CarInsurance.com Insights

- Drivers with annual mileage under 7,500 can save up to10% on their premiums.

- Good student discounts can save drivers 12% on their car insurance.

- Drivers who’ve been with their auto insurer for 20 years can save 11% with a loyalty discount.

Car insurance discounts are among the best ways to save on auto insurance premiums. Many discounts — airbags, low-mileage discounts, multi-policy discounts, years licensed— can help you save from 2% to more than 20% and lock in the cheapest car insurance.

“Discounts can really add up to a lot of savings,” says Katie Sopko, an insurance broker at A Plus Insurance. “There’s paperless, prior insurance, vehicle use, annual mileage, homeowner, good student, military, multi-policy and more. Prior insurance and multi-policy discounts are the biggest discounts by far. Prior insurance could mean savings of anywhere between $20-$40 each month, while multi-policy — depending on how many policies are bundled — could save a consumer $15-$30 per month.”

However, determining the actual discount amount for car insurance can be challenging, so we’ve analyzed discounted car insurance rates to help you save on your car insurance policy.

Which driver discounts are available?

Car insurance discounts that apply to your driving record, defensive driving classes, occupation and veteran status are driver profile discounts. How much you can save is based on your insurance company, coverages, driver profile and the laws in your state.

Here’s how much you can save with various driver profile discounts.

Safe driver/good driver discount

Some insurance companies offer “safe driver” or “good driver” premium discounts to individuals with a proven track record of responsible driving behavior. Safe-driving discounts vary by company.

To qualify for these price breaks, drivers typically need to be accident-free and ticket-free for a period. Each insurer determines the duration of this time frame, although three to five years is typical.

Other insurers offer a safe-driving discount to policyholders who agree to have their driving monitored and earn it by showing good driving habits.

Some of the major insurance companies that offer safe-driver discounts include:

- American Family Insurance: Discounts are available to those with no accidents, violations or claims within the last five years.

- State Farm: A discount of up to 30% is available for drivers who enroll in Drive Safe & Save and agree to have their driving behavior monitored.

- Allstate: The Safe Driving Bonus is offered to policyholders for every six months they remain accident-free.

- GEICO: Those who are accident-free for five years can earn a good-driver discount of up to 22%.

- Progressive: The Snapshot program offers a safe-driver discount to those who agree to monitor their driving and drive safely. Progressive says the average discount for those enrolled in Snapshot is $146.

- Travelers: A discount is offered to drivers who meet specific qualifications, including avoiding at-fault accidents, major comprehensive insurance claims and moving violations.

- Nationwide: Drivers with a record of at least five years of safe driving may be eligible for a discount. You can also enroll in the SmartRide program that monitors your driving and earns you up to 40% in discounts.

- AARP Auto Insurance Program from The Hartford: Those who have had no collisions or at-fault accidents for five years and are violation-free may qualify for a safe-driver discount.

- USAA: Drivers who keep a good driving record for over five years can earn a safe-driver discount. You can also save up to 30% if you enroll in the USAA SafePilot program and agree to have your driving monitored.

How does a good driver discount work?

Car insurance companies also differ on which parts of a policy are discounted. However, in general, it will apply to the following coverage premiums:

- Bodily injury liability

- Property damage liability

- Comprehensive coverage

- Collision coverage

- Personal injury protection (PIP)

- Medical payments (MedPay)

The method of giving the discount can also vary. Here are some common options:

- Flat discount: A flat rate set by your insurer reduces your premium costs.

- Tiered discount: The longer you are free of violations and accidents, the more significant your good driver discounts.

- Graduated discount: Given for each year of accident-free/safe driving.

California good driver discount (20%)

California law mandates a 20% good-driver discount for residents who have had a valid driver’s license for the past three consecutive years, have no more than one point on their license, and have no serious driving convictions.

Savings for driving less (6%-9%)

People who drive less aren’t as risky to insurers, so depending on the number of miles you travel, you might be able to get a discount. The highest savings are for drivers who commute less than 5 miles each way (9%). Furthermore, drivers who commute 10-14 miles each way can get a 7% discount.

“Car insurance companies offer two kinds of discounts for low-mileage consumers. The first is where consumers who drive below a certain threshold qualify (typically 7,500 miles),” says Aniruddha Pangarkar, assistant professor of marketing at the Austin E. Cofrin School of Business at the University of Wisconsin-Green Bay. “In this first case, companies like GEICO and State Farm offer highly competitive rates that can help drivers get substantial discounts. For the second type of discount, which is calculated based on a pay-per-mile rate, many insurance companies like Nationwide, Allstate and Liberty Mutual offer discounts. Many companies use apps to track their employees’ driving histories. Nationwide is a company that is reputed to offer good discounts in the pay-per-mile category.”

Lower annual mileage (8%)

Some low-mileage drivers may see savings reflected as a reduction in their base rate. The discount is typically applied to bodily injury liability, PIP, property damage liability and collision premiums. If you drive less than 7,500 miles per year, you’ll get the highest discount of nearly 10%, with the discount dropping off over 9,999 miles.

Usage-based discount programs (10%)

Usage-based insurance (UBI)/telematics/pay-as-you-drive programs can net discounts of 10%, depending on your driving behavior. Drivers can opt to install a monitoring device or use a mobile app provided by their insurance company to assess their driving habits.

The discount is typically for the premium related to the three significant coverages of bodily injury liability, property damage liability and collision. It is usually applied per vehicle, not per driver.

Good student discount (12%)

Good student discounts are available to full-time high school or college students who maintain a 3.0 (B) grade point average or meet other specific academic criteria set by the auto insurance provider.

Homeschooled teen drivers may also be eligible based on the results of standardized exams. The good student discount typically applies to bodily injury liability, property damage liability, PIP, medical payments, collision and comprehensive coverages.

Away-from-home student discount (16%)

Student away discounts are available for parents or guardians of a full-time student (typically under 25) who lives 100 miles or more from home and does not have a vehicle. Discounts may apply to liability coverages, as well as PIP, medical payments, collision and comprehensive coverage on the vehicle assigned to the student.

Senior/mature driver training discount (5%)

A senior driver training discount is typically available to adults 55 or older (sometimes the threshold is 60 or 65, depending on state laws or insurer guidelines) who have completed an approved accident-prevention class, such as the AARP defensive driving course.

This discount typically is good for three years and applies to bodily injury liability, property damage liability, collision and comprehensive coverages.

Professional employee discounts (12%)

Profession/occupation discounts are available for certain occupations, such as scientists, lawyers, doctors, firefighters, engineers, law enforcement agents and teachers.

Education discounts (7%)

Risk studies have found that individuals in certain professions or those with specific college degrees are less likely to file claims, so insurance companies offer these individuals a discount. Having a master’s or doctorate degree will provide an extra 1% discount over having a bachelor’s degree.

Other driver profile car insurance discounts

- Married (9%): Married drivers and sometimes domestic partners who prove they have lived together for a specific period. Married drivers pay less than single drivers.

- Pleasure-use discounts (6%): Discount for those who don’t use their vehicles for commuting and log very few miles.

- Farm-use discounts (12%): Discounts for those who mainly drive the vehicle for agricultural business and whose full-time income is from farming.

Check out our guide on how to get discounts on car insurance

What are policy car insurance discounts?

Policy discounts are car insurance discounts that apply to your insurance policy — think of savings for bundling your policies or purchasing a new policy before yours expires.

Bundling/multi-policy discount

Multi-policy/bundle discounts are available to individuals who purchase multiple policies from the same insurance provider. Homeowners who bundle their auto policies usually get the highest discounts, but you can also get discounts for bundling with renters insurance.

Here are discounts for bundles:

- Multi-policy, homeowners: 14%

- Multi-policy, condo: 12%

- Multi-policy, renters: 6%

- Multi-policy, life: 4%

- Multi-policy, umbrella: 4%

Savings for signing early (7%)

Drivers who start a policy with a new auto insurance provider and those switching car insurance companies or who purchase a policy seven to 10 days before the renewal date can receive this discount.

Paid-in-full reduction (9%)

You can receive a premium reduction if you pay your premium in full before the policy’s effective date.

Paperless discount (3%)

Paperless discounts are available to drivers who sign up to access their account online and receive documents via email-this can be a one-time discount or an ongoing benefit, depending on your insurer.

Loyalty discount (8%)

A loyalty discount is offered to drivers who remain with their current insurer year after year, rather than seeking new coverage elsewhere. The longer you stay with the company, the more significant the discount you could receive.

Here’s a breakdown of discounts for years with the same company:

- One year with the company: 5%

- Two years with the company: 5%

- Three years with the company: 6%

- Four years with the company: 7%

- Five years with the company: 7%

- 10 years with the company: 10%

- 15 years with the company: 11%

- 20 years with the company: 11%

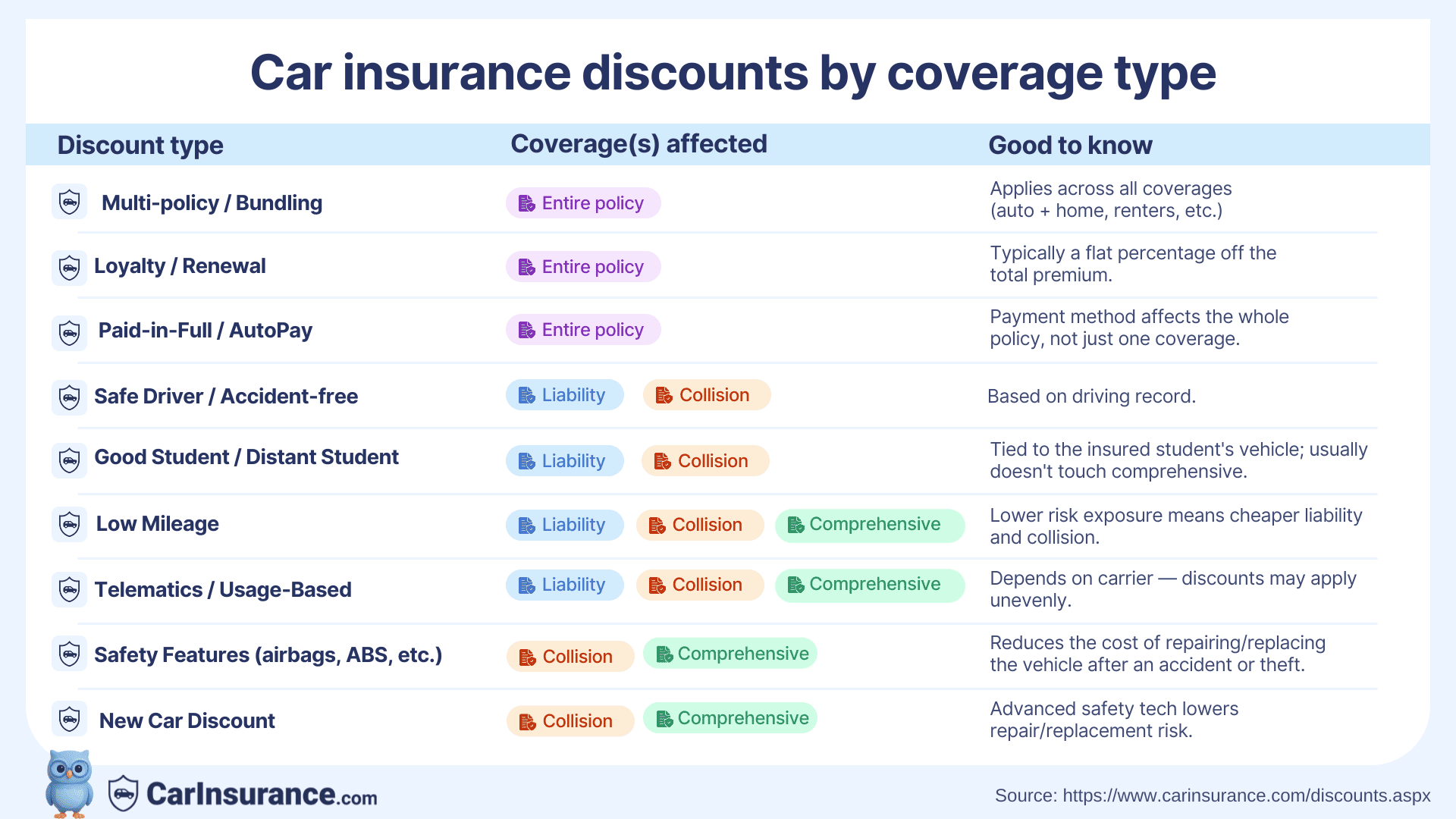

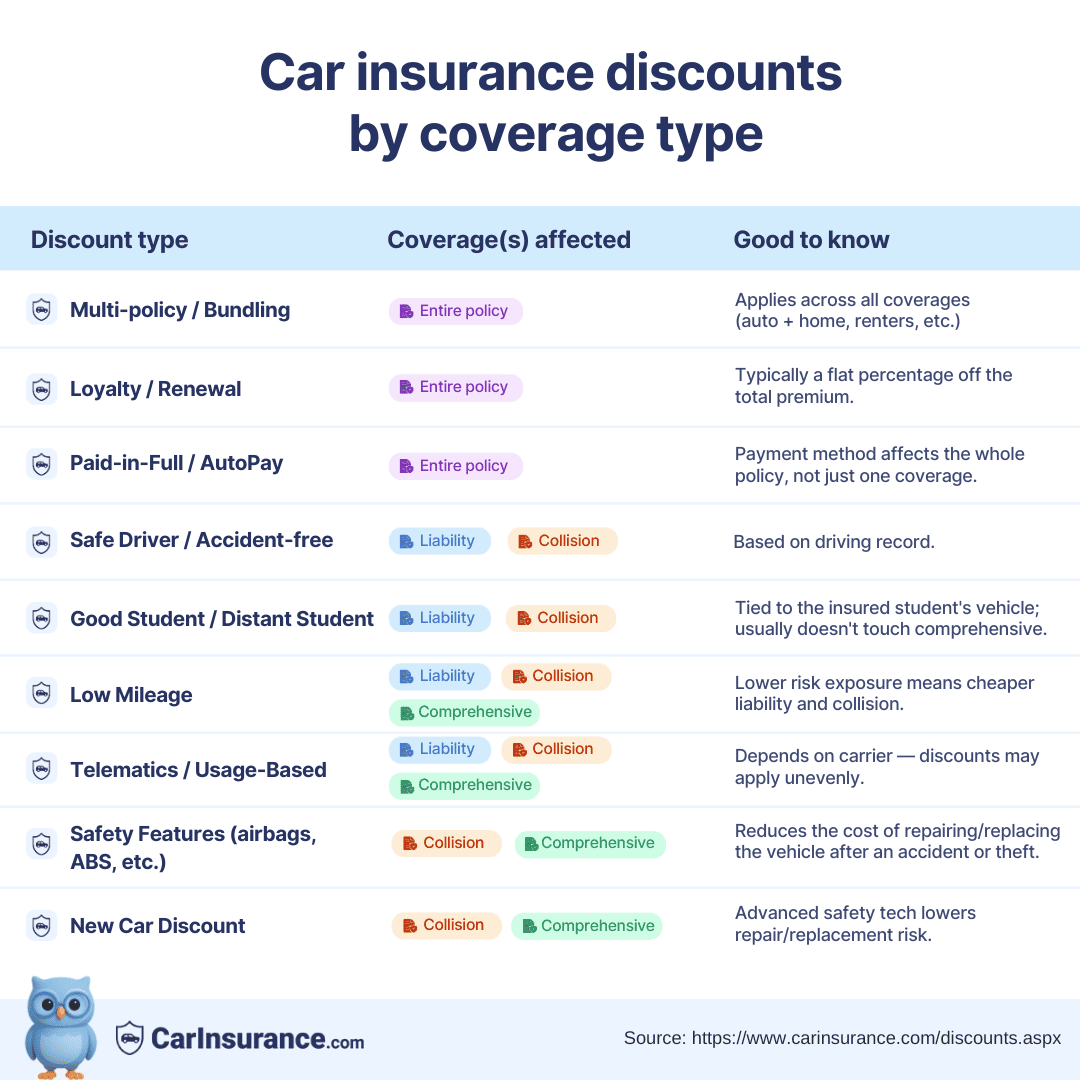

- Multi-policy/bundling: Applies across all coverages since it’s tied to having multiple policies (e.g., auto and home).

- Loyalty/renewal: Often a percentage off the total premium.

- Paid-in-full/autopay: Discounts for payment type usually apply to the whole policy.

Discounts that apply to specific coverages

- Safety features (airbags, anti-lock brakes and anti-theft devices): Reduce the collision and comprehensive portion of your premium.

- Telematics/usage-based discounts: Depending on the carrier, these can affect liability, collision and comprehensive, but only a portion.

- Low mileage: Tied to liability and collision coverage, since reduced driving lowers risk.

- Good student/distant student: Typically applies to the liability and collision coverages of the student’s insured vehicle.

Discounts that apply most heavily to liability

- Safe driver/accident-free: Affects liability coverages the most because insurers price liability risk based on driving history.

Which vehicle car insurance discounts are available?

At the lower end of the spectrum regarding vehicle-discount amounts are discounts that apply to your vehicle, such as discounts for anti-theft devices, new car and safety feature discounts.

Anti-theft car insurance discount (2%)

Anti-theft/vehicle recovery discounts are for vehicles with anti-theft devices or a vehicle recovery system. Discounts are available for active or passive disabling devices, audible alarms and tracking devices. The discount for each anti-theft device is only around 1%-2%.

New car discount (6%)

Drivers can qualify for a new car discount on the collision portion of their insurance policy for the first three years of owning a new vehicle.

High-tech safety feature discounts (3%)

Standard safety features, such as side-impact, driver, and passenger airbags, and anti-lock brakes, garner fairly small price breaks. Airbag discounts are typically applied to your PIP or MedPay portion of your policy. Discounts may apply to liability, personal injury protection (PIP), medical payments (MedPay) and/or collision coverage.

Discounts for safety device installation:

- Anti-lock brakes: 3%

- Back-up sensor: 4%

- Daytime running lights: 2%

- Driver alertness monitor: 2%

- Lane departure warning: 1%

- Rearview camera: 1%

Don’t forget to ask about these discounts

Many drivers miss out on hidden savings because insurers don’t always advertise all their available discounts. Make sure to ask about:

- Employer or alumni discounts: Large companies, unions and alumni associations often have partnerships.

- Green/hybrid/EV discounts: Eco-friendly cars sometimes qualify for extra savings.

- New car discount: Cars less than three years old often qualify for lower rates due to advanced safety tech.

- Paperless billing and e-signature: Switching to digital documents can reduce costs by a few percentage points.

- Affinity/membership savings: Groups like AARP, credit unions or professional organizations.

- Defensive driving courses: Recently completing an accredited course can unlock discounts.

- Occupation-based discounts: Teachers, nurses, first responders and military often qualify.

- Student away at school: Parents can save if their kids are in college more than 100 miles away without a car.

- Loyalty milestone discounts: Some insurers reward 3, 5, or 10+ years with a company.

Even if your insurer hasn’t mentioned it, ask directly. Many carriers only apply certain discounts when a customer specifically requests them.

Frequently Asked Questions: Car insurance discounts

Do all discounts apply to my entire car insurance premium?

Not always. Some discounts — like multi-policy, loyalty or autopay discounts — typically apply to your whole premium. Others, such as safety features or new car discounts, often apply only to the collision or comprehensive portions of your policy. Always ask your insurer which parts of your coverage a discount will reduce.

Can I combine multiple discounts?

Yes, but how they combine depends on the insurer. Discounts don’t always stack in a simple way. For example, if you qualify for both a safe driver discount and a bundling discount, you’ll save on both — but not always the maximum percentage quoted. Each discount is applied to the adjusted premium, not the original base rate.

What’s the biggest car insurance discount I can get?

It varies, but bundling your auto policy with home or renters insurance, maintaining a clean driving record, and using telematics programs typically deliver the largest savings. Your total savings will depend on your driving history, vehicle and state regulations.

Do car insurance discounts vary by state?

Yes. Some states regulate which discounts insurers can offer. For example, usage-based insurance may not be available everywhere, and defensive driving course discounts are often tied to state-specific programs. Always check your state’s rules and ask your insurer for a state-specific list of available discounts.

What’s the easiest discount to qualify for?

Going paperless, paying upfront or signing up for autopay is often the simplest way to get an immediate discount. Many insurers also offer loyalty savings if you renew with them, and most drivers can get a break for basic safety features like airbags and anti-lock brakes.

Are there discounts for new or young drivers?

Yes. Students can often qualify for “good student” discounts with a B average or better, and families may save if a student goes to college 100+ miles away without a car. Some insurers also reward teens who complete accredited driver’s education or defensive driving courses.

Final thoughts

Remember to ask your agent about discounts: Insurers don’t always automatically apply every discount you qualify for. Request a full list of available discounts when getting quotes or renewing your policy, and mention memberships, affiliations or recent life changes (like marriage, moving or buying a new car).

“You also want to be sure you have the coverage you need, that you are working with a responsive company if you need to file a claim, and that you take advantage of discounts you may be entitled to,” says Kandie Landers, owner of Brightway Insurance. “Your coverage needs are not just determined by your car, but also by understanding the whole of the assets you own, your family makeup and many other factors.”

Resources & Methodology

Methodology

CarInsurance.com analyzed data from Quadrant Information Services to get car insurance rates. The rates are based on sample profiles of 40-year-old male and female drivers carrying full coverage policies with limits of $ 100,000/$300,000/$100,000 and $500 collision and comprehensive deductibles. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs