CarInsurance.com Insights

- Adding a teen driver to a parent’s policy is usually cheaper than buying a separate standalone policy.

- Teen drivers significantly increase premiums, but discounts for good students, driver training and safe driving programs can reduce costs.

- Vehicle choice matters — insuring a safe, modest vehicle is far less expensive than covering a sports car.

- Usage-based insurance (telematics) programs can reward safe teen driving with additional savings.

- Shopping around before adding a teen is critical, as rate increases vary widely between insurers.

The best and most affordable way to insure a teenage driver is to add them to your existing auto policy and list them on your safest, most economical car rather than the shiny SUV.

Besides, you shouldn’t miss out on good-student and driver-training discounts for additional savings. Another hack for saving on premiums is to shop around and compare rates before choosing a company to make sure you get the best deal.

Finally, establish clear rules about safe driving, such as prohibiting speeding and using a phone while driving. It not only helps lower your insurance costs but also reduces the risk of an accident that could cause your premiums to skyrocket.

CarInsurance.com’s InsureMyTeen calculator

Adding a teenager to your auto insurance can significantly impact your premium, but it’s often the most cost-effective option in the long run. CarInsurance.com’s InsureMyTeen calculator helps you compare the cost of adding your teen to your existing policy versus buying them their own insurance.

You can use this tool to:

- Estimate how much you could save by adding your teen to your policy

- Compare cost differences based on average insurance rates

Whether you’re looking for the cheapest way to insure your teen or want a clearer understanding of your options, this tool simplifies the decision-making process, providing you with reliable insights without the guesswork.

How much can you save on car insurance for teens?

We couldn't find any data for the selected combination. Please try different options to view results.

What our insurance experts say

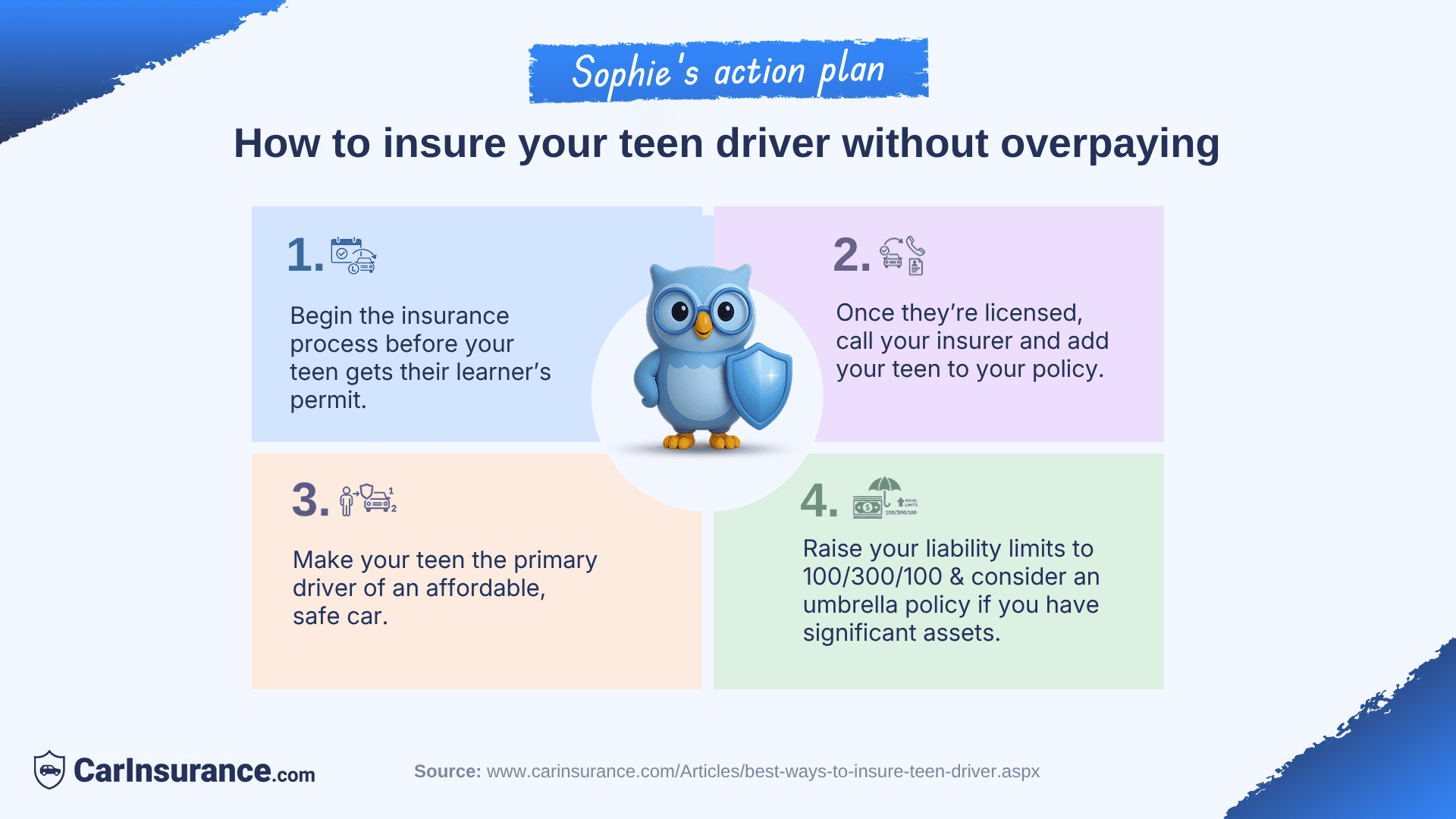

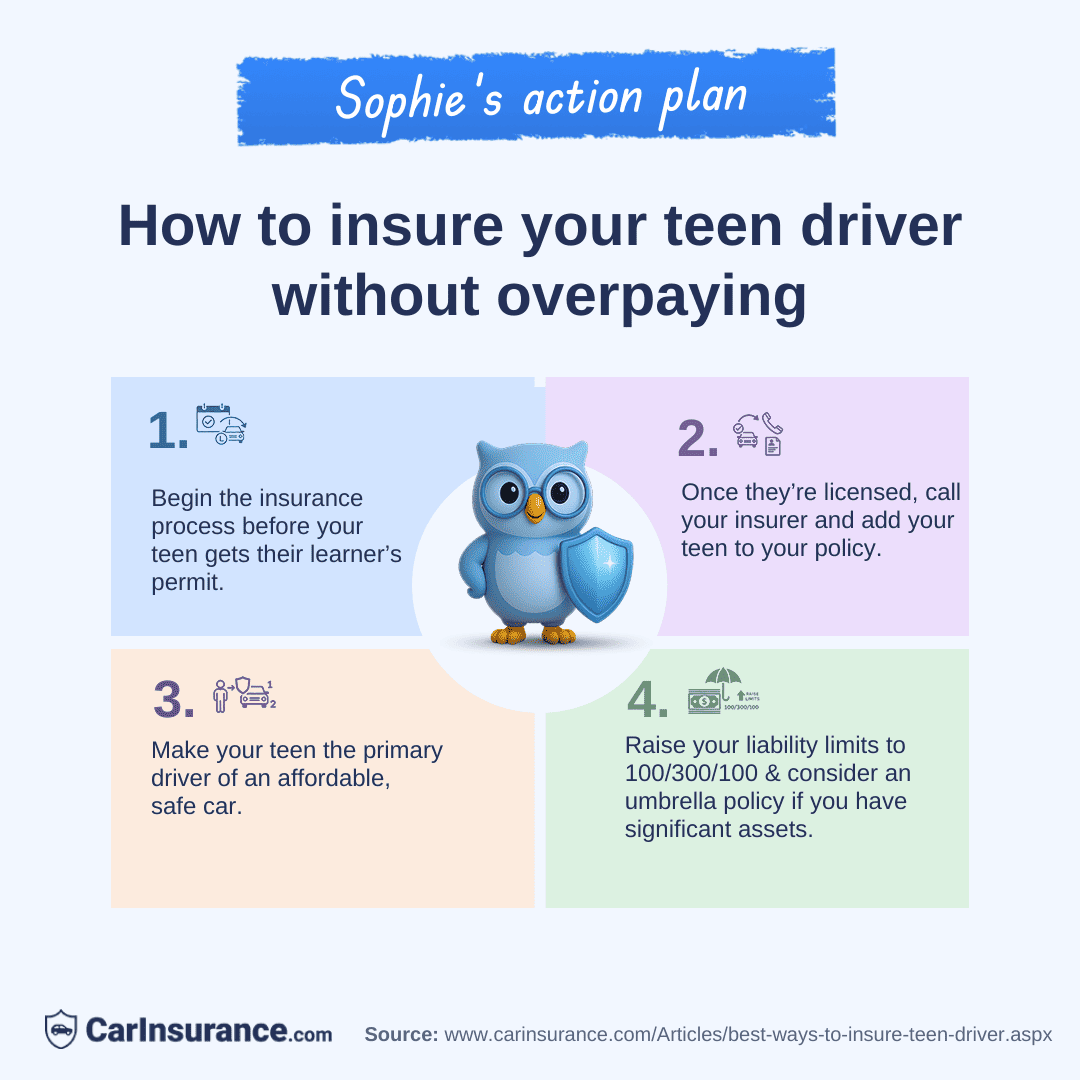

Adding a teen driver to your policy will almost always be significantly cheaper than having the teen covered through their own policy. Increase your liability limits to 100/300/100 – at a minimum – to protect yourself and your teen driver from liability because teens are far more likely to get into accidents than older drivers. Finally, consider an umbrella insurance policy for additional liability coverage to get comprehensive protection.

Do you have to add a teenager to your car insurance policy?

If your teen is going to be driving, they need a car insurance policy – whether they purchase their own or you add them to their policy. However, purchasing their own policy will be much more costly than having your teen added to your policy – but teens can only have their own policies if they’re of the age of majority.

“The auto insurance premium depends on a driver’s expected accident rate, which is calculated based on the driver’s past driving record. It is important to drive safely to maintain a good driving record,” says Ting Liu, associate professor of economics at Stony Brook University. “Insurance typically costs less if a student can stay on a parent’s policy. This is possible if one of the parents is listed on the title of the student’s car.”

How to add a teenage driver to car insurance

Below you’ll find the steps to add your teen driver to your car insurance policy.

- Contact your insurance company: The first step is to contact your car insurance company and find out when you need to add them to your policy. Depending on the carrier, this may occur when your child receives their permit or when they obtain their driver’s license.

- Shop around and compare quotes: It’s a good idea to shop around and get quotes from at least three other insurers for a similar coverage and deductible policy. You may find a lower rate with another carrier, making switching car insurance companies worthwhile.

- Purchase adequate coverage: When you are ready to add your teen driver to your policy, ensure they have sufficient liability coverage. Experts recommend limits of at least 100/300/100.

- Assign a safe car: If your family owns more than one car, list your teen as the primary driver on the vehicle that’s cheapest to insure.

- Ask about discounts: When you add your teen, ask about available discounts, such as the good student discount, driver training discount, student-away discount (if applicable) and bundling with homeowners or renters insurance. Payment options, such as auto-pay or pay-in-full, may also help reduce costs.

Don’t forget to review the policy at renewal time because premiums typically decrease over time as your teen maintains a clean driving record.

How much coverage do you need for teen drivers?

CarInsurance.com recommends getting a full coverage policy for insuring teenage drivers. Buy a policy with the following coverage:

- $100,000 in liability to pay for injuries to others; up to $300,000 per accident

- $100,000 to pay for damage to other vehicles and property

- Comprehensive coverage to pay for damage from flooding, hail, fire, animal strikes and theft

- Collision to pay for damage to the vehicle you own

As always, when adding a teen driver to your policy, understand that if your child is in an accident, it is the parents’ assets – such as savings, investments, retirement accounts, home equity and future incomes – that are at risk in the event of a liability claim.

Myles Holley, a property and casualty product specialist with Barnum Financial Group, advises parents to also inquire about an umbrella policy.

“While you have to maintain certain liability limits to qualify for this policy, and it carries an additional out-of-pocket cost, the amount of benefit you would receive in the event you use this policy would far outweigh any additional premium cost,” Holley says.

Wise words

Teens cannot buy their own auto insurance policies until they reach the age of majority in their state. It’s always more cost-effective to insure a teenager on a parent’s policy.

How much does your insurance go up when you add a teenage driver?

If teens are added to a parent’s policy, you’ll pay less than insurance for a teen on their own. Additionally, rates for females are cheaper than rates for males.

Teen males typically pay the highest insurance premiums, with an annual rate of $10,321 for a 16-year-old male on his own policy and $5,807 per year for a 19-year-old male, according to recent data.

If those same teens were added to a parent’s policy instead, the parent’s premium would increase by $4,856 per year for the 16-year-old and $4,116 per year for the 19-year-old.

See other rates in the table below.

| Age | Gender | Teen policy | Teen added to a parent’s policy |

|---|---|---|---|

| 16 | Female | $9,331 | $4,173 |

| 16 | Male | $10,321 | $4,856 |

| 17 | Female | $7,698 | $3,924 |

| 17 | Male | $8,621 | $4,564 |

| 18 | Female | $6,719 | $3,761 |

| 18 | Male | $7,569 | $4,398 |

| 19 | Female | $5,133 | $3,517 |

| 19 | Male | $5,807 | $4,116 |

How much does car insurance cost for teens by coverage type?

Full coverage car insurance with liability limits of $100,000/$300,000/$100,000 is the most expensive car insurance for teens, as it provides the most comprehensive financial protection.

Sixteen-year-old drivers pay $9,825; 17-year-olds pay $8,162 per year; 18-year-olds pay $7,146 annually and 19-year-olds pay $5,470 per year for full coverage car insurance. As you can see, rates drop significantly from year to year.

The table below shows the cost of car insurance for teens at different ages: Full coverage, 50/100/50 liability only, state minimum liability only, and non-owner state minimum liability coverage.

Compare rates to get the cheapest car insurance for your teen driver

To get the best rate, shop for your coverage. Each insurance company has different rates for each driver’s policy profile. Adding a teen driver changes that profile, which means your existing carrier may no longer offer the lowest price for you.

If you want to add a teenager to your car insurance, remember that any accidents or violations within five years will impact how much you pay for insurance – and compare rates from at least three insurers.

Panos D. Prevedouros, emeritus professor of civil and environmental engineering at the University of Hawaii at Mānoa, said his teenage daughter faced a high premium for basic coverage in her first six months of driving.

“Immediately after completing six months accident-free, she shopped around and got a much better deal – more coverage and lower premium,” Prevedouros says. “After a year, she could get a lower premium by going through the programs offered by big box retailers, unions, company plans, etc.”

Will my insurance rates drop once my teen gains driving experience?

Car insurance for teens is costly. Males and females aged 16 pay the most on average, regardless of whether they have their own policy or are insured through their parents’ coverage.

The upside is that many teenage drivers can expect their rates to decrease annually, provided they maintain a clean driving record. Car insurance premiums continue to decline as you age, with drivers in their 50s and 60s enjoying some of the lowest average annual rates among all age groups.

What are the best cars for teen drivers?

One of the most challenging aspects of adding a teen driver can be choosing the best car for your teen. You want the car to be safe, which typically means models from 2015 and newer, as these come with safety features such as electronic stability control.

The Insurance Institute for Highway Safety (IIHS) and Kelley Blue Book recommend the Honda Civic, Toyota Corolla and Mazda3, but other vehicles are also worth considering.

“Economic models from such manufacturers as Kia, Honda, Ford and Toyota are always a good bet, but similar vehicles from Subaru, Mini, and the like tend to be favorably rated due to their safety features,” Holley says. “As always, higher-end vehicles from BMW, Mercedes-Benz and Infiniti will come with a higher insurance cost, but even certain models from Mazda and Chevrolet can be rated as ‘Sport’ vehicles and have a similar insurance cost.”

Frequently Asked Questions: Best teen car insurance

Should teens have their own policies or stay on their parents’ policy?

Getting a teen on his or her own insurance policy is almost always more expensive than adding a teenager to your car insurance. Here is what to keep in mind:

- You’re still liable for your child’s accidents if they’re younger than 18. When you sign for your teen’s license, most states assign you the responsibility for your child as a driver.

- You’ll still have to sign the policy. To buy a car and a car insurance policy, a binding legal contract, your teen will likely need a parent to sign the paperwork with them.

- When a separate teen policy makes sense: Getting your teen their own policy is typically only a good idea if the child has already accumulated tickets or been involved in accidents, which would raise the rates on your family policy. Then, it may be time to get your teen driver an older car with liability coverage on the child’s policy.

How can you save money on insurance for young drivers?

There is no way to avoid a rate increase once you add a teenager to your car insurance policy, but here are a few ways to get car insurance discounts for teen drivers:

- Good student discount: Most insurers offer a good student discount to teens with a “B” average. Requirements can vary, so contact your insurer for details. Typically, this discount averages 12%.

- Safety features save money: Putting your teen in a car loaded with safety features will usually result in a discount, as long as it’s not a sports car. Features that may result in a discount include anti-theft devices, anti-lock brakes (ABS), adaptive cruise control, lane departure warning and collision preparation systems. Ask your insurer what safety features will garner a discount. These typically are 3% each.

- Student-away discount: If your teen lives more than 100 miles from home, you should get a break on your auto insurance. A student-away discount can save an average of 16%.

Can teen drivers save on insurance through telematics programs?

One way to keep teens safe is to monitor their driving habits. Some insurance companies offer specific programs for teen drivers that monitor this behavior.

Here are two options available to parents of new drivers:

State Farm Steer Clear: To qualify for this discount, you must be under 25 and have a clean driving record. The app requires your teen to complete five training modules: lessons, videos, driving scenarios and quizzes.

The teen driver must also record (with the app) at least five hours of driving in at least 10 trips. Parents can monitor teens’ driving via the app and once training is complete, they can apply for a discount.

American Family Teen Safe Driver Program: This app uses TrueMotion technology to monitor distracted driving and other high-risk behaviors while driving. The app scores each trip your teen drives and highlights areas that need improvement.

The app allows parents to monitor the results, their teen’s driving scores and location. After 3,000 miles or a year in the program, you will receive a 10% discount on your policy. Drivers must be 21 or younger.

Key takeaways for insuring a teen driver

Adding a teenage driver to your car insurance policy will be expensive – there is no way around that. Ultimately, the best thing to do is a comparison shop to find the best rates. Every insurer calculates its rates differently, so you may save hundreds of dollars, if not more, by shopping around.

Within a few years, rates can decrease drastically if the teen driver keeps a clean record and qualifies for a good driver discount.

~Scott Nyerges contributed to this story

Resources & Methodology

Sources

Insurance Information Institute. “Students.” Accessed February 2026.

Methodology

CarInsurance.com analyzed data from Quadrant Information Services to get car insurance rates. The rates are based on sample profiles of 40-year-old male and female drivers, as well as male and female teen drivers aged 16-19, carrying full coverage policies with limits of $100,000/$300,000/$100,000 and $500 collision and comprehensive deductibles. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs