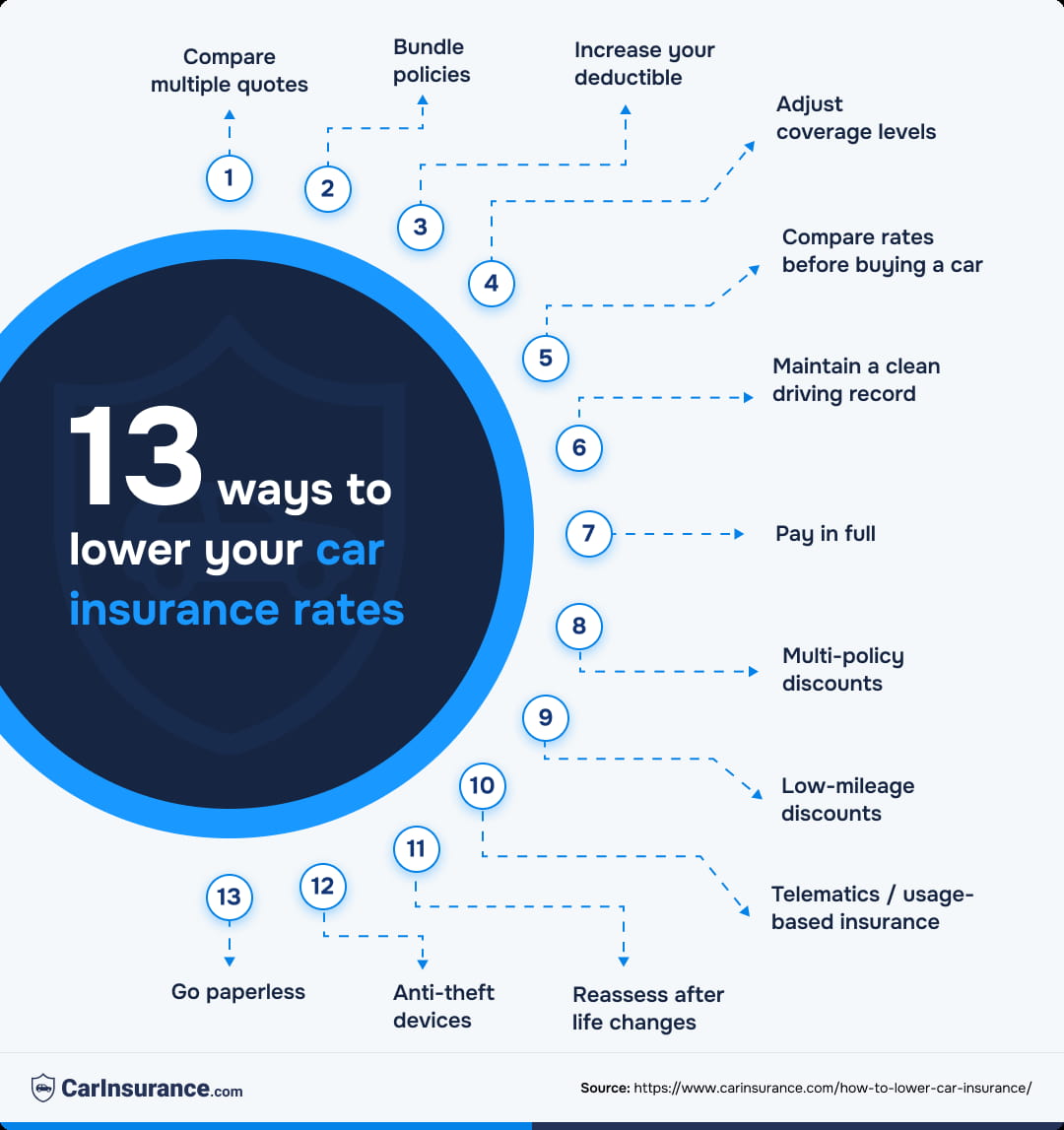

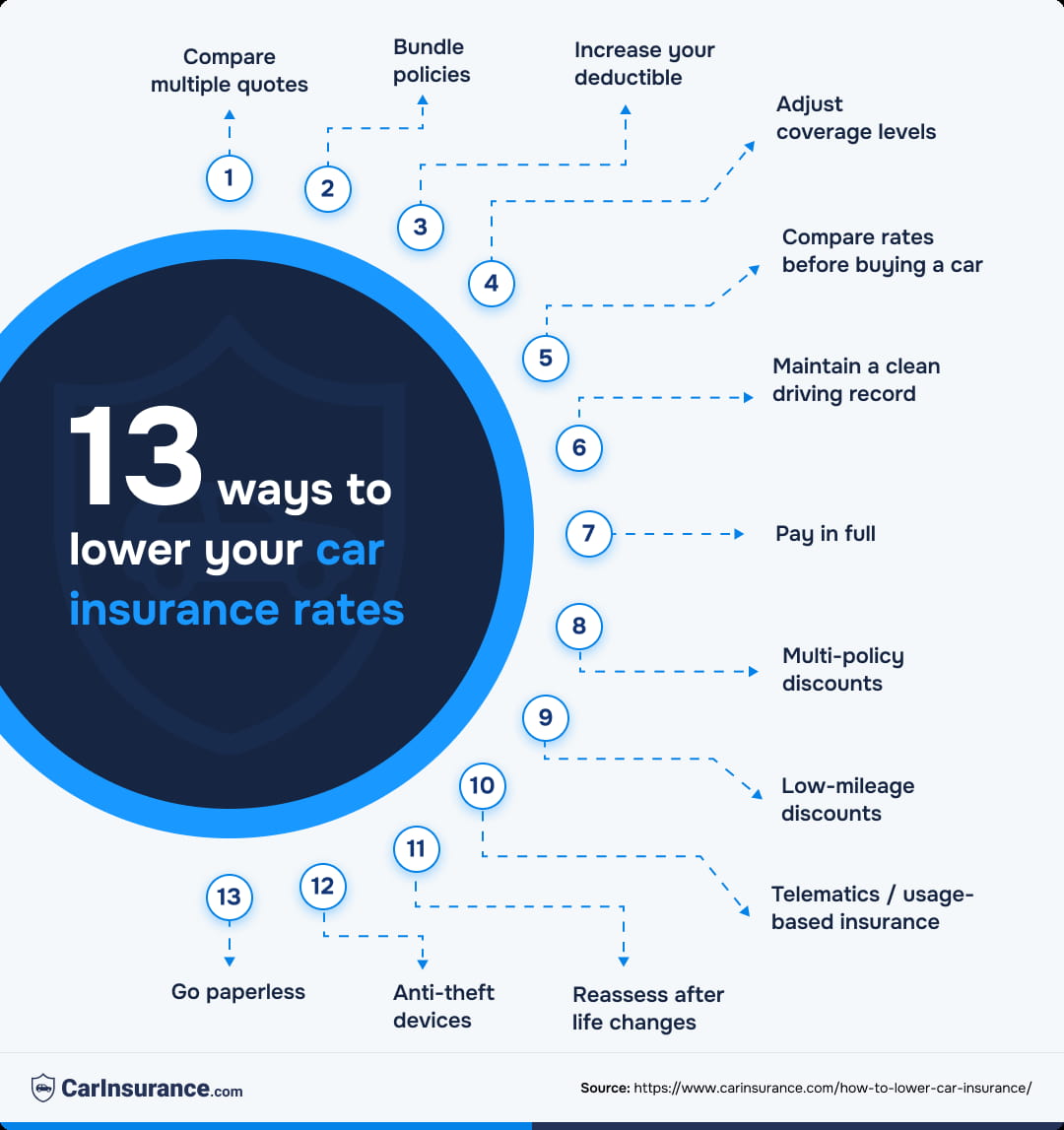

13 ways to lower your car insurance rates

These tips are proven strategies to lower car insurance costs. Not every tip will apply to every driver, so review each carefully to see whether it could work for you.

The biggest savings usually come from the first few strategies below, but use as many as possible to get the lowest possible car insurance rate.

- Compare multiple quotes

- Bundle policies

- Increase your deductible

- Adjust coverage levels

- Compare rates before buying a car

- Maintain a clean driving record

- Pay in full

- Multi-policy discounts

- Low-mileage discounts

- Telematics / usage-based insurance

- Reassess after life changes

- Anti-theft devices

- Go paperless

Learn how to save money on car insurance by breaking down each tactic below.

Compare multiple quotes

The best way to find the cheapest car insurance is to compare quotes from several insurers. You could save hundreds of dollars each month, since rates vary greatly from one insurer to the next. It’s especially important if your driving history isn’t perfect.

“Comparing car insurance prices before each renewal will show you which insurer is willing to offer you the best rate,” says Fran Majidi, an insurance expert at Modotech, an insurance software company.

Majidi explains that high-risk drivers with a history of accidents, license suspension, insurance lapses and DUIs should get quotes from insurers that specialize in non-standard insurance.

“If you’re a high-risk driver, specialty insurers may offer you better rates than a traditional car insurance company,” she says.

Most car insurance companies make it simple to request a quote online or you can use our car insurance calculators to get an idea of how much you could save.

Bundle policies

You could save about 13% by bundling your auto insurance policy with home policy from the same insurer. This method also makes it easier to manage multiple policies in one place.

The amount you could save by bundling often varies based on the type of policy. Nationally, the average savings for bundling your auto policy with another one are:

- 13% discount for combining auto and homeowners insurance

- 12% discount for combining auto and condo insurance

- 6% discount for combining auto and renters insurance

- 4% discount for combining auto and life insurance

But bundling is not always a guarantee of savings. Compare the cost of purchasing your policies separately to the price break you get with a bundle. It’s possible, for example, that you would do better to buy a home policy on its own and get your auto coverage from a company that offers one of the cheapest rates. Request a few quotes for individual policies and bundle options to find the best deal.

“Comparing car insurance prices before each renewal will show you which insurer is willing to offer you the best rate.”

Fran Majidi, insurance expert at Modotech

Increase your deductible

You could save 40% or more on your insurance premiums by raising your deductible to $1,000, according to the Insurance Information Institute. That works out to more than $1,000 in annual savings over the average full-coverage insurance rate.

Even a moderate increase in your collision and comprehensive deductibles can significantly reduce your rates, with an average savings of 15% to 30%. For instance, if you increase your deductible from $250 to $500, you can save an average of $282 a year on your premiums.

When shopping for auto insurance, make sure to request rates for different deductibles to save more. And remember, your deductible is the amount you’ll pay out of pocket before insurance kicks in, so make sure you can afford the deductible you choose.

Adjust coverage levels

Adjusting your coverage levels could help you save more than a thousand dollars per year, depending on the changes you make.

For example, if you switch from full coverage (with liability limits of 100/300/100) to liability-only coverage with limits of 50/100/50, you’d save $1,544 per year. You can drop comprehensive and collision coverage on older vehicles.

Many experts say it’s time to drop these coverages when the actual cash value you’d receive for your vehicle doesn’t justify the insurance expense. But don’t drop that coverage without giving it some thought.

“Lowering your coverage limits will lower your auto insurance premium. However, keep in mind that setting your liability limits too low may expose you to major financial risks if you cause an accident,” Majidi says.

The amount of car insurance you need depends on many factors, but most states require a minimum amount of liability coverage. This is the cheapest car insurance you can legally use to operate a vehicle within your state.

Most drivers can benefit from having full coverage and higher liability limits. Full coverage includes liability, collision and comprehensive insurance, and is especially important if you lease or finance your car or own a newer vehicle.

Compare car insurance rates before buying a vehicle

You could save hundreds of dollars per year on auto insurance by being choosy when car shopping.

Insurance rates depend on your vehicle’s make and model, as well as how expensive it is to repair or replace the vehicle. Small SUVs with safety features are cheaper to insure than luxury cars or sports cars, for example.

Instead of assuming that cheaper cars mean cheaper insurance, compare car insurance rates by vehicle when shopping for a car. This allows you to choose a vehicle with affordable insurance rates.

Below is a list of the top 10 cheapest cars to insure.

| Cheapest model | Six-month rates | Monthly rates |

|---|---|---|

| Subaru Crosstrek | $1,150 | $192 |

| Jeep Wrangler | $1,154 | $193 |

| Honda CR-V | $1,158 | $193 |

| Subaru Outback | $1,161 | $194 |

| Volkswagen Tiguan | $1,165 | $194 |

| Mazda CX-5 | $1,172 | $195 |

| Volkswagen Taos | $1,181 | $197 |

| Honda HR-V | $1,188 | $198 |

| Subaru Forester | $1,189 | $198 |

| Chevrolet TrailBlazer | $1,191 | $198 |

Maintain a clean driving record

Good driver discounts can save you up to 17% on your premiums, because safe drivers are less likely to get into accidents.

A poor driving history can disqualify you from getting the cheapest car insurance. That includes things like speeding tickets, accidents and citations for driving under the influence. Insurers will check your record for risky driving habits like these and could raise your rates if they see them.

In addition, insurance companies usually require that you have a clean driving record for at least three years. That means no DUIs, no moving violations and no at-fault accidents.

You can take steps to lower your insurance bill by avoiding expensive tickets and accident claims. Pay attention to your speed, don’t run red lights, be cautious and drive defensively.

If you do have some negative items on your driving history, it pays to shop around for insurers who offer cheap car insurance for drivers with a ticket or DUI.

Pay for your auto policy in full

Drivers will save an average of 9% by paying for insurance upfront.

Depending on your car insurance company, your policy will be valid for six months or one year. You can pay your premium upfront in full or in monthly installments. A paid-in-full discount nets an average savings of $232 per year on a full coverage policy.

Drivers with this discount will spend $2,346 annually on car insurance, compared to $2,578 without it. If you want the discount, consider saving a monthly amount to pay your next premium in full.

Multi-policy discounts

You could knock up to a quarter off your premium by insuring multiple cars. For instance, Progressive offers an average discount of 12% when you insure multiple vehicles and GEICO offers savings of up to 25%.

When comparing insurance quotes, make sure to include all drivers and vehicles on each quote to get the lowest, most accurate rates.

Low-mileage discounts

Drivers who log less than 7,500 miles annually net an average discount of 9%. Drivers with annual mileage of 10,000-11,999 garner a 7% discount.

Driving less than the American average of 13,476 miles per year (according to the Federal Highway Administration) could help you save money on car insurance.

Keep track of your odometer during the course of the year; lower-than-average mileage could help you save when it’s time to renew your auto policy. If you know you’re a low-mileage driver, seek out insurance companies that will reward you with better rates.

Telematics/usage-based insurance

If you sign up for a telematics program with your insurance company, you can save 10% on your policy. A telematics program is a car insurance option that uses technology to monitor your driving habits.

Typically, it involves installing a small device in your vehicle or using a mobile app to track behaviors like speed, braking, mileage, phone usage and time of day. Insurers use this data to assess your risk level and you may receive discounts or personalized rates based on how safely you drive.

You can also consider a pay-per-mile insurance policy, which allows you to pay based on the actual miles you drive, rather than just giving a discount for driving less.

Reassess after life changes

Life changes, like marriage, can reduce your auto premiums by an average of 9% because insurers view married drivers as less risky.

Moving to a new ZIP code, changing jobs or even changing where you park your car can all affect how your insurer calculates risk. For example, married drivers or those who move to safer neighborhoods often qualify for lower premiums or discounts.

Updating your policy is a smart move whenever something significant changes in your life. Let your insurer know as soon as possible, as this could help you save on your next renewal.

Anti-theft devices

Installing anti-theft devices can lead to a 2% discount on your auto premiums. These devices help lower your car insurance premiums by reducing the risk of theft or vandalism. Insurers see it as a sign you’re taking steps to protect your car, which lowers your risk level.

If your vehicle already has anti-theft devices installed, make sure your insurer knows about them. It could lower your car insurance costs.

Go paperless

Choosing to go paperless is another easy way to save on car insurance. When you agree to get your bills, policy documents and updates by email instead of postal mail, most insurers will pass along a 3% discount. It helps the company reduce printing and mailing costs; it’s also better for the environment.

You should be able to opt for paperless statement delivery within your account management dashboard.

Wise words

If you want to take advantage of discounts, pay attention to the savings potential each insurer offers. For example, Progressive’s good student discount starts at 5%, whereas GEICO’s smart student discount is 15%. Take advantage of all available car insurance discounts to receive additional reductions.

What factors determine how much you’ll actually save?

The cost of car insurance varies from driver to driver based on a variety of factors. The savings you could see on your next auto insurance bill depend on:

- What you’re paying now

- Where you live, work and garage your vehicle

- Your driving history, including tickets, accidents or DUIs

- Which discounts are you eligible for

- Which strategies will you choose to lower your risk level

Drivers who haven’t shopped for a new car insurance policy in years are likely to be overpaying for coverage. If you haven’t compared insurance companies in a while, you’re probably missing out on lower rates — especially if your circumstances have changed and you’ve maintained a good driving record.

According to our data analysis, drivers save an average of $694 per year by switching insurance providers.

Which coverage changes lower costs without creating risk?

Making changes to your auto insurance can reduce your premiums, but be cautious not to take it too far.

Raising your deductible can lower your premium while keeping your coverage choices intact. That’s because the deductible comes out of your pocket, not the insurance company’s. If you file a claim with a $500 deductible, you’re essentially taking on $500 of the cost of the claim while the insurance company pays the rest. Make sure you have the deductible amount in savings.

Dropping full coverage is another way to lower your costs, but it’s important to do the math first. Full coverage includes collision, which pays to repair or replace your car after an accident. It also includes comprehensive coverage, which pays to repair or replace your car after other disasters (like theft, fire or storms).

If you have a brand-new car, it’ll probably cost less to keep full coverage insurance than it would to replace the car yourself. On the other hand, if you’re driving an older vehicle that has seen better days, it probably doesn’t make financial sense to keep full coverage. In that case, you may feel comfortable keeping liability only — that protects you if you cause injury or property damage, but it doesn’t cover replacing your vehicle.

As you’re modifying coverage, be careful not to drop your liability coverage too low. Consider one example of the risk: If you cause an accident that injures someone else, they could sue you for all of their medical costs. That could wind up being tens or even hundreds of thousands of dollars in bills. Keeping higher liability coverage ensures you won’t be wiped out if you cause an accident.

What discounts should you ask for (that insurers don’t advertise)

There are plenty of discounts that could help you save more than you expected on your car insurance. Be sure to check whether you qualify for one or more of these discounts:

- Occupation-based

- Low-mileage

- Telematics

- Good student

- College student living away from home

- Loyalty or long-time customer

- Safe driver

- Accident-free

- Driver education course

- Driver safety features

- Military and veteran

- New car

- Passive restraint or airbags

- Early bird

How can my job or profession qualify me for lower insurance rates?

You might qualify for discounts based on your job, profession or employer. Firefighters and scientists earn the steepest professional discounts, averaging 12%, saving up to $300 annually on a full-coverage insurance policy.

Keep in mind that these discounts vary by state and insurer, so while it’s worth checking out, savings aren’t guaranteed.

Car insurance companies that offer occupational discounts

Select your profession to see insurance discounts and click on the numbers in the “State Availability” column to see the list of states where the companies offer discounts.

Select your profession to see insurance discounts, and click on the numbers in the "State Availability" column to see the list of states where the companies offer discounts.

How do life events create instant savings opportunities?

Big life changes could trigger new opportunities to save money on your car insurance. For example, getting married can lower your risk profile and make you eligible for a lower rate. So could moving to a new ZIP code, celebrating a milestone birthday or getting a new job closer to home.

When changes like these happen, they affect your risk profile — the various factors that insurers use to decide how much it could cost them if you file a claim and how likely you are to do so. Some life events reduce your risk, making insurance more affordable. It’s worthwhile to let your insurance company know whenever you experience a change that could affect your rates, such as:

- Moving: Location is an important factor in determining car insurance rates.

- Marriage: Statistically, married people are more likely to have safer driving habits than singles.

- Aging up: Insurers typically offer lower rates to people aged 25 to 65.

- Starting college: If your student moves away to school, it could help lower your rates.

- Paying off your loan: Older, paid-off cars are typically less costly to insure, and you might opt to drop optional coverage, too.

- Buying a home: You might qualify for new homeowner discounts you weren’t eligible for before.

- Switching jobs: Hybrid or remote positions could mean much less commuting and, therefore, a lower risk of an accident.

Car insurance savings tips by driver profile

While there are some tried-and-true methods of saving money on car insurance, the best ways to save sometimes depend on your age and driver profile.

Below are some tips for saving money on car insurance based on your situation.

Teen/new drivers

The best way for teen drivers to get the cheapest car insurance is typically to be insured on a parent’s policy.

Insuring teens and new drivers tends to be quite expensive, so don’t forget to explore other options for cutting costs:

- Good student discounts (for good grades)

- Away-at-school discounts (for college students living away at school)

- Discounts for completing a driver safety course

Seniors

Seniors and retirees can significantly lower their premiums by taking advantage of low-mileage driving discounts if they don’t drive much.

Other ways for seniors to lower their auto insurance bill:

- Complete a defensive driving course, like AARP Smart Driver

- Sign up for a telematics program, which can lower your rate for good driving habits

- Take advantage of good driver discounts for being accident-free

Low-mileage vs. commuters

Occasional drivers who don’t commute regularly could save big bucks by signing up for usage-based insurance. Also called a pay-per-mile policy, this type of policy charges a flat monthly premium and a small fee per mile driven.

Commuters, especially those who have long commutes, might lower their rates with:

- Bundle discounts

- Affinity discounts for membership in an alumni or professional organization

Urban vs. rural drivers

Drivers in urban areas often pay more for car insurance than those in rural areas, as higher population density increases the risk of crime or crashes. If you live in a city, consider these ways to save:

- Make sure your vehicle has safety features, like an anti-theft device

- Keep your car in a covered garage

- Opt for public transportation when you can to reduce the number of miles driven

Common mistakes to avoid when shopping for car insurance

Here are some common mistakes that many drivers make when trying to save money and how you can avoid them:

- Choosing a state minimum coverage policy to save money. Such low coverage provides very limited financial protection. It’s smarter to spend more to get a full coverage policy, which will cover your own losses if you get into an accident.

- Not comparing quotes annually. Ignoring your car insurance costs means you could be overpaying. Compare car insurance quotes at least once per year (or after a significant life event) to find a better deal for your current situation and coverage needs.

- Forgetting to ask about discounts. Car insurance providers won’t know what you might qualify for if you don’t tell them. Choose a company that offers multiple discounts that fit you so you can maximize your savings.

- Letting your policy lapse. A gap in insurance coverage will likely result in a costlier policy when you sign up for insurance again. Mark your calendar carefully or set up autopay so you never miss a payment or lose coverage.

Frequently Asked Questions: How to save on car insurance

How can I get cheaper car insurance?

The best way to get cheaper insurance is to request new quotes from multiple insurance companies and choose the carrier with the best rate and coverage.

Is it safe to increase my deductible?

Yes, it’s safe to increase your deductible, as long as you can afford the higher deductible in the event of a claim. You’ll need to pay that deductible before your insurance coverage kicks in. You should avoid raising your deductible to a limit that you couldn’t comfortably pay out of pocket if you had a loss.

Does my credit score affect my rates?

Not exactly. In most states, insurance companies can use a credit-based insurance score to calculate your rates. This score is not the same as your credit score. It measures how well you manage risk and includes many of the same factors that make up your credit score, such as payment history, credit mix and age of credit. Boosting your credit score with timely payments will likely raise your credit-based insurance score, too.

How often should I shop for quotes?

You should shop for new car insurance quotes at least once a year. You can even shop around whenever it’s time to renew your policy if you want to make sure you’re getting the best rate possible. It’s also beneficial to get new quotes after a major event or life change, such as moving to a new city, getting married, buying a new car or adding a teen to your policy.

Can my car choice lower my premium?

Yes, choosing a car with solid safety features and low repair costs can save you big bucks on your car insurance premiums. Insurance companies offer lower rates for cars with modern safety technology and equipment, such as forward-collision warning, automatic braking and lane-assist features. The same goes for cars with low-cost, easy-to-find replacement parts and vehicles at low risk of theft.

What’s the fastest way to lower my rate right now?

To lower your rate right away, review your policy to ensure it reflects your current situation, especially if you’ve had any major life changes. Ask your insurance company what other discounts you qualify for, raise your deductible, and, most importantly, compare your current rates to other car insurance companies to be sure you’re getting the lowest possible.

How can I lower my car insurance after an accident or ticket?

If you’ve had an accident or ticket, take a defensive driving course to lower your premiums. Consider changing your deductible or optional coverages if it makes sense. Policy renewal is a good time to search for a company that offers cheap insurance for drivers with accidents or tickets on their record.

Should I drop comprehensive and collision?

If your car is leased or financed, you may be required to keep comprehensive and collision insurance. Many lenders and leasing companies won’t let you go without. You might also keep these coverages if you rely on the car for work. But if your car is older, paid off or could be replaced easily, you might consider dropping comprehensive and collision to save money.

Ready to find your best route to lower rates?

By making a few small changes, you can save big on your auto insurance policy. Focus on the biggest wins: comparing rates, bundling policies and requesting all of the discounts you’re eligible for.

Most steps for reducing your car insurance bill are quick, and you can get started right away. Use tools like our auto insurance calculator to help you estimate your savings before committing. CarInsurance.com helps you navigate savings with confidence, so you can stop overpaying and start saving money.

Resources & methodology

Sources

- GEICO. “Car Insurance Discounts – Save Money on Auto Insurance.” Accessed February 2026.

- Progressive. “Auto Insurance Discounts.” Accessed February 2026.

- United States Department of Transportation – Federal Highway Administration. “Average annual miles per driver by age group.” Accessed February 2026.

Methodology

CarInsurance.com commissioned Quadrant Information Services to get car insurance rates. The rates are based on sample profiles of 40-year-old male and female drivers carrying full coverage policies with limits of $ 100,000/$300,000/$100,000 and $500 collision and comprehensive deductibles. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs